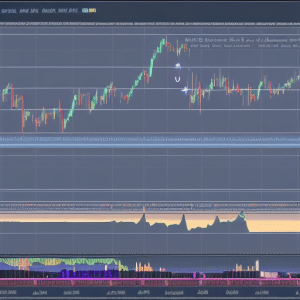

MicroStrategy now holds 640,250 Bitcoin worth roughly $69 billion. This publicly traded company is investing serious institutional money into crypto. Years ago, this level of mainstream adoption seemed impossible.

Understanding blockchain technology has become much simpler. Companies like Coinbase have made buying crypto easy. What began as a niche interest has evolved into real financial infrastructure.

This guide focuses on how distributed ledgers are changing digital ownership and trust. I’ll explain the basics using market evidence and credible sources. My aim is to show you the practical side of blockchain.

Key Takeaways

- Major corporations like MicroStrategy hold billions in Bitcoin, signaling mainstream institutional acceptance of digital assets

- Blockchain basics have become accessible to everyday people through platforms facilitating fractional cryptocurrency purchases

- Understanding distributed ledger technology no longer requires advanced technical expertise

- Real-world adoption has transformed crypto from experimental concept to functional financial infrastructure

- Institutional players now control approximately 2.5% of Bitcoin’s total supply

- The technology represents a fundamental shift in how we approach trust and digital transactions

What is Blockchain Technology?

Blockchain technology creates unchangeable records. Thousands of computers worldwide keep copies and verify they match. This system differs from traditional databases that rely on central authority.

Blockchain is a distributed ledger system. Transactions are recorded across multiple computers at once. It’s like a shared document with strict rules and ironclad guarantees.

The name “blockchain” describes its structure perfectly. Each block contains transactions. These blocks link together chronologically, forming a chain. Every new block references the one before it.

Definition and Key Concepts

Several key concepts define blockchain technology. Decentralization spreads power across all participants. Transparency allows anyone to view transaction history. Immutability makes changing recorded data nearly impossible.

Consensus requires network agreement on transaction validity. These concepts work together, reinforcing each other. Decentralization enables transparency, which supports consensus and creates immutability.

Cryptography plays a crucial role too. Each block has a unique fingerprint called a hash. This string of characters is generated by a mathematical formula.

How Blockchain Works

Let’s use Bitcoin as an example to understand blockchain. The process starts when someone initiates a transaction. Alice wants to send Bitcoin to Bob.

She broadcasts this intention to the network of computers. These computers, called nodes, maintain the blockchain. The transaction then goes through several steps.

- Transaction Announcement – Alice’s transaction gets broadcast to thousands of nodes across the Bitcoin network simultaneously

- Verification Process – Network nodes check that Alice actually has the Bitcoin she’s trying to send and hasn’t already spent it elsewhere

- Block Formation – Valid transactions get bundled together into a new block by specialized nodes called miners

- Consensus Achievement – The network must agree this new block is legitimate through a process called proof-of-work (more on mining later)

- Chain Addition – Once consensus is reached, the new block gets added to the chain and distributed to all nodes

- Transaction Completion – Bob can now see the Bitcoin in his wallet, and the record becomes permanent

This process eliminates middlemen. No bank verifies funds. No payment processor authorizes transfers. The network performs these functions through mathematical consensus.

Blockchain technology shines when someone tries to cheat. Modifying old transactions is nearly impossible. It would require recalculating hashes for all subsequent blocks faster than the network.

This computational challenge creates security without central authority. Math enforces the rules, not corruptible human institutions. The implications extend far beyond cryptocurrency.

The History of Blockchain

Blockchain’s evolution is fascinating. Understanding its history makes the technology click into place. It emerged from decades of cryptographic research and now reshapes entire industries.

This technology started as a solution to a specific problem. Now, it’s a fundamental shift in how we think about digital trust.

Origins of Blockchain Technology

The story begins in 2008, during the global financial crisis. Satoshi Nakamoto published a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.”

Nakamoto’s invention wasn’t just digital money. It solved the double-spending problem without a trusted third party. This challenge had stumped cryptographers since the 1980s.

Nakamoto combined existing technologies in a novel way. Hash functions, digital signatures, and proof-of-work consensus were known concepts. But linking them into a verifiable distributed ledger was revolutionary.

On January 3, 2009, Nakamoto mined the first Bitcoin block. It contained a message about banks needing bailouts. This showed it wasn’t just a technical experiment.

Milestones in Blockchain Development

Blockchain has evolved from a single implementation to a diverse ecosystem. Each milestone shifted understanding of the technology’s potential.

| Year | Milestone | Significance | Impact Metric |

|---|---|---|---|

| 2009 | Bitcoin Network Launch | First practical blockchain implementation goes live | Genesis block mined January 3 |

| 2015 | Ethereum Platform Debuts | Smart contracts enable programmable blockchain applications | Expanded use cases beyond currency |

| 2017 | ICO Boom | Initial Coin Offerings raise billions for blockchain projects | Over $5.6 billion raised globally |

| 2020 | Institutional Adoption Begins | Major corporations add Bitcoin to balance sheets | MicroStrategy starts strategy with 21,454 BTC purchase |

| 2025 | Mainstream Integration | Top 15 public companies hold substantial Bitcoin reserves | Combined holdings exceed 900,000 BTC |

The 2015 launch of Ethereum was a game-changer. Vitalik Buterin’s platform showed blockchain could execute complex programs through smart contracts. Developers realized they could build decentralized applications without downtime or interference.

The 2017 ICO boom was exciting and chaotic. Projects raised millions in minutes. While many failed, it funded serious innovation and brought blockchain into mainstream conversation.

The blockchain is an incorruptible digital ledger of economic transactions that can be programmed to record not just financial transactions but virtually everything of value.

Around 2020, institutional adoption transformed blockchain. Fortune 500 companies began implementing it seriously. MicroStrategy’s strategy is striking – they’ve accumulated over 640,000 BTC since August 2020.

In 2015, no institutional money was in blockchain. By 2025, the top 15 public companies will hold over 900,000 BTC. This represents billions in corporate treasuries.

Central banks are now developing digital currencies based on blockchain. The technology designed to bypass traditional finance is being adopted by those institutions.

Each milestone shows more than technical progress. They reveal how decentralized systems can reshape finance, organizations, and even governments.

Key Components of Blockchain

Blockchain fundamentals involve the machinery that keeps decentralized networks running. The architecture becomes less daunting when broken down into manageable pieces. These basics help everything else make sense.

Three core elements work in perfect harmony to create a secure and decentralized system. These are blocks, chains, and nodes. They form the foundation for every blockchain network.

Blocks, Chains, and Nodes

A block is a digital container storing transaction data. It’s like a page in a ledger book. Each block has transaction records, a timestamp, and a unique cryptographic hash.

The cryptographic hash links each block to the previous one. It creates an unbreakable chain of information. This chain stretches back to the first block ever created.

The chain is a sequence of blocks going back to the genesis block. Every single transaction since then exists somewhere in that chain. It’s an impressive record of all activity.

Nodes are computers running blockchain software across the network. Each node keeps a complete copy of the entire blockchain ledger. Thousands of nodes verify transactions and maintain network integrity.

No single node controls the network. If one node fails or cheats, others ignore it and continue operating. This setup makes blockchain resilient compared to centralized databases.

The system is self-reinforcing. New transactions get broadcast to all nodes. Nodes verify the rules, then miners bundle transactions into a new block. All nodes update their ledgers once the block is added.

Consensus Mechanisms

Consensus mechanisms allow nodes to agree on valid transactions without central authority. They’re crucial for decentralized networks. Two major types exist: Proof of Work and Proof of Stake.

Proof of Work requires miners to solve complex puzzles before adding a new block. It’s a mathematical race with rewards for the winner. This system makes network attacks extremely expensive.

Proof of Stake works differently. Validators lock up cryptocurrency as collateral. The network randomly selects validators to create new blocks based on their stake. This method uses less energy than Proof of Work.

| Feature | Proof of Work (Bitcoin) | Proof of Stake (Ethereum) |

|---|---|---|

| Energy Consumption | High – requires massive computational power for mining operations | Low – validators use standard hardware without intensive calculations |

| Security Method | Economic cost of computing power makes attacks prohibitively expensive | Financial penalties for malicious behavior through slashing staked funds |

| Barrier to Entry | Requires specialized mining equipment (ASICs) costing thousands of dollars | Requires 32 ETH stake (approximately $60,000-$100,000 depending on price) |

| Transaction Speed | Bitcoin processes roughly 7 transactions per second with 10-minute block times | Ethereum handles 15-30 transactions per second with 12-second block times |

| Network Participation | Miners compete globally, concentration in regions with cheap electricity | Validators can operate from anywhere with stable internet connection |

Both mechanisms solve the Byzantine Generals Problem in distributed systems. They use cryptography, economics, and game theory to reach consensus. Each approach has its own strengths and trade-offs.

Tools like Etherscan and Blockchain.com let you watch these systems in action. You can see new blocks added and trace individual transactions. It helps visualize how nodes reach agreement.

Understanding these components explains blockchain’s unique properties. The combination creates a system that’s simultaneously transparent and secure, decentralized and coordinated. That’s the power of blockchain fundamentals working together.

Types of Blockchain

Blockchain networks come in different flavors. Not every blockchain serves the same purpose or operates under identical rules. Your specific needs determine the architecture you choose.

Three distinct models offer unique trade-offs. These include accessibility, control, and performance. Picking the wrong architecture can derail a project before it starts.

Public vs. Private Blockchains

Public blockchains are open networks where anyone can participate without permission. Bitcoin is a perfect example with over 15,000 active nodes globally. Ethereum follows the same philosophy, processing billions in daily transactions.

Public blockchains offer radical transparency and decentralization. Every transaction becomes part of a permanent, auditable record. No single entity controls the network, making censorship nearly impossible.

However, this openness has drawbacks. Transaction speeds are slower, and privacy is minimal. All activity is visible to everyone.

Private blockchains restrict access to approved participants. They’re ideal for enterprises needing blockchain benefits without exposing sensitive data. These networks sacrifice some decentralization for faster speeds and enhanced privacy.

Hyperledger Fabric is the go-to framework for private blockchain implementations. Major corporations use it to streamline supply chains and manage digital assets. Transaction throughput can reach thousands per second, compared to Bitcoin’s seven.

These blockchain concepts reveal why organizations choose different architectures. Public blockchains prioritize trustlessness and transparency. Private blockchains optimize for speed and confidentiality.

| Feature | Public Blockchain | Private Blockchain | Consortium Blockchain |

|---|---|---|---|

| Access Control | Open to anyone | Restricted to approved users | Limited to consortium members |

| Transaction Speed | Slower (7-15 TPS) | Fast (1000+ TPS) | Moderate to Fast (100-1000 TPS) |

| Decentralization Level | Fully decentralized | Centralized or limited | Semi-decentralized |

| Use Case Examples | Cryptocurrencies, DeFi | Enterprise data management | Financial institutions, supply chain consortiums |

Consortium Blockchains

Consortium blockchains bridge the gap between open and private networks. These semi-decentralized systems are controlled by a group of organizations. They apply blockchain concepts to multi-party collaboration.

R3 Corda dominates the consortium space, especially among financial institutions. Banks use Corda to share information and execute transactions. The platform processes billions in enterprise transactions.

The consortium model appeals to industries where competitors need to cooperate. Shipping companies might track cargo without trusting a single entity. Healthcare organizations can share patient data securely across hospital networks.

Consortium blockchains balance competing priorities effectively. They’re faster than public blockchains but more decentralized than private ones. Access restrictions provide privacy, yet multiple organizations validate transactions.

Public blockchains like Bitcoin have processed over $10 trillion in cumulative transaction volume. Private and consortium blockchains focus on enterprise transaction counts rather than monetary value.

Understanding these distinctions changes how you approach blockchain implementation. The architecture determines who can participate and how fast transactions process. It also affects the level of privacy you can expect.

Each blockchain type excels in specific scenarios. Public blockchains are best for maximum transparency. Private blockchains suit internal corporate processes. Consortium blockchains help organizations cooperate without surrendering control.

How Blockchain Ensures Security

Blockchain’s security mechanisms are elegant, powerful, and hard to break. It distributes security across multiple layers, working like a well-designed fortress. This system has withstood attacks that would crumble centralized systems quickly.

This blockchain technology overview combines ancient math with modern computing power. It replaces institutional trust with mathematical certainty and network consensus. The numbers show it’s working remarkably well.

Consider your bank account. You trust the bank to keep accurate records and protect your data. Blockchain replaces that trust with a system that doesn’t rely on any single entity.

Cryptography in Blockchain

Cryptography is the mathematical backbone of blockchain security. The system uses two main tools: hash functions and digital signatures. Each serves a specific purpose in protecting your data.

Hashing is fundamental to everything else. Bitcoin uses SHA-256, which produces a fixed 256-bit output from any input. You can’t work backward from the hash to discover the original data.

This makes it practically unbreakable:

- Deterministic output: The same input always produces the same hash, making verification simple

- Avalanche effect: Changing even one character in the input completely changes the output hash

- Collision resistance: Finding two different inputs that produce the same hash is computationally infeasible

- One-way function: Computing the hash is easy, reversing it is essentially impossible

The SHA-256 hash of “Hello World” differs completely from “Hello world”. This sensitivity protects blockchain data from tampering. Digital signatures prove you own and authorized a transaction.

This system uses public-private key cryptography. Your private key creates a signature that anyone can verify with your public key. Nobody can forge it without your private key.

When you understand how public key cryptography works, you realize it’s not about hiding information – it’s about proving authenticity without revealing secrets.

Your private key creates a unique seal that everyone can recognize as yours. Only you can create it. This is how selling 0.2 ETH or any blockchain transaction stays secure.

The math involves large prime numbers and modular arithmetic. The result is a system where a 256-bit private key has more combinations than atoms in the universe.

Decentralization and Trust

Decentralization is where blockchain security shines compared to traditional systems. It’s based on trustless trust. You’re trusting mathematics and economic incentives, not individuals or institutions.

Thousands of independent nodes keep a complete copy of the blockchain. The network uses consensus mechanisms to verify transactions. The majority of nodes must agree before anything is added.

This creates a fundamentally different security model:

| Security Aspect | Traditional System | Blockchain System |

|---|---|---|

| Point of Failure | Single database server | Would need to compromise 51% of network |

| Data Verification | Trust the administrator | Mathematical consensus across thousands of nodes |

| Attack Cost | Hack one system | Control majority of distributed network |

| Recovery | Depends on backups | Thousands of identical copies exist simultaneously |

Attacking major blockchains is almost pointless. Launching a 51% attack on Bitcoin would cost hundreds of millions per hour. Even if successful, it would likely crash the value of the stolen assets.

Major blockchain networks like Bitcoin and Ethereum have never been successfully attacked at the protocol level. Exchanges and wallets get hacked, but those aren’t the blockchain itself.

The distinction matters. When Mt. Gox lost 850,000 Bitcoin in 2014, it was the exchange’s failure. The blockchain kept running perfectly, maintaining its unbroken chain of valid transactions.

In a decentralized system, there’s no honeypot for attackers to target – you’d need to compromise thousands of independent nodes simultaneously, which is exponentially harder than hacking one central server.

This distributed verification creates “Byzantine fault tolerance”. The system continues working correctly even if some nodes fail or act maliciously. Economic incentives ensure the majority remains honest.

The blockchain technology overview approach to security responds effectively to threats. Fixes can be implemented across the network without any single point of control.

Cryptographic security and decentralized verification have proven themselves against countless attacks over a decade. This track record speaks louder than any technical specification.

Applications of Blockchain Technology

Blockchain technology has moved from theory to practice. It’s generating billions in value and solving real problems. Let’s explore how it’s being used today.

Two sectors stand out for their rapid adoption: financial services and supply chain management. These industries have found practical solutions to longstanding issues.

Financial Services and Cryptocurrencies

The financial sector leads in blockchain adoption. It’s evolved from early cryptocurrency experiments to multi-billion dollar institutional investments.

MicroStrategy now holds 640,250 BTC worth approximately $69 billion at an average purchase price of $74,000 per coin. This shows a significant commitment to blockchain-based assets by a public company.

Institutional adoption is widespread. Many companies now hold Bitcoin as a strategic asset.

- MARA Holdings maintaining 53,250 BTC in corporate reserves

- Metaplanet holding 30,823 BTC as a strategic asset

- Tesla keeping Bitcoin on its balance sheet despite market volatility

- Coinbase premium indicators showing positive US institutional demand

Platforms like Coinbase have made blockchain investments accessible to everyone. You can now own a fraction of a Bitcoin without spending thousands.

This fractional ownership has opened the door for many new investors. It’s made cryptocurrency more approachable for the average person.

The evidence shows institutional investors are accumulating positions at unprecedented rates, signaling confidence in blockchain’s long-term viability as a financial infrastructure.

Blockchain offers more than just cryptocurrency holdings. It enables fast cross-border payments and eliminates hefty transaction fees. It also provides round-the-clock market access.

Supply Chain Management

Blockchain solves a key problem in supply chains: verifying product authenticity. It tracks items from manufacture to delivery without relying on a single authority.

Blockchain provides transparent, unchangeable record-keeping. Every product movement is recorded and can’t be altered or deleted.

VeChain uses blockchain to track luxury goods, drugs, and food products. It uses unique IDs and sensors to record data at every step. This has significantly reduced counterfeit products in supply chains.

IBM’s Food Trust tracks food from farm to table. It provides full transparency about origin, processing, and transportation. Companies can quickly identify contamination sources using this technology.

The practical benefits include:

- Authenticity verification – Consumers can scan products and see their complete history

- Counterfeit prevention – Each legitimate product has a unique blockchain record that can’t be duplicated

- Efficiency improvements – Automated tracking reduces manual paperwork and human error

- Rapid recall capability – Contaminated batches can be identified and removed within hours

Blockchain in supply chains offers clear value. It prevents fake drugs from reaching patients and ensures organic products are truly organic.

| Industry Sector | Blockchain Application | Primary Benefit | Key Platform |

|---|---|---|---|

| Luxury Goods | Authenticity tracking | Counterfeit prevention | VeChain |

| Food Safety | Farm-to-table tracking | Rapid contamination identification | IBM Food Trust |

| Pharmaceuticals | Drug provenance verification | Fake medication elimination | MediLedger |

| Electronics | Component sourcing transparency | Quality assurance | Samsung SDS |

Blockchain is expanding into voting, identity verification, and healthcare records. It’s useful wherever transparent, unchangeable record-keeping is needed without central control.

Blockchain has quickly become essential. These are now production systems handling billions in value and protecting global supply chains.

Smart Contracts Explained

Smart contracts revolutionized blockchain technology. These self-executing programs operate without human intervention once deployed. They changed my view on blockchain’s potential beyond cryptocurrency tracking.

Smart contracts combine simplicity and power. They eliminate the need for lawyers, banks, or middlemen to enforce agreements.

What Are Smart Contracts?

Smart contracts are computer programs stored on a blockchain that automatically execute when specific conditions are met. They function as digital “if-then” statements that can’t be stopped or changed.

Imagine buying a house using a smart contract. The contract holds the funds and releases payment when the seller provides proof of title transfer.

Ethereum introduced Solidity, a language for creating self-executing agreements. Its Turing-complete nature allows developers to build complex applications on the blockchain.

Smart contracts eliminate trust requirements. You rely on mathematical certainty instead of trusting the other party’s word.

Smart contracts work through these key mechanisms:

- Deterministic execution: Same inputs always produce identical outputs

- Transparency: Anyone can verify the contract code before interacting

- Immutability: Once deployed, the contract cannot be altered or stopped

- Decentralized operation: No single entity controls execution

Use Cases for Smart Contracts

Decentralized finance (DeFi) is a major application of smart contracts. Platforms like Uniswap and Aave use them to create lending protocols and decentralized exchanges.

DeFi protocols handle billions in transactions through code alone. No CEO makes decisions, and no customer service resolves disputes.

Here are real-world implementations that impressed me:

| Industry | Application | Benefit |

|---|---|---|

| Insurance | Flight delay compensation | Automatic payouts when oracle data confirms delays |

| Supply Chain | Milestone-based payments | Funds release when goods reach checkpoints |

| Digital Rights | Royalty distribution | Artists receive payment every time work is resold |

| Real Estate | Rental agreements | Automated rent collection and access control |

Supply chain management benefits from smart contracts. Payments trigger automatically when shipments reach specific GPS coordinates. The contract verifies location data and releases funds instantly.

Smart contracts ensure fair payment for digital rights management. Artists automatically receive royalties when their NFT artwork resells. The contract enforces this forever without monitoring.

Several tools make smart contract creation accessible. Remix IDE offers a browser-based environment for beginners. Hardhat provides professional-grade testing and deployment capabilities.

Smart contracts represent a paradigm shift in agreements. They rely on mathematical certainty rather than legal systems and reputation.

Insurance contracts showcase this perfectly. Compensation pays out automatically if a flight delay exceeds the defined threshold. No claims process or disputes about coverage terms are needed.

This blockchain fundamental transforms how we think about agreements. You rely on code that must execute exactly as written.

The Role of Miners in Blockchain

Miners are crucial to blockchain networks’ security and operation. They validate transactions and maintain consensus, preventing system cheating. Without miners, decentralized networks like Bitcoin couldn’t function.

Mining in blockchain differs from extracting gold. It involves validating transactions and adding new blocks through computational work. In Proof of Work systems, miners compete in a massive computational lottery.

Miners collect pending transactions from the mempool. They bundle these into a candidate block and hash it repeatedly. The goal is to find a hash meeting the network’s difficulty target.

Understanding the Mining Process

The difficulty is intense. Bitcoin requires about 19 leading zeros in the resulting hash. It’s like rolling dice millions of times per second for a specific combination.

Bitcoin’s network hashrate recently hit all-time highs. It represents about 400-600 exahashes per second. That’s 400 quintillion hashing attempts every second across the entire network.

More hashpower means more lottery tickets. This creates competition, pushing miners to upgrade equipment for an edge.

Economic Rewards and Mining Incentives

Miners run businesses with substantial costs. Rewards and incentives in mining come from two primary sources: block rewards and transaction fees.

Bitcoin’s block reward is currently 6.25 BTC per block. This amount halves every four years in a “halving event”. The next halving will reduce it to 3.125 BTC.

Transaction fees are the second revenue stream. Users can attach higher fees for faster processing. During congestion, these fees can become substantial.

Public mining companies operate on a massive scale. MARA Holdings holds 53,250 BTC, worth over $2 billion at recent prices. Other major players run thousands of mining machines across multiple facilities.

These companies bet that mining rewards will exceed costs. It’s a calculated risk requiring careful planning and operational efficiency.

| Mining Company | Bitcoin Holdings | Monthly Production | Hashrate Contribution |

|---|---|---|---|

| MARA Holdings | 53,250 BTC | ~800 BTC | ~50 EH/s |

| CleanSpark | ~9,000 BTC | ~600 BTC | ~30 EH/s |

| Riot Platforms | ~10,000 BTC | ~550 BTC | ~28 EH/s |

The incentive structure aligns miners’ interests with network security. Attacking Bitcoin would require controlling over 50% of the total hashrate. This would cost hundreds of millions in equipment and electricity.

Mining is changing. Ethereum moved to Proof of Stake in 2022, eliminating mining for staking. This addresses energy concerns while maintaining security through different mechanisms.

As block rewards decrease, transaction fees must increase for miner revenue. This shift will test the economic model’s long-term viability. It’s a question that intrigues blockchain researchers and investors.

Challenges Facing Blockchain Adoption

Blockchain faces significant obstacles that hinder mainstream adoption. These challenges affect everyday users and shape the technology’s practical applications. Understanding these issues provides a more complete picture of blockchain’s current state.

Real barriers impact blockchain’s usability. Slow transaction speeds and confusing regulations are just two examples. These problems influence how quickly blockchain can become a practical tool.

Scalability Issues

Blockchain’s current limitations are evident in its transaction speeds. Bitcoin processes about 7 transactions per second, while Ethereum manages 15-30. Visa’s network, however, handles over 24,000 transactions per second.

This bottleneck becomes frustrating during peak demand. I once paid over $60 in fees for a single Bitcoin transaction. That’s more than the lunch I was trying to buy!

The 2021 bull run made things worse. Ethereum gas fees often exceeded $100 for simple transactions. This priced out average users, contradicting blockchain’s goal of accessibility for everyone.

| Network | Transactions Per Second | Average Fee (Peak Times) | Confirmation Time |

|---|---|---|---|

| Bitcoin | 7 TPS | $60+ | 10-60 minutes |

| Ethereum | 15-30 TPS | $100+ | 2-15 minutes |

| Visa Network | 24,000 TPS | $0.10-0.20 | Seconds |

“Layer 2” solutions are being developed to address scalability problems. The Lightning Network for Bitcoin and rollups for Ethereum offer faster, cheaper transactions. However, these solutions add complexity to blockchain for beginners.

These solutions aren’t seamlessly integrated yet. Users must understand fund movement between layers, manage different wallets, and trust additional infrastructure. Each new layer creates potential points of failure.

Regulatory Concerns

Governments worldwide struggle to classify and regulate blockchain applications. This lack of clarity creates uncertainty for businesses considering blockchain adoption. Long-term technology investments become risky when future rules are unclear.

Recent developments show vastly different approaches across countries. El Salvador made Bitcoin legal tender, while China banned cryptocurrency transactions entirely. These opposing strategies complicate matters for international businesses.

The regulatory landscape for blockchain remains fragmented and uncertain, creating challenges for widespread enterprise adoption.

The United States has taken an enforcement-heavy approach through the SEC. Regulators pursue companies through lawsuits and penalties rather than providing clear guidelines. This creates uncertainty about which blockchain projects are legal.

Regulatory clarity will likely emerge, but the timeline remains uncertain. This hesitation keeps many enterprises from investing in blockchain technology. Companies can’t risk investing in tech that might become heavily restricted.

Additional Obstacles to Overcome

Blockchain faces several other significant challenges beyond scalability and regulation:

- Environmental concerns: Energy-intensive mining operations consume massive amounts of electricity, though the shift to Proof of Stake is improving this situation

- User experience barriers: Losing your private keys means losing your funds permanently with no customer service to call for help

- Persistent scams: Fraud and theft damage the technology’s reputation and make mainstream users hesitant to participate

- Limited interoperability: Different blockchains often can’t communicate with each other easily

The private key problem is particularly troubling. Traditional banking offers recovery options when you forget your password. Blockchain’s approach means one mistake can cost you everything you’ve stored.

I know someone who lost access to early Bitcoin holdings due to a forgotten password. No appeals process or customer service could help. The funds remain permanently inaccessible.

Realistic Outlook Moving Forward

Evidence suggests these challenges are solvable, not permanent. Scalability solutions are improving with each iteration. Regulations are developing as governments gain understanding. User experience gets better as developers learn from mistakes.

However, ignoring these obstacles does more harm than good. Anyone exploring blockchain for beginners should understand both its potential and limitations. The technology shows promise while facing real barriers to mainstream adoption.

These challenges will likely take years to fully resolve. Widespread blockchain adoption depends on addressing scalability, regulation, and usability concerns. Realistic expectations help prevent disappointment when blockchain doesn’t immediately transform everything.

The Future of Blockchain Technology

Blockchain technology is changing fast. It could be as big as the internet’s early days. Industry experts predict major shifts, but exact timelines are uncertain. We’re nearing a turning point in blockchain’s development and adoption.

Big companies are investing heavily in blockchain. This was unthinkable just ten years ago. They’re putting serious money into digital assets and blockchain infrastructure.

Institutional Adoption and Market Dynamics

Corporate blockchain adoption is growing rapidly. MicroStrategy now holds $69 billion in Bitcoin. The top 15 corporate treasuries own over 900,000 BTC. Analysts say this is just the start.

Big investors are buying more digital assets. Coinbase premiums show strong buying from large players. This trend has stayed steady even during market ups and downs.

The economy affects when blockchain gets adopted. US CPI data impacts crypto markets by influencing interest rates. These rates affect all risky assets, including blockchain-based ones. Short-term price movements clearly show these connections.

Emerging Trends Worth Watching

Blockchain is changing more than just crypto. Enterprise blockchain solutions are a big shift happening now. Supply chains are using blockchain at full scale.

Companies track products from start to finish with blockchain. This creates new levels of transparency. Blockchain-based digital identity could change how we manage personal info online.

Users might control their own digital identities through decentralized systems. Central Bank Digital Currencies (CBDCs) show governments accept blockchain-based money as inevitable. CBDCs validate the technology, even if they’re controlled versions.

AI and blockchain are working together more. This improves security and automation. AI can spot issues in blockchain networks. Blockchain makes AI decisions more transparent.

Blockchain will become invisible infrastructure – you won’t think about using blockchain any more than you think about using TCP/IP when browsing the internet.

Revolutionary Applications on the Horizon

Future blockchain uses go beyond money. Decentralized Autonomous Organizations (DAOs) could change how companies are run. They allow truly democratic decisions without traditional bosses.

Blockchain voting could make cheating in elections nearly impossible. It would create a clear record while keeping votes private. Real estate tokenization is another game-changer.

Blockchain tokens can represent property ownership. This lets people invest small amounts in expensive buildings. Web3 apps promise to give users control of their data.

Instead of big tech owning your info, you’d decide who sees it. You might even get paid when companies use your data.

| Future Application | Primary Benefit | Adoption Timeline | Current Development Stage |

|---|---|---|---|

| Decentralized Autonomous Organizations | Democratic governance without hierarchy | 3-7 years | Early implementations active |

| Blockchain Voting Systems | Fraud-resistant transparent elections | 5-10 years | Pilot programs in limited jurisdictions |

| Real Estate Tokenization | Fractional ownership accessibility | 5-8 years | Regulatory frameworks developing |

| Web3 Data Ownership | User control over personal information | 3-10 years | Infrastructure building phase |

| Enterprise Supply Chains | End-to-end transparency | 2-5 years | Active deployments expanding |

Experts disagree on how long blockchain adoption will take. Some say 5-10 years for finance and supply chains. Others think it could be decades before the tech fully matures.

Current development shows huge investment in blockchain infrastructure. Venture capital keeps flowing in, showing strong institutional faith. The impossible keeps becoming normal in blockchain.

Five years ago, most people ignored Bitcoin. Now, big banks offer crypto services. Companies hold billions in digital assets. Real blockchain apps are changing finance and supply chains.

These aren’t just ideas anymore. They’re working projects with real users and results. Mainstream adoption will likely happen slowly, then all at once.

Blockchain will become invisible, powering apps without users noticing. It’s like how you don’t think about internet protocols when watching videos. The future of blockchain isn’t just about crypto prices.

It’s about rethinking trust, value, and organization in a digital world. Whether this future comes in five or twenty years is unclear. But the direction seems set.

Getting Started with Blockchain

You’re ready to dive into blockchain technology. Good news! You don’t need a computer science degree or a big wallet. Let’s explore some practical ways to begin your journey.

Learning Tools and Platforms

“Mastering Bitcoin” by Andreas Antonopoulos offers accessible technical depth. Coursera and edX provide blockchain courses from top universities. These range from beginner to advanced levels.

For hands-on experience, try buying a small amount of cryptocurrency. This lets you explore wallets and transactions without financial risk. Blockchain explorers show real-time transactions, making concepts easier to understand.

The future of blockchain integration showcases networks like Solana. These can handle up to 65,000 transactions per second, addressing scalability challenges.

Connect With Others

Reddit communities like r/Bitcoin and r/Ethereum are great for beginners’ questions. Bitcoin Talk forums and local meetups connect you with experienced blockchain enthusiasts. GitHub repositories reveal actual development discussions for the technically curious.

Ignore get-rich-quick schemes and focus on the technology itself. Start with amounts you can afford to lose. Remember, confusion is part of the learning process.