Ethereum is a decentralized blockchain-based platform that enables the development and deployment of smart contracts and distributed applications. It has transformed the way businesses operate, allowing for more efficient transactions and faster processes. It has become one of the most popular digital currencies in the world, with an ever-increasing market value. As such, investors across the globe are keen to understand how Ethereum prices are determined and what factors influence them. The live Ethereum price in CAD provides valuable insights into its current market value, which can be used to inform investment decisions. This article will discuss how Ethereum prices are determined, factors that influence them, strategies for investing in it, as well as potential benefits and risks associated with investing in it.

Key Takeaways

- Ethereum is a decentralized blockchain-based platform for smart contracts and distributed applications.

- The live Ethereum price in CAD provides valuable insights for investment decisions.

- Ethereum’s decentralized nature allows for greater security in app development.

- The value of Ethereum is determined by factors such as market supply and demand, macroeconomic factors, and speculation.

Overview of Ethereum

Ethereum is a blockchain-based distributed computing platform, featuring smart contract functionality and providing a virtual machine with the capacity to execute peer-to-peer contracts. The open source software was developed in 2013 by Vitalik Buterin and has since become one of the most widely used platforms for creating decentralized applications. Ethereum leverages blockchain technology to enable smart contracts, allowing users to exchange digital assets, track ownership, and create secure transaction records. This makes it possible for organizations to automate processes like ordering goods or services without relying on third-party intermediaries. Additionally, Ethereum’s decentralized nature allows developers to build apps with much greater security than traditional centralized systems. As such, Ethereum is an increasingly popular choice for businesses and individuals looking for a reliable platform on which they can trust their digital transactions. Furthermore, the ability of Ethereum’s smart contracts to securely store data makes it an attractive option for storing sensitive information. With this capability combined with its numerous other advantages, Ethereum has quickly become a leader in the world of cryptocurrency and blockchain technology. In conclusion, these features have helped drive up the demand for Ether (ETH) tokens – leading many Canadians to turn to live ETH price CAD charts as a way of tracking how their investments are performing over time..

How the Ethereum Price is Determined

Determining the value of Ethereum involves a range of factors, including market supply and demand. Macroeconomic factors play an important role in influencing the price of Ethereum as they affect the availability and demand for it. Factors such as changes in interest rates, inflation, GDP and unemployment are all taken into account when establishing the Ethereum price. The relationship between supply and demand is also essential, as it determines how much Ether can be bought or sold at a given time. When there is an increase in demand but limited supply, prices tend to rise; similarly, if there is more supply than demand then prices may fall.

In addition to these macroeconomic fundamentals, speculation has a significant influence on the short-term market movements of Ethereum prices. This means that investors’ confidence in the future potential of Ethereum will largely determine its current value. Therefore understanding how sentiment affects investor behaviour is key for predicting future changes in price trends of Ethereum CAD pairs. Moving forward into subsequent sections this paper will explore the various factors that influence the ethereum price further.

Factors That Influence the Ethereum Price

Assessing the various aspects that affect Ethereum’s value is a critical factor in predicting its price trends. The cryptocurrency market, blockchain technology, and other economic indicators can all greatly influence the price of Ethereum. Cryptocurrency markets are highly volatile, meaning they can swing from high to low quickly, often due to speculative trading or news headlines. As such, it is important to stay informed on recent events that may have an effect on its value. Blockchain technology is also a major factor as improvements in scalability and efficiency of the network have a direct bearing on Ethereum’s price. Other economic indicators such as inflation rates or interest rates also play a part in determining the current and future prices of Ethereum.

The live ethereum price in CAD can be found through many different sources online including popular cryptocurrency exchange websites or trading platforms like Coinbase or Kraken. These websites offer real-time updates about Ether’s current value relative to other fiat currencies such as US Dollars (USD) or British Pounds Sterling (GBP). Additionally, there are various tools available for tracking changes in ETH/CAD over time so investors can monitor any fluctuations in order to make strategic decisions around buying and selling their holdings.

The Live Ethereum Price in CAD

The current CAD value of Ethereum can be tracked through various sources, such as cryptocurrency exchanges and trading platforms. Keeping a reliable eye on the real-time rates of the currency exchange is important for investors who are looking to capitalize on the volatility of Ethereum’s price. By using a trading platform, users are able to determine the current rate at any given moment which allows them to make informed decisions about investing in and exchanging Ethereum tokens for other digital or fiat currencies. Additionally, some platforms provide tools that allow users to track historical data in order to better gauge future trends and maintain a strategic portfolio.

Overall, understanding the live ethereum price in CAD provides valuable information for those interested in capitalizing on its fluctuating market; by weighing both past performance and present conditions, investors can make sound decisions about their investments and devise strategies aimed at maximizing their potential profits while mitigating risk associated with volatile cryptocurrencies such as Ethereum. With this knowledge of current ethereum prices one can begin to explore how these fluctuations might affect the global economy.

How the Ethereum Price Affects the Global Economy

Analyzing the impact of Ethereum’s price fluctuations on the global economy has become an important consideration for financial professionals. With its decentralized, open-source nature, Ethereum has created a platform that is both volatile and unpredictable in terms of market value. Therefore it is necessary to understand buying strategies and market volatility when considering investing in Ethereum. This will help investors gain insights into how changes in the value of Ethereum can ripple through the global economy and affect other markets. As a result, many financial institutions have adopted strategies to hedge against potential losses due to cryptocurrency fluctuations. Furthermore, understanding trends in Ethereum prices also helps investors make informed decisions about their investments and plan accordingly for future growth or decline in value.

Understanding Ethereum Price Trends

Ethereum prices have been known to fluctuate significantly in the short-term, with occasional fluctuations of up to 20% or more in a single day. Longer term price movements tend to be much calmer, but there are still significant changes that have occurred over longer periods of time since Ethereum’s launch in 2015. It is therefore important to understand both short and long-term price movements when analyzing Ethereum’s value over time. By understanding these trends, investors can gain insight into the future prospects of the cryptocurrency and make informed decisions about whether or not it is a good investment opportunity.

Short-term Price Movements

Recent short-term price movements of Ethereum in Canadian dollars have been characterized by sharp changes, often swinging from one extreme to the other within a matter of hours. For example, on April 3rd 2021, Ethereum prices rose from $1,365 CAD to a peak of $2,077 CAD in only two and a half hours – akin to a ship being thrown around by sudden gusts of wind. This volatility is largely attributed to market speculation and the perceived risk associated with crypto investments. As such, these fluctuations create an uncertain landscape for investors who are looking to capitalize on short-term gains. Nevertheless, many remain optimistic that Ethereum will continue its upward trend despite the crypto volatility caused by high levels of speculation. Moving forward, it will be interesting to observe how long-term price movements affect the overall trajectory of Ethereum’s value in Canadian dollars.

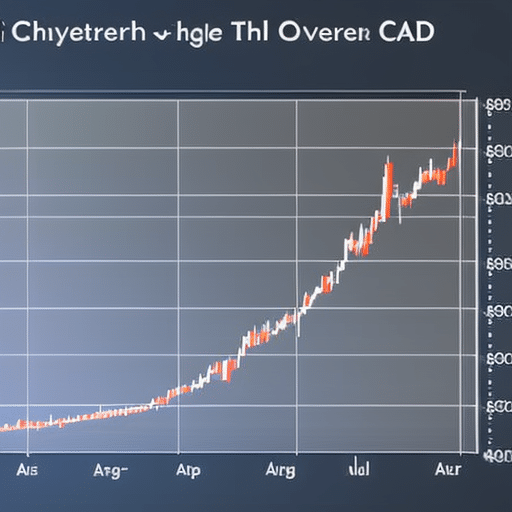

Long-term Price Movements

In comparison to short-term price movements, Ethereum’s long-term trajectory has been marked by gradual but steady growth. This is largely driven by changes in the supply and demand of Ether tokens in the market as well as changes in the overall market sentiment towards Ethereum. Over the past few years, Ethereum has seen its price steadily increase, with sporadic drops along the way due to corrections or sudden shifts in investor sentiment. In terms of long-term investment strategies for Ethereum, investors should look at factors such as innovation within the Ethereum platform itself as well as potential competitors that could offer similar services and features on their own blockchain networks. As such, it is important to be aware of how these factors may influence Ethereum’s long-term price trajectory before investing. With this knowledge in mind, investors can then devise suitable strategies for investing in Ethereum over the long term.

Strategies for Investing in Ethereum

Comparing the risks and rewards of investing in Ethereum to other cryptocurrencies can help investors make informed decisions when evaluating strategies. When considering investment timing, it is important to consider the market volatility of Ethereum, as well as any specific news or events that may influence its price. Additionally, diversification strategies should be taken into account when making an investment decision, as this can help reduce risk while still allowing for potential returns. Investing in a variety of coins or tokens allows investors to spread their risk across multiple assets and minimize losses if one asset performs poorly. For example, an investor might consider investing part of their portfolio in Ethereum and another part in Bitcoin or other altcoins such as Litecoin or Monero. By doing so they are diversifying their portfolio and increasing the chances of achieving positive returns over time. With these considerations in mind, investors can develop a solid strategy for investing in Ethereum that takes into account both short-term and long-term prospects.

Benefits of Investing in Ethereum

Investing in Ethereum can be a lucrative venture if done properly. With its native cryptocurrency, Ether, and the blockchain-based technology that powers it, Ethereum offers many advantages to potential investors. When looking into buying strategies for Ethereum, one should consider market sentiment as well as the current economic trends in order to make an informed decision.

Investors may benefit from the high volatility of Ether when compared to other cryptocurrencies or assets, allowing them to take advantage of short-term movements in the market. Additionally, Ethereum is an open platform which means anyone can develop applications on it without needing permission from a third party – making it attractive for developers who wish to build dApps or enterprise solutions. Furthermore, with its smart contract capabilities and decentralized nature, Ethereum facilitates trustless transactions between two parties without requiring middlemen or centralized entities such as banks or governments. As such, investing in Ethereum could potentially generate higher returns than traditional investments while also providing access to innovative technologies not available elsewhere. Transitioning into the next section about ‘risks of investing in ethereum’, one must consider these factors before deciding whether this asset class is right for them.

Risks of Investing in Ethereum

Despite the potential benefits of investing in Ethereum, there are various risks that should be carefully considered before making any decisions. Price volatility is one major risk associated with investing in Ethereum. The price of Ethereum can fluctuate dramatically from day to day, and even within a single trading session. This makes it difficult to accurately predict where the price will go next, and could result in significant losses if investors make poor investment strategies. Another risk of investing in Ethereum is its relative lack of regulation compared to other markets. With less regulation comes increased risk as investors may not have access to the same protections they would have when trading on regulated exchanges or through a financial advisor.

Finally, scams related to Ethereum are also a considerable risk factor for investors. As with any digital currency, unscrupulous actors may attempt to exploit unsuspecting users by offering fake investments or services related to Etherum. It is therefore important for investors to do their due diligence before engaging with any company or individual claiming to offer investment opportunities related to Etherum. These risks should all be taken into consideration when evaluating whether or not an investment in etherum is right for you:

| Risk Factor | Potential Impact | |||

|---|---|---|---|---|

| Price Volatility | Significant Losses | |||

| Lack of Regulation | Increased Risk | |||

| Scams Related To Ethereum | Financial Losses | Limited Liquidity | Difficulty Exiting Positions |