Ethereum is a decentralized platform that enables the creation, distribution, and exchange of digital assets. It has become increasingly popular as an investment option due to its potential for high returns. This article will explore whether investing in 0.03 Ethereum is a smart decision at this time by looking at relevant factors such as current market trends, advantages and disadvantages of investing in Ethereum, and available strategies. Additionally, it will address other topics such as mining and Ethereum-based tokens. By the end of this article, readers should have a better understanding of what risks are associated with investing in 0.03 Ethereum and be able to make informed decisions about their investments.

Overview of Ethereum

Ethereum is an open-source, public, blockchain-based distributed computing platform featuring smart contract functionality. It enables decentralized applications to be built and run without any fraud, control or interference from a third party. The Ethereum Virtual Machine (EVM) allows developers to build and deploy distributed applications on the Ethereum blockchain. Smart contracts are self-executing contracts that enable users to exchange money, property or anything of value in a transparent way while avoiding the services of traditional middlemen such as lawyers and brokers. Decentralized applications can be developed using the same underlying technology as Ethereum’s smart contracts – allowing developers to create their own digital assets, financial products and other digital services over the blockchain network.

The potential benefits of investing in Ethereum include access to a wide range of decentralized applications, secure transactions facilitated by smart contracts, anonymity for users and low transaction costs due to its decentralized nature. However, before deciding whether it is a good time to invest in Ethereum, there are several factors that need to be considered such as market trends, risks associated with investing in cryptocurrency markets and security concerns related to holding funds on exchanges.

Factors to Consider Before Investing

When considering an investment in cryptocurrency, it is important to weigh the potential advantages and disadvantages of doing so. One advantage being that Ethereum has been steadily increasing in value, however there are also risks associated with such investments that must be taken into account. It is essential to evaluate factors such as current market conditions, economic cycles, and various investment strategies when deciding whether or not investing in Ethereum at this time is a wise decision. For example, if the current bear market persists for several months or longer then investing now may not be the most prudent move. On the other hand, if short-term economic trends indicate that Ethereum prices are likely to rise over the next few weeks or months then now could be a good time for investors to consider buying Ethereum. In any case, understanding the various factors involved in making an informed investment decision is key before committing funds towards purchasing any type of cryptocurrency.

The next step is to consider potential advantages of investing in ethereum at this time including its potential for growth and appreciation over time as well as its low transaction fees compared to traditional payment methods which make it attractive for online transactions and remittances. Additionally, Ethereum’s decentralized nature makes it an attractive option for those seeking an alternative form of currency outside of traditional banking systems. Therefore, by carefully weighing all relevant factors before committing funds towards purchasing ethereum can help investors determine whether or not this type of investment will provide good returns on their money over time.

Advantages of Investing in Ethereum

Investing in Ethereum offers a number of advantages. Firstly, it has very low transaction fees compared to other cryptocurrencies and traditional payment systems such as credit cards or PayPal. Secondly, the security of the blockchain technology used by Ethereum makes it highly secure and difficult for hackers to access. Lastly, Ethereum is an open-source platform that enables developers to create decentralized applications which provides further potential for growth and investment opportunities.

Low Transaction Fees

Transaction fees associated with Ethereum are lower compared to other cryptocurrencies, making it an attractive option for investors. Gas costs on the Ethereum network are determined by the amount of computational power required to complete a transaction, as well as the current demand for GAS on its blockchain. This makes Ethereum transactions more affordable than those conducted on other networks. Additionally, scalability issues have been addressed in recent updates which has further lowered transaction fees and allowed for higher throughput. As a result, investors can benefit from lower transaction costs when investing in Ethereum compared to other digital currencies or traditional payment systems. This combined with its high security makes Ethereum an appealing choice for many potential investors.

High Security

Built on the decentralized blockchain, Ethereum offers unparalleled security, often being referred to as a ‘fortress of solitude’. This is achieved through its smart contract technology which allows for the development of decentralized applications. Ethereum’s robust security protocols are further reinforced by its open-source platform and community-driven development model.

| Security Protocols | Description | Example |

|---|---|---|

| Encryption | Protects data from unauthorized access | Hardware Security Module (HSM) |

| Authentication | Verifies user identity | Digital Signatures |

| Permissions | Defines user or group access rights | Access Control Lists (ACL) and Role Based Access Control (RBAC) |

| Auditing | Tracks all changes to records | Transaction Logging & Auditing |

| Monitoring │ Continuously watches system activity │ Intrusion Detection Systems │ |

These security protocols ensure that users can securely use and store their Ethereum without risk of malicious attack. Additionally, these measures help maintain the integrity of the network while providing a safe environment for transactions to take place. By investing in Ethereum you would be securing your digital assets with one of the most secure platforms available today. Transitioning seamlessly into the next subtopic about ‘open-source platform’, it is important to note that this open-source nature helps promote transparency as well as encourages third party developers to build upon existing features.

Open-Source Platform

Ethereum’s open-source platform provides users with the opportunity to access its underlying code, allowing for peer review and ongoing innovation. This makes it possible for developers to create and deploy decentralized applications (DApps) on the Ethereum blockchain. Additionally, Ethereum supports smart contracts, which facilitate automatic execution of transactions between parties without relying on a trusted third party. Furthermore, Ethereum enables the creation of decentralized exchanges that allow users to trade digital assets without centralized control or intermediaries. As such, Ethereum’s open-source platform provides an array of advantages that make it an attractive option for investors seeking a secure and reliable way to invest in cryptocurrency.

The potential benefits offered by Ethereum’s open-source platform are clear; however, there are also certain risks associated with investing in any cryptocurrency. These include volatility in market prices due to speculative trading activity and regulatory uncertainty due to lack of oversight. Consequently, investors should carefully weigh both the advantages and disadvantages before deciding whether now is a good time to invest in 0.03 ethereum or not.

Disadvantages of Investing in Ethereum

Investing in Ethereum carries a certain degree of risk. Firstly, the future of the cryptocurrency market is uncertain and therefore there is no guarantee that any investment will be profitable or make a return. Secondly, due to its decentralized nature, Ethereum is vulnerable to hacking which may result in financial losses for investors. Finally, the complex system of trading and investing in Ethereum requires significant knowledge on how the technology works and can be difficult to understand for those not familiar with blockchain technology.

Uncertainty about its Future

Given the present uncertainly surrounding its future, exercising caution when investing in 0.03 ethereum may be prudent; after all, ‘look before you leap’. Speculation risks and future trends must be taken into consideration prior to deciding whether or not to invest in this cryptocurrency. As there is no guarantee of the value of 0.03 ethereum over time, it is important to have an understanding of current market forces and potential fluctuations. Additionally, investors need to understand that cryptocurrencies are highly volatile and therefore subject to price movements that could result in significant losses. Therefore, due diligence must be undertaken by those considering investing in 0.03 ethereum so as to reduce any potential risk associated with such investments.

Given these complexities, it is important for potential investors to do their own research and make sure they are comfortable with the level of risk involved before making decisions regarding 0.03 ethereum investment. Moreover, one should bear in mind that the success of such an investment depends on various factors including economic conditions and government regulations which can change quickly. As such, exercising caution when investing in 0.03 ethereum may be wise given the present uncertainty about its future performance and movement in prices over time. With this in mind, transitioning into a discussion about the risks associated with hacking should be approached cautiously as well.

Risk of Hacking

Due to the decentralized nature of cryptocurrencies, including 0.03 ethereum, they are at risk of being hacked and stolen by malicious actors. This could be done by exploiting known weaknesses in the system or through phishing scams which trick users into revealing private keys or passwords. As a result, investors should keep in mind that there is a certain amount of risk associated with investing in 0.03 ethereum due to the possibility of it being hacked:

- Malicious actors may target exchanges or wallets where cryptocurrency is stored;

- Hackers may use sophisticated techniques such as malware and data breaches to gain access to funds;

- Phishing scams can also be used to steal private keys and passwords from unsuspecting victims;

- The complexity of the system makes it difficult for users to protect themselves from hackers.

Given these risks, potential investors must carefully consider whether now is a good time for them to invest in 0.03 ethereum before taking any action.

Complexity of the System

The complexity of the cryptocurrency system, including 0.03 ethereum, can make it challenging for users to protect their funds from malicious actors. Ethereum is an open-source blockchain network that allows users to create and deploy decentralized applications (dApps) and smart contracts through its native programming language Solidity. This complexity requires users to have a thorough understanding of the technology in order to ensure that their funds are secure from cyber threats. The creation of dApps and Smart Contracts also require developers with knowledge of how to code in Solidity and other web development languages, increasing the complexity of building on Ethereum even further.

| For those interested in investing in 0.03 ethereum, this increased complexity should be kept in mind when evaluating risk vs reward potentials as there may be additional challenges associated with navigating the network’s unique infrastructure. | Risk | Complexity |

|---|---|---|

| Hacking | Programming Knowledge Required | |

| Theft | Decentralized Applications & Smart Contracts | |

| Fraudulent Activity | Open Source Blockchain Network |

This brings us to our next topic – current market trends – which could potentially impact investment decisions related to 0.03 ethereum.

Current Market Trends

Analyzing current market trends reveals the viability of investing in 0.03 ethereum. Cryptocurrency markets are volatile, and blockchain technology is rapidly changing the landscape of finance. Investing in 0.03 ethereum requires careful consideration of several factors:

- Crypto volatility – crypto markets can swing wildly day to day, with prices shifting rapidly between gains and losses;

- Blockchain technology – technology behind cryptocurrencies continues to evolve at a blistering pace;

- Market conditions – macroeconomic forces influencing the cryptocurrency marketplace must be taken into account.

Given all these considerations, it is necessary to evaluate potential return on investment before investing in 0.03 Ethereum.

Potential Return on Investment

Evaluating potential return on investment is essential when considering investing in 0.03 Ethereum. Investors must consider the volatility associated with such an investment, and risk of liquidity issues should also be taken into account. A thorough analysis of both requires a deep understanding of the current market trends, as well as an assessment of historical data to help inform future projections. Volatility analysis can provide insight into how much risk is associated with any given investment, while liquidity risk measures the ability to quickly convert an asset back into cash without significant loss in value. By assessing these factors, investors can more accurately determine their potential returns on investment and better understand the risks involved with 0.03 Ethereum investments.

Having considered both volatility analysis and liquidity risk, investors will then need to evaluate decentralized finance (defi) on Ethereum as a further factor influencing potential return on investment. Defi involves using smart contracts and blockchain technology for financial transactions that are faster, cheaper, and more secure than traditional banking systems or exchanges. As such, it may offer additional opportunities for investor returns which should be weighed against other considerations before investing in 0.03 Ethereum.

Decentralized Finance (DeFi) on Ethereum

Decentralized Finance (DeFi) on Ethereum is a rapidly growing industry that has recently seen unprecedented growth and activity. In this regard, investing in the Ethereum blockchain could be an attractive option for investors, as its smart contracts and trustless protocols make it possible to benefit from the advantages of DeFi applications without having to worry about the risks associated with centralized finance. Smart contracts enable users to securely store and transfer digital assets, while trustless protocols allow for quick transactions without requiring trust between two parties. These features have made Ethereum one of the most popular blockchains for building decentralized applications.

The growth of DeFi on Ethereum has been fueled by numerous projects built on its platform such as Compound, Uniswap, MakerDAO and Aave. These projects have enabled users to access various services including asset trading, lending/borrowing services, derivatives trading, stablecoins issuance and more. All these services are powered by innovative financial instruments such as automated market makers (AMMs), liquidity pools and yield aggregators that provide investors with higher returns than traditional financial products. Therefore investing in 0.03 ethereum at this time could potentially bring good returns if done correctly considering all risk factors involved in such investments. As we continue our discussion into ‘Ethereum 2.0’, it is clear that investing into the Ethereum blockchain now could be beneficial to investors who understand how these new technologies work and can mitigate any potential risks associated with them effectively.

Ethereum 2.0

Exploring the potential of Ethereum 2.0, it is clear that the upcoming upgrades to the blockchain could revolutionize decentralized finance and bring unprecedented levels of financial innovation. The upgrade will feature a shift from an energy-intensive proof-of-work consensus algorithm to a more efficient proof-of-stake protocol. This new consensus mechanism will allow for greater scalability, faster transaction speeds, and lower costs. Additionally, Ethereum 2.0 will introduce improved smart contracts capabilities that enable developers to create complex dapps with higher security than ever before. This could open up an entirely new realm of possibilities in terms of financial services and products built on top of the Ethereum network. As such, there is much speculation about whether now is a good time to invest in Ethereum ahead of these major improvements coming into effect.

Ethereum-Based Projects

The Ethereum blockchain has enabled the development of a wide range of projects and applications, which have the potential to transform various industries. Initial Coin Offerings (ICOs) are one such example, allowing businesses to raise capital quickly and efficiently without having to rely on traditional sources of finance. However, ICOs come with risks due to lack of regulation and the difficulty in assessing whether an ICO is legitimate or not. Smart contracts are another technology made possible by Ethereum that can automate processes through predetermined rules encoded into a code, eliminating intermediaries like lawyers and brokers from common transactions. This could revolutionize how people interact with each other as well as how companies conduct business. Thus, projects built on Ethereum’s platform offer investors the opportunity to participate in innovative products that could yield substantial returns if successful. Moving forward, it is important to analyze price history when considering any investment in order for investors to make informed decisions.

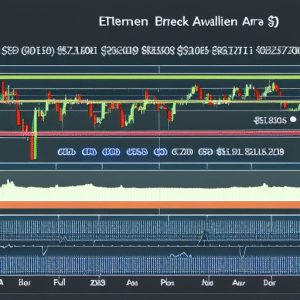

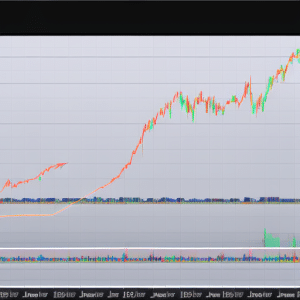

Analyzing Ethereum Price History

Evaluating Ethereum’s price history reveals that it has experienced significant volatility over the past five years. For example, in January 2018 its value peaked at $1,400 before dropping to around $100 by December 2018. This can be attributed to a few factors:

- The increasing popularity of Ethereum-based smart contracts and decentralized applications as well as blockchain technology generally;

- Regulatory uncertainty surrounding cryptocurrency markets;

- The emergence of rival technologies such as Tron and EOS; and

- Difficulty in predicting future market conditions for cryptocurrencies like Ethereum.

Overall, current market conditions are uncertain and investing in any cryptocurrency is risky business so potential investors should proceed with caution and seek professional advice before making any decisions. Nevertheless, long-term investors could still benefit from the upside potential of Ethereum given its underlying technology and growing adoption rates of blockchain solutions for businesses across industries.

Ethereum Mining

Mining Ethereum is an activity in which computers solve complex algorithms to create new blocks on the Ethereum network and secure its transactions, receiving rewards for their work in the form of Ether. The process requires specialized mining hardware with a high hash rate, as well as substantial amounts of electricity to power the hardware. As more miners join the network, and the difficulty levels increase accordingly, it becomes harder for individual miners to generate profits from their activity. This could make investing in mining hardware a risky proposition at times when Ethereum’s price is volatile or declining. Nevertheless, continuing research into more efficient mining techniques may allow some investors to continue profiting from Ethereum mining even during periods of market volatility. As such, investors should evaluate potential risks before making decisions about whether or not to invest in Ethereum-based tokens or mining equipment.

Ethereum-Based Tokens

Exploring Ethereum-based tokens can be an intriguing way to gain exposure to the potential of blockchain technology. Tokenized assets, such as ERC20 tokens, can potentially revolutionize a wide range of activities from financial trading and real estate transactions to content monetization and digital identity management. Such tokenized assets are typically created and managed through smart contracts on the Ethereum blockchain, enabling users to benefit from a trustless infrastructure that is secure, transparent and efficient.

The use of tokenized assets carries with it certain risks, however. With the rise in popularity of cryptocurrency investments, there has been an increase in fraudulent activity by malicious actors attempting to take advantage of unsuspecting investors for their own personal gain. Therefore, before investing in any Ethereum-based tokens it is important to ensure that one understands all associated risks and performs adequate due diligence. This transition leads us into the next section about understanding the risks involved when investing in Ethereum.

Risks of Investing in Ethereum

Investing in Ethereum carries the potential for significant returns, yet it is important to understand the risks associated with such an endeavor. Network vulnerabilities can cause large-scale disruptions in trading and transactions as well as present opportunities for malicious actors to exploit users’ funds. Additionally, financial risks pose a major challenge due to the highly volatile nature of cryptocurrencies and the lack of investor protection. In particular, there is no guarantee that Ethereum will retain its current value or increase in value, meaning investors could potentially suffer severe losses. Therefore, it is essential to assess these risks carefully before investing in Ethereum or any other cryptocurrency. With this knowledge, investors can be better prepared for what lies ahead when considering whether now is a good time to invest in Ethereum.

Investing Strategies

When evaluating Ethereum investment strategies, it is important to consider the associated risks and rewards. When investing in Ethereum, key factors to be aware of are cryptocurrency regulations, fees and commissions, market volatility, and tax implications.

Cryptocurrency regulations vary by country and can change quickly. It is important to stay informed on the local laws governing investments in cryptocurrencies such as Ethereum. Fees and commissions should also be taken into account when formulating an investment strategy. Additionally, due to its volatile nature, investors should be prepared for potentially large swings in market prices when investing in Ethereum. Lastly, investors should keep up with the taxation requirements of their jurisdiction which may include income taxes on profits or sales taxes on purchases/sales of cryptocurrencies like Etheruem.