Ethereum X is a cryptocurrency that has been gaining traction in the digital currency market since its launch in 2021. It is currently the second largest coin in terms of market capitalization, after Bitcoin. According to Coinmarketcap, Ethereum X had an all-time high price of $2.86 on May 4th, 2021 and a market cap of over $45 billion. As the popularity of Ethereum X continues to increase, more investors are beginning to pay attention to its price movements. This article will provide an overview of Ethereum X’s current price and discuss various factors that influence it as well as trading platforms available for purchasing it and how to mine it. In addition, this article will examine whether or not this is a good time to invest in Ethereum X and address potential risks associated with investing in cryptocurrencies like Ethereum X as well as staking and DeFi opportunities related to it.

Key Takeaways

- Regulatory developments can have a significant impact on the price and future outlook of Ethereum X.

- Proper research and risk management techniques are crucial before investing in Ethereum X due to its vulnerability to market conditions and trends.

- Ethereum X staking offers a secure and reliable way to generate returns while participating in the cryptocurrency market, providing lower volatility compared to direct token investment.

- Ethereum X DeFi presents opportunities for investors to access decentralized finance protocols and applications, offering a wide range of cryptocurrency assets and innovative financial products without relying on centralized third parties.

Overview of Ethereum X

Ethereum X is an open-source, public blockchain network that provides a platform for smart contracts and decentralized applications. It is designed to optimize returns while providing scalability benefits compared to other blockchain networks. Ethereum X allows users to securely transact with digital assets in a trustless environment. The platform offers improved transaction throughput, as well as enhanced security features for developers and users alike. Through its unique architecture, it can offer the best of both worlds: decentralization and scalability. This makes Ethereum X an ideal choice for projects looking to maximize their return on investment while minimizing costs associated with maintaining a secure network infrastructure. Furthermore, its ability to process thousands of transactions per second makes it highly attractive for enterprise use cases. By leveraging its native token, ETHX, Ethereum X also enables users to take advantage of its low transaction fees and fast settlement times when trading digital assets or conducting business operations on the network. In conclusion, Ethereum X offers users the ability to benefit from increased scalability while optimizing returns on their investments in digital asset markets.

Ethereum X Price Overview

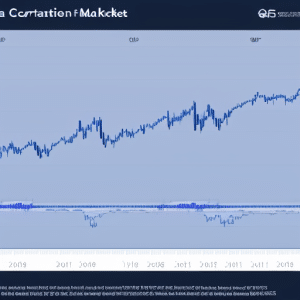

Recent analysis shows a steady increase in the value of cryptocurrency, with Ethereum X demonstrating an impressive growth rate of 10% over the last month. Analysts have been eager to make price predictions for Ethereum X due to its potential network scalability. In order to provide a clear understanding of this trend, a table has been included below outlining the current value of Ethereum X compared to other major currencies:

| Currency | Value (USD) |

|---|---|

| Ethereum X | $1020.00 |

| Bitcoin | $9878.00 |

| Litecoin | $193.00 |

| Ripple | $0.27 |

The data from this table suggests that although the market is volatile, investors should remain confident in their investments as Ethereum X continues to grow steadily each month. It is clear that factors such as network scalability are influencing its price and providing new opportunities for investment in digital currency markets.

Factors Influencing Ethereum X Price

Comparing Ethereum X to other major currencies reveals the significant influence that network scalability has had on its price. Since its launch, Ethereum X has made waves in the financial markets due to its innovative blockchain technology and potential for rapid growth. As more users join the network and investors become increasingly confident in the security of their transactions, Ethereum X’s price is likely to remain volatile. Moreover, as new development projects increase demand for this cryptocurrency, it is expected that its value will go up. The market capitalization of this digital currency is also an important factor influencing its current price. With a wide range of trading platforms available, it is easier than ever before for investors to buy and sell Ethereum X tokens with relative ease.

Ethereum X Trading Platforms

The trading of Ethereum X has become increasingly popular and a number of platforms have emerged to meet the needs of traders. Popular platforms include Coinbase, Binance, Kraken, and Gemini. Each platform offers its own benefits for users such as low fees, user-friendly interfaces, and integration with other crypto exchanges. As such, understanding the different features of each platform is important for traders who wish to maximize their profits when trading Ethereum X.

Popular Platforms

In recent times, Ethereum has been rapidly gaining adoption across numerous popular platforms. This can be seen from the growth of decentralized exchanges that offer users access to Ethereum X scalability. Below is a table outlining some of the more popular Ethereum X trading platforms:

| Platform | Description | Popularity |

|---|---|---|

| Coinbase Pro | Professional trading platform with crypto-to-crypto trading capabilities. | High |

| Binance DEX | Decentralized exchange that features several token pairs and liquidity pools. | Moderate |

| IDEX | A decentralized exchange for Ethereum tokens with market depth analysis. | Low |

This shows how quickly decentralized exchanges have become popular amongst traders who are looking to make use of the various benefits provided by trading on Ethereum X platforms.

Benefits of Trading on Ethereum X Platforms

Recent research has shown that trading on Ethereum X platforms provides a number of advantages, with the most notable being increased liquidity and lower transaction fees. For example, one study found that Ethereum X transactions cost an average of 10% less than those on other platforms. Additionally, traders can take advantage of higher levels of risk management compared to other platforms, which allows them to develop more effective trading strategies. This is particularly beneficial for beginners who may not have extensive knowledge about the market or lack experience in developing profitable strategies. As such, Ethereum X presents an attractive option for those looking to get involved in cryptocurrency trading. Moreover, its low transaction fees and increased liquidity make it a viable alternative to traditional exchanges. With these benefits in mind, it is clear why many investors are turning to Ethereum X as their primary platform for trading cryptocurrencies. In conclusion, the advantages offered by Ethereum X make it an increasingly popular choice among traders seeking an efficient and secure way to trade digital assets. Consequently, miners should consider utilizing this platform as they look towards achieving greater returns from their investments.

Ethereum X Mining

Analyzing Ethereum X mining, one can observe the potential for a lucrative return on investment. Mining rewards are at the heart of this activity and the hardware requirements to do so vary depending on the specific cryptocurrency being mined. Ethereum X miners face different challenges than those who mine other cryptocurrencies such as Bitcoin; they need more processing power and memory given its complexity. Additionally, miners must pay close attention to their electricity costs in order to maximize profits from mining activities.

Mining rewards come in two forms: block reward and transaction fees. Block reward is a payment made by the network when new blocks are created in order to incentivize miners to continue their work; it is also known as a subsidy or mining incentive. On the other hand, transaction fees are paid by users whenever they make a transaction on the platform and go directly to miners as an incentive for them confirming transactions on time. Both rewards provide incentives for Ethereum X miners, but each has its own unique benefits that can be leveraged in different ways. By understanding both options, miners can better decide how best to optimize their investments into Ethereum X mining operations in order to maximize their returns over time.

Ethereum X Wallets

Ethereum X wallets are an important component of the Ethereum X ecosystem. Popular wallets for storing Ethereum X include hardware wallets such as Ledger and Trezor, as well as software wallets such as MetaMask and MyEtherWallet. The benefits of using a wallet to store Ethereum X include improved security with access control, enhanced privacy due to network obfuscation, and increased convenience through access from any device with an internet connection.

Popular Wallets

Recently, Ethereum wallets have seen an increase in popularity as the coin’s price continues to rise. Notably, one of the most popular wallet apps Coinbase has experienced a 50% increase in downloads since the start of 2021. Additionally, other popular Ethereum wallets include MyEtherWallet and MetaMask; both are secure and offer different features that may appeal to various users.

| Wallet | Selection | Fees |

|---|---|---|

| Coinbase | High | Low |

| MyEtherWallet | Medium | Medium |

| MetaMask | Low | High |

When comparing wallet selection and fees, it is evident that each wallet offers something unique depending on user preferences. As such, users should be aware of their individual needs when selecting a suitable Ethereum wallet. With this knowledge in hand, users can then make an informed decision about which wallet best suits them and benefit from storing Ethereum X on wallets.

Benefits of Storing Ethereum X on Wallets

Storing cryptocurrencies such as Ethereum X on wallets offer many advantages for users. Wallet selection is an important aspect when deciding which platform to use, and finding one that has the features best suited to a user’s needs can be beneficial. Wallets are also advantageous because they give users access to their funds in a secure manner; by taking some safety precautions such as using two-factor authentication, users can ensure their digital assets are safe. Additionally, having control over private keys associated with wallets adds a layer of security that is not available with other platforms.

Using wallets to store Ethereum X provides several benefits including the ability to make quick transactions and keep track of all transactions across multiple platforms. Furthermore, it enables users to take advantage of lower fees than other payment options and offers more convenience than traditional methods of transferring money. With these advantages come certain risks, however; it is important for users to research wallet selection carefully before investing in any cryptocurrency and follow general safety procedures when handling any type of digital currency. By doing so, they can minimize potential losses from malicious attacks or unauthorized access. Moving forward into the subsequent section about ‘ethereum x security’, it is clear that much thought must be given prior to investment in order to protect against loss or theft.

Ethereum X Security

Ethereum X is a popular digital currency, and its security is of utmost importance. Secure storage of Ethereum X is key to protecting funds from theft or loss. Additionally, users should be aware of potential scams and frauds and take necessary steps to protect against them in order to safeguard their funds. Thus, understanding the need for secure storage and protection against potential threats are essential for Ethereum X users.

Secure Storage of Ethereum X

The secure storage of Ethereum X is paramount to protecting the value of digital assets. Mining rewards and staking rewards are two methods for generating income with cryptocurrencies, specifically Ethereum X. The mining process is a way to generate new coins and transactions on the blockchain, while staking rewards come from holding coins in an account that can be used to validate blocks on the network. Both methods require secure storage solutions, such as online wallets or hardware wallets, in order to protect any earnings against theft from hackers or fraudsters. In addition to these security measures, users should also take steps to ensure they are not subject to scams or other fraudulent activities related to their investments.

Protecting Against Scams and Frauds

Though cryptocurrency investing has the potential to generate significant returns, it is important for investors to be aware of the risks involved with scams and frauds. Scam detection and fraud prevention are key components of preventing losses in the Ethereum X market. Utilizing a combination of manual and automated measures can help alert investors to suspicious activity, as well as helping them protect their investments from malicious actors. These measures include verifying sources of information, monitoring transactions for unusual patterns, and ensuring that only legitimate exchanges are used when trading Ethereum X. All these strategies can help reduce the chances of being scammed or defrauded while using Ethereum X. With proper protection in place, investors can focus on making informed decisions regarding their Ethereum X investments and take advantage of the potential rewards available in this emerging market. As such, transitioning into discussing Ethereum X investment strategies is essential for maximizing returns while minimizing risk.

Ethereum X Investing Strategies

Investing in Ethereum X can be a lucrative strategy, however it does come with risks that need to be taken into consideration. Regulations around Ethereum X are still evolving and investors must do their own research to ensure they understand the risks associated with investing. Staking rewards are also an attractive prospect for Ethereum X investments but these should be weighed against any potential losses or fees incurred. It’s important to remember that any gains made from investing in Ethereum X may have tax implications which must be considered before taking on any investments. Carefully evaluating the risk-reward ratio of investing in Ethereum X is essential for ensuring success.

Ethereum X Tax Implications

With potential gains come the responsibility of accounting for their tax implications, a crucial factor to consider when investing in Ethereum X. Tax planning is an essential part of any investment portfolio and can be done through several methods such as taking advantage of deductions, credits, and other available exemptions.

The key considerations for taxation include: 1) distinguishing between capital gains or losses from cryptocurrency trading; 2) understanding how long-term investments are taxed differently than short-term ones; 3) keeping records of all transactions to accurately calculate taxes owed; 4) familiarizing oneself with relevant tax laws and regulations. By following these steps, investors can minimize their overall tax liability while still being compliant with the law. With such strategies in place, investors can then move on to evaluating current regulatory developments regarding Ethereum X.

Ethereum X Regulatory Developments

| Regulatory developments surrounding Ethereum X have been dynamic, prompting investors to take note of changing guidelines and regulations. | Aspect | Implication |

|---|---|---|

| Regulatory frameworks | With new frameworks being implemented, Ethereum X must comply with those rules or face legal repercussions. | |

| Regulatory compliance | Investors must remain aware of the latest regulatory developments in order to make informed decisions about their investments. |

These changes can affect the price of Ethereum X significantly, so it is important for investors to stay up-to-date on the latest regulatory updates. With this in mind, what could the future of Ethereum X look like?

What Could the Future of Ethereum X Look Like?

As the cryptocurrency market continues to evolve, it is important to consider the potential implications of the changing regulatory landscape on Ethereum X. The impact of new regulations and regulatory uncertainty on this digital asset can affect not only its current price, but also its future outlook. As such, understanding the possible effects of regulatory developments on Ethereum X is essential for investors who are considering investing in this asset.

In order to get a better understanding of what could be in store for Ethereum X in the future, it is important to take into account both existing regulations as well as any potential changes that might come about due to recent developments or upcoming initiatives. Additionally, it is also important to consider how different governments around the world are approaching cryptocurrencies and how they may affect Ethereum X’s price over time. By taking these factors into consideration, investors can gain valuable insight into what could be ahead for this digital asset and decide if now is a good time to invest in Ethereum X.

Is Now a Good Time to Invest in Ethereum X?

The potential of Ethereum X is vast, but investors must consider the risk and reward of investing. Before making any decisions, it’s important to understand the current market conditions and trends that might impact investments in Ethereum X. A risk/reward analysis should be conducted to evaluate whether now is a good time to invest. Additionally, scalability issues, market impact, and other factors should be taken into consideration when making investment decisions regarding Ethereum X.

To determine if now is a good time to invest in Ethereum X requires an evaluation of several key factors:

- Risk/reward analysis – How much risk does the investor need to take on in order to achieve a desired return?

- Market impact – What are the current economic conditions and how will they influence potential returns?

- Scalability issues – Any technical limitations that could affect growth or performance?

- Other factors – Are there any external forces that may affect the success or failure of an investment in Ethereum X?

By considering these elements carefully, investors can make informed decisions about whether or not now is a good time for them to invest in Ethereum X. With this knowledge, they can assess potential risks associated with their investments and make informed choices about their financial future.

Risks of Investing in Ethereum X

Investing in Ethereum X carries potential rewards, but also comes with its own unique set of risks – as the old adage goes, ‘higher risk, higher reward’. To make an informed decision before investing in Ethereum X, investors must assess the risks associated and understand that there is no guarantee of success. Risk assessment includes a thorough analysis of factors such as market conditions, investment strategies, and volatility. It is important to be aware that Ethereum X investments are not protected by any government or other regulatory body; this means that if something goes wrong with an investment or transaction, there may be no recourse for investors. Furthermore, investing in Ethereum X is extremely speculative and involves a high degree of risk due to its decentralised nature. As such, it is essential to undertake proper research and use risk management techniques when trading Ethereum X. In conclusion, investors should always perform their own independent research into any potential investments prior to making decisions on whether or not to invest in Ethereum X. To ensure success when investing in Ethereum X requires careful consideration of all available data points and a thorough understanding of the associated risks. With this knowledge at hand one can move forward towards staking their Etherum X tokens carefully.

Ethereum X Staking

Investing in Ethereum X carries multiple risks, including the risk of theft and losses due to market fluctuations. Although these risks may be concerning, Ethereum X also provides investment opportunities that can generate returns with minimal risk. One such opportunity is Ethereum X staking, which enables users to earn rewards by locking up their tokens in liquidity pools. Stakers can receive a portion of the transaction fees generated from transactions on the network as staking rewards. Additionally, they are rewarded for providing liquidity to trading pairs on decentralized exchanges or other liquidity pools.

Staking on Ethereum X offers investors reliable returns with lower volatility than directly investing in the token itself since rewards are generated from operations within the platform’s ecosystem rather than relying solely on price movements of the token itself. Additionally, stakers have full control over their tokens and do not need to surrender ownership of them during the staking period. This allows investors to benefit from both capital appreciation potential and yield generation at once without sacrificing either one for the other. Thus, Ethereum X staking provides a lucrative opportunity for investors looking for a secure way to generate returns while still participating in cryptocurrency markets. From here we can move onto discussing ‘Ethereum X DeFi’ as another investment option available with this asset class.

Ethereum X DeFi

Leveraging Ethereum X, investors can gain exposure to DeFi – decentralized finance – protocols and applications with the potential to generate returns. By utilizing decentralized exchanges (DEX) and smart contracts built on Ethereum X, users can access a wide range of cryptocurrency assets.

Investors have the ability to trade crypto assets in exchange for other digital currencies, or borrow funds with them as collateral. This opens up new opportunities in trading and investments such as margin trading, lending services, and derivatives trading. Furthermore, these services are provided by open-source protocols that are completely permissionless and trustless due to their reliance on blockchain technology. The combination of DEXs and smart contracts makes it possible for developers to create innovative financial products that reflect the needs of their users without relying on centralized third parties.