Ethereum X is a cryptocurrency platform built on the Ethereum blockchain. It has been touted as one of the most promising digital currencies available, and its success has been marked by rapid growth in value. For example, when it debuted in December 2020, its price was just $0.30 per coin; however, within a month, that rate had increased to over $10.00 per coin. This article discusses the potential for an Ethereum X price forecast and provides analysis about investing in this digital currency.

The market for cryptocurrencies continues to be highly volatile and unpredictable due to factors such as government regulation, technological advancements, and supply/demand dynamics. As such, investors must use a range of analytical tools to evaluate potential investments before making any decisions. To better understand how Ethereum X may perform over time and whether it should be included in an investment portfolio requires a closer examination of its historical price movements and predictions from industry experts regarding its future performance.

Key Takeaways

- Ethereum X debuted with a price of $0.30 per coin in December 2020 and quickly increased to over $10.00 per coin within a month.

- The price of Ethereum X is highly volatile and is influenced by factors such as supply trends, demand drivers, government regulation, technological advancements, and supply/demand dynamics.

- The market for cryptocurrencies, including Ethereum X, is still largely unregulated, which contributes to its volatility.

- Understanding the volatility of Ethereum X is crucial for making informed investment decisions, and investors should consider analyzing fluctuating currency values, monitoring government regulations, researching news events, and analyzing trading volume data.

Overview of Ethereum X

Ethereum X is a decentralized platform that utilizes blockchain technology to facilitate digital transactions of various kinds, enabling users to securely store and transfer digital assets in an efficient manner. Ethereum X has a fixed maximum supply cap of tokens which provides the system with mining rewards for miners who verify transactions on its network. This incentivizes miners by providing them with rewards as they validate new blocks thus ensuring the safety and security of the Ethereum X network from malicious activities. Supply caps also ensure that more tokens are not mined than initially intended, helping maintain price stability in the market for cryptocurrencies. As such, these features make Ethereum X an attractive choice for investors looking to invest in cryptocurrencies.

The Market for Cryptocurrencies

Cryptocurrencies are becoming increasingly popular as an investment, with the potential for significant returns on investment. The market for cryptocurrencies is still in its early stages and largely unregulated, making it a risky proposition for those looking to invest. However, the mining industry has grown significantly due to the demand for cryptocurrencies, with miners competing to solve complex mathematical problems in order to receive cryptocurrency rewards. This competition has resulted in increased difficulty levels as well as higher prices for some of the more established currencies like Ethereum X. As the market matures and regulation increases, there will be greater stability and opportunity for investors. As such, careful consideration should be given when assessing the potential returns associated with investing in cryptocurrencies such as Ethereum X. With this in mind, we can now turn our attention to examining Ethereum X’s price history.

Ethereum X Price History

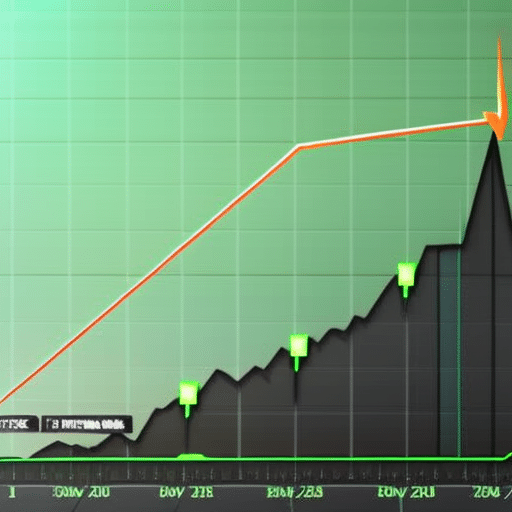

Ethereum X is a cryptocurrency that has been gaining traction since its introduction in late 2019. Historical price performance of Ethereum X suggests high volatility, with notable highs and lows experienced over the past year. Despite significant price fluctuations, Ethereum X has proven to be a viable investment option for many traders looking to take advantage of the volatile crypto market.

Historical Price Performance

The historical price performance of Ethereum has been significant, demonstrating considerable volatility. The past trends in the market have displayed a range of buying strategies that have proven to be successful in the short-term.

In particular, those who identified and capitalized on the bullish trend at the beginning of 2021 were able to make impressive gains. As with any investment strategy, however, there was also an inherent risk associated with such moves as Ethereum X is highly volatile and can quickly drop back down again. This highlights the need for caution when trading this asset and for investors to stay abreast of any changes in market conditions that could lead to further fluctuations in its value. Transitioning into the next section, it’s important to understand the degree of volatility associated with Ethereum X before making any long-term investments decisions.

Volatility of Ethereum X

Understanding the volatility of this asset is essential for investors to make informed decisions when assessing its long-term investment potential. Ethereum X has experienced significant price fluctuations due to its supply trends and demand drivers, indicating a high degree of volatility. In particular, any changes in the availability and demand of Ethereum X can cause drastic shifts in its market value as seen over recent years. It is therefore necessary for investors to analyze these dynamics closely before investing in it to mitigate risks associated with major price swings. To gain an accurate view of the price forecast for Ethereum X, it is important to understand how these factors affect its overall market performance.

Ethereum X Price Forecast

The Ethereum X price forecast is a complex analysis which requires both industry outlook, technical analysis, and fundamental analysis to be considered. Industry outlook involves looking at past and current trends in the cryptocurrency market to understand where prices may go in the future. Technical analysis uses data derived from market movements such as chart patterns and volume to predict future price performance. Fundamental analysis looks into economic indicators such as inflation, supply/demand, government regulations, etc., which can also affect the direction of Ethereum X prices. All three analyses need to be considered when forecasting future Ethereum X prices.

Industry Outlook

Analyzing the industry outlook for Ethereum X is essential to predicting its future price. As a blockchain-based platform, Ethereum X stands to benefit from global adoption of blockchain technology across various industries. The utility tokenization of Ethereum X could provide it with further advantages as more businesses look to cryptocurrency and tokens as a means to access services or goods. The potential applications of Ethereum X in finance, healthcare, and other sectors could significantly increase its value and exposure in the market, leading to higher demand for ETHX tokens.

The growth of decentralized finance (DeFi) has been a major area of focus among investors in recent years, which presents new opportunities for Ethereum X to leverage its utility tokenization capabilities. Additionally, increased regulation on cryptocurrency exchanges and trading platforms would likely lead to greater investor confidence in the security of investments and potentially create an influx of capital into the system. With these factors taken into consideration, it is clear that the industry outlook for Ethereum X can have a significant impact on its future price performance. This will be explored further through technical analysis in the next section.

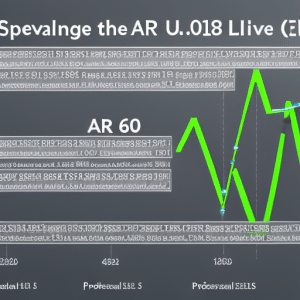

Technical Analysis

Technical analysis is a valuable tool to evaluate the possible price movements of Ethereum X by studying past performance. By using technical indicators and chart patterns, investors can gain insight into when to buy or sell Ethereum X. Technical analysis uses historical prices and volume data to identify trends and predict future price movements. By looking at various technical indicators such as moving averages, momentum oscillators, and relative strength index (RSI), traders can make informed decisions on whether to enter or exit a position in Ethereum X. Chart patterns like head & shoulders, double tops/bottoms, triangles are also used in technical analysis for predicting potential price direction.

Overall, technical analysis is a powerful tool that provides useful information on the Ethereum X market; however, it should be combined with fundamental analysis in order to get an accurate picture of the overall market conditions.

Fundamental Analysis

Moving on from Technical Analysis, Fundamental Analysis is another important tool when forecasting Ethereum’s price. Fundamental analysis looks to the macroeconomic environment and underlying economic indicators to evaluate the overall health of an economy and its currency. The primary fundamental drivers for Ethereum are:

- General growth of blockchain technology

- Macroeconomic factors such as GDP and inflation rates

- Consumer sentiment towards cryptocurrency investments

These three elements can be used to gauge the current market conditions in order to make accurate predictions about future prices. By analyzing these key fundamentals, investors can gain a better understanding of how the Ethereum market will respond in different scenarios and make more informed decisions regarding their investments. Ultimately, by understanding the underlying factors that drive Ethereum’s price, investors can have a better chance at predicting its future performance and making smart investment choices for their portfolios. With this foundational knowledge in place, it is now possible to move onto discussing price predictions for Ethereum X specifically.

Ethereum X Price Predictions

Ethereum X is a cryptocurrency that has gained attention from investors and speculators due to its potential for appreciation. As such, the predictions on Ethereum X’s future price have been made by various sources. Short-term predictions look good for Ethereum X, as many analysts suggest that it will appreciate in value within the next few months. Medium-term predictions are mixed, with some suggesting further gains while others caution against too much optimism. Long-term projections are even more varied, with some predicting large gains and others expecting a substantial decrease in value. It is difficult to say definitively what will happen to Ethereum X’s price over time but it seems likely that its performance will depend on how well it can manage its volatility and remain attractive to investors.

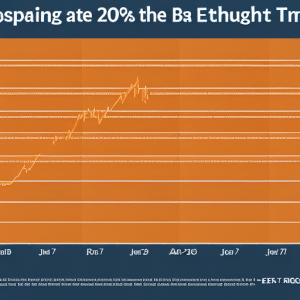

Short-Term Predictions

Analyzing the current market conditions of Ethereum, it can be expected that the price will remain volatile in the short term. Short-term predictions for Ethereum are subject to major fluctuations due to the uncertainty of the market. Investing strategies should focus on understanding and predicting these trends:

- Analyze fluctuating currency values

- Monitor government regulations

- Research news events

- Analyze trading volume data.

These strategies provide insight into potential price movements which can help investors make informed decisions about their investments. With a proper risk management strategy, investors may find success in navigating these uncertain times. As such, transitioning into a discussion about medium-term predictions is imperative for making successful long-term investment decisions.

Medium-Term Predictions

Continuing on from the short-term predictions, medium-term price forecasts for Ethereum are largely dependent on long-term macro trends that can affect the supply and demand of the cryptocurrency. To further understand these trends and predict where Ethereum’s price may head in the mid-term, it is important to look at a variety of factors which can influence its performance.

| Factor | Description |

|---|---|

| Supply & Demand | The total amount of available Ethereum as well as its popularity or lack thereof will affect its price over time. This includes both actual transactions and speculative trading volume. |

| Macro Trends | Longer-term economic conditions such as inflation, recession, or other global events can have an effect on Ethereum’s price. It is important to look at what impact this could have on its value in the medium term. |

| Regulatory Environment | Regulations set by governments or governing bodies can also impact how people view cryptocurrencies and their values. Knowing what regulations exist now and what might come into play in the future will be crucial when predicting prices for Ethereum in the medium term. |

Given these factors, it is possible to make educated guesses about where Ethereum’s price might go in the next few months, but nothing is certain until it actually happens. As we move closer to addressing long-term predictions for Ethereum’s pricing movements, it is important to keep all of these variables in mind when making any conclusions about its potential future performance.

Long-Term Predictions

Drawing from the factors discussed in medium-term predictions, long-term forecasts for Ethereum can be made by examining additional variables that may have an impact on its value in the future. These include regulatory developments and economic indicators. Regulatory changes can often have a significant effect on cryptocurrency prices, so it is important to keep up with current events that may affect Ethereum’s price. In addition, economic indicators such as inflation rates and GDP growth can provide insight into what direction Ethereum might take in the long term. As these trends become more evident, investors can make better decisions about their investments in Ethereum. As economic conditions change over time, so too will the potential of Ethereum to increase or decrease in value accordingly.

Potential of Ethereum X

The potential of Ethereum X is evident in its average daily trading volume, which has exceeded $2.5 billion since October 2020. This suggests that the cryptocurrency is increasingly being adopted by investors and traders who recognize its potential as a reliable and secure digital asset. Ethereum X’s blockchain technology also promises to revolutionize the way supply chains operate, with its ability to handle high network capacity for transactions without compromising speed or security. This could open up new opportunities for businesses and organizations looking to make their operations more efficient and cost-effective while maintaining data integrity. Moreover, Ethereum X’s scalability allows it to meet the increased demand of users as they continue to join the platform due to its easy-to-use interface and expansive features. However, despite these advantages, there are still risks associated with investing in Ethereum X that should be taken into consideration before making any decisions.

Risks of Investing in Ethereum X

Investors should be aware of the various risks associated with investing in Ethereum X, such as volatility, liquidity concerns, and regulatory uncertainty. While Ethereum X offers potential for high returns, it also has a higher risk profile compared to other cryptocurrency investments. Factors like the ever-changing regulatory environment surrounding cryptocurrencies and lack of investment strategies for managing these risks can make investing in Ethereum X a risky proposition. As such, investors should thoroughly research the asset before making any decision to invest. To mitigate some of these risks it is important to develop an appropriate investment strategy that takes into account factors such as risk tolerance and time horizon. Moving forward, one must consider tips for investing in Ethereum X before committing funds.

Tips for Investing in Ethereum X

Navigating the cryptocurrency market can be a challenge, and wise decisions are essential for achieving success when investing in Ethereum X. By understanding the risks associated with this alternative investment, value investors can structure their portfolio to reduce potential losses:

- Diversification: An important component of any successful investment strategy is diversification. By spreading investments across various asset classes and currencies, investors can minimize their risk. Additionally, they should also consider allocating a portion of their holdings into more traditional investments such as stocks or bonds.

- Market Volatility: Cryptocurrency markets are inherently volatile due to their decentralized nature and lack of regulation. As such, it is important to factor in these short-term fluctuations when considering an Ethereum X investment. Investors must exercise patience and discipline when making trades in this environment, as emotional decisions tend to lead to poor outcomes in the long term.

- Security Risks: Finally, security risks must always be taken into account with any kind of cryptocurrency investment. It is critical that investors take steps to protect themselves from hackers and other malicious actors by using secure wallets and exchanges with strong security measures in place.

By taking the time to understand the risks associated with investing in Ethereum X, value investors can make informed decisions about how best to structure their portfolios for maximum returns while minimizing losses over time.

How to Buy Ethereum X

Understanding the purchasing process is essential for investors who wish to invest in Ethereum X. To purchase Ethereum X, there are several strategies that can be implemented depending on regional availability and payment methods. Cryptocurrency exchanges, such as Coinbase and Binance, allow investors to buy Ethereum X using a variety of payment methods including credit/debit cards, wire transfers, or other supported cryptocurrencies. Additionally, peer-to-peer (P2P) networks may offer direct person-to-person transactions without relying on a third party intermediary. This method of trading is especially useful in regions where cryptocurrency exchanges are not available or have limited support for certain payment methods. Furthermore, investors should consider the risk associated with each buying strategy when determining their investment decision. For example, P2P networks may require more trust between parties due to lack of escrow services compared to cryptocurrency exchanges that provide built-in dispute mechanisms for buyers and sellers.