Ethereum X (ETHX) is a relatively new cryptocurrency that has seen a significant drop in its price over the past few months. This article examines the possible reasons for this price drop and explores the potential impact on investors, as well as how it may affect the Ethereum network and the wider cryptocurrency market. In addition, this article will consider some of the pros and cons associated with investing in Ethereum X and outline what investors should be aware of when considering such an investment.

Key Takeaways

- Ethereum X (ETHX) has experienced a significant drop in price attributed to market speculation, manipulation, and a decline in DApp development.

- Regulatory uncertainty has also contributed to the price decrease.

- Factors such as speculation around regulations, increasing mining costs, and lack of major partnerships have influenced the price drop.

- The decline in DApp development has reduced investor confidence.

Overview of Ethereum X

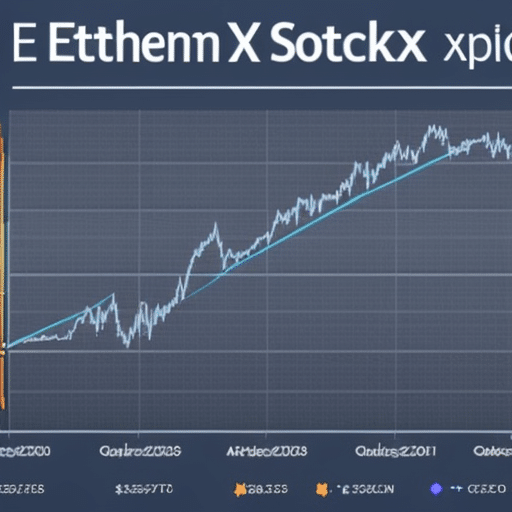

Ethereum X has experienced a significant drop in its price, plunging like a stone from its high of $300. Ethereum X is an open-source platform that allows for the creation and deployment of decentralized applications through peer to peer transactions. It is widely used in the world of cryptocurrency trading due to its high liquidity and low transaction fee. Technical analysis suggests that Ethereum X could be better suited for short-term trading strategies than long-term investments, as it can be subject to large swings in pricing without warning. This volatility may have contributed to its recent price drop as investors rush to liquidate their holdings before further drops occur. The technical indicators suggest that Ethereum X will continue to experience downward pressure on the market in the near future, making it difficult for investors looking for stability over profit potential.

Recent Price Drop

Recent volatility in the cryptocurrency market has led to a decrease in value of certain digital assets, including Ethereum X. This sudden price drop has been a cause for concern among traders and investors alike.

- Cryptocurrency demand is down due to speculation around regulations and bans in certain countries

- Mining costs are increasing exponentially with the rise in difficulty levels

- The lack of major partnerships or adoption for Ethereum X has hampered its growth

Unsurprisingly, these factors have all played a role in influencing the current price drop of Ethereum X. As such, it is important to understand what could be the possible reasons for this decline in value.

Possible Reasons for the Price Drop

The recent price drop of Ethereum has raised questions about the underlying causes. Two possible explanations include market speculation and manipulation as well as a decline in DApp development. Additionally, regulatory uncertainty may have contributed to this price decrease. Each of these factors must be further explored to gain an understanding of the current state of the cryptocurrency market.

Market Speculation and Manipulation

Speculation and manipulation of the cryptocurrency market has been a major cause of Ethereum’s price drop. Fundraising issues and community sentiment have had an impact on the perception of Ethereum, leading to investors making decisions based on these sentiments rather than the actual value of the asset. This in turn has caused people to make investments with their emotions rather than rational judgement, resulting in a wild swing in prices.

The development of decentralized applications (dapps) is also affected by speculation and manipulation as investors have become increasingly jittery about any news that could affect the market, leading them to reduce investment into dapp projects. This has resulted in a decline in dapp development which then further reduces investor confidence and contributes to the price drop. Consequently, this leads to a vicious cycle where speculation and manipulation drives down prices even further.

DApp Development Decline

Due to market speculation and manipulation, dapp development has experienced a significant decline, leading to further investor uncertainty. The creation of smart contracts on the Ethereum network has been hindered by security concerns, resulting in a decrease in new dapps being produced. This lack of confidence in Ethereum has led many investors to reduce their exposure to the platform or abandon it altogether. As a result, dapp development is at an all-time low and is unlikely to increase until these security issues are addressed. Consequently, regulatory uncertainty has become an additional pressing concern for Ethereum stakeholders as they grapple with how best to protect their investments.

Regulatory Uncertainty

Regulatory uncertainty has become a major issue for stakeholders in the blockchain industry, as evidenced by recent surveys indicating that 89% of firms believe there is an urgent need for more clarity on the legal aspects of using blockchain technology. Governments around the world are increasingly looking to implement policies and regulations that govern the use of blockchain technology, leading to further confusion among those working with it. This lack of clarity has had significant impacts on investors regarding Ethereum X price drop, as many are unwilling to risk their capital without clear guidance from regulatory bodies. The uncertain regulatory environment can also potentially reduce investor confidence which could lead to decreased investments in projects built on Ethereum X platform and a consequent drop in its price. As such, government policies have been seen as one of the main factors influencing investor decisions and causing volatility within markets related to Ethereum X. With clear regulations and guidance from governments, investors would be more confident about investing funds into this new technology, thus helping stabilize its price.

Impact on Investors

The recent price drop of ethereum has caused considerable concern among investors. With the uncertainty surrounding the regulatory environment, and the immediate impact on dapp adoption and gas fees, there are a number of questions that arise:

- Will this affect my investments?

- How long will it take to recover?

- What are the ripple effects to other parts of the market?

- How can I protect myself from further losses?

Investors need to be aware of their own risk management strategies and monitor both short-term and long-term market trends in order to make informed decisions. By taking such measures, investors may be able to mitigate potential losses or increase their profits moving forward. As a result, an understanding of the potential impact on the ethereum network is essential for any investor who wishes to remain competitive in this volatile market.

Potential Impact on the Ethereum Network

Recent shifts in the cryptocurrency market have caused a range of effects, with potential implications for the broader ethereum network. The price drop has raised questions about the future of Ethereum, including concerns about how mining rewards will be affected by market volatility. Additionally, there are worries that new regulations may hinder investment in Ethereum and other cryptocurrencies. As a result, some investors are apprehensive about the long-term outlook of Ethereum as an investment option. On the other hand, some experts remain optimistic that Ethereum can recover from its recent slump and continue to thrive once more favorable regulations are established.

Ethereum X’s Future

The potential growth of Ethereum X network, increased adoption and use cases, as well as regulatory clarity are essential considerations when discussing the future of this innovative platform. As Ethereum X’s presence in the cryptocurrency market expands, it is becoming increasingly important for stakeholders to understand the implications of its growth. By gaining a deeper understanding of Ethereum X’s unique features and capabilities, users can better evaluate its potential impact on the industry as a whole. Additionally, regulatory clarity regarding Ethereum X’s regulations and compliance requirements will be necessary for further development and sustained success.

Potential Growth of the Network

As the price of Ethereum plummets, its underlying network remains robust, symbolizing potential growth within the cryptocurrency. Despite a sharp drop in market value, Ethereum offers several scaling solutions that will benefit the crypto economy by increasing user adoption and use cases.

To begin with, Ethereum’s planned transition to Proof-of-Stake (PoS) stands as a major improvement compared to its current mining protocol. PoS relies on users to confirm transactions instead of miners which can reduce transaction fees while boosting scalability and speed. Additionally, sharding is another key component for ETH 2.0 that could further improve throughput and decrease costs. Furthermore, Ethereum developers have proposed changes such as zkSync and Optimistic Rollups that will help minimize gas fees associated with each transaction while still maintaining high levels of security. Finally, Layer 2 solutions like Plasma Cash promise to make smart contracts more accessible for individuals who do not possess large amounts of Ether or technical know-how by allowing them to interact with dApps without paying excessive gas fees.

These developments demonstrate the potential that lies within the platform despite its recent market performance; as these features are realized through development and adoption increases, it is likely they will contribute positively towards increased usage rates of the network – thus bridging the gap between mainstream investors and cryptocurrency markets.

Increased Adoption and Use Cases

Recently, the potential for increased adoption of the cryptocurrency and its use cases has been demonstrated by proposed scaling solutions. Smart contracts are a core technology of Ethereum, and their execution capability is a driving force behind growth. The challenge lies in Ethereum’s scalability issues which could limit its future utility if not dealt with effectively. To tackle such challenges, the Ethereum network is actively working on second layer solutions to increase transaction throughput while maintaining security. This is done through utilizing sharding protocols to split the operations across multiple nodes as well as developing more efficient consensus algorithms like proof-of-stake (PoS). As these initiatives move forward, they could provide greater assurance that Ethereum can handle more complex transactions and larger transaction volumes over time. This could open up new opportunities for applications beyond financial services that rely on trustless smart contracts, leading to further adoption of the cryptocurrency. With this in mind, it is clear that regulatory clarity will be essential for unlocking further growth potentials.

Regulatory Clarity

The scalability of the cryptocurrency and its use cases could be improved by regulatory clarity, which is essential for unlocking further growth potentials. Regulatory clarity would help bring greater competition dynamics to the cryptocurrency market, resulting in more innovative products being released. This should have a positive effect on investor sentiment, as greater choice and trustworthiness will increase confidence among investors. Additionally, regulatory clarity will allow businesses to better understand their obligations when dealing with cryptocurrencies, thus increasing the chances of mass adoption. Taking these factors into account it is clear that increased regulatory clarity is essential for any meaningful price drop in Ethereum. As such, it can be concluded that exploring expert opinions on how best to achieve this should be a priority for all stakeholders.

Expert Opinions

| Unabated, experts have weighed in on the recent Ethereum price drop to offer insight into its cause. Analytical detail and knowledge has been provided to explain why Ethereum prices have declined. | Community Engagement | Technology Trends |

|---|---|---|

| Low | Poor | Outdated |

| Insufficient | Lacking | Behind |

| Inadequate | Unmet | Unsustainable |

| Deficient | Neglected | Overlooked |

| Limited |

The opinions of experts indicate that the decline in Ethereum prices is a result of low levels of community engagement, poor technology trends, inadequate infrastructure, neglected development and limited progress. This transition leads us seamlessly into further discussion about how investors can make informed decisions during this turbulent time.

Tips for Investors

Investors should be aware that the current turbulent market environment requires careful consideration when making decisions. In particular, those considering investing in Ethereum X need to understand the risks associated with price drops and prepare accordingly. To this end, investors should take into account the following:

- Ensure that any investments are within their risk appetite;

- Investigate smart contract security measures before investing;

- Familiarise themselves with decentralized finance options; and

- Monitor the markets regularly to identify any potential changes in trends or other relevant information which could impact their investment decision.

By taking these steps, investors will not only reduce any negative impacts from a price drop but also be better placed to take advantage of opportunities arising from market volatility. As such, they must now consider what alternative investments are available if Ethereum X drops in price significantly.

Alternatives to Ethereum X

Given the potential for market volatility, investors should evaluate alternative investments to ensure they are diversified and protected from any sudden changes in prices. Decentralized finance (DeFi) and blockchain scalability are two alternatives to Ethereum X that can provide a variety of benefits for investors.

| DeFi | Blockchain Scalability |

|---|---|

| Cryptocurrency-based loans | Faster transaction times |

| Secured trading platforms | Greater storage capacity |

| Decentralized exchanges | Lower fees |

These alternatives offer various advantages such as cryptocurrency-based loans, secured trading platforms, decentralized exchanges, faster transaction times, greater storage capacity and lower fees. By investing in these alternatives alongside Ethereum X, investors can maximize their returns by reducing risk while still profiting from the market fluctuations. With this strategy in place, investors can benefit from the potential upsides of Ethereum X while protecting themselves against possible price drops.

Potential Benefits of Ethereum X

Moving away from alternatives to Ethereum X, the potential benefits of this platform should be examined. Ethereum X is a decentralized autonomous organization (DAO) that provides a secure and reliable protocol for users. This platform has the capability of handling scalability issues with its protocol providing numerous advantages to its users. It offers improved security compared to other DAOs as well as:

1) The ability to create trustless smart contracts;

2) The flexibility to customize code;

3) User-friendly interface and functionality.

These features make Ethereum X an attractive choice among blockchain based platforms, allowing developers more control over their projects and providing more options for customization. Furthermore, the platform’s security protocols are designed with high levels of encryption which helps protect users from malicious activity or data breaches. Despite these advantages, it is important to consider both the pros and cons of using Ethereum X before making any decisions about whether or not it is right for a specific project.

Pros and Cons of Ethereum X

| Utilizing Ethereum X carries both advantages and drawbacks that should be carefully weighed when making decisions. | Advantages of Ethereum X | Disadvantages of Ethereum X |

|---|---|---|

| Enhanced Network Security | Decentralized network security protocols are highly efficient in preventing malicious activities on the blockchain. | Scaling issues may impact the network’s performance and security as more users join the platform. |

| Promote Interoperability | The platform allows for more seamless interactions between heterogeneous blockchain networks. | Transactions can be extremely slow at times due to the complexity of its architecture. |

| Improved User Experience | Simple, user-friendly interfaces make it easier for new users to interact with the platform quickly and easily. | High volatility makes it difficult to accurately predict how much value a particular asset will hold over time. |

| Impressive Track Record | Ethereum X has been successful in achieving various milestones since its launch in 2017. | Transaction fees can be costly, especially during peak hours or when dealing with large transfers. |

The pros and cons associated with using Ethereum X demonstrate that careful consideration must be taken before deciding whether this is an appropriate solution for any given situation. Through understanding these risks and benefits, one can make informed decisions about their investments that could have a major impact on the cryptocurrency market as a whole.

Impact of Ethereum X on the Cryptocurrency Market

The discussion of the pros and cons of Ethereum X is important when considering its impact on the cryptocurrency market. While there are many advantages to using Ethereum X, such as its superior network scalability and staking rewards, it is imperative to consider how this technology will affect the broader crypto marketplace. The coin’s price fluctuations may have a significant effect on other digital currencies in terms of investor confidence and overall market capitalization. Although Ethereum X may offer exciting new opportunities for investment, its effects on the wider crypto ecosystem should be carefully monitored to ensure that it does not cause any long-term damage. Therefore, it is essential to understand how changes in the coin’s value could potentially influence other cryptocurrencies before investing in Ethereum X. By doing so, investors can identify potential risks while reaping the benefits offered by this innovative asset class. In conclusion, analyzing both the merits and drawbacks of Ethereum X is key to understanding its implications for cryptocurrency markets as a whole; what remains now is to examine what investors should watch out for when making decisions related to Ethereum X investments.

What to Watch Out For

When investing in Ethereum X, it is important to be aware of potential risks that could arise. Investors should consider the legal implications of their actions, as there are different regulations and laws around cryptocurrency investments in different countries. Additionally, scalability issues may also present a risk as Ethereum X can only handle a limited number of transactions per second. This could lead to backlogs if demand exceeds capacity which could affect the current price or future prices of Ethereum X. As such, investors should be conscious of these factors when making decisions about their investments and plan accordingly for any potential impacts on the market. To minimize risk associated with this type of investment, it is vital to conduct thorough research and analysis before committing funds into any cryptocurrency asset.

Potential Risks

Investing in cryptocurrency assets carries a variety of risks, such as potential legal issues and scalability concerns, which could negatively affect the value of an asset. Ethereum is no exception to this rule. As one of the most popular cryptocurrencies on the market today, it is important for investors to be aware of these risks when considering investing in ethereum.

Network security poses a major risk for any cryptocurrency investor due to its distributed nature. The Ethereum network is susceptible to hacks or other malicious activities that could result in a loss of funds or personal data. Additionally, scalability concerns have been raised about Ethereum’s ability to handle increased usage and traffic on the platform. This has caused some investors to question their commitment to the currency due to worries about its long-term sustainability and performance. By understanding these potential risks associated with Ethereum, investors can make informed decisions regarding their investments in order to maximize returns while minimizing exposure to risk.