Ethereum is a popular decentralized cryptocurrency platform that enables smart contract technology and allows for the development of distributed applications. It has become one of the most successful cryptocurrencies in the world, with its market capitalization rising to over $200 billion. This article will analyze Ethereum’s price trends and explore some of the factors that have contributed to its rise. Additionally, it will evaluate Ethereum’s potential as an investment and consider some of the challenges facing it today. Finally, this article will discuss what might be expected from Ethereum in the future.

Key Takeaways

- Governments’ hesitation and legal framework issues are impacting Ethereum’s price trends.

- The uncertainty from regulators is causing project failures and delays, which can affect Ethereum’s price.

- Ethereum’s potential success over time is dependent on its ability to address challenges in adoption and growth.

- The launch of Ethereum 2.0, with improved scalability and security, is highly anticipated and seen as a major milestone that could impact Ethereum’s price.

Overview of Ethereum

Ethereum is a decentralized open-source blockchain platform that facilitates the deployment of smart contracts and distributed applications, as illustrated in Figure 1 below. This makes it an attractive technology for developers who want to create and deploy decentralised finance protocols and tokenization protocols. Ethereum’s vast ecosystem of users, developers, miners, validators, and other stakeholders has enabled it to become the second largest cryptocurrency by market capitalisation. Its popularity has been further bolstered by the emergence of Initial Coin Offerings (ICOs), which make use of its network for fundraising activities. As a result, Ethereum has seen considerable price appreciation over the years due to increased investor interest. Furthermore, its long-term prospects are supported by a robust development roadmap that includes updates such as ETH 2.0 and Sharding which will increase scalability and reduce transaction fees on its network.

The recent surge in Ethereum prices has led to renewed interest from investors looking to capitalize on this trend. The ability of Ethereum’s blockchain technology to enable innovative financial products is likely to attract more institutional investments in the coming months which could drive up prices further. On-chain analytics also suggest that large holders are accumulating ETH at current levels indicating prolonged bullish momentum in the market for Ethereum tokens going forward. These factors combined with improved fundamentals promise an exciting future ahead for Ethereum price trends.

Ethereum Price Trends

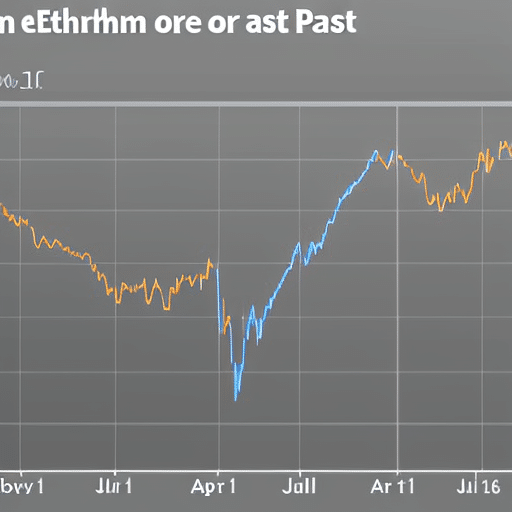

Analyzing the fluctuations of the cryptocurrency market, it is evident that Ethereum has experienced significant shifts in its value. Some of these shifts can be attributed to tokenization and dApps development, two factors which have helped propel Ethereum’s rise in recent years. To understand these trends better, we can look at several key elements:

- the rise and fall of ETH prices over time;

- ETH activity on centralized exchanges;

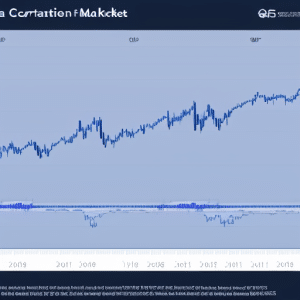

- correlations between ETH prices and other cryptocurrencies; and

- stablecoins’ impact on ETH prices.

By closely examining each of these components, it is possible to gain insights into Ethereum’s price movements in the cryptocurrency markets since its launch in 2015. This analysis provides a basis for understanding why certain trends occur and how they are likely to continue as well as identifying potential points along the way for trading opportunities or strategic investments. Transitioning into subsequent sections, we will explore some of the factors behind Ethereum’s rise in more detail.

Factors Behind Ethereum’s Rise

The rise of Ethereum in the cryptocurrency market can be attributed to a number of factors, such as tokenization and dApps development. Regulatory uncertainty has also played an important role in driving the price of Ethereum up. The lack of clear regulatory guidance for cryptocurrencies, including Ethereum, has resulted in an environment where investors are more likely to take risks on digital assets like Ethereum. Moreover, scalability issues have forced developers to find innovative solutions that increase the speed and capacity of the network, which in turn increases its value. Due to these factors, Ethereum has been able to remain competitive with other large-cap coins and increase its value substantially over time. Consequently, this makes it a viable investment opportunity for those looking for exposure to cryptocurrencies.

Ethereum’s Potential as an Investment

Ethereum has become increasingly attractive to investors due to its potential for growth and profit. Volatility, utility and liquidity all play a role in determining the value of an investment, and Ethereum offers these features in abundance. This article will explore the reasons why Ethereum may be a wise choice for those looking to grow their investments, particularly with regard to volatility, utility, and liquidity.

Volatility

Examining Ethereum’s volatility, one can observe that it is highly subject to the whims of the market. Fluctuations in Ethereum’s price are often driven by speculation or changes in mining profitability. For example, when new investors enter the market and drive up demand for Ether, prices tend to increase; conversely, if miners find more efficient ways to mine Ether and reduce profitability, prices may drop sharply. Moreover, Ethereum’s high volatility also means that its price can be affected by news events and other external factors such as government regulations or political instability. As such, investors should be aware of all potential risks involved with investing in Ethereum and consider their own risk tolerance levels before making any decisions. Consequently, understanding how Ethereum works within the larger cryptocurrency space is key for assessing its potential utility as an investment vehicle.

Utility

Given its decentralized nature, Ethereum has the potential to provide users with services that are not available through traditional financial institutions. This utility is being explored by developers in the form of Decentralized Finance (DeFi) applications, which allow users to trade and lend digital assets, as well as use stablecoins for transactions. DeFi applications can be used for a variety of purposes including borrowing money, trading cryptocurrencies, and creating smart contracts. These features offer greater flexibility than centralized finance systems and have helped drive up demand for Ethereum-based tokens. Furthermore, stablecoins offer an alternative to traditional fiat currencies, allowing users to transact on the blockchain without needing to convert their funds into various cryptocurrency forms. As more people start leveraging these innovative financial tools built on Ethereum’s blockchain technology, it is likely that there will be an increase in price volatility due to increased liquidity.

Liquidity

The increased liquidity of Ethereum-based tokens has created a range of new opportunities for users to transact and interact with digital assets. In particular, decentralized exchanges have become more and more popular, providing users with an alternative to centralized exchanges that offer greater control over their funds. Furthermore, the ability to earn staking rewards by holding Ether has also been beneficial in increasing liquidity as it incentivizes hodlers to keep their funds within the Ethereum network. These developments have made it easier for users to move funds in and out of the Ethereum ecosystem, leading to improved capital flows and higher levels of liquidity overall. As a result, these trends have had a positive effect on Ethereum price movements in recent months. However, there are still some challenges facing Ethereum that need to be addressed before its full potential can be realized.

Challenges Facing Ethereum

Analyzing Ethereum’s performance reveals a number of challenges that could potentially impede its growth. Foremost among these is the fact that Ethereum is limited by scaling issues, which make it difficult to handle large numbers of transactions. This has caused transaction fees to increase and become expensive for users. Additionally, Ethereum faces regulatory uncertainty due to the decentralized nature of blockchain technology. Many governments have been hesitant to embrace cryptocurrency because it does not fit into their existing legal frameworks. This makes it difficult for businesses and developers who are trying to create applications built on top of Ethereum’s blockchain technology as they cannot be certain if their products will be accepted in their respective countries. As a result, many projects have failed or have been delayed due to a lack of clarity from regulators. These factors present significant challenges for Ethereum in terms of adoption and growth, as they can inhibit innovation and slow down progress. Transitioning from these challenges, an analysis of the future prospects for Ethereum must now be made in order to determine its potential success over time.

The Future of Ethereum

The Ethereum platform is rapidly evolving, and its future path is becoming increasingly more clear. Version 2.0 of the platform, expected to launch in 2021, promises to offer improved scalability and security through a shift from a proof-of-work consensus algorithm to a proof-of-stake system. Additionally, increased adoption of smart contracts on the Ethereum blockchain has opened up new possibilities for decentralized applications that have yet to be fully explored. These developments suggest an exciting future for Ethereum as it continues to mature into its full potential.

Ethereum 2.0

Exciting news of the launch of Ethereum 2.0 has been met with anticipation from crypto-investors, sending ripples of excitement throughout the market. Many have hailed this as a major step forward in the blockchain space due to its improved scalability and security over earlier versions. Ethereum 2.0 was designed to improve upon existing issues related to scalability by introducing a new consensus algorithm known as Proof-of-Stake (PoS). This algorithm replaces the current Proof-of-Work (PoW) protocol that is used for mining and validating transactions on the Ethereum network. Additionally, PoS offers an increase in security measures such as improved malicious actor detection and prevention which can lead to better protection against hacking attempts. The launch of Ethereum 2.0 is seen as a major milestone in the blockchain space and could open up many opportunities for users looking to utilize smart contracts with increased efficiency and security features. As such, it is expected that its adoption will continue to grow in the coming years.

Smart Contract Adoption

The transition from Ethereum 2.0 to Smart Contract Adoption provides insight into the potential implications of blockchain technology in the near future. Ethereum 2.0 was a necessary step towards achieving scalability, and now with smart contract adoption, its full capabilities can be utilized for various applications beyond just payments and transfers. Here are three benefits that have caused an upsurge in smart contract adoption:

- Cost Savings – By using automated processes through smart contracts, costs associated with manual labor and paperwork are eliminated or reduced significantly.

- Security – Smart contracts provide a secure platform for storing data and executing transactions as they are immutable and incorruptible due to their decentralized nature on the blockchain network.

- Speed of Transactions – The removal of intermediaries leads to faster execution times as all parties involved do not need to wait for any manual approval process or third-party verification before proceeding with a transaction or agreement.

Despite these advantages, there is still uncertainty when it comes to legal issues surrounding smart contracts as they are relatively new in terms of development and implementation which has led some countries to be wary about adopting them on a wide scale basis at this moment in time. Nevertheless, the potential that lies within these technologies is immense and could possibly revolutionize different sectors if adopted properly by governments across the world in the near future.

Frequently Asked Questions

How secure is Ethereum?

Ethereum’s public ledger and smart contracts make it an incredibly secure platform. Over 85 million transactions have been successfully processed, with no security breaches reported since its launch in 2015. Ethereum is a top choice for reliable data storage and transactions, providing users with robust security features that protect their data.

Are there any risks associated with Ethereum?

Investing in Ethereum carries risk, as with any asset. Asset diversification is a key strategy to mitigate this risk. Additionally, users should be aware of transaction fees and potential price fluctuations when trading or investing in Ethereum.

Is Ethereum accepted as a form of payment?

Utilizing a rhetorical device, it is evident that many merchants are increasingly accepting Ethereum as a form of payment. Payment processing platforms have enabled merchant adoption, allowing for the digital currency to be used across different industries. Data analysis reveals an upward trend in using Ethereum for payments, emphasizing its use case beyond its price trends.

Is Ethereum mining profitable?

Ethereum mining can be profitable, depending on the cost of electricity and other equipment costs compared to the rewards gained from mining. Mining rewards are determined by the current Ethereum network difficulty and block reward. Analyzing these factors is crucial to determining whether or not Ethereum mining is a viable option.

How can I buy and sell Ethereum?

As a wise investor, one must learn the intricacies of investing strategies and technical analysis in order to buy and sell Ethereum effectively. A journey of success begins with an understanding of the market and its potential. Taking calculated risks is essential when trading cryptocurrency.