Ethereum is a blockchain-based distributed computing platform and operating system featuring smart contract functionality that enables developers to build and deploy decentralized applications. It is the second-largest cryptocurrency by market capitalization after Bitcoin, and it has been gaining popularity since its launch in 2015. This article provides an overview of Ethereum’s current price, past price predictions, and future predictions based on various factors influencing the currency’s value. Price volatility will also be discussed as well as prediction for the week, month, year, and future.

Key Takeaways

- Ethereum’s price is currently fluctuating.

- Short-term predictions for Ethereum’s price are challenging due to market volatility.

- Factors influencing Ethereum’s price include supply and demand, news, market sentiment, regulations, and inflation rate.

- Long-term predictions for Ethereum’s price consider historical performance, economic indicators, and technology development.

Overview of Ethereum

Ethereum is a decentralized, open-source blockchain platform that enables users to create and deploy smart contracts. It was proposed in 2013 by the programmer Vitalik Buterin and has since become one of the most popular blockchains for exploring use cases. Through its own scripting language, Ethereum Virtual Machine (EVM), developers can create distributed applications that run on hundreds of thousands of computers throughout the world. In addition to understanding blockchain technology, Ethereum’s primary function is to provide a platform for creating decentralized applications, making it an attractive option for both developers and businesses alike. By utilizing digital tokens or cryptocurrencies such as Ether (ETH) which are used to power the network, Ethereum allows users to transfer value between accounts without going through centralized third-party service providers. This makes it an invaluable tool for securely transferring money or other assets without relying on banks or other financial institutions.

Given its popularity and potential uses, there has been much speculation surrounding current Ethereum prices as well as predictions about what those prices might be in the future. As such, many investors have begun looking at various methods for predicting how these prices may develop over time.

Current Ethereum Prices

At the present moment, the value of cryptocurrency Ethereum is fluctuating. Ethereum prices are largely driven by the fundamentals of its underlying blockchain technology, as well as technical analysis. The following points provide insight into how Ethereum’s current price is determined:

- Supply and demand – Ethereum has a limited supply and is subject to changes in demand from buyers.

- News – News about the development of Ethereum and its use cases can have an impact on prices.

- Market sentiment – Investors’ confidence in cryptocurrencies drives their willingness to buy or sell, which affects prices.

- Regulations – Government regulations that either encourage or discourage investment can affect prices.

- Inflation rate – The inflation rate of fiat currencies may also influence the price of Ethereum.

These factors all contribute to determining the current market price for Ethereum, making it difficult to predict where it will go next with any degree of certainty. However, understanding these elements helps investors make educated guesses about future price movements for better decision-making when investing in Etherum.

Ethereum Price Predictions

Ethereum is an open-source blockchain platform that has been gaining traction in the cryptocurrency markets since its release in 2015. Predictions for Ethereum prices have varied significantly, ranging from short-term to long-term outlooks. In this discussion, we will explore current Ethereum price predictions and analyze both short-term and long-term trends. By examining past and present market conditions, we can gain insight into potential future developments of the Ethereum market.

Short-term Predictions

Predictions for Ethereum’s price in the short-term can vary greatly given the volatile nature of cryptocurrency markets. Technical analysis and market trends are typically used to make predictions about the future value of a crypto asset such as Ethereum. Through the use of statistical methods, such as trend lines and support/resistance levels, traders attempt to predict where Ethereum might go in terms of price over a certain period of time. In addition, market sentiment and news events often have an influence on current prices, thus making it difficult to accurately forecast short-term prices.

Though accurate predictions are hard to make, it is possible that Ethereum’s price could continue its upward momentum or experience a dip due to factors such as increased competition from other cryptocurrencies or regulatory changes. As such, forecasting Ethereum’s short-term price movements should be done with caution and taking into account all available data points before investing any capital. With this in mind, long-term predictions become more relevant since they take into account multiple variables that could affect Ethereum’s future value.

Long-term Predictions

Long-term prognostications of cryptocurrency markets, such as Ethereum, often rely on many more variables than short-term forecasts. Analyzing trends, investment strategies, and other factors can be used to make longer-term predictions about the future price of Ethereum:

- Examining historical performance data and market trends can help provide insight into how the market might move in the future.

- Looking at economic indicators like GDP growth and inflation rates for countries that use cryptocurrencies can help determine whether the demand for Ethereum will increase or decrease.

- Understanding the underlying technology of Ethereum and how it is being developed may give clues as to where its price could go in the long run.

These long-term predictions are often difficult to make accurately due to their reliance on so many variables; however, taking a comprehensive approach to analyzing these factors can be useful when attempting to predict where Ethereum prices may go in the future. By understanding what is influencing ethereum prices today, investors can create better strategies for investing in this cryptocurrency over time.

Factors Influencing Ethereum Prices

Analyzing the various factors that can influence Ethereum prices is essential in formulating an informed prediction for today. Smart contract development and blockchain technology are two of the most significant contributors to Ethereum’s price, as they offer a platform for secure transactions and decentralized applications. The amount of resources invested into these technologies by developers has a direct effect on its long-term success, which will ultimately be reflected in the market’s current prices. Additionally, the level of public interest in trading Ethereum has an influence on its value. If more people buy and sell ETH, then demand increases and so does its worth relative to other currencies or assets. As such, increased media attention can lead to higher levels of trading activity and thus affect the current price. With this information taken into account, one can consider how volatility may also play a role in determining Etheruem’s price for today.

Ethereum Price Volatility

Despite the potential for significant fluctuations in Ethereum’s value, it is expected that its volatility will stabilize over time. Coinbase trading has been a major factor influencing Ethereum price volatility as well as blockchain security. In addition to these factors, speculative activity is also known to affect the price of Ethereum significantly due to traders’ reactions to news and developments within the cryptocurrency market. As investors become more knowledgeable about the technology and its uses, it is likely that Ethereum prices will become less volatile over time. However, this process may take many years before any sort of stability can be achieved. To better understand how various external factors influence Ethereum prices, it is important to analyze correlations between currency pairs and other external variables. With such an analysis, it is possible to predict future changes in pricing with some degree of accuracy moving forward.

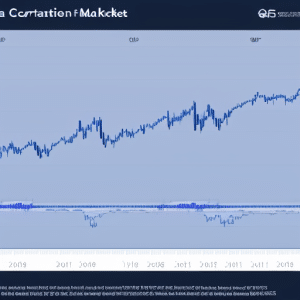

Ethereum Price Correlations

Comparing the movements of other assets to Ethereum can help to identify correlations and understand how external factors may affect its price. Technical analysis, including studying price charts, is often used to detect patterns in the market that could provide clues into future prices. This technique is used by traders and investors to gain insight into Ethereum trends and opportunities. Additionally, it is important to consider the effects of macroeconomic events on cryptocurrency as a whole. For example, when Bitcoin had a large drop in value due to China’s ban on ICOs in 2017, Ethereum also experienced a decline in its price. The correlation between Bitcoin and Ethereum has been demonstrated multiple times over the years with both cryptocurrencies tending to move together based on news or major events impacting either one of them.

By understanding these correlations, investors can make informed decisions about which currencies are more likely to experience positive or negative impacts from market forces. Furthermore, comparing other asset classes such as stocks or commodities helps investors further diversify their portfolios against risk associated with volatile markets like cryptocurrency. Ultimately, analyzing these relationships allows for better predictions about where Ethereum will go next and helps create strategies for profiting from changes in its price.

Analyzing Ethereum Prices

In order to gain an understanding of Ethereum’s price movements, technical analysis can provide valuable insights into potential trends and opportunities. The use of charts and indicators can reveal trends in Ethereum prices in a way that is easy to interpret. By studying the price history, traders are able to identify patterns that may help them predict future moves. Additionally, mining activity on the blockchain has a direct effect on the price of Ethereum due to its finite supply. Mining activities are recorded on the blockchain and analyzed by miners who are looking for profitable trading opportunities. As such, changes in mining activity must be taken into account when analyzing Ethereum prices. Furthermore, understanding how developments in blockchain technology impact Ethereum’s price can also be very useful when making predictions about where prices might go next.

Ethereum Price Prediction Tools

Over time, the use of Ethereum price prediction tools has become increasingly popular for traders interested in taking advantage of potential opportunities. Interestingly, a recent survey showed that nearly 75 percent of investors are now using these tools to make decisions about their investments. These tools can help users to better understand market trends and identify any potential areas of risk or reward. They also allow users to analyze historical data, compare different markets, and create custom strategies based on individual needs. Additionally, with the increasing popularity of Ethereum wallets and blockchain technology, many prediction tools are able to integrate this information into their predictions as well.

In conclusion, Ethereum price prediction tools have become an invaluable tool for investors looking to make informed decisions about their investments. By utilizing analysis techniques such as historical data comparison and custom strategies enabled by modern technologies like Ethereum wallets and blockchain technology, these tools provide an efficient way for traders to gain insight into current market conditions.

Tips for Investing in Ethereum

Investing in Ethereum can be a lucrative endeavor, but it is important to consider certain factors before making any decisions. When investing in Ethereum, diversifying one’s portfolio is essential for reducing risk as well as researching the various projects that are available. Furthermore, setting stop losses should also be taken into consideration when investing in Ethereum as these will help to minimize potential losses.

Diversify Your Portfolio

Diversifying one’s portfolio can be an effective way to mitigate risk when predicting the price of Ethereum. This is because it allows investors to spread their investments across different asset classes, currencies, and markets in order to reduce the risk of any single investment. Alternatives investments, such as gold or real estate, can provide a hedge against volatility that may arise from investing solely in Ethereum. Additionally, diversification strategies such as hedging or market timing can enable investors to better manage their exposure to the crypto market.

The use of alternative investments and diversification strategies can be beneficial for both speculative traders and long-term investors alike. By spreading their capital across various assets, these strategies allow investors to balance risk with potential returns while also reducing overall volatility in one’s portfolio. In addition to diversifying one’s portfolio within the cryptocurrency space, researching other Ethereum projects can help traders gain further insight into the direction of Ethereum prices.

Research Ethereum Projects

Gaining an understanding of other Ethereum projects can provide investors with valuable insights into the direction of the Ethereum market. By researching various initiatives utilizing Ethereum’s blockchain technology and smart contracts, investors can determine which projects may have an effect on the currency’s overall value. Identifying these projects and evaluating their potential success or failure gives investors a better picture of what to expect in terms of Ethereum price predictions for today. Additionally, exploring other projects allows investors to understand how different developments within the ecosystem contribute to its overall growth and stability. Knowing this information can help inform investment decisions by providing a more well-rounded perspective of the entire cryptocurrency market. With this knowledge, investors are better equipped to make informed decisions about where they should put their resources when considering Ethereum price predictions for today.

Set Stop Losses

Implementing stop losses is akin to having a safety net, helping investors to reduce risk while investing in the cryptocurrency market. Stop losses are set as predetermined points at which an investor will close out their position in order to limit their exposure to potential losses if the asset’s value drops below a certain level. This practice can be beneficial for short term traders due to the volatility of cryptocurrencies, allowing them to minimize their losses and protect their profits. Additionally, it can serve as part of a portfolio diversification strategy by enabling investors to select a range of assets that have different risk profiles.

Stop loss orders should always be used with caution and should only be implemented after thorough analysis has been undertaken. It is important for investors to understand how these strategies work before attempting any kind of trading in order to ensure they are making the best possible decisions with regard to protecting their investments. With this knowledge and understanding, investors can then consider whether Ethereum price prediction for today would make sense for them given their individual goals and risk appetite.

Ethereum Price Prediction for Today

Analyzing Ethereum price prediction for today requires an understanding of the current market conditions, trends in past performance, and potential future scenarios. Cryptocurrency mining and blockchain technology are integral components of the industry that can heavily influence the price of Ethereum on any given day. By studying these constantly evolving factors, investors can make more confident decisions about their investments.

The accuracy of any Ethereum price prediction for today is contingent upon the collective success or failure of recent developments within the industry. The rapid evolution of cryptocurrency and blockchain technologies has made it increasingly difficult to predict prices accurately with precision. Nevertheless, by remaining up-to-date with news sources and paying attention to long-term trends, investors may gain insight into what direction prices are likely to move in over time.

Ethereum Price Prediction for Tomorrow

Gauging the potential movements of Ethereum in the coming day is like navigating a rollercoaster – unpredictable and thrilling. While there are several methods to predict Ethereum’s price for tomorrow, technical analysis offers one of the most reliable ones. Technical analysis uses past market data to identify trends and patterns that could indicate future performance. It can also provide investors with an idea of where the cryptocurrency is headed, as well as offer advice on when to buy or sell. Some key components of technical analysis include:

- Chart reading: Analyzing historical charts in order to identify trends or patterns which could help predict future price changes

- Support/Resistance levels: Identifying specific points on a chart which could act as either support (price won’t go below this point) or resistance (price won’t go above this point)

- Volume: Monitoring trading activity in order to determine if certain trades will be successful or not

- Indicators: Using tools such as Moving Averages, Relative Strength Index, etc., to better understand how prices might change in the future. With these tools and strategies combined, investors can make more informed decisions regarding their investments in Ethereum and have a better understanding of its potential fluctuations for tomorrow. Ultimately though, it’s important for investors to remember that no matter how much research they do, predicting Ethereum’s price tomorrow is still an uncertain endeavor due its high volatility. This transition into understanding predictive factors for longer-term investment decisions such as ‘ethereum price prediction for the week’.

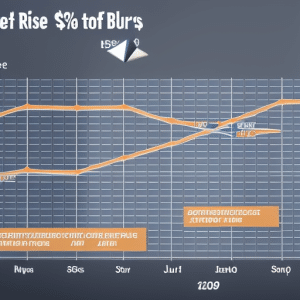

Ethereum Price Prediction for the Week

Forecasting the potential movements of the cryptocurrency over an extended period of time requires a deeper understanding of its market data and technical indicators. To assess Ethereum’s price performance for the week, traders must be mindful of key risk factors that can help them make sound trading decisions. When predicting short-term price movements, it is important to pay attention to fundamentals such as news headlines and economic releases. This information can assist in avoiding risk while also making informed trading strategies. Additionally, technical analysis with the use of trend lines, chart patterns, and support/resistance levels should be taken into account when speculating about Ethereum’s potential weekly movement. Overall, by combining both fundamental and technical analysis when predicting Ethereum’s price performance for the week, traders can have a better idea of where prices may move in order to adjust their strategies accordingly. Moving forward into month-long predictions will require further research into these topics.

Ethereum Price Prediction for the Month

In order to assess the potential movements of cryptocurrency over an extended period of time, it is essential to consider a variety of factors that have influence on price volatility. In the case of Ethereum, such factors include technical analysis, market sentiment and other macroeconomic events that can affect its price. Technical analysis involves examining past price movements in order to discern patterns and predict future prices. It is based on the premise that history has a tendency to repeat itself in financial markets. Market sentiment is another important factor as it reflects investors’ perception of Ethereum’s value at any given point in time. Investors are able to gauge this sentiment by looking at current news stories and social media activity related to cryptocurrencies. Additionally, macroeconomic events such as policies enacted by governments or central banks may also have a significant impact on Ethereum’s long-term outlook. By taking all these factors into consideration when making predictions for the month ahead, investors can gain greater insight into which direction the price might move in over the next 30 days. To conclude, an accurate forecast requires an understanding not only of individual cryptocurrencies but also how they interact with each other and global markets more broadly. With this information in hand, investors should be well equipped to make informed decisions about their investments going forward into the year ahead.

Ethereum Price Prediction for the Year

Analyzing the various factors that can influence Ethereum’s price in the long-term is crucial for making accurate projections for its value in the coming year. Technical analysis of market data and investment strategies are two important ways to forecast Ethereum’s future price movements:

- Technical Analysis: By studying historical trends, investors can learn from past experiences to identify potential trading opportunities. This requires an understanding of technical indicators such as moving averages, support/resistance levels, and Fibonacci retracements. Other techniques such as chart reading and trend following are also important for predicting prices in the short-term.

- Investment Strategies: Another way to predict Ethereum’s price movements is by using a variety of trading strategies. These include buying on dips, swing trading, day trading, hedging against other currencies or commodities, or investing in derivatives like options or futures contracts. Investors should also consider their risk tolerance before making any investment decisions. By combining these methods with fundamental analysis of news and economic events, investors can gain insight into where Ethereum may be headed in the near future.

By taking into account both technical analysis and investment strategies when forecasting Ethereum’s price over the next year, investors can make well informed decisions about how to best position themselves for success. These predictions will provide valuable guidance when setting up a portfolio that meets an individual investor’s risk profile and goals. With careful planning and attention to detail, it is possible to create a successful strategy that takes advantage of Ethereum’s potential growth over time while mitigating risk exposure along the way. As such, these forecasts serve as an invaluable tool when considering an investment strategy focused on Ethereum’s long-term success.

Ethereum Price Prediction for the Future

Identifying the potential trajectories of the digital asset’s value in the future is essential for making informed decisions about investment strategies. To predict Ethereum’s price in the future, analysts must evaluate both its historical performance and apply technical analysis to assess current market conditions. Technical analysis, which involves studying chart patterns and indicators, can be used to identify when prices are overbought or oversold, allowing investors to make educated predictions on where markets may go in the near-term. Risk management is also a key component of forecasting Ethereum’s price as it helps investors understand how much risk they should take on and what steps they should take to mitigate that risk. By combining these two approaches – technical analysis with risk management – investors can create better strategies for predicting Ethereum’s price in the future.

Frequently Asked Questions

What is the best way to invest in Ethereum?

The best way to invest in Ethereum is to develop a comprehensive trading strategy that incorporates market analysis and sound trading principles. This should be based on careful research and detailed evaluation of the current market conditions.

How can I minimize the risk of investing in Ethereum?

To minimize the risk of investing in Ethereum, it is important to consider various investing strategies and engage in effective risk management. Adopting a methodical approach that includes researching and understanding market trends and volatility can help reduce potential losses.

What are the potential long-term implications of Ethereum?

Smart contracts and token economics are two potential long-term implications of Ethereum. These both present risks related to security, scalability, and sustainability that must be carefully considered before investing in the technology.

How can I track Ethereum prices on a daily basis?

Tracking Ethereum prices on a daily basis requires understanding mining strategies and blockchain technology, as well as analyzing market trends and adoption rates. With this knowledge, one can determine the long-term implications of these factors on price predictions.

What is the most reliable Ethereum price prediction tool?

Technical and fundamental analysis are two reliable methods for predicting Ethereum prices. Technical analysis examines market trends of price movements, while fundamental analysis focuses on underlying factors such as economic news. These techniques can be used to accurately forecast future Ethereum prices.