Ethereum is a blockchain-based, open source platform that facilitates the development and deployment of decentralized applications. It was created in 2015 by Vitalik Buterin and has since gained significant traction amongst developers, investors, and businesses. Ethereum is powered by Ether (ETH), a cryptocurrency which can be used to pay for transaction fees for transactions conducted on the Ethereum network. The price of Ether has seen significant volatility over the past few years, making it an attractive target for traders and investors. This article will discuss the factors influencing Ethereum’s price movement today as well as offer up predictions about its future performance in the market.

Key Takeaways

- Ethereum is a blockchain-based platform for decentralized applications, powered by the cryptocurrency Ether (ETH).

- Factors influencing Ethereum’s price include usage demand, economic conditions, innovations in the cryptocurrency space, and market liquidity levels.

- Recent trends indicate a gradual increase in Ethereum’s value since mid-August 2020.

- Analysts use technical indicators and fundamental analysis to predict future price movements.

Overview of Ethereum

Ethereum is a distributed public blockchain network that provides an open-source platform for the development of decentralized applications while providing robust security, scalability, and flexibility. It utilizes smart contracts to enable users to create various applications such as financial services, supply chain management, digital identity management and more. Ethereum allows developers to build decentralized applications on its platform that are not controlled by any central authority – this has led to many innovative use cases being explored with blockchain technology. Many industries have already begun utilizing Ethereum’s technology for their projects due to its ability to provide secure and reliable transactions without requiring high costs or complex infrastructure. Ethereum also supports a variety of other blockchain applications including token issuance, asset tracking, voting systems and more.

The value of Ethereum is determined by numerous factors including usage demand, economic conditions, innovations in the cryptocurrency space, sentiment towards cryptocurrencies in general and market liquidity levels. As such it is important for investors to keep abreast of news and developments in these areas so as not to be taken aback by sudden price movements or changes in market sentiment which can affect the price of Ether significantly. Moving forward into the subsequent section about ‘factors affecting ethereum price’, it is necessary to understand how different variables influence its valuation so as to make informed investment decisions accordingly.

Factors Affecting Ethereum Price

The factors influencing the current value of cryptocurrency Ethereum are numerous and varied. Cost analysis of Ethereum is a complex task, taking into account fluctuations in its supply and demand. These are determined by both market forces such as investor sentiment, political instability or technological advances, as well as internal factors such as inflation rates and changes in mining rewards. Market analysis is also significant when calculating the price of Ethereum, due to the fact that it trades on exchanges alongside other cryptocurrencies like Bitcoin and Litecoin. As these markets experience large swings in value, so too does Ethereum’s own pricing. Additionally, news coverage of blockchain technology can influence prices either positively or negatively depending on the nature of the report. All of these elements contribute to an ever-changing Ethereum landscape where prices can fluctuate wildly over short periods of time.

These volatile conditions create both opportunities for traders to make profits or suffer losses depending upon their timing and accuracy when making investments decisions. As such, understanding recent developments surrounding Ethereum’s price movements is key for informed investing strategies going forward.

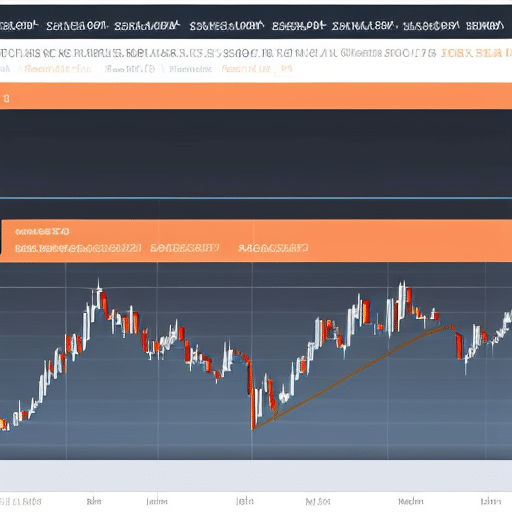

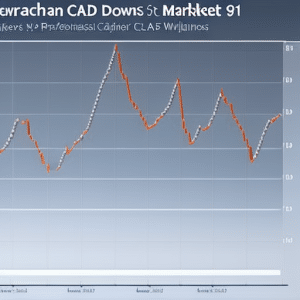

Recent Ethereum Price Movements

Ethereum prices have been highly volatile over the past few months. Price fluctuations have been seen across the board, with notable peaks and troughs occurring during this period of time. Recent trends indicate a gradual increase in value since mid-August 2020, though there are still significant swings in price from day to day. These fluctuations and trends make it difficult for investors to predict what might happen next, making Ethereum an especially intriguing asset class for traders.

Price fluctuations

Price movements of Ethereum have been volatile today. The fluctuations can be attributed to a myriad of factors, including supply and demand, scalability issues, and overall market sentiment. Supply and demand are key drivers in determining the Ethereum price as they are with any other asset or commodity. As Ethereum gains more attention from investors, its value can increase due to an influx in buyers. On the other hand, when there is a decrease in demand for Ether coins its price may fall significantly. Additionally, scalability issues related to Ethereum’s blockchain technology could cause significant price swings depending on how quickly developers address them. Finally, overall market sentiment contributes to the volatility of Ethereum prices as positive news may encourage more investment while negative news could lead to a sell-off by traders.

The trends of Ethereum prices over time also provide insight into future predictions about where it might go next. Analysts have used patterns such as cycles or historical data points to gauge what their estimated value should be moving forward. By understanding these trends better, investors can make informed decisions regarding their investments in this cryptocurrency asset class.

Price trends

Analyzing historical price data can provide useful insights into future Ethereum prices, however, it is important to note that this method is not infallible and should be considered with caution. By examining the past trends of Ethereum’s price fluctuations, one can gain an understanding of the magnitude of its price volatility and devise trading strategies accordingly. In particular, looking at how much the price has changed over a given period of time can give traders a better idea of when to enter or exit the market in order to maximize their profits. Similarly, observing the pattern of Ethereum’s price movements over a longer time frame may also help investors to identify potential opportunities for investing. However, it is important to remember that these trends are likely to change in the future and should only be used as part of an overall investment strategy. With this in mind, transitioning into a discussion about ethereum price predictions could help investors make more informed decisions.

Ethereum Price Predictions

Exploring Ethereum price movements today, numerous predictions have been made regarding future trends. These predictions are based on a variety of market data and analysis that can be used to forecast both short-term and long-term patterns. Analysts will often use a combination of technical indicators such as trendlines, moving averages, and relative strength index to identify potential support or resistance levels in the market. Other analysts may use fundamental analysis to focus on the underlying fundamentals of Ethereum’s network and technology in order to predict future prices. These predictions can help inform investment strategies for those looking to invest in the cryptocurrency. With all these factors taken into account, investors must carefully weigh their options before making any decisions related to buying or selling Ethereum. Transitioning into the next section, it is important for investors to consider how various investment strategies could fit into their overall portfolio when considering the current price movements of Ethereum today.

Investment Strategies

Investing in Ethereum can be an exciting endeavor, however it is important to consider a few strategies to maximize success. Diversification of assets across multiple investments is key for reducing risk, while dollar-cost averaging and proper risk management are essential for maintaining the long-term health of the portfolio. Understanding these three strategies is paramount for any successful Ethereum investor.

Diversification

Diversifying portfolios through asset allocation can provide investors with protection against volatile Ethereum prices. Crypto diversification enables investors to spread their investment capital across a range of different digital assets, such as Bitcoin and other alternative coins. This allows them to reduce volatility risk by reducing the concentration of investments in any one asset. A portfolio allocated across multiple assets has a lower overall level of risk compared to an individual asset’s price movements. Beyond diversifying investments into different cryptocurrencies, investors should also consider allocating funds into traditional markets or commodities in order to further reduce risk exposure. Risk management is a critical component for successful investing strategies that could help protect against losses due to sudden market corrections or changes in sentiment.

Risk management

Risk management is an essential component for investors to consider when allocating funds across various digital assets and traditional markets. Hedge funds, in particular, can be valuable tools for risk assessment and diversification strategies. However, it is important that investors assess a variety of factors such as market volatility, correlations between different asset classes, and potential macroeconomic trends before making any decisions about their portfolio allocations. Additionally, investors should not forget to factor in the liquidity of their investments when assessing risk. By taking into account these elements of risk management, investors can effectively balance their portfolios with both digital assets and traditional markets while also managing overall exposure to risk.

In conclusion, proper risk assessment and management are critical considerations for any investor looking to protect themselves from potential losses due to market fluctuations. Incorporating a combination of hedge funds alongside other financial instruments such as dollar-cost averaging can help mitigate the risks associated with investing in volatile markets while still allowing one to take advantage of potentially rewarding opportunities.

Dollar-cost averaging

Risk management is an important aspect of investing in cryptocurrencies, such as Ethereum. Dollar-cost averaging (DCA) is a popular risk management technique that provides investors with the opportunity to reduce risk through diversification and cost benefit analysis. DCA involves investing a fixed amount of money periodically over time instead of making one large investment. This allows investors to spread their investments across different asset classes which can help smooth out volatility in the market and lower overall risk exposure. Additionally, this method allows for a more even allocation of assets when compared to lump sum investing, meaning that the investor can benefit from cost benefit analysis rather than taking on all the risks associated with larger individual investments.

Pros and Cons of Investing in Ethereum

Investing in Ethereum can present potential rewards as well as some drawbacks, making it essential for an investor to consider all variables before making a decision. Some of the key considerations before investing in Ethereum include:

- Social media influence – Many investors have been influenced by sensational news and rumors circulating on social media platforms, leading to erratic trading decisions.

- Scalability issues – The Ethereum network is not yet able to handle the large transaction volumes needed for mainstream use cases.

- Volatility – The price of Ether is highly volatile, which can lead to high gains or losses depending on the timing of investment or sale.

- Regulatory uncertainty – Governments around the world are still trying to figure out how best to regulate cryptocurrency markets, creating uncertainty about future regulations that could affect investments in Ethereum and other cryptocurrencies.

As such, investors should be aware that investing in Ethereum carries both risks and rewards and take necessary precautions when considering an investment strategy. With a comprehensive understanding of these pros and cons, investors can make informed decisions about whether or not they should invest in Ethereum.

Ethereum’s Impact on the Cryptocurrency Market

The emergence of Ethereum has had a significant impact on the crypto market, creating opportunities and challenges for investors. The increased cryptocurrency volatility due to ETH mining has created both risks and rewards for those looking to invest. Those that are able to successfully navigate the market have the potential to reap large returns, while others may suffer losses due to their lack of experience or understanding. Nevertheless, Ethereum’s presence has been beneficial overall as it has given investors more options and allowed them access into a new asset class with unique characteristics. As such, it provides an attractive opportunity for those wishing to diversify their portfolios away from traditional investments. Furthermore, its decentralized nature allows nearly anyone around the world access without having to deal with intermediaries or government regulations. This transition into further exploration of Ethereum’s potential for future growth comes at an opportune time as many investors are now eager for new sources of profit in what is becoming an increasingly crowded investment landscape.

Ethereum’s Potential for Future Growth

As the cryptocurrency landscape continues to develop, Ethereum’s potential for long-term growth has skyrocketed to unprecedented heights. Despite current price volatility and associated risks, Ethereum remains one of the most promising digital currencies in terms of its technological capabilities and scalability. The platform is well-suited for applications such as smart contracts and decentralized autonomous organizations (DAOs), providing a robust infrastructure for developers to build innovative products. In addition, Ethereum offers unique features such as gas fees that incentivize miners to process transactions quickly and securely. These qualities make it an attractive option for investors looking to diversify their portfolios with cryptocurrencies in the long run. With so much potential for future growth, it is no surprise that many analysts are bullish about Ethereum’s prospects moving forward. As such, Ethereum mining may prove to be a lucrative endeavor in the coming years.

Ethereum Mining

Ethereum mining is a process of verifying and adding transaction records to the Ethereum blockchain. It involves miners who use their computing power to solve complex mathematical problems, which in turn provide rewards in Ether tokens. The pros of mining Ethereum include generating passive income and having access to the latest technology. On the other hand, cons include high investment costs associated with the hardware used for mining and energy consumption.

What is Ethereum mining?

Mining Ethereum provides participants with an opportunity to acquire the cryptocurrency and its associated rewards. Ethereum mining is a process where miners use specialized computers or hardware to validate transactions on the Ethereum blockchain, receiving rewards in the form of Ether (ETH) for their work. This process requires significant energy consumption, as well as specialized knowledge and expertise from stakeholders involved. Below are some of the pros and cons of mining Ethereum:

- Pros: Miners receive ETH as a reward for confirming transactions on the blockchain; miners also benefit from transaction fees; mining can be profitable when done correctly.

- Cons: Mining requires substantial computing power and electricity costs; competition has become increasingly intense; there is a risk of theft or loss due to hacking attempts.

Ethereum mining has been gaining traction in recent years due to its potential profitability, but it is important for prospective miners to understand both the advantages and disadvantages before getting started. Moving forward, we will explore some of the key pros and cons associated with Ethereum mining in greater detail.

Pros and cons of mining Ethereum

Mining Ethereum is a popular way to generate cryptocurrency rewards, but it is not without its drawbacks. As with any cryptocurrency mining process, Ethereum mining consumes significant amounts of energy and computing power, making it an energy-intensive task. This means that miners have to weigh the cost of electricity against the potential rewards when considering whether to mine Ethereum. Additionally, since there is a limited amount of Ether available for mining, competition among miners can be fierce and may require high-end hardware in order to stay ahead. Despite these risks and drawbacks, many people are still drawn to the potential rewards associated with Ethereum mining.

How to Buy and Sell Ethereum

Investing in Ethereum is a popular way to make money due to its recent price movements. There are several strategies for purchasing and selling Ethereum, including buying via an exchange, purchasing from a peer-to-peer platform, or trading on a derivative market. When buying or selling Ethereum, investors should consider the market’s current liquidity levels, fees associated with transactions, and trading volume of particular tokens. Traders also need to be aware of the risks associated with such transactions as volatility can lead to significant losses if not managed properly. Additionally, traders must keep in mind any taxes they may owe when trading cryptocurrencies. A comprehensive understanding of these factors will ensure that investors maximize their profits while minimizing risk when buying and selling Ethereum. With this knowledge in hand, traders can develop a sound strategy for investing in Ethereum that suits their goals and financial situation. By following these strategies, investors can benefit from the sharp price movements seen within the Ethereum market today and into the future. As such, transitioning into learning about wallets is an important next step for any investor interested in making money through cryptocurrency markets.

Ethereum Wallets

Securely storing Ethereum requires the use of a specialized wallet, much like putting money in a bank account; thus, it is wise to ‘look before you leap’ when selecting one. Ethereum wallets are digital wallets that store users’ private keys and enable access to their public address on the blockchain network. This public address allows users to interact with other users and facilitate transactions, such as sending or receiving Ether and tokens created on the Ethereum blockchain through its smart contracts and tokenization system. Additionally, these wallets allow users to monitor their balance without any third-party interference. As safety is paramount when dealing with cryptocurrency assets, it is essential for users to properly research all available options prior to choosing an Ethereum wallet. Consequently, this will ensure that their funds are adequately protected from malicious actors or potential hacks. By transitioning into a discussion about security measures related to Ethereum wallets, users can further protect themselves from any form of unwanted risk exposure.

Ethereum Security

The use of Ethereum wallets is one way to store, send, and receive Ether tokens. However, it is important to take into account the various security threats that may exist when using such wallets. As with any system involving money or other valuable assets, there are always potential security risks associated with the use of an Ethereum wallet. This article will explore some of the most common Ethereum security threats and discuss potential solutions for protecting against them.

Ethereum security threats can range from malicious actors attempting to gain access to user funds through hacking or phishing attacks, as well as vulnerabilities in smart contracts that can be exploited by attackers. To mitigate these risks, users should take steps such as enabling two-factor authentication wherever possible and only transacting on trusted sites that have a good reputation for providing secure services. Additionally, users should make sure their computer systems are up-to-date with the latest security patches and antivirus software in order to protect against malicious actors who may try to exploit system vulnerabilities. By understanding the risks associated with using Ethereum wallets and taking appropriate precautions, users can ensure their funds remain safe from attack. In conclusion, it is clear that effective security measures must be taken in order to protect oneself from potential cyberattacks when utilizing an Ethereum wallet; these measures should include both technical safeguards as well as best practices when interacting with third parties online. With these steps taken, users can then move forward towards exploring regulations related to Ethereum transactions and asset transfer protocols without fear of compromising their funds or personal information.

Ethereum Regulations

Understanding the regulations in place for Ethereum transactions is essential for ensuring an individual’s funds remain secure. A thorough understanding of the applicable regulations within one’s jurisdiction can help ensure that investments are made in a compliant manner and with appropriate tax implications in mind. From a practical standpoint, it also helps to develop an investment strategy which takes into account the potential risks associated with holding and trading cryptocurrencies such as Ethereum.

It is important to remember that, depending on one’s location, cryptocurrency activity may be subject to different sets of regulations than those which govern traditional investments and taxes. Therefore, individuals should familiarize themselves with all applicable laws before engaging in any activities involving Ethereum or other digital currencies. This familiarity will help them make informed decisions regarding their investments while avoiding potential legal issues down the road.

Ethereum Taxation

Due to the decentralized nature of Ethereum and other cryptocurrencies, taxation can be an important factor for investors to consider when making decisions about their investments. Tax shelters are often used by investors as a way to minimize or eliminate taxes on cryptocurrency holdings. For example, holding Bitcoin in a retirement account provides tax shelter benefits that can help reduce capital gains taxes. Additionally, certain nations have advantageous taxation policies regarding cryptocurrency investments – such as Malta and Switzerland – providing another avenue for investors looking to maximize their return on investment. As with any financial decision, it is important for investors to understand the taxation implications of their investments, which may vary depending on jurisdiction. With increasing government regulation of the crypto markets and greater clarity in taxation policies, investors can make more informed decisions about their investments in Ethereum and other cryptocurrencies.

The next section will discuss various resources available to individuals interested in investing in Ethereum and other cryptocurrencies.

Ethereum Resources

Analyzing the investment landscape of Ethereum and other cryptocurrencies can provide valuable insights into potential gains or losses. To maximize returns, it is important to be aware of the different resources available to traders when investing in Ethereum. Trading strategies such as diversification offer investors a variety of benefits, including improved risk management and increased liquidity. Many investors use technical analysis to help them make better decisions when trading Ethereum. This involves looking at historical data in order to identify trends and create effective trading strategies. In addition, there are numerous online forums, blogs, news sites, and other sources providing advice on how to trade Ethereum successfully. By researching these sources thoroughly before making any trades, investors can gain a better understanding of the risks associated with investing in this volatile market. Additionally, most exchanges offer educational materials for beginners so they can become more familiar with trading strategies that could potentially reduce their chances of incurring losses in the future.

Frequently Asked Questions

What is the current price of Ethereum?

The current price of Ethereum (ETH) is determined by a range of factors including mining activity and trading volume. ETH is currently trading at around $350 USD, though this figure may fluctuate depending on market conditions.

How does Ethereum compare to other cryptocurrencies?

Cryptocurrency buying trends indicate that Ethereum is among the most popular digital assets. However, scalability issues can be a cause of concern for those wanting to invest in Ethereum. It is important to consider these factors when comparing it to other cryptocurrencies.

What are the risks associated with investing in Ethereum?

Utilizing investing strategies and analyzing market trends, it is essential to be aware of the risks associated with investing in Ethereum. Historically, cryptocurrency prices are volatile and unpredictable, making it a risky venture. Additionally, there is an inherent lack of regulation which may lead to potential losses.

What are the benefits of using an Ethereum wallet?

Using an Ethereum wallet provides users with various buying strategies and security measures to protect their funds. This can include features such as multi-signature authentication, user-controlled private keys, and automated transaction monitoring.

Are there any special taxes or regulations regarding Ethereum?

Satirically evoking emotion, one might be surprised to find that Ethereum is subject to taxation implications and governance rules like any other asset. Objectively informed, this analysis highlights the various implications of trading in cryptocurrency.