Ethereum is a decentralized, open source platform built on blockchain technology. It allows developers to build and deploy distributed applications, as well as create their own custom tokens. Ethereum’s rising popularity has caused its price to skyrocket in recent years, making it an attractive option for investors and traders alike. This article will explore the history of Ethereum’s price movements and analyze various factors that have impacted it, such as mining operations, technical analysis, and trading strategies. Additionally, this article will provide insight into long-term investment strategies and risk management techniques tailored specifically for Ethereum. Finally, readers will gain an understanding of the different types of wallets available for storing their Ether tokens securely.

Key Takeaways

- Ethereum’s price has skyrocketed in recent years, reaching an all-time high of $1,432.88.

- Factors influencing Ethereum’s price include mining operations, technical analysis, and trading strategies.

- Understanding short-term trading strategies and longer-term investment objectives is important for maximizing returns and minimizing risk.

- Effective risk management approaches, such as diversification and hedging techniques, can help manage the risks associated with Ethereum investments.

Overview of Ethereum

Ethereum is often likened to a digital oil, fueling the modern economy with its decentralized blockchain technology. Ethereum is an open-source computing platform based on blockchain technology. It enables developers to create and deploy decentralized applications (also known as smart contracts). Smart Contracts are digital contracts that can be programmed using Ether, Ethereum’s cryptocurrency, to enable two parties to exchange money, property or other assets without the need for a third party or centralized platform. The use of Smart Contracts provides a secure and efficient way of executing agreements, reducing transaction costs and eliminating the need for intermediaries. Blockchain Technology also makes it possible for users to securely store data in an immutable ledger distributed throughout thousands of computers all around the world. This ensures that no single point of failure exists within the network and allows users to transact directly with each other without any centralized authority controlling their transactions. These features make Ethereum an attractive choice for many organizations and individuals looking for efficient ways of transacting online. As such, Ethereum has become one of the most popular cryptocurrencies in the world due its potential applications across many industries. With its increasing popularity, there has been rising interest in understanding the fluctuations in its price history over time.

Ethereum Price History

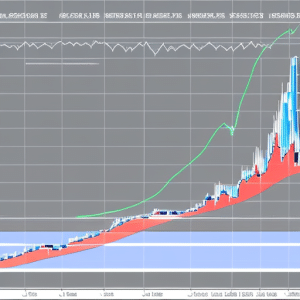

The cryptocurrency market has seen a significant shift in value over the past several years, with Ethereum being no exception. The price of Ethereum has increased dramatically since its launch in 2015, reaching an all-time high of $1,432.88 on January 13th 2021. This remarkable rise is largely attributed to the platform’s growing reputation as a leader in blockchain scalability and decentralized finance (DeFi). Furthermore, given the platform’s ability to support applications that are not available on other blockchains, many believe that Ethereum will continue to be a major player in the crypto space for years to come.

In addition, there appears to be a strong correlation between Ethereum’s price movements and overall investor sentiment towards cryptocurrency markets at large. As such, it is important to consider factors such as regulatory developments and macroeconomic trends when analyzing Ethereum price history. Moving forward, understanding these key drivers of price will be essential for predicting future movement of the coin and assessing its potential investment opportunities.

Factors Influencing Ethereum’s Price

Analyzing the various forces influencing Ethereum’s price can provide valuable insights into its possible future trajectory. There are a few key factors that have contributed to Ethereum’s historical price movements, which include:

- Cryptocurrency Markets:

- Supply and demand of Ether tokens

- Trading volume

- Speculation on market trends

- Blockchain Technology:

- Network upgrades and improvements

- Changes in consensus algorithms

- Network scalability measures

These dynamics set the backdrop for Ethereum’s current and future performance in the cryptocurrency markets. As such, they must be taken into account when attempting to understand how Ethereum is likely to fare in the days, weeks, and months ahead. With this knowledge at hand, we can now move forward with examining technical analysis as a tool for predicting Ethereum’s future price movements.

Technical Analysis

Examining the underlying market dynamics through technical analysis can provide insight into future price movements of Ethereum. Technical analysis is used to predict the direction of a security’s price by analyzing the supply and demand dynamics, using various charting tools such as trend lines, support and resistance levels, candlesticks, volume bars and sentiment analysis. Supply and demand dynamics involve analyzing how many buyers and sellers are in the market at any given time. This can be used to identify short-term buying or selling pressure that may cause a temporary spike or dip in prices. Sentiment analysis is another tool used by traders to measure investor opinion on Ethereum, which can indicate whether investors are bullish or bearish on its future prospects. By combining technical analysis with fundamental knowledge about Ethereum’s value drivers, traders can gain better insight into potential price movements of the asset. In conclusion, looking at supply dynamics, sentiment analysis as well as other elements through technical analysis can help traders form an informed view of where Ethereum prices may move in the near future. To further understand how this works in practice it is important to consider how mining affects the cryptocurrency’s pricing structure.

Ethereum Mining

Mining Ethereum is a process by which new Ether tokens are created and confirmed on the Ethereum blockchain. Network Difficulty is an indicator of how hard it is for miners to successfully mine blocks, while Mining Profitability measures the expected return on investment from mining equipment used to mine Ethereum. This profitability can be affected by changes in network difficulty, rewards earned from successful block mining, and the cost of electricity used to power mining equipment.

Network Difficulty

The Ethereum network difficulty has seen an increase of over 150% since the beginning of 2018, with a hash rate on the network reaching all-time highs. This is due to increased competition among miners for mining rewards, as well as changes in difficulty adjustment algorithms that have caused more rapid adjustments. As a result, miners have had to invest heavily in powerful hardware and energy resources to remain profitable. Despite these challenges, Ethereum remains one of the most popular networks for mining cryptocurrency.

The success or failure of Ethereum mining profitability depends largely on how quickly the difficulty can adjust according to market demand. If the difficulty fails to adjust quickly enough, then miners will be unable to compete and profits will drop significantly. On the other hand, if the difficulty adjusts too rapidly then it could lead to significant losses for longer-term miners who are unable to quickly adapt their strategies. Understanding how and when difficulties adjust is essential for successful Ethereum mining operations.

Mining Profitability

Successful Ethereum mining operations depend greatly on the profitability of the venture. Cloud mining and ASIC miners are two tools that have been used to increase profitability in Ethereum mining operations. Cloud mining involves outsourcing work to a third-party company, which provides hash power that is then shared among users. ASIC miners, on the other hand, are devices specifically designed to mine Ethereum more efficiently than traditional computer hardware. The use of these technologies has enabled some miners to remain profitable even when faced with difficulty increases from network congestion or rising prices in electricity costs. As Ethereum moves closer to its version 2.0 upgrade, it will be interesting to see how changes in technology will affect miner’s ability to remain profitable in the future.

Ethereum 2.0

Launching Ethereum 2.0, an upgrade to the existing blockchain, has been widely anticipated as a major step forward for the cryptocurrency. This new version of Ethereum offers several features such as staking rewards and enhanced smart contract capabilities that could potentially increase its value in comparison to other cryptocurrencies. It also offers better scalability and speed, which could make it more attractive to investors.

Ethereum 2.0 also introduces new security protocols which have been designed with the aim of improving the network’s reliability and preventing fraudsters from exploiting vulnerabilities in the system. These security measures should provide users with greater confidence in terms of their funds’ safety when investing in or trading Ethereum tokens. Additionally, these protocols are expected to help reduce transaction costs compared to traditional payment systems, making Ethereum more accessible for everyday users as well as businesses looking to use it for transactions or smart contracts.

The Impact of Regulatory Changes

Recent regulatory changes have the potential to significantly impact the future of Ethereum and other cryptocurrencies. Governments around the world are increasingly recognizing the need for regulatory compliance when it comes to cryptocurrency, and many countries are now implementing policies that will shape how cryptocurrency markets operate in the future. Regulatory shifts in policy can influence a variety of factors related to Ethereum, including its price movements and how it is used by enterprises. As governments continue to adjust their stance on cryptocurrency, there is a real possibility for major impacts on Ethereum’s market value as well as its use-cases in enterprise applications. In turn, these developments could create new opportunities or challenges for companies looking to take advantage of Ethereum-based solutions.

The Potential for Ethereum-based Enterprises

The potential for businesses to leverage Ethereum-based solutions could lead to major developments in the cryptocurrency space. Decentralization benefits and enterprise opportunities are two key elements that make Ethereum attractive for businesses. By leveraging the power of blockchain technology, companies can benefit from a secure and transparent platform with low transaction costs. This enables them to create applications and services that are faster, cheaper and more efficient than those available on traditional platforms. Additionally, enterprises can develop custom software on top of Ethereum’s decentralized network without having to worry about security or scalability issues.

In comparison to other cryptocurrencies, Ethereum offers a number of advantages for businesses. For example, its smart contracts feature allows users to securely store data across multiple nodes by providing immutable records that cannot be altered or deleted. This makes it ideal for creating tamper-proof agreements between parties in a trustless environment. Furthermore, the development of decentralized applications (dApps) on top of its distributed ledger provides an additional layer of security and privacy not found in traditional systems. As such, it is clear that there are numerous potential opportunities open to businesses when leveraging Ethereum-based solutions; thus pointing towards a bright future ahead for the cryptocurrency space as a whole.

Comparing Ethereum with Other Cryptocurrencies

Comparing Ethereum with other cryptocurrencies, it is evident that it offers unique features that provide the potential for businesses to leverage its decentralized solutions. Ethereum’s blockchain technology has a more expansive and accessible supply than many of its competitors, allowing for greater economic incentives in comparison. This creates an environment in which businesses can utilize Ethereum as an efficient tool for managing data securely and without the need for third-party intermediaries. Moreover, Ethereum provides users with a platform to create their own cryptocurrency tokens, allowing them to customize the functionality and applications associated with them. These features make Ethereum attractive to both investors and businesses looking to capitalize on its versatility and scalability. As such, these unique characteristics have created a great opportunity for businesses who wish to leverage this technology in order to gain competitive advantages over their peers. With this in mind, it is clear why Ethereum has become one of the most popular cryptocurrencies on the market today. Consequently, understanding how this crypto asset operates will be essential when considering its potential impact on price movements going forward.

Ethereum Price Predictions

Forecasting the potential trajectory of the cryptocurrency market has become a major focus for many analysts, with Ethereum’s price movements garnering significant attention. Analysts must consider the factors affecting supply and demand, scalability issues, technological advancements, and adoption rates to make predictions about Ethereum’s future performance.

The current data suggests that Ethereum is likely to remain volatile in the near term due to its high liquidity and frequent fluctuations in user sentiment. However, long-term projections have been more optimistic as new developments continue to drive increased adoption of Ethereum’s blockchain technology. With an increasing number of users looking to invest in Ethereum, understanding how to effectively capitalize on the emerging asset class is key for many investors moving forward.

How to Invest in Ethereum

Investing in Ethereum can be a lucrative endeavor, especially for those who understand the risks and rewards associated with cryptocurrency markets. Ethereum is a decentralized blockchain-based platform that enables users to build smart contracts and applications using its native Ether token, which can also be used as a store of value or traded on exchanges. By investing in Ether, one can receive staking rewards by helping secure the network or access potential returns from participating in the growth of decentralized apps built upon the platform. Additionally, investors may benefit from leveraging smart contracts to create automated trading strategies or hedging against volatility. As such, it is important to take into account all factors when making long-term investment decisions and ensure that any potential gains outweigh the risks involved.

Long-term Investment Strategies

Given the volatile nature of cryptocurrency markets, carefully considering a long-term investment strategy is essential for any Ether investor to maximize potential returns and minimize risk. A successful long-term strategy should focus on tokenomics and DeFi protocols. Tokenomics refers to the rules by which tokens are issued, distributed, used, and destroyed within a network — all of which affects a token’s value over time. Decentralized finance (DeFi) protocols offer access to financial services such as lending, borrowing, trading, and derivatives without relying on central intermediaries like banks or brokers. By understanding the complexities of these two concepts in relation to Ethereum’s price movement, investors can make informed decisions about their investments that help their portfolios succeed in the long run. To achieve this end, it is important that traders have an understanding of both short-term trading strategies as well as longer-term investment objectives.

Short-term Trading Strategies

Short-term trading requires a comprehensive analysis of market conditions in order to identify advantageous opportunities for profit. This type of trading is largely driven by technical analysis, which seeks to identify patterns in price movements and predict future trends. In the Ethereum market, this may involve studying price charts or utilizing smart contracts and decentralized finance (DeFi) tools to gain insights into the overall direction of the crypto asset. In addition, short-term traders should be aware of potential risks associated with their strategies such as high volatility and liquidity concerns. By understanding these risks, traders can better manage them through strategic risk management approaches. With the right approach, short-term trading can provide lucrative opportunities for those willing to take on the challenge. To maximize returns while minimizing risk exposure, it is important that traders have an effective strategy for identifying entry and exit points in the market.

Strategies for Risk Management

After discussing short-term trading strategies for Ethereum, it’s important to consider risk management strategies as well. Risk management is an essential component of any investment strategy that seeks to maximize returns while minimizing losses. There are several approaches investors can use when trying to manage their risks:

1) Diversification: This involves spreading investments across different asset classes or investing in assets with low correlations. This helps reduce the overall volatility of a portfolio, reducing risk.

2) Hedging Techniques: These involve using derivatives such as options contracts and futures contracts to offset losses from other investments. By hedging against specific market movements, investors can reduce their exposure to risk and limit potential losses if things don’t go as planned.

3) Stop Loss Orders: These orders allow traders to set predetermined points at which they will exit a trade if it moves in an unfavorable direction. By setting a stop loss order on a position, traders can protect themselves from large losses if the market moves against them.

4) Risk Limits: Investors should also have predefined limits on how much of their capital they are willing to lose on any given investment or transaction. Establishing these limits ahead of time helps ensure that risks are kept within acceptable levels and that investors remain disciplined in their approach to trading Ethereum.

By implementing these strategies for managing risk, investors can confidently pursue opportunities in the Ethereum markets without overexposing themselves to unnecessary risks. With an appropriate strategy in place, investors can achieve greater success in navigating the volatile crypto markets and increase the likelihood of achieving their goals with regard to profits and long-term growth potentials. From here we will explore techniques for securely storing Ether through Ethereum wallets which provide additional layers of security for ETH holders’ funds..

Ethereum Wallets

Investing in Ethereum involves protecting funds by securely storing Ether with the help of Ethereum wallets. Ethereum wallets, such as hardware wallets, hot wallets and cold wallets, provide users with a secure way to store their digital assets and gain access to staking rewards. Hardware wallets are one of the most secure options for storing Ether as they offer offline storage capabilities and increased security measures. Such measures include two-factor authentication (2FA), PIN protection and private keys that are stored on an external device or paper. Hot wallets provide users with fast access to their digital assets but lack the high level of security provided by hardware wallets, due to increased accessibility and risk of online hacking attempts. Cold storage is also used for long-term holding of coins which provides maximum security since the coins cannot be accessed from an online network or computer but instead must be physically retrieved from a USB drive, CD ROM or other form of media.

Frequently Asked Questions

Is Ethereum a good long-term investment?

Ethereum is a decentralized platform offering potential for long-term investment due to its smart contract capabilities, crypto mining rewards and increasing adoption rate. Its technical features provide a competitive edge over other cryptos, making it an attractive option for investors.

What is the best way to store Ethereum?

Storing Ethereum safely and securely is an important part of any buying strategy. Assessing potential security risks, such as hacking or theft, is essential to successful long-term storage. Cold wallets are a popular choice for storing Ethereum due to their added layer of security.

What is the most secure way to buy Ethereum?

When purchasing Ethereum, the most secure way to do so is to use a trusted cryptocurrency exchange that has implemented robust security measures and taken steps to reduce security risks. Such exchanges must also be regularly monitored for suspicious activity.

Are there any fees associated with buying Ethereum?

The average fee structure for buying Ethereum revolves around trading fees, which can range from 0.1% to 0.25%. Such fees are relatively low compared to traditional financial services and help make the cryptocurrency market more accessible to traders.

What are the current regulations in my country regarding Ethereum?

Regulations concerning Ethereum vary by country. Tax implications and legal considerations should be examined before engaging in Ethereum transactions. It is important to identify and comply with all relevant regulations in order to ensure a secure, successful transaction.

![-up of a hand holding a smartphone displaying a graph of the 12 Ethereum rate in [Specific Country/Region]](https://ethereumfunding.io/wp-content/uploads/2023/08/12-ethereum-rate-in-specific-country-region_817-300x300.png)