Ethereum is a blockchain-based platform that enables users to create and execute smart contracts. The Ethereum price index tracks its value over time, allowing investors to better understand the fluctuating value of the currency. As of April 2021, the average daily traded volume for Ethereum was $6.3 billion USD, making it one of the largest digital currencies in terms of market capitalization. This article will explain what the Ethereum Price Index is, its benefits, and how various factors can impact its price. Additionally, this article will discuss where to track the index and how mining difficulty, block size, block time, and network usage affect Ethereum’s price fluctuations.

Key Takeaways

- Ethereum is a blockchain-based platform for creating and executing smart contracts.

- The Ethereum Price Index (EPI) measures Ethereum’s price movements and provides real-time data on its market performance.

- Factors that impact Ethereum’s price include supply and demand, inflation, economic growth, and trading strategies.

- CoinMarketCap, CryptoCompare, Blockfolio, Delta, and CryptoPriceTicker are sources to track the Ethereum Price Index.

Overview of Ethereum

Ethereum is a decentralized, open-source platform that enables the execution of distributed applications and smart contracts while utilizing blockchain technology. Smart contracts are computer protocols designed to digitally facilitate, verify, or enforce the negotiation or performance of an agreement. They operate on a self-executing basis and can be used to replace traditional paper contracts for digital transactions. Blockchain technology is a foundational element of Ethereum, providing users with the ability to build immutable distributed ledgers using cryptographic signatures. The use of blockchain technology allows all participants to access an up-to-date record of all transactions executed on Ethereum without any single point of failure. By allowing multiple parties to securely interact with each other without any third-party intermediaries, Ethereum has opened up opportunities for automated digital interactions in many industries such as finance, health care and government services. As a result, Ethereum has become one of the most widely adopted platforms for decentralized applications and smart contracts. Its popularity has also resulted in an increase in its value which is tracked by various indices such as the ethereum price index.

What is the Ethereum Price Index?

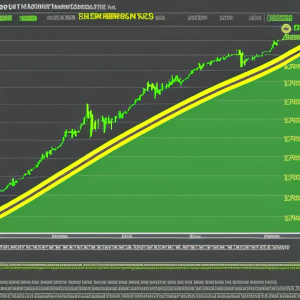

Cryptocurrencies have seen an impressive growth in value over the past few years, with Ethereum leading the way with a compound annual growth rate of nearly 400%. The Ethereum Price Index (EPI) is a measure of Ethereum’s price movements and provides real-time data on its market performance. It takes into account factors such as staking pools and gas limits that impact the price of Ether, allowing for precise analysis. By providing a comprehensive view of all relevant factors affecting the price of Ether, EPI offers traders and investors insight into their potential profits or losses. Additionally, it enables users to make informed decisions about when to enter or exit markets. As such, understanding the EPI can be essential for maximizing returns from trading Ethereum.

Benefits of the Ethereum Price Index

The Ethereum Price Index (EPI) provides investors and traders with invaluable insight into the current market performance of Ether, allowing for more informed decisions when entering or exiting markets. The EPI has several key benefits including:

- Altcoins Comparison: The EPI allows investors to compare the price of Ethereum to other altcoins available in the market, providing a comprehensive overview of which currencies are performing better than others. This helps investors make more educated decisions on which cryptocurrencies to invest in and when.

- Scalability Concerns: The EPI also provides insight into scalability concerns for Ethereum, helping investors understand how their investment may be impacted by potential future changes to the network’s capacity. This allows them to take steps to protect their investments if needed.

- Data-Driven Analysis: Finally, the EPI offers data-driven analysis that can help investors make better decisions about when they should enter or exit a particular market. By providing real-time updates on pricing trends and volume information, it gives users an edge over manual traders who don’t have access to this kind of data.

Overall, the Ethereum Price Index is an incredibly valuable tool for both experienced and novice crypto-investors alike, enabling them to make more informed decisions regarding their investments. By leveraging its insights into altcoin comparisons, scalability concerns, and data-driven analysis, users can maximize their returns while minimizing risks associated with volatile cryptocurrency markets. With these benefits in mind, it is clear that understanding the Ethereum Price Index is essential for any investor looking to succeed in today’s crypto landscape. Going forward, we will examine what factors impact ethereum price so we can gain a better understanding of where it may go next.

Factors That Impact Ethereum Price

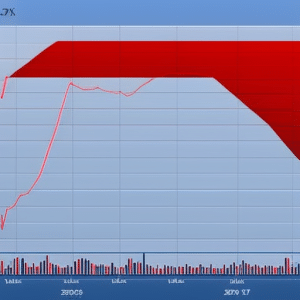

Analyzing the factors that influence Ethereum price can be akin to navigating a maze, as there are various variables at play. Supply and demand for Ethereum is one of the most important determinants of its price. When more people want to buy Ethereum than sell it, the price tends to rise. On the other hand, when there is an imbalance between buyers and sellers with more people wanting to sell than buy, the price declines. Other macroeconomic factors such as inflation and economic growth also impact Ethereum’s price movements in different ways. Trading strategies such as technical analysis can also help investors identify trends in Ethereum prices over time. Lastly, investment strategies such as dollar-cost averaging can help investors take advantage of dips in Ethereum prices or hedge against volatility over long-term periods. All these factors work together simultaneously to determine Etheruem’s current market value. Taking into consideration all these nuances helps investors make better decisions about their investments in cryptocurrency markets like Ethereum’s.

The next step is understanding where to track the latest information about the Ethereum Price Index in order to stay informed about any changes or fluctuations in its value from day-to-day or week-to-week basis.

Where to Track the Ethereum Price Index

Staying abreast of current fluctuations in the value of Ethereum requires knowledge of where to track the index. A number of sources allow users to conveniently monitor Ethereum’s price, including websites, smartphone apps, and browser extensions:

- CoinMarketCap is a popular website that provides up-to-date information on cryptocurrency prices and market capitalization. Additionally, CoinMarketCap also displays staking rewards and gas costs for each cryptocurrency listed on their platform.

- CryptoCompare is another website that offers a comprehensive overview of cryptocurrencies with real-time data from various exchanges. It also features an interactive chart to compare the Ethereum price index with other indices such as Bitcoin, Litecoin, Ripple, etc.

- Blockfolio is an app available for both Android and iOS devices which grants users access to daily market updates and price alerts whenever Ethereum reaches a certain value or fluctuates beyond set parameters.

- Delta is another mobile application that permits users to keep track of digital asset prices while managing their portfolios across multiple exchanges under one roof. It features real-time portfolio tracking equipped with news updates and analytic charts concerning crypto markets worldwide.

- CryptoPriceTicker is an extension available for Google Chrome that monitors cryptocurrency tickers in real-time while offering support for over 400 coins including Etheruem. This allows traders to stay informed about changes in the market without having to switch between tabs or windows while browsing the web.

As such, staying well informed about current developments in the world of cryptocurrency requires familiarity with these resources which provide accurate data regarding Ethereum’s price index relative to other crypto assets around the globe providing invaluable insight into this rapidly changing industry.

Ethereum Price Index vs Other Cryptocurrency Indices

Tracking the Ethereum Price Index is an important aspect of evaluating the health of this digital asset. This index provides data on the value of Ethereum in relation to other currencies and helps investors make decisions around their investments. However, it is not the only cryptocurrency index available for comparison. Other indices such as those based on mining rewards or scalability issues can provide additional information about a particular currency’s relative performance.

The Ethereum price index measures the value of Ether (ETH) relative to other cryptocurrencies and fiat currencies, while many other indices measure different metrics within the cryptocurrency market including mining rewards or scalability issues. By comparing these various indices, investors can better understand how their chosen currency is performing in relation to its peers and make an informed decision on whether to invest or not. With this knowledge, investors can be sure that they are making investments based on reliable data points rather than speculation alone. Thus concluding this subsection, we will now discuss how Ethereum’s price index relates to its total market capitalization.

Ethereum Price Index and Market Cap

Ethereum’s price index, which tracks the digital asset’s performance versus other major currencies, is closely linked to its total market capitalization. This correlation can be explained by the fact that changes in Ethereum’s value are largely determined by mining rewards and smart contracts. Mining rewards are released to miners at regular intervals and serve as a reward for maintaining the network and verifying transactions on it. Smart contracts provide a secure way of storing data or performing transactions on the blockchain without needing third-party intermediaries. As such, these two factors have a significant effect on Ethereum’s market capitalization. As more miners join the network and users take advantage of smart contracts, Ether prices tend to rise accordingly. Understanding this relationship between Ethereum’ price index and its total market capitalization can help investors make better decisions when investing in digital assets. Transitioning into market sentiment analysis provides further insight into how investors perceive Ether’s performance over time.

Ethereum Price Index and Market Sentiment

Observing the attitude of investors towards Ethereum’s performance can provide a dynamic insight into its price index and market capitalization. To gain further insights, it is important to consider community sentiment, mining profitability, and other factors that influence the cryptocurrency ecosystem. These elements can be used to gauge investor optimism or pessimism related to Ethereum’s current position in the market and help form an overall picture of its price index:

- Analyzing the amount of conversation about Ethereum on social media platforms can give an indication of how much attention it is receiving from potential investors;

- Evaluating historical data on mining profitability for Ethereum can show if miners believe there will be increased returns in the near future;

- Examining transaction volume for Ethereum over time will demonstrate whether people are buying or selling the cryptocurrency.

By understanding these factors, one can better understand how they impact investor confidence and consequently drive changes in the Ethereum market cap. This knowledge may enable traders to accurately predict upcoming trends in the price index which could prove beneficial when making trading decisions. From here, we will explore how trading volume has influenced Ethereum’s pricing behavior.

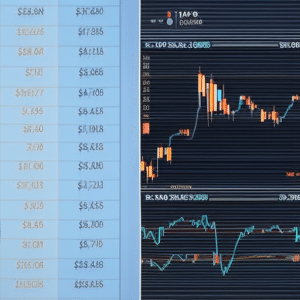

Ethereum Price Index and Trading Volume

Examining the trading volume of Ethereum is essential to understanding its price index and market capitalization. The blockchain technology behind Ethereum enables decentralized applications, which has made it one of the most popular digital assets in the world today. Its 24-hour trading volume on exchanges often surpasses that of Bitcoin’s and indicates how much Ether is being bought and sold every day. A high trading volume is usually associated with increased liquidity, which gives traders more confidence when entering and exiting positions in the market. Moreover, a higher trading volume generally leads to a more stable price index as large buy orders tend to drive up prices while large sell orders typically cause prices to drop. As such, investors should pay close attention to the daily trading volumes when evaluating whether or not to invest in Ethereum. By understanding its trading volume, they can better assess their risk exposure and make informed decisions regarding their investments. Transitioning from this subtopic, transaction fees are an important part of analyzing the Ethereum price index since they reflect demand for Ether on exchanges as well as network usage levels for users who are deploying contracts or interacting with other parts of the network.

Ethereum Price Index and Transaction Fees

Analyzing transaction fees is an essential component of understanding Ethereum’s price index and market capitalization, providing insight into the level of demand for Ether on exchanges as well as network usage. In order to understand the amount of money being put into the Ethereum blockchain through transactions, it must be analyzed in terms of both its current value and its historical trends. Transaction fees are paid to miners in order to incentivize them to include transactions in blocks they mine – these fees are an important source of income for miners, along with mining rewards generated from block verifications. As such, a higher number of transactions will lead to higher transaction fees and increased revenue for miners. Furthermore, since transaction fees are denominated in Ether, this can have a direct effect on the overall value of Ether due to increased demand. By analyzing transaction fee data over time, it is possible to gain an understanding of how changes in network utilization impact Ethereum’s price index and market capitalization. This information can also provide further insights into how blockchain technology is being used by businesses and individuals around the world.

The amount of computing power or ‘hashrate’ used by miners is another factor that affects the profitability of mining operations and therefore has implications for Ethereum’s price index. A higher hashrate indicates that more people are investing in mining resources which could result in greater demand for ether due to competition between miners. On the other hand, a lower hashrate could indicate reduced activity within the network which could reduce demand and prices accordingly. It is important then to analyze both transaction fee data as well as hashrate data when assessing Ethereum’s price index and market capitalization. As such, analyzing both datasets together can provide valuable insights into how cryptocurrency markets operate under different levels of demand and supply dynamics.

Ethereum Price Index and Network Hashrate

Investigating the interplay between Ethereum’s network hashrate and its price index provides a window into how the cryptocurrency markets respond to different levels of demand and supply. Factors such as staking rewards, code updates, miner incentives, and mining difficulty all contribute to changes in network hashrate. These factors can be observed through analyzing Ethereum’s price index over time which indicates when there are shifts in market sentiment or activity.

For example, a sudden decrease in network hashrate could be linked with a drop in Ethereum’s price index due to miners no longer being incentivized to mine. Conversely, when new code updates increase miner incentives or reduce mining difficulty, an increase in hashrate will typically accompany an increase in the ETH price index. Understanding these dynamics reveals how investor confidence is related to Ethereum’s overall health and performance on the market. Transitioning now into a discussion of ‘Ethereum Price Index and Mining Difficulty’ further highlights this relationship.

Ethereum Price Index and Mining Difficulty

Assessing the correlation between mining difficulty and Ethereum’s price index can provide insight into how the cryptocurrency markets respond to changes in demand and supply. Mining difficulty is a measure of how difficult it is for miners to find blocks, and subsequently receive rewards from them. In general, as Ethereum’s price increases, more miners join the network to take advantage of greater rewards; thus increasing mining difficulty due to increased competition. Conversely, lower prices often lead to fewer miners on the network as they are unable to generate sufficient returns in comparison with higher gas fees that come with higher prices. This can cause a decrease in mining difficulty. The relationship between Ethereum’s price index and mining difficulty provides an important indication of market sentiment regarding the cryptocurrency’s value and future prospects. By understanding this link better, investors can make more informed decisions about their investments in Ethereum or other cryptocurrencies. Moving on from this topic, analysis of Ethereum’s current block size will enable further exploration into its features and performance metrics.

Ethereum Price Index and Block Size

Comparing Ethereum’s block size with its price index can provide insight into the cryptocurrency’s performance and scalability. The Ethereum blockchain is enabled by distributed ledger technology, enabling users to create their own smart contracts and digital tokens. As a result of this technology, the maximum block size for Ethereum is determined by its network difficulty—the number of miners on the network competing to solve mathematical puzzles in order to verify transactions. This competition drives up the price of Ether as well as increases the block size, making Ethereum more resilient to attacks from malicious actors. Additionally, larger blocks are beneficial for scaling purposes as they increase throughput capacity on the blockchain and enable more transactions per second. By understanding how these two factors interact with each other, investors can gain insights into Ethereum’s long-term prospects. A higher price index may indicate improved scalability or increased demand for Ether tokens while a larger block size could suggest that the network is becoming more secure over time. Understanding these nuances in data helps investors make informed decisions regarding their investments in cryptocurrency assets such as Ether tokens. As such, comparing Ethereum’s block size with its price index provides valuable insight into its overall performance and scalability potential. Transitioning seamlessly into discussing ‘Ethereum Price Index and Block Time’, it is important to consider not just how large blocks are but also how quickly they are being processed by miners across the network.

Ethereum Price Index and Block Time

One of the most important factors that influences the Ethereum price index is block time. Block time is the average amount of time it takes for a new block to be added to the blockchain. This process, however, isn’t as straightforward as it may seem. The speed and frequency at which new blocks are added depend heavily on various factors such as network usage, transaction volume, and difficulty levels of mining activity. In addition to these variables, supply and demand also play an important role in determining block times for a given blockchain technology like Ethereum.

In order for transactions and smart contracts to be successfully executed on Ethereum’s blockchain technology, miners must generate new blocks at a certain rate. As more people use Ethereum’s network, more transactions are made resulting in increased pressure on miners to generate blocks faster than usual. This causes miners to increase their hash power leading to an increase in difficulty levels thus resulting in slower block times. Conversely if less people utilize ethereum’s network then miners will have lower difficulty levels resulting in faster block times due to reduced competition amongst them. This demonstrates how both supply and demand can influence Ethereum’s block time which ultimately affects its price index as well.

Therefore it can be understood that when analyzing Ethereum’s price index one must consider not only its internal variables such as block size but also external variables like supply-demand dynamics that affect its underlying blockchain technology’s performance metrics – with one of them being its average block time requirement.

Ethereum Price Index and Network Usage

Analyzing the dynamics of network usage is essential to understanding the Ethereum price index. This is because of how decentralization process and scalability issues affect it. The Ethereum blockchain was designed with a focus on decentralization, which means that no single entity has control over its operation. As such, its price is determined by the collective agreement of all participants in the network. Furthermore, scalability issues can arise if too many transactions are processed simultaneously, resulting in slow transaction times and higher fees due to increased demand for resources. Understanding these dynamics can help inform investors about how various factors can affect the Ethereum price index and enable them to make informed decisions when investing in Ethereum-based assets.

Frequently Asked Questions

What is the difference between Ethereum Price Index and other cryptocurrency indices?

Cryptocurrency indices differ from Ethereum price index in that they take into account blockchain security and economic incentives when calculating the value of a digital asset. These metrics provide an analytical, methodical, data-driven approach to assessing crypto market performance. For example, one interesting statistic is that the total cryptocurrency market cap reached a record high of $2.2 trillion in 2021.

How does market sentiment affect the Ethereum Price Index?

Market sentiment can significantly affect the Ethereum price index, as it can increase or decrease the risk associated with smart contracts and token velocity. Analyzing market sentiment through data-driven methods is important for understanding how these factors play a role in determining the Ethereum price index.

What is the correlation between Ethereum Price Index and trading volume?

Research has found a strong correlation between Ethereum price index and trading volume, with macroeconomic forces of supply and demand playing a significant role. For instance, increasing trading activity often leads to higher prices due to heightened demand. Conversely, lower volumes can lead to depreciation in value.

How does Ethereum Price Index compare to other cryptocurrency indices?

Investors may use different investment strategies when comparing Ethereum price index to other cryptocurrency indices, such as analyzing supply dynamics and market sentiment. Data-driven analysis can help identify trends and potential opportunities for investing.

How does network hashrate and mining difficulty affect the Ethereum Price Index?

Network hashrate and mining difficulty have a direct impact on Ethereum price index, as they influence crypto trading by affecting block rewards. High hashrates lead to increased competition for blocks, thereby reducing rewards and thus impacting the market value of Ethereum.