Ethereum is a decentralized platform that runs on smart contracts; enabling users to make transactions without the need for a third party. The Ethereum network is comprised of thousands of independent nodes, each running their own version of the blockchain. In the UK, the price of Ethereum has been steadily increasing over time as more people become aware of its potential and start investing in it. As such, understanding what affects the Ethereum price in UK and how to take advantage of these market trends is becoming increasingly important for investors. This article seeks to provide an overview of Ethereum and explore factors influencing its price in UK, historical trends, mining opportunities, trading platforms, investment strategies and security tips.

Key Takeaways

- Factors that affect the price of Ethereum in the UK include supply and demand, political and economic events, market sentiment, and regulatory changes.

- Understanding the regulatory environment and staying informed about regulatory developments is crucial for making informed investment decisions in the UK.

- Investors should be aware of the risks associated with investing in Ethereum, such as volatility, liquidity, and security issues.

- Keeping up with current news and conducting thorough research on reputable exchanges and wallets is essential for reducing potential losses from scams and frauds.

Overview of Ethereum

Ethereum is a decentralized open-source blockchain platform that enables the creation of smart contracts and distributed applications. It has become the most popular cryptocurrency since its launch in 2015, and has seen rapid growth with increasing global market capitalization. The Ethereum market in the UK is characterized by high levels of volatility due to frequent changes in prices, which require investors to be very aware of the current trends in order to maximize their returns. This volatility is largely attributed to blockchain technology, which allows for secure transactions without any third party interference or manipulation. As such, it is important for investors to keep an eye on news regarding blockchain developments as well as remain informed about the latest Ethereum price fluctuations in order to make informed decisions when trading. With this information, investors can identify various opportunities within this dynamic and ever-changing market. The next section will focus on factors influencing Ethereum price in UK.

Factors Influencing Ethereum Price in UK

The Ethereum market in the UK is impacted by a variety of factors, including supply and demand, political and economic events, market sentiment, and regulatory changes. Supply and demand are essential components of any market as they affect the availability of Ethereum tokens at various prices. Political and economic events can also have an impact on the price of Ethereum in the UK, with Brexit being a major factor to consider. Market sentiment among investors also has an effect on Ethereum price movements; positive news stories tend to increase its value while negative news stories can cause dips in its value. Lastly, regulatory changes from government agencies such as the Financial Conduct Authority (FCA) should be taken into account when considering pricing trends in the UK.

Supply and Demand

Theoretically, the price of Ethereum in the UK is determined by the balance between supply and demand. Supply dynamics and demand forecasting are essential components of accurately predicting Ethereum’s future value. By understanding both sides of the equation, investors can make well-informed decisions on when to buy or sell their holdings.

Supply and demand affect Ethereum prices in several ways:

- An increase in supply relative to existing demand may lead to a decrease in price due to oversupply, while an increase in demand relative to existing supply may lead to an increase in price due to undersupply.

- Fluctuations in global Ethereum markets such as those based on Bitcoin’s movements can also influence local prices.

- Political and economic events that cause currency devaluation or appreciation could have a direct effect on UK Ethereum prices as well.

These factors demonstrate how intricate the market for cryptocurrencies is, making it difficult for investors to accurately predict prices without studying dynamic trends across different markets.

Political and Economic Events

Political and economic events can have a direct effect on the value of cryptocurrencies, such as Ethereum, in the United Kingdom. Investment risks associated with blockchain technology are always a factor when considering investment in ethereum or other digital assets in the UK. This is because investors are looking to maximize their return while also mitigating any potential losses. The current political climate and economic events will play an important role in determining the future direction of Ethereum prices in UK markets. For example, if there is an increase in geopolitical tension or economic instability, then this could result in fewer investors being willing to invest in Ethereum due to the increased level of risk involved. On the other hand, if there is an improvement on these fronts then it could lead to increased levels of investment which would consequently drive up ethereum prices. Consequently, it is essential for investors to remain aware of any changes that may affect Ethereum prices so they can make informed decisions about their investments. Market sentiment will be the next topic discussed which will further explore how current events shape how people feel about investing in ethereum and other digital assets.

Market Sentiment

Investment decisions in digital assets can be strongly influenced by market sentiment. Market sentiment is a combination of investor emotions and the overall attitude towards the industry, which impacts how investors perceive and value different investments. Market sentiment is typically determined through analysis of various data points including news stories, stock prices, trading volumes, and other indicators that demonstrate how investors are feeling about a particular asset or sector. In the case of Ethereum in the UK, market sentiment can be tracked using sentiment analysis techniques to gauge changes in investor opinion over time. Sentiment analysis involves tracking mentions of Ethereum on social media platforms as well as assessing changes in news articles related to Ethereum. Additionally, market analysts may employ technical analysis tools such as candlestick charts to assess price movements for further insight into investor behavior and prevailing attitudes towards Ethereum in the UK. By understanding these trends over time, investors can gain valuable insights into current market conditions that could prove useful when making investment decisions related to Ethereum in the UK.

The regulatory landscape is another important factor impacting the price of Ethereum in the UK. Governments around the world have begun enacting laws that affect cryptocurrency exchanges and transactions, which can directly influence prices across markets for certain digital assets like Ethereum. Thus it is important for investors to keep track of any possible regulatory changes that could potentially affect their holdings in order to make informed decisions regarding their investments.

Regulatory Changes

Global regulatory shifts have the potential to drastically alter the landscape of digital asset trading, with implications for investors across different markets. In the case of Ethereum in the UK, regulatory changes can have a significant impact on price volatility and long-term trends:

-

Price Volatility: Regulatory uncertainty coupled with increasing investor demand can drive increased volatility in Ethereum prices as new investors enter or exit the market. Shifts in regulations may also contribute to varying degrees of volatility depending on how they are interpreted by participants.

-

Regulatory Implications: Regulations governing digital assets vary from country to country, and understanding these differences is important for investors looking to capitalize on opportunities in different markets. For example, recent regulation changes in the UK have opened up more avenues for institutional investment in Ethereum that had previously been unavailable. This shift has had positive implications for overall price stability and long-term growth prospects.

In conclusion, regulatory changes can play a key role in influencing both short-term and long-term trends related to Ethereum prices within the UK market. As such, it is important for investors to stay abreast of any developments that could affect their investments. With this knowledge, they will be better positioned to take advantage of opportunities or protect themselves against risks during times of uncertainty. By keeping track of regulatory developments, investors will be able to make informed decisions about their investments and benefit from potential gains over time as cryptocurrency markets mature and become more established worldwide. With this understanding of current regulations affecting ethereum prices within the UK market, we now move onto examining historical trends regarding ethereum prices within this region.

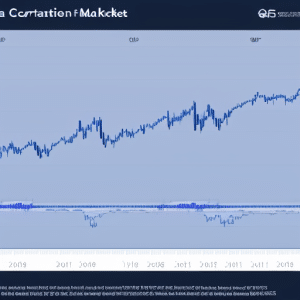

Ethereum Price in UK Historical Trends

Analyzing the Ethereum price in the UK reveals a historical trend of volatility. Through technical analysis, it is possible to identify patterns of demand and supply that suggest market trends over time. Social media can be used to infer sentiment and track investor behaviour, which can provide an insight into what factors might be affecting Ethereum’s value against the British pound. This data can then be used to understand how Ethereum’s price has changed since its introduction in 2015. Despite short-term fluctuations, Ethereum remains one of the most popular digital currencies available on exchanges around the world. Moving forward, understanding its historic performance could indicate potential points for entry or exit when trading this currency in the UK.

Ethereum Mining in the UK

Mining of the cryptocurrency Ethereum is a popular activity in the United Kingdom, with miners seeking to acquire rewards from verifying transactions and creating new blocks on the blockchain. To do so, UK-based miners will need to invest in appropriate hardware and software that is up-to-date and able to handle higher demand for processing power. Mining hardware such as ASICs (Application Specific Integrated Circuits) are designed specifically for mining cryptocurrencies like Ethereum, while mining software can be used to optimize performance of a miner’s hardware setup. As Ethereum’s value continues to rise, demand for mining operations in the UK has increased significantly. This has resulted in an increase in local businesses offering products and services related to Ethereum mining. With these resources available, miners can acquire all the necessary components they need for their own mining operations within the UK itself. Transitioning into the next section about ‘ethereum trading platforms in the uk’, it is clear that there are numerous options available for individuals looking to trade Ethereum within this region.

Ethereum Trading Platforms in the UK

The United Kingdom has several popular ethereum trading platforms, such as Coinbase, Kraken and eToro. All of these platforms offer traders excellent access to the UK’s Ethereum markets, providing users with a variety of options for buying and selling digital assets. Furthermore, each platform provides detailed analysis tools to help traders accurately monitor Ethereum price movements in the UK and make informed decisions about their investments.

Coinbase

Coinbase, a leading cryptocurrency platform in the UK, provides users with access to Ethereum prices and trading, offering an intuitive interface for those new to the digital asset space. Coinbase offers users a wealth of features such as:

- Instant buy/sell transactions

- Advanced order types

- Secure storage options

The platform also provides insights into the latest cryptocurrency trends and blockchain adoption levels in the UK market. As such, Coinbase is an essential tool for those looking to stay informed about Ethereum price movements and trade activity in the region. Through its user-friendly design and comprehensive features, Coinbase facilitates seamless navigation of current Ethereum markets in the UK. This allows users to make sound investment decisions based on accurate market data and up-to-date analysis. By providing traders with access to real-time information on pricing fluctuations, Coinbase enables investors to capitalize on potential opportunities quickly without missing out on valuable returns. With this comprehensive suite of tools at their disposal, traders can be sure that they are making wise decisions when it comes to their investments in Ethereum within the UK market. Additionally, by facilitating ease of trading through secure storage options and advanced order types, Coinbase ensures that transactions are both safe and efficient for all participants involved.

Kraken

Kraken is a cryptocurrency platform that provides users with access to Ethereum trading and market data. It offers a variety of features that are designed to help investors make informed decisions about their investments, such as detailed charts of price history, order books and advanced trading tools. Additionally, Kraken allows traders to view real-time pricing information for Ethereum in UK pounds. As such, it is an ideal platform for both experienced traders and new investors looking to gain exposure to the Ethereum market in the UK.

Kraken also provides users with guidance on trading tips and investor strategies specific to the UK market which can be used as part of an overall investment strategy. The platform’s user-friendly interface makes it easy for new investors to navigate while its range of features offer experienced traders the ability to take advantage of sophisticated trading tools. By taking into account factors such as current prices, past trends and order books, Kraken helps investors make more informed decisions when investing in Ethereum in the UK.

eToro

eToro is an online platform that provides users with access to a wide range of digital assets, offering a comprehensive suite of trading tools and features designed to help investors make informed decisions. eToro enables its users to buy and sell Ethereum in the UK with features such as:

- Trading Tools: Comprehensive charts and analysis tools for making data-driven decisions when trading Ethereum on eToro.

- Technical Analysis: Analyze price movements in order to identify trends or entry/exit points.

- Social Trading: Follow experienced traders’ portfolios, copy their trades, or discuss markets on the platform.

- Mining Hardware: eToro also sells mining hardware for those who wish to mine Ethereum themselves.

- Price Volatility: Prices can be volatile due to the limited number of Ethereum available, so keep this in mind when considering investing in Ethereum on eToro.

Given its comprehensive suite of trading tools and access to mining hardware, eToro is a popular choice amongst investors looking to trade Ethereum in the UK market. As such, understanding how price volatility may affect one’s investment decision is key when navigating this asset class via eToro; transitioning now into discussing ‘Ethereum Wallets in UK’.

Ethereum Wallets in UK

In the United Kingdom, there are several Ethereum wallets available to users that will enable them to securely store and manage their cryptocurrency investments. Popular wallet providers include Exodus, MyEtherWallet, Atomic Wallet, MetaMask, Trezor and Ledger. These wallets offer features such as crypto taxation specific to the UK government’s blockchain legislation, enhanced security measures and the ability to connect with decentralized applications (dApps). It is important for users to research various wallets before choosing one in order to ensure that it meets all of their needs. Additionally, some wallets may also have fees associated with using them or transferring funds.

It is also important for users in the UK to be aware of the taxes they may owe on any profits earned from trading Ethereum or other cryptocurrencies. The UK government has implemented regulations around cryptocurrency taxation and requires traders to report any capital gains made during a tax year. Understanding this information can help users make informed decisions about their Ethereum investments and how they should be managed. With this knowledge in hand, investors can move onto researching Ethereum exchanges in the UK which provide an efficient means of purchasing or selling Ether tokens at market prices.

Ethereum Exchanges in UK

The UK market for Ethereum has seen an influx of exchanges in recent years. Binance, Bittrex, and Bitfinex are all major players in the ethereum exchange landscape in the UK. These exchanges offer traders a variety of tools to facilitate trading activities such as margin trading and liquidity pooling, making them attractive options for those looking to maximize their profits from Ethereum investments. As such, these three exchanges are likely to remain important players in the UK ethereum exchange market in the coming years.

Binance

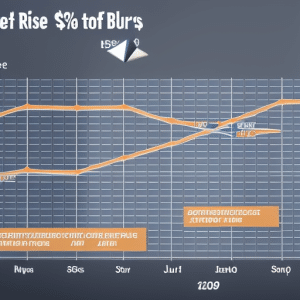

Binance, a leading crypto trading platform, has seen an increase in Ethereum prices in the UK over the past year. For instance, one London-based investor saw their holdings of Ethereum rise by 500% in six months. This surge can be attributed to various factors, including ICO investing and advancements in blockchain technology.

Investors are increasingly drawn to Binance for its ease of use and low fees compared to other exchanges. Furthermore, Binance is among the most reliable platforms as it enforces strict security protocols such as two-factor authentication and encryption technology. This encourages more investors to purchase Ethereum on Binance due to its secure environment and competitive pricing structure.

By providing a safe platform for buying Ether with fiat currencies such as Pound Sterling (GBP), Binance has become a popular choice for buying Ethereum in the UK. As such, it’s no surprise that Ethereum prices have risen significantly in this region over the past year – resulting in significant profits for those who invested early on the platform. With these advantages, it’s likely that Binance will continue to see increased demand from UK users looking to buy Ether with GBP or other fiat currencies. Thus concluding this section about ‘Bittrex’, let us move on towards exploring another exchange called ‘Bittrex’.

Bittrex

Bittrex is a leading crypto exchange offering traders an array of features and services to facilitate secure and efficient trading. It provides users with a robust network security platform, as well as tools to monitor their portfolio and track the market trends. Bittrex also has low fees compared to other exchanges in the UK, making it popular among investors who are looking for ways to maximize their profits by reducing costs. With its extensive selection of coins offered, Bittrex allows users to diversify their portfolios and hedge against price volatility. The platform also offers margin trading capabilities which further enables investors to increase their profits without having to put in more capital. All these features make Bittrex an attractive option when looking into Ethereum prices in the UK.

Bitfinex

Bitfinex is a cryptocurrency exchange that provides users with advanced trading tools and services, allowing them to navigate the volatile crypto market with ease – like a duck taking to water. This platform offers traders an array of features such as margin trading, multiple order types, price volatility alerts and more complete liquidity solutions. Bitfinex also has a variety of helpful features for Ethereum traders in the UK:

- Advanced charting tools

- Low fees

- High liquidity

- Strict security protocols

The combination of these features allows for increased control over price volatility and improved liquidity issues for Ethereum traders in the UK. As one of the largest exchanges available, Bitfinex offers users confidence when dealing with cryptocurrencies within this region. With its comprehensive offerings, it is no surprise why many view this platform as a top choice when it comes to trading Ethereum in the UK. Transitioning into the next section about ‘ethereum mining pools in uk’ will provide further insight into where miners can obtain rewards from their work on Ethereum networks in this region.

Ethereum Mining Pools in UK

Mining pools are a popular option among Ethereum miners in the United Kingdom due to their ability to increase efficiency and profitability. Mining pools allow individuals to combine their resources, such as mining hardware and cloud mining power, so that they can solve blocks more quickly than they would be able to do on their own. This increased speed of solving blocks allows miners to receive rewards for their work more often, which increases their overall profit potential. Furthermore, Ethereum mining pools enable users with relatively small amounts of computing power or capital to enter the market without being disadvantaged by larger competitors. As a result, UK-based Ethereum miners have embraced pooling as an effective way to mine cryptocurrency efficiently and effectively.

These advantages of using Ethereum mining pools in the UK make them an attractive option for those looking into entering the market; however, it is important for investors to consider all available options before making a decision about how best to proceed. As such, it is important that prospective miners research not only current prices and trends but also potential price predictions before investing in any form of cryptocurrency mining.

Ethereum Price Predictions in UK

The mining of Ethereum in the UK is a popular activity and has become increasingly sophisticated due to the decentralization impact. As a result, mining pools have been on the rise and making it easier for miners to join forces with other miners to increase their chances of success. However, predicting the price of Ethereum in the UK is not as straightforward as one may think. This is because Ethereum, like any other cryptocurrency, is highly volatile and its prices can be subject to extreme fluctuations depending on various factors such as scalability solutions or adoption trends. Therefore, analyzing these trends along with fundamental aspects such as news reports and market analysis are important for understanding how Ethereum prices will be affected over time in the UK.

Ethereum Tax in the UK

As the cryptocurrency market continues to grow, it is important to understand the taxation regulations related to Ethereum in the UK. The country has recently released a guidance document that outlines how digital currency transactions should be taxed. The document states that any profits or losses from crypto trading activities are subject to capital gains tax and income tax, depending on whether they are held for investment purposes or used for speculation. Dark markets, which are not regulated by financial authorities, can also be subject to additional taxes. Furthermore, HMRC (Her Majesty’s Revenue & Customs) has stated that crypto miners must pay VAT (Value Added Tax) on their earnings as well as any other applicable taxes such as corporation tax and national insurance contributions. It is important for investors and traders of Ethereum in the UK to be aware of these taxation requirements so they can stay compliant with local laws and regulations.

Understanding the regulations regarding Ethereum in the UK is essential for anyone involved in trading or investing activities within this market. Knowing the relevant rules will help ensure compliance with all relevant authorities while also protecting oneself from unwanted penalties or fines due to non-compliance. Therefore, it is important for investors and traders of Ethereum in the UK to become familiar with all applicable crypto taxes before conducting any transactions with digital currencies.

Ethereum Regulations in the UK

The UK has long been a leader in cryptocurrency regulation, and its stance on Ethereum is no different. In April of 2020, the Financial Conduct Authority (FCA) announced that it would begin regulating Ethereum to strengthen consumer protection and reduce instances of fraud. This move was largely welcomed by the industry as many had previously questioned the lack of clarity surrounding Ethereum’s tax implications and other regulations. As a result of this announcement, all firms dealing with cryptocurrencies must register with the FCA if they wish to be authorised or recognised by them.

In addition to this new regulation, HMRC (Her Majesty’s Revenue & Customs) released their guidance on crypto taxes in 2019 which outlined how profits acquired from Ethereum are liable for capital gains tax. Furthermore, businesses involved in issuing tokens must also comply with anti-money laundering regulations as well as data protection laws such as GDPR (General Data Protection Regulation). To summarise:

- The Financial Conduct Authority regulates Ethereum transactions for consumer protection;

- Profits acquired from Ethereum are taxable under capital gains tax;

- Anti-money laundering regulations and data protection laws must also be adhered to when dealing with cryptocurrencies like Ethereum in the UK.

By understanding these key regulations, investors can safely navigate the ever-changing landscape of cryptocurrency trading in the UK and make informed decisions about their investments before moving onto examining potential ethereum investment strategies in the UK.

Ethereum Investment Strategies in the UK

Investing in cryptocurrencies like Ethereum presents a range of opportunities for UK investors to capitalize on the potential of digital assets. With the market constantly evolving, it is important for investors to be aware of the taxation and other regulations associated with cryptocurrency investments in the UK. Investors should also be aware of any risks that may be involved when investing in Ethereum, such as volatility, liquidity and security issues. Additionally, understanding different strategies used by experienced investors can help inform decisions and maximize returns. As such, it is important to research investment strategies carefully before diving into the world of cryptocurrencies. By taking time to understand the regulatory landscape, identify risks and develop an appropriate strategy accordingly, UK investors can better equip themselves with a comprehensive approach towards their Ethereum investments. Furthermore, having an awareness of current trading tips can provide additional insight into how best to navigate this rapidly changing industry.

Ethereum Trading Tips in the UK

Considering the ever-evolving cryptocurrency market, savvy investors should familiarize themselves with some trading tips to capitalize on Ethereum investments in the UK. The following list of four key points offers a starting point for those looking to maximize their profits:

- Utilizing technical analysis can provide invaluable insights into price movements and help investors make better decisions when buying or selling Ethereum in the UK.

- Risk management is critical for any investment portfolio, and proper allocation of funds towards Ethereum is essential to ensure long-term success.

- Conducting thorough research into the reputability of exchanges and wallets before making any transactions will reduce potential losses from scams and frauds.

- Keeping up with current news related to Ethereum will provide an edge over other traders by allowing them to act quickly on new developments in the market.

By implementing these strategies, investors can improve their chances of success when trading Ethereum in the UK; however, it is important to keep in mind that no one strategy guarantees profits or protects against losses. As such, moving forward it would be prudent to investigate additional security measures when considering investing in Ethereum within the United Kingdom

Ethereum Security Tips in the UK

Given the volatility of the cryptocurrency market, it is essential for investors to employ effective security measures when trading Ethereum in the UK. Crypto scams are becoming increasingly prevalent as fraudsters capitalize on naive investors who don’t understand how to protect their digital assets. Blockchain fraud is another area of concern, with hackers using malicious software to steal funds from vulnerable users. To ensure that investors remain secure while trading Ethereum in the UK, it is important for them to take certain precautions such as only investing through reputable exchanges and utilizing two-factor authentication for extra protection. Additionally, never sharing private information or wallet keys with anyone should be strictly avoided. With these measures in place, traders can rest assured knowing their funds are safe and secure. As a result, they can focus their attention on researching ethereum resources in the UK that can help maximize returns from their investments.

Ethereum Resources in the UK

With the cryptocurrency market ever-changing, it can be difficult to stay abreast of the best ethereum resources in the UK without a dedicated guide. Fortunately, there are a number of reputable sources that provide up-to-date information about the latest cryptocurrency regulations and blockchain technology in the UK. The Financial Conduct Authority (FCA) is an independent body responsible for regulating financial services in the UK and provides guidance on how to invest safely and securely with digital assets such as ethereum. Additionally, the British Blockchain Association is another great resource for those looking to understand more about blockchain technology as well as its implications for the future of business operations in Britain. Finally, EthereumUK is an online forum focused on providing information about ethereum markets and news related to developments in this sector within the United Kingdom. All these resources offer valuable insights into current trends and developments taking place in this rapidly changing industry.

Frequently Asked Questions

What is the difference between Ethereum and Bitcoin?

Ethereum and Bitcoin are both decentralized digital currencies. The main difference is that Ethereum offers smart contracts and decentralized applications, while Bitcoin does not. In the UK, Ethereum has seen a steady increase in price since its introduction to the market.

How do I buy Ethereum in the UK?

In order to purchase Ethereum in the UK, one must first open an account with a UK-based exchange. After this, users will need to use their wallets to transfer funds from their bank accounts into their exchange account before being able to buy Ethereum. It is important to research the various exchanges available in the UK and choose one that best suits your needs.

What is Ethereum mining and how does it work?

Ethereum mining is a process of verifying transactions on the Ethereum blockchain, used to secure the network and reward miners. Mining rigs are specialized hardware that use proof-of-work algorithms to generate blocks. These rigs perform complex calculations in order to receive block rewards in Ether. This system is integral for ensuring trust and stability within the Ethereum ecosystem.

What is the safest way to store Ethereum?

Analyzing the security measures associated with storing Ethereum, popular wallets are widely considered to be the safest way. Various factors including market knowledge of Ethereum in the UK should be taken into account when making decisions.

How can I use Ethereum for payments?

Ethereum can be used for payments through cryptocurrency exchanges and smart contracts. These provide a secure, decentralized platform to facilitate transactions between two parties with minimal fees and without the need for an intermediary. Understanding the ethereum market in the UK is essential to ensure successful utilization of this digital currency for payments.