Ethereum is a decentralized, open-source blockchain platform that enables users to create and deploy smart contracts and distributed applications, as well as store and transfer digital assets securely. Its native token, Ether (ETH), is the second largest cryptocurrency by market capitalization after Bitcoin. As Ethereum becomes more widely adopted across various industries, its price has seen rapid growth over the past few years. This article will analyze the historical price movement of Ethereum, discuss factors influencing its price fluctuations, examine Ethereum forecasting models used by experts in predicting ETH prices, and evaluate strategies for minimizing risk when investing in ETH.

Key Takeaways

- Ethereum is a decentralized blockchain platform that allows users to create and deploy smart contracts and distributed applications.

- Ethereum’s native token, Ether (ETH), is the second largest cryptocurrency by market capitalization.

- The price of Ethereum has experienced rapid growth over the past few years but is also known for its volatility.

- Factors such as market speculation, technological advancements, regulatory changes, and macroeconomic factors influence the price fluctuations of Ethereum.

Overview of Ethereum and Cryptocurrency

Cryptocurrency, such as Ethereum, has revolutionized the way money is viewed and used in our society, ironically presenting both opportunities and challenges. Ethereum was created in 2015 by Vitalik Buterin who wanted to build a decentralized platform based on blockchain technology that could support smart contracts and facilitate cryptocurrency transactions. Crypto mining is essential for Ethereum’s network security as it helps create new blocks on the blockchain while verifying transactions within the network. This ensures that all of the data stored on the blockchain remains secure and unaltered. Blockchain security also plays an important role in protecting users’ digital assets from malicious attack or theft. With these two components working together, Ethereum offers a highly secure environment for its users to conduct cryptocurrency transactions without compromising their funds or privacy. Transitioning into the next section, this paper will analyze historical price movement of ethereum to gain insight into how this digital asset may behave in the future.

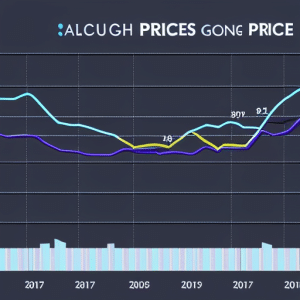

Historical Price Movement of Ethereum

Examining the past performance of cryptocurrency provides insight into possible future trends. Ethereum, in particular, has been quite volatile since it was first created in 2015. This price volatility is caused by a variety of factors including market speculation and global trade events:

- It experienced huge spikes with the arrival of new technology advancements such as smart contracts, decentralized finance (DeFi) projects and Initial Coin Offerings (ICOs).

- Similarly, when there were major regulatory changes or trade sanctions placed on some countries, Ethereum’s price often reacted strongly to these events.

- In addition, large-scale market speculation can cause wild fluctuations in the price of Ethereum.

- Finally, general macroeconomic factors like consumer spending habits and inflation also have an effect on the value of Ethereum over time.

These varying influences have resulted in a turbulent history for Ethereum’s prices over its short life span so far. As a result, understanding how these forces interact to affect ether’s pricing can be key to forecasting its future trend.

Analysis of Factors Influencing Ethereum’s Price

Comprehensive examination of the various influences impacting the value of a cryptocurrency can help provide insight into possible future trends. Ethereum, in particular, has seen its price fluctuate drastically over time due to its unique characteristics and technology; these factors include the use of smart contracts and blockchain technology. Smart contract applications allow users to exchange money, property, shares, or anything else of value in a transparent and conflict-free manner while avoiding third party intermediary services such as banks or brokers. Additionally, Ethereum’s blockchain technology allows developers to build decentralized applications that are free from censorship and manipulation by governments or corporations. These two features make it an attractive option for investors as well as potential users who wish to benefit from its advanced capabilities. As such, analysis of these factors is essential for understanding any future price movements of Ethereum. Transitioning into the subsequent section about ‘ethereum price forecasting models’, it is important to consider all influencing factors before attempting to make predictions about its future trajectory.

Ethereum Price Forecasting Models

In order to effectively predict the future of a cryptocurrency, various forecasting models can be employed to analyze its influencing factors. Technical indicators and fundamental analysis are two popular methods that help in predicting the price of Ethereum. Technical indicators provide insights into short-term trends by analyzing trading volume or data points related to the asset’s past performance. Fundamental analysis takes a more holistic approach as it looks at the economic conditions that could affect Ethereum’s price, such as regulations or sentiment from market participants. Both approaches have their advantages and disadvantages but they both contribute to providing an understanding of how Ethereum might behave in the near future. By combining these models with expert predictions for Ethereum’s price, investors can make better decisions when trading this digital currency.

Expert Predictions for Ethereum Price

Given the uncertainty of the cryptocurrency market, expert predictions can provide valuable insight into potential Ethereum prices. Despite any perceived limitations, such forecasts are based on a combination of technical and fundamental analysis that can be used to inform decisions about trading this digital asset. Investor sentiment is taken into account to assess how well-received new announcements and updates are likely to be with traders. In addition, data from various exchanges are utilized to determine the most popular trading strategies among investors in order to gain an understanding of market behavior. Ultimately, these analyses help experts form educated opinions on where Ethereum prices could head in the future. Moving beyond technical and fundamental analysis, it is also important to consider the risk associated with investing in Ethereum as a part of any comprehensive price forecasting strategy.

Risk of Investing in Ethereum

The potential of cryptocurrencies such as Ethereum can be alluring for investors. However, it is important to consider the risks associated with investing in cryptocurrency. Cryptocurrencies are not immune to market volatility and may experience sudden fluctuations in value over short periods. Furthermore, cryptocurrencies are decentralized, meaning that there is no central authority or financial institution governing their transactions or protecting against fraud; this exposes investors to an elevated risk of theft and losses due to hacking. As such, it is vital for investors to understand these risks associated with investing in Ethereum and apply strategies which minimize them.

Strategies to Minimize Risk

Investing in cryptocurrency can be risky, yet certain strategies can help reduce the potential of losses. One such strategy is to hedge against volatility by using derivatives like futures and options contracts. These financial instruments allow investors to lock in a future price for their investments, thus mitigating some of the risk associated with market fluctuations. Additionally, trading techniques such as stop loss orders provide investors with a way to limit their losses if prices dip too low. Stop loss orders work by automatically selling an asset when it reaches a predetermined price level and are useful tools for managing risks in volatile markets like those associated with cryptocurrency investing. Finally, diversification is another key strategy for reducing risk; spreading investments across different types of cryptocurrencies or assets can help protect against sudden drops in value due to unforeseen events or factors affecting an individual asset’s performance. By following these strategies, it is possible to mitigate much of the risk associated with investing in Ethereum and other cryptocurrencies.

Frequently Asked Questions

What is the minimum amount of money required to invest in Ethereum?

The risk of investing in Ethereum requires careful market analysis and prudent risk management. Determining the minimum amount to invest depends on individual goals, financial capabilities, and investment strategy. Objective decisions should be informed by thorough research and analysis to ensure successful outcomes.

Are there any government regulations related to Ethereum?

Government regulations related to Ethereum may include buying restrictions and margin trading limitations. Such policies are intended to protect investors, as well as ensure the integrity of the market.

How secure is Ethereum compared to other cryptocurrencies?

Ethereum’s smart contracts and blockchain security are formidable compared to other cryptocurrencies; its distributed ledger technology is designed to be tamper-proof. This ensures a layer of protection against data manipulation and unauthorized access, making it a secure choice for investors.

Are there any taxes associated with trading Ethereum?

When trading Ethereum, taxes may be applicable depending on the specific transaction. For example, income tax may need to be paid when executing smart contracts or through Initial Coin Offerings (ICOs). Taxation also depends on the jurisdiction of the investor.

Is it possible to make money from Ethereum mining?

Yes, it is possible to make money from Ethereum mining by using suitable mining hardware and joining a mining pool. Profits can be achieved through block rewards and transaction fees. However, profitability depends on several factors such as electricity costs, network difficulty, and the efficiency of hardware.