Ethereum is a blockchain-based distributed computing platform and operating system featuring smart contract functionality. It enables developers to build and deploy decentralized applications. Ethereum is the second most popular cryptocurrency after Bitcoin, both in terms of market capitalization and trading volume. In the United Kingdom, Ethereum has become increasingly popular among investors, traders, and miners as a means of payment or investment opportunity. This article will discuss Ethereum price comparison in the UK, including local exchanges, online exchanges, cloud mining services, popular wallets for storing Ethereum tokens securely, and provides advice on how to find the best prices and make secure purchases.

Key Takeaways

- When comparing Ethereum providers in the UK, it is important to consider factors such as fees, liquidity, trustworthiness, and security concerns.

- Researching the reputation and customer service ratings of providers is crucial to ensure a reliable and trustworthy platform for buying Ethereum.

- Additional fees, such as transaction fees and withdrawal limits, should be taken into account when purchasing Ethereum from a provider.

- It is important to select a secure platform for Ethereum transactions to protect against potential security breaches and ensure the safety of your investments.

Overview of Ethereum

Ethereum, the revolutionary blockchain technology, has been hailed as a revolutionary innovation of the 21st century, likened to the ‘Internet of money.’ Ethereum is an open-source distributed blockchain network that enables users to build and deploy decentralized applications. It uses its own cryptocurrency called ether which is used to facilitate payments on its platform. The blockchain technology employed by Ethereum allows for secure transactions and data storage due to its decentralized nature, meaning no single entity controls it. This makes it attractive for those seeking a reliable alternative to centralized systems. Moreover, Ethereum’s smart contracts allow developers and users to create automated agreements between different parties with a much lower transaction cost than traditional methods. Additionally, Ethereum supports numerous cryptocurrency trends such as Initial Coin Offerings (ICOs) and Decentralized Autonomous Organizations (DAOs). These features have made Ethereum one of the most popular cryptocurrencies in the world today with daily trading volumes reaching billions of dollars every day. With these features in mind, it becomes apparent why many investors are looking towards this innovative technology when considering cryptocurrency investments in the UK market.

Ethereum Price in the UK

Cryptocurrency values in the United Kingdom have recently seen fluctuations, with Ethereum being no exception. Ethereum’s value has been affected by factors such as economic uncertainty and rising inflation. As a result, it is important to understand the current market state of Ethereum before making any buying decisions. Here are some tips to consider when investing in Etherium in UK:

- Monitor the news for changes in the economy that could affect cryptocurrency prices

- Research different exchanges available in UK to find out which offer competitive prices

- Take into account security risks associated with storing cryptocurrency online

- Consider using a hardware wallet for secure storage of your funds

These buying tips should provide guidance on how to make informed decisions about investing in Ethereum in the UK. Additionally, understanding potential security risks associated with online storage should help protect your investments from malicious actors. With these considerations made, investors can better assess their options and make decisions based on their financial goals.

Ethereum Price Comparison Sites

Comparing Ethereum prices across various websites can be a useful exercise in determining which one offers the best features and prices. Different sites offer different features, such as price alerts, currency conversion calculators, and live charts with technical indicators. It is important to consider the pros and cons of each site before making any decisions about where to buy or sell Ethereum. By weighing up the advantages and disadvantages of each site, buyers or sellers can make an informed decision on which platform suits their needs best.

Comparison of features

A detailed evaluation of the features available between UK-based Ethereum purchases reveals a variety of distinctions worth noting. The primary factors to consider include:

- The degree of price fluctuations that each site offers;

- The security measures implemented on each platform;

- The fees associated with making a purchase; and

- The ease of use for the user interface.

Each of these areas can have a significant impact on the ultimate cost of the Ethereum purchased, thus requiring careful consideration before selecting one platform over another. In order to make an informed decision, it is important to understand both the pros and cons of each site prior to making a purchase.

Pros and cons of each site

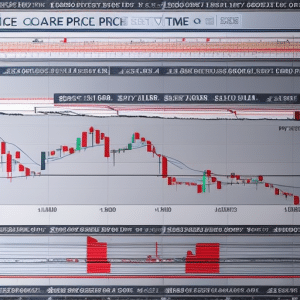

When assessing various platforms for purchasing cryptocurrency, it is important to consider the advantages and disadvantages associated with each option. Peer-to-peer trading sites such as eBay UK can offer a higher degree of convenience, making it easier to purchase Ethereum quickly. However, they tend to be more expensive than other exchanges due to fees associated with transactions. Furthermore, price volatility on these sites can be high due to the presence of individual sellers who may not always have accurate pricing information. As a result, buyers must ensure that any purchases are made at fair market value or risk overpaying for Ethereum. On the other hand, local exchanges often run into liquidity issues and have limited payment options which can make it difficult for buyers to complete their purchases. They also tend to provide less customer support than dedicated crypto exchange sites which could lead to delays in resolving disputes that may arise during a transaction. Nevertheless, local exchanges may offer better prices than peer-to-peer trading sites due to lower overhead costs and competition among sellers. Moving forward, an analysis of both types of platforms should be undertaken in order to determine which offers the best value in terms of cost and convenience when buying Ethereum in the UK.

Local Exchanges

UK-based exchanges offer a range of Ethereum prices, with the average price of 0.0678 BTC per ETH being significantly lower than the global average of 0.0725 BTC per ETH. This difference can be attributed to UK taxes and exchange fees, which vary depending on the specific exchange that is chosen. For those who are looking for the best available rate, local exchanges may provide an advantage as they are generally more reliable and have fewer restrictions when it comes to trading volumes. Furthermore, these exchanges also tend to have lower transaction fees as compared to their online counterparts. As such, local exchanges may be an attractive option for those looking to purchase Ether in the UK at a competitive rate. However, it is important to remember that local exchanges can still charge higher rates than other methods such as peer-to-peer trading or over-the-counter transactions and should always be taken into consideration when making a decision about where to purchase Ether from in the UK. With this in mind, online exchanges may provide a better alternative due to their increased liquidity and access to global markets which could ultimately lead to more favourable prices for buyers.

Online Exchanges

Online exchanges provide a viable option for those looking to compare ethereum prices in the UK. A comparison of features such as fees and trading limits, as well as pros and cons of each exchange should be considered before making any decisions. Different exchanges will offer varying levels of security and user-friendliness, so it is important to research the specific details of each one before committing funds.

Comparison of features

Comparing Ethereum prices in the UK requires an understanding of the various features associated with each exchange. Benefits and risks associated with each exchange must be taken into account when choosing the most suitable platform for trading Ethereum. The comparison of features between exchanges includes aspects such as ease of use, security, fees, deposit and withdrawal restrictions, customer service, availability of trade options and currency pairs offered.

It is important to consider both the pros and cons of each exchange before making a decision on which platform to use for trading Ethereum. Knowing the advantages and disadvantages associated with each option allow traders to make informed decisions that help them reduce their risk exposure while taking advantage of any potential gains from their investment activities.

Pros and cons of each exchange

Building on the previous discussion of comparison of features, this section will analyze the pros and cons of each Ethereum exchange. Trading fees are one important factor to consider when evaluating exchanges. Different exchanges charge different amounts for buying and selling Ethereum, so it is important to research these fees before making a decision. Exchange fees also vary depending on how users choose to pay for their transactions – some exchanges offer discounts or other incentives if users opt for certain payment methods.

Another factor to consider when comparing exchanges is the level of security they offer. Some exchanges have strong security measures in place while others may be more vulnerable to hacking attempts or other malicious activity. It is therefore important to research an exchange’s past history and reputation before depositing any funds into it. With the right combination of trading fees, exchange fees, and security measures, it should be possible to find an Ethereum exchange that meets all your needs. Having considered both features and pros/cons, we can now move onto discussing brokers which provide access to Ethereum markets.

Brokers

Investigating the various brokers offering Ethereum in the United Kingdom can provide investors with insight into how to acquire this asset. Analyzing broker services helps traders better understand blockchain technology and hash rate, two key components associated with cryptocurrency trades. By comparing different brokers, traders can get an idea of fees, security measures, and other factors that will impact their success. Brokers may vary in terms of minimum deposits, trading platforms, payment methods accepted, and customer service availability. It is important for traders to research potential brokers before making a decision as it could have a direct effect on trading performance. Additionally, understanding the technical aspects of Ethereum transactions is essential to ensure successful trades. Transitioning from broker-based purchases to direct purchases requires an understanding of the underlying technology involved including consensus algorithms and smart contracts.

Direct Purchases

Direct purchases of Ethereum involve buying the cryptocurrency directly with a fiat currency such as USD or EUR. This method for purchasing Ethereum is often more convenient and potentially less expensive than going through a broker. Such purchases require an in-depth comparison of features, however, as different platforms offer different security measures, payment options, user interfaces, fees and other features. Pros and cons of direct purchases must be weighed to determine which platform or service best meets an individual’s needs and preferences.

Comparison of features

Analyzing the features of Ethereum in the UK reveals a variety of advantages and disadvantages. Price volatility is one factor to consider when transacting with this cryptocurrency; as Ethereum’s value can fluctuate rapidly, users must be aware that their transactions could be worth more or less than expected. Security concerns are also present with Ethereum; while the blockchain offers a secure layer of encryption, there have been reports of hackers exploiting user accounts for large amounts of money. It is therefore important to ensure that all personal data is stored securely and passwords are kept private. As such, it can be seen that there are both positive and negative aspects to using Ethereum in the UK. Transitioning to the next section, a further analysis will examine the pros and cons of direct purchases with this cryptocurrency.

Pros and cons of direct purchases

Examining the implications of making direct purchases with cryptocurrency, it is evident that there are both advantages and disadvantages to consider. The primary advantage of making direct purchases in Ethereum is the convenience and relative safety it offers. Direct purchases can be made without involving third-party exchanges, allowing users to keep their personal information safe from potential security breaches. Furthermore, because Ethereum transactions are typically processed much faster than traditional bank transfers or credit card payments, users may benefit from more expedient completion times for their transactions.

However, there are also considerable drawbacks associated with making direct purchases in Ethereum due to its decentralized nature. Cryptocurrency can be highly volatile and has no government or central bank backing it up; this can mean that buyers may experience large fluctuations in the value of their currency over time. Additionally, some countries have begun to restrict or prohibit direct purchases in cryptocurrencies due to security concerns; this could make it difficult for purchasers in such countries to access Ethereum markets and purchase directly without encountering legal issues. As such, careful consideration must be taken before entering into any cryptocurrency transaction as a buyer. Moving forward, another important factor which should be considered when looking at buying Ethereum is access through cryptocurrency ATMs.

Cryptocurrency ATMs

Cryptocurrency ATMs are becoming increasingly popular in the UK, offering customers an automated way to purchase Ethereum and other digital currencies. These machines provide a convenient option for those who prefer not to go through the more rigorous process of setting up an online wallet or trading account. UK regulations for cryptocurrency transactions require users to provide identification before they can make a purchase from an ATM. This is because the machines must adhere to existing anti-money laundering laws, which means that payment methods such as debit cards are limited and only certain types of currencies can be used. Additionally, there may be additional fees associated with using these ATMs such as processing fees which vary depending on the machine being used. However, despite these extra costs, cryptocurrency ATMs offer a fast and secure way for individuals to buy Ethereum without having to worry about meeting any complicated KYC requirements or dealing with lengthy registration processes. The transition into trading platforms provides another avenue where investors can find alternative ways to acquire cryptocurrencies like Ethereum and take advantage of advantages such as low-cost transaction fees and greater liquidity compared to direct purchases from ATMs.

Trading Platforms

Trading platforms provide prospective investors with plentiful possibilities to purchase digital currencies such as Ethereum. Many of the major trading platforms offer peer-to-peer transactions, providing buyers and sellers from different countries to exchange their local currency for Ethereum. These exchanges are relatively safe, although there is a risk of fraud or price volatility associated with them. Furthermore, some platforms enable users to trade directly between two cryptocurrencies without using fiat money as an intermediary. This could be used to obtain Ethereum at a lower cost than what is offered on traditional exchanges and may prove useful for UK investors seeking the best prices available. Price volatility should also be taken into account when deciding whether or not to use these trading platforms since the value of Ethereum can fluctuate rapidly depending on market conditions.

Mining Ethereum

Mining Ethereum is a process that involves using specialized computer hardware to generate new blocks on the blockchain, thereby earning rewards in the form of Ether. It is an important part of maintaining the integrity and security of the Ethereum network. In this discussion, we will compare features, analyze pros and cons, and provide an overview of mining Ethereum. We will examine how different hardware components can affect profitability, as well as other factors such as energy consumption and setup costs. Furthermore, we will consider how current market conditions may influence decision-making when considering whether or not to mine Ethereum.

Comparison of features

Comparing the features of various Ethereum providers in the UK can provide an informed decision on which platform best meets individual needs. When considering buying from a provider, potential buyers should consider factors such as fees, liquidity, trustworthiness, and security concerns. Buyers should also research each provider’s reputation and customer service ratings before making a purchase to ensure they receive the best possible service. Additionally, it is important to be aware of any additional fees associated with making an Ethereum purchase, such as transaction fees or withdrawal limits. As many platforms offer different levels of security for their users, buyers should take the time to select the most secure option available. By researching all of these factors before committing to any particular provider, buyers can make sure that they are getting the best deal possible while minimizing their risk.

Furthermore, it is also beneficial for buyers to look into alternative options for purchasing Ethereum in order to find more competitive prices or better terms than offered by traditional providers. In this way, buyers can minimize their costs and maximize returns when investing in Ethereum. Ultimately, taking into account all these considerations can help buyers make an informed decision about which Ethereum provider will best suit their needs and budget.

Pros and cons of mining Ethereum

Exploring the process of mining Ethereum can provide a comprehensive understanding of the associated benefits and drawbacks. Crypto miners benefit from increased security as transactions are recorded on an immutable ledger, providing transparency for all users and verifying that the data entered into the blockchain is accurate. Mining rewards are also given to miners who successfully complete computational tasks, which incentivizes them to continue with their work. On the other hand, mining Ethereum requires significant computing power and resources. It can be costly to buy or build specialized hardware specifically designed for cryptocurrency mining, and it also takes up time as miners must continuously monitor their equipment to ensure optimal performance. As such, there are both advantages and disadvantages when considering Ethereum mining. In conclusion, these aspects must be carefully weighed against one another in order to make an informed decision about whether or not it is worth undertaking this endeavor. The next section will discuss cloud mining services as an alternative approach for those interested in pursuing cryptocurrency activities without having to manage their own hardware setup.

Cloud Mining Services

Evaluating the various cloud mining services available for Ethereum in the UK provides an opportunity to optimize potential profits from cryptocurrency investments. Cloud mining services offer a variety of features and fees that must be taken into consideration when deciding on which service to use. These include:

- Cloud mining fees – This is often a monthly fee associated with using cloud based services. It should be noted that some cloud miners charge higher rates than others, so it is important to compare these costs across different providers before selecting one.

- Mining contracts – Some cloud miners offer long-term contracts that guarantee specific hash powers and other conditions over a period of time. It may be beneficial to select such contracts if the user wishes to ensure consistent output from their Ethereum investment.

- Security – Security measures are paramount when dealing with cryptocurrencies, so it is important to make sure any chosen cloud miner provides adequate encryption measures and other security protocols.

- Customer support – Many of the best providers offer customer support, which can help users troubleshoot any issues they encounter while using their service.

- Flexibility – Not all miners are created equal, so it may be beneficial to look for one that offers more flexible options such as custom plans or custom hardware configurations for larger scale operations.

As such, users should weigh up carefully each of these factors when evaluating which service would provide them with the greatest return on investment in terms of Ethereum price comparison in UK markets. By doing this research thoroughly, investors can maximize their profits and protect themselves against potential losses from fluctuating prices or changes in market conditions. Ultimately, choosing the right cloud mining service for Ethereum investments can go a long way toward ensuring successful returns in UK markets over time.

Popular Ethereum Wallets

Cryptocurrency investors require secure storage solutions for their Ethereum investments, making popular Ethereum wallets a must-have item. While there are many options available, the most important selection criteria to consider when choosing an Ethereum wallet is its security features and exchange fees. Wallets that offer two-factor authentication, biometric identification, multi-signature control, and backup encryption provide users with peace of mind that their funds are safe from malicious actors. Additionally, comparing exchange fees between wallets can help investors find the best price for transactions while minimizing unnecessary costs. Furthermore, it is important to select a wallet that provides access to all cryptocurrency exchanges in case you wish to compare prices across different platforms. By researching these features thoroughly and selecting a wallet appropriately tailored to each individual’s needs, investors can protect their assets and maximize profits through accurate pricing comparisons.

How to Find the Best Price

Finding the best value for cryptocurrency investments requires thorough evaluation of exchange fees and security features available. Buyers should carefully compare different exchanges to find the one that offers the most favorable price, as well as lowest transaction fees and most secure transactions. It is important to evaluate the safety, reliability, customer service, and policies associated with each exchange before purchasing Ethereum or any other digital currency. The buyer’s guide should include comparisons of exchange rates, liquidity levels, payment methods accepted, and fee structures in order to select an exchange with the best overall value. Additionally, buyers should review customer reviews and ratings for each exchange to ensure they are getting a reliable service provider when making a purchase. By taking these steps prior to investing in Ethereum or any other cryptocurrency, buyers can make sure they get the best possible price while ensuring their funds remain secure. This will set them up for success when it comes time to make a secure purchase.

How to Make a Secure Purchase

To protect investors from potential losses, it is critical to make a secure cryptocurrency purchase. When purchasing Ethereum in the UK, there are several steps that should be taken to ensure the purchase process is as secure as possible. First, buyers should always use a secure payment method such as a credit card or bank transfer. This will help prevent any unauthorized transactions and ensure personal information is protected. Additionally, buyers should research the seller before making any purchases. It is important to read reviews and confirm that the seller has a good reputation for providing quality service and products. Finally, buyers should take measures to protect their privacy during the purchase process by using an encrypted connection and avoiding sharing personal information with anyone else involved in the transaction. By following these steps, investors can be confident they are making a safe and secure Ethereum purchase in the UK at an excellent price.

Frequently Asked Questions

What is the current price of Ethereum?

Alluding to a complex web of interactions, the current price of Ethereum fluctuates in an ever-evolving token economy. Smart contracts are integral to this dynamic, driving values which depend on data-driven analysis and analytical detail.

Is Ethereum safe to invest in?

Ethereum miners and token security are key factors in determining the safety of investing in Ethereum. Detailed analysis of these components, as well as data-driven research, should be undertaken before making any decisions to invest.

How can I store my Ethereum securely?

"A stitch in time saves nine":investing in Ethereum requires careful planning, including secure storage options. Wallet solutions such as hardware wallets, paper wallets and software wallets provide safe buying strategies for storing Ethereum. Selecting a wallet should be based on data-driven analysis of features like security, convenience and cost.

What is the difference between Ethereum and Bitcoin?

Ethereum and Bitcoin are both decentralized digital currencies, however Ethereum provides the additional capability of executing automated, self-enforcing smart contracts and decentralized applications. This provides it with a wider range of potential applications than Bitcoin.

What is the potential for Ethereum’s future value?

The potential for Ethereum’s future value is unpredictable, with price trends and investment risks both playing a role in its success. Analyzing data-driven insights can provide clues to the cryptocurrency’s long-term prospects, but ultimately it remains a volatile asset that demands caution when investing.