Ethereum is an open-source, decentralized blockchain-based platform that enables smart contract functionality and the development of distributed applications. It serves as a global platform for developers to deploy their own applications and to create their own digital tokens. Since its launch in 2015, Ethereum has become one of the most widely traded digital assets in the world. This article aims to analyze Ethereum’s price performance over time, exploring factors influencing its price movements as well as providing an outlook on its future prospects. In addition, this article will provide practical advice on investing in Ethereum and best practices for investors.

Key Takeaways

- Ethereum’s price is influenced by factors such as investor confidence, mainstream adoption, scalability issues, regulatory uncertainty, and legal frameworks.

- Analysis of mining rewards and trading strategies can provide insights into Ethereum’s price movements.

- Ethereum provides a secure environment for transactions and executing complex contracts without intermediaries.

- Stablecoins have an impact on Ethereum’s success in the cryptocurrency market.

Overview of Ethereum

Ethereum is an open-source, public blockchain-based distributed computing platform featuring smart contract functionality. It was created as a tool for developers to create and deploy decentralized applications (DApps) on the Ethereum network. Ethereum’s popularity has grown amongst developers, businesses, and investors due to its use of technology and its ability to capture market share in the cryptocurrency space. Its impact has been felt across various industries from finance to healthcare, with many companies investing in the technology for their use cases. Ethereum provides a secure environment wherein users can easily transact with each other and execute complex contracts without relying on third parties or intermediaries. This makes it ideal for use cases such as decentralized finance (DeFi). With its potential to revolutionize existing markets and create new ones, Ethereum is well positioned to remain one of the leading players in the crypto space going forward. As such, understanding how its price has performed historically is essential in analyzing whether it is worth investing in at this point in time.

Historical Price Performance

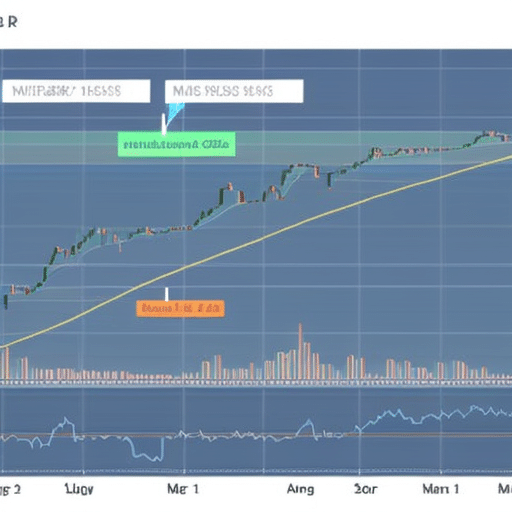

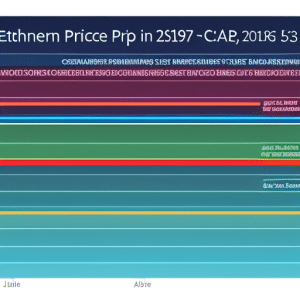

Investigation of the past performance of cryptocurrency reveals a fascinating trajectory. Ethereum, first released in 2015, is no exception. It has experienced tremendous growth and volatility over its life cycle. Technical analysis can be used to decipher some of Ethereum’s historic price movements, with scalability issues being key drivers of volatile swings.

Ethereum’s market capitalization also played an important role in its price movements; as it grew, so did pricing beyond all-time highs. Other factors such as investor confidence and mainstream adoption also had a major impact on Ethereum’s historic prices. Moving forward, these same factors will continue to shape the future price of Ethereum and must be taken into account when considering investment opportunities.

Factors Impacting Ethereum’s Price

The value of cryptocurrency is impacted by a variety of factors such as investor confidence, mainstream adoption and scalability issues. Network effects play an important role in the success of any cryptocurrency, as the more users come on board, the greater the utility that can be derived from it. Ethereum has been no exception to this rule; its growth has been tied to the rapid expansion of its user base. However, network effects alone may not be enough for cryptocurrencies to gain widespread acceptance – regulatory hurdles need to be addressed as well. Regulatory uncertainty has caused a degree of caution among investors and institutions when it comes to entering into the crypto space, resulting in volatility for Ethereum’s price movements. Moving forward, clarity on legal frameworks will likely prove critical for Ethereum’s long-term success and could significantly contribute towards stabilizing market prices.

In order to fully understand Ethereum’s price movements, it is important to analyze various aspects which are influencing its performance. Thus far we have discussed how factors like network effects and regulatory hurdles have influenced Ethereum’s pricing dynamics; analyzing them in depth will provide further insight into price trends over time.

Analyzing Ethereum’s Price Movements

By exploring the various factors influencing Ethereum’s performance, it is possible to gain a more comprehensive understanding of its price movements. Ethereum’s mining rewards and trading strategies are two major elements that play a role in the development of the cryptocurrency’s value. The amount of Ether mined per block is fixed, so when demand increases for the currency, miners are incentivized to increase their efforts and reward payments become higher. Trading strategies also contribute to Ethereum’s price as investors attempt to capitalize on market trends or speculation by buying or selling large amounts of coins in a short period of time. This can cause drastic changes in both prices and volumes traded. As such, analysis of these two factors provides insight into Ethereum’s past and current price movements. In conclusion, this analysis gives us an idea about how future events may have an impact on the cryptocurrency’s trajectory going forward into the future.

Ethereum’s Future Outlook

Evaluating Ethereum’s future prospects involves considering the potential drivers of its growth and evaluating how these may interact with other cryptocurrency markets. As the world’s second-largest cryptocurrency, Ethereum has seen remarkable growth since its inception in 2015, driven by increasing mainstream acceptance and adoption. Its underlying blockchain technology is highly versatile and enables developers to create decentralized applications (DApps) and smart contracts on top of it without relying on a third party. This makes it an attractive investment for many investors who believe that this technology could revolutionize the way we live our lives. Additionally, Ethereum’s price movements are often used as a barometer of industry sentiment towards cryptocurrencies as a whole, due to its market cap representing roughly 13% of all cryptos in circulation. Consequently, any movement in either direction could potentially have significant implications across the crypto space. However, despite Ethereum’s potential upside, there are still some risks and challenges that need to be taken into account when assessing its future outlook. To ensure a successful future for Ethereum requires careful consideration of these issues as well as continued monitoring of global trends in both technology and finance.

Potential Risks and Challenges

Considering Ethereum’s future prospects involves assessing the potential risks and challenges that could impede its growth. One major risk is regulatory oversight, as governments across the world are increasingly scrutinizing digital assets and blockchain technology. The uncertain legal status of cryptocurrencies has created an environment of uncertainty, which could pose a long-term challenge for Ethereum’s adoption and growth. Another major risk is scalability issues, as Ethereum has not yet been able to scale up to handle large transactions on its network without incurring high fees or significant delays. This can become a problem if demand for the platform continues to grow in the near future. Finally, there is also potential competition from other blockchain protocols, such as EOS or Tron, that offer faster transaction speeds and lower fees than Ethereum does currently. As such, these risks and challenges must be taken into account when considering Ethereum’s future outlook. To further explore this issue, it is important to look at the impact of stablecoins on Ethereum’s success in the cryptocurrency market.

The Impact of Stablecoins

The potential risks and challenges associated with Ethereum are significant, as demonstrated by the recent volatility of its price. Consequently, one important factor for evaluating the future prospects for Ethereum is the impact that stablecoins may have on its price. The adoption of stablecoins has been growing rapidly in recent years, driven by an increase in usage as a medium of exchange and store of value. With their low volatility and superior liquidity to other cryptocurrencies, stablecoins represent a potentially more attractive option than Ethereum or other digital assets.

Moreover, the presence of stablecoins could affect Ethereum mining operations due to their higher transaction fees compared to those charged by miners. This could create an imbalance in the economic incentives between miners and users that could result in reduced miner activity and increased difficulty for transactions to be processed effectively on the network. As such, it is important to consider how this dynamic might play out going forward when considering Ethereum’s price forecast for 2021 and beyond.

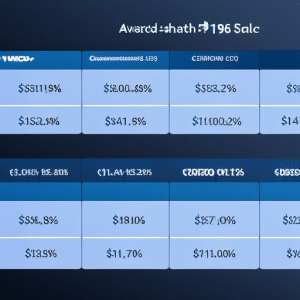

Ethereum’s Price Forecast for 2021 and Beyond

Analyzing the potential factors influencing Ethereum’s trajectory in 2021 and beyond is critical to understanding its future price movements. Decentralization, scalability solutions, and other key developments have the power to shape Ether’s price outlook. To this end, investors must consider:

- The impact of DeFi: Decentralized finance (DeFi) projects are becoming increasingly popular on the Ethereum platform and may result in a higher demand for Ether.

- Potential scalability solutions: Ethereum developers are actively working on improving network scalability, which could enable more transactions per second and lower transaction fees.

- Security risks: Hacks or security breaches can cause large-scale losses to investors who have placed funds in smart contracts or decentralized applications (dApps).

- Regulatory environment: Governments across the globe could impose regulations on cryptocurrencies that could affect ETH prices in both positive and negative ways.

Investors should be aware of these potential implications when considering their options for investing in Ethereum as it will help them weigh the associated risks against possible gains going forward into 2021 and beyond. With a better understanding of how these developments might influence Ether’s price outlook, investors can make more informed decisions about how to best invest in Ethereum moving forward without requiring step-by-step instructions..

How to Invest in Ethereum

Investing in Ethereum requires an understanding of the factors driving its price movements, as well as an evaluation of the associated risks. It is important to know the different ways of buying Ethereum, such as with a credit card or through a cryptocurrency exchange. Additionally, it is essential to take security measures such as setting up two-factor authentication and using encrypted wallets when investing in Ethereum. With these buying tips and security measures, investors can make informed decisions regarding their investments in Ethereum. Furthermore, knowledge about various strategies for trading Ethereum can help investors maximize their returns while minimizing their potential losses.

Best Practices for Investing in Ethereum

Making a wise investment in Ethereum demands strategic planning and an understanding of the risks associated with the cryptocurrency market. To develop an effective strategy, investors should consider both fundamental and technical analysis to identify opportunities for profitable investments. Fundamental analysis involves looking at economic indicators such as the demand for smart contracts, decentralized finance, and other blockchain-based applications. Technical analysis focuses on price trends over time to determine support and resistance levels. It is important to have a comprehensive understanding of these analyses before investing in Ethereum to ensure informed decisions are made that have the potential for returns or profits.

When investing in Ethereum, it is also important to remain up-to-date on regulatory changes that may influence prices, as well as any upcoming news or developments within the cryptocurrency industry. With this knowledge, investors can adjust their strategies accordingly while minimizing risk exposure. As with any investment decision, careful consideration needs to be taken when deciding whether or not Ethereum is a suitable choice for one’s portfolio; by following these best practices, investors can make better investments that will yield positive results in the long run. With this in mind, it is time now to move on to discussing the summary and conclusions of this topic.

Summary and Conclusions

Overall, understanding the fundamental and technical aspects of Ethereum investments can be beneficial for informed decision making and successful returns. When investing in Ethereum, it is important to consider the tax implications of any potential gains as well as market sentiment. To ensure a positive return on investment, investors should:

- Analyze the market conditions before investing

- Develop a clear strategy to maximize profits

- Research potential risks associated with cryptocurrency investments

- Monitor current trends in order to remain knowledgeable about changes in the market

In conclusion, it is essential that investors analyze their own financial goals prior to investing in Ethereum or any other cryptocurrency asset class. Additionally, staying abreast of industry news and developments will help investors make more informed decisions when selecting which coins to invest in and when deciding when to enter or exit positions. As such, incorporating these best practices into an overall investment strategy will increase the likelihood of achieving desired returns from Ethereum investments over time.

Frequently Asked Questions

What is the minimum amount of money required to invest in Ethereum?

"In an age of rapid technological advancement, investing in Ethereum can offer diversification benefits that are crucial for any investment strategy. With the minimum amount to invest ranging from $100 to $1000, there is an option available for most investors."

What are the tax implications of investing in Ethereum?

Investing in Ethereum can lead to capital gains, depending on the investment strategies employed. It is important to consider any tax implications from this investment before proceeding.

What other cryptocurrencies should I consider investing in?

Considering investment strategies and market trends, one may wish to examine other cryptocurrencies beyond Ethereum. Bitcoin, Litecoin, Dash, and Ripple are all viable choices for investors looking to diversify their portfolios. Analysis of each is key to uncovering the potential returns they offer.

How secure is Ethereum?

Ethereum is a secure platform, backed by blockchain technology, to facilitate smart contracts. It has features such as cryptographic hash functions and consensus algorithms that provide a high level of security from malicious attacks.

What are the advantages of investing in Ethereum compared to traditional investments?

Investing in Ethereum offers a unique risk-return profile compared to traditional investments, with higher liquidity and volatility. Compared to stocks and bonds, Ethereum offers the potential for greater returns due to its underlying blockchain technology. Additionally, investors have access to increased liquidity as Ethereum can be traded 24/7 on global exchanges.