Ethereum is like a digital train speeding through the crypto landscape, carrying with it an ever-growing number of passengers. Ethereum is a decentralized platform that powers smart contracts and allows developers to build and deploy decentralized applications. It has been gaining traction since its launch in 2015 and now stands as one of the most successful blockchain projects in the world. The Ethereum CAD price chart is a valuable tool for traders looking to capitalize on this digital asset’s trajectory.

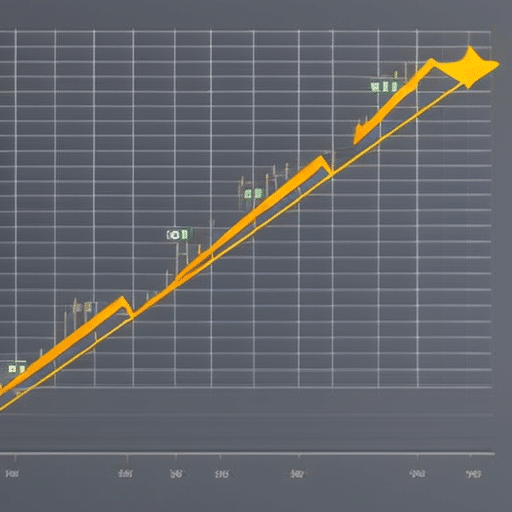

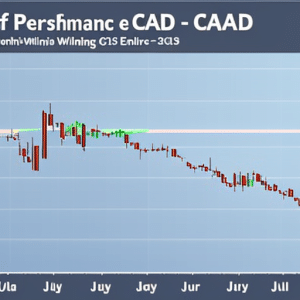

The Ethereum CAD price chart provides a comprehensive view of the cryptocurrency’s historical performance against Canada’s dollar. It offers users an up-to-date overview of current prices, trading volumes, market capitalization, and other pertinent data points related to this asset. Additionally, investors can use the chart to identify trends in order to inform their short or long term investment decisions.

Overview of Ethereum

Ethereum is an open-source, public blockchain-based distributed computing platform and operating system featuring smart contract functionality. Ethereum was first proposed in 2013 by Vitalik Buterin, a programmer and co-founder of Bitcoin Magazine. The primary purpose of the Ethereum network is to facilitate the development of decentralized applications (dApps) that can be used to store data, execute transactions, and create contracts between users on the network. It has become one of the most popular platforms for developers building dApps due to its ability to support multiple programming languages and its broad utility across different industries.

Given its popularity as a platform for developing dApps, understanding Ethereum fundamentals such as smart contract technology is key when analyzing ethereum cad price chart. Smart contracts are agreements between two or more parties that are written in code format and stored on the blockchain, allowing users to digitally sign these documents without having to rely on paper documentation or third parties for enforcement. By utilizing these technologies within Ethereum’s blockchain infrastructure, developers can create complex programs with enhanced security protocols that allow users to transfer money or assets securely with reduced transaction costs compared to traditional payment systems.

Understanding the Ethereum CAD Price Chart

Analyzing the exchange rate between Ethereum and the Canadian Dollar provides insight into the digital currency’s value. By studying price volatility, market analysis, and other factors, investors can gain a better understanding of how changes in Ethereum prices impacts their investments. Examining the price chart also helps to identify any potential market trends that could be beneficial for investing in Ethereum. Through careful examination of the Ethereum CAD Price Chart, investors are able to make more informed decisions about their investments. Additionally, by being aware of any potential risks associated with investing in digital currency, investors can ensure that they are taking every precaution necessary to minimize risk and maximize returns on their investments. By thoroughly analyzing the data presented in the Ethereum CAD Price Chart, investors can develop an effective strategy for managing their portfolio and staying ahead of the market.

Advantages of the Ethereum CAD Price Chart

Examining the exchange rate between Ethereum and the Canadian Dollar can provide investors with a range of advantages. The Ethereum CAD Price Chart helps to illustrate the current market trends of this digital currency, allowing investors to make better informed decisions regarding their investments. Smart contracts allow for secure transactions within Ethereum, providing an additional layer of security benefits when compared to other types of investments. Furthermore, the chart allows investors to assess the volatility of the market and decide whether or not they want to invest in it at that given time. With this information, investors can determine how much risk they are willing to take on when investing in Ethereum compared to other forms of investments or currencies. This data-driven approach provides investors with greater insight into their potential investment opportunities and can help them make smarter decisions. By using the Ethereum CAD Price Chart, investors can gain valuable insights into this digital currency’s current market performance and make informed decisions about when is best to invest or divest from it. Transitioning into the next section without using ‘step,’ understanding possible disadvantages associated with investing in Ethereum is essential for any investor looking for long-term success in this asset class.

Disadvantages of the Ethereum CAD Price Chart

Despite its advantages, the Ethereum-Canadian Dollar exchange rate can also present certain drawbacks for investors to consider. First and foremost is the volatility of Ethereum which can be a huge risk factor when investing in this currency. Secondly, there is always the risk that CAD could become less valuable over time due to inflation or other economic factors. Lastly, it may take longer to exchange Ethereum for CAD than vice versa as not all Canadian exchanges accept it as a form of payment. All of these risks should be taken into account when considering an investment in Ethereum with CAD.

It is important to note that while these drawbacks exist, they do not necessarily outweigh the potential benefits associated with using the Ethereum-CAD price chart for trading purposes. With careful planning and analysis, investors can use this chart to their advantage and minimize any potential losses they might otherwise encounter from volatile market conditions or unfavorable economic events.

Using the Ethereum CAD Price Chart for Trading

Exploring the potential of using cryptocurrency exchange rates to facilitate trading can be a powerful opportunity for investors. Utilizing the Ethereum CAD Price Chart to inform trading strategies and market analysis is an effective way for traders to benefit from the volatile crypto markets. By studying the historical data, investors can identify patterns and trends that may help them predict future price movements and develop successful trading plans. Looking at how different variables such as volume, news events, and other market conditions influence prices over time allows traders to gain valuable insight into how different factors interact with each other in determining overall performance. The Ethereum CAD Price Chart also provides traders with additional information such as daily high and low prices, which helps them make more informed decisions when making trades. With this beneficial tool, traders have a better chance of achieving their financial goals in the digital currency markets. Transitioning into other Ethereum charts could offer further insights on market performance of specific cryptocurrencies.

Other Ethereum Charts

Ethereum offers a variety of charting options for traders and investors to analyze. These include the Ethereum USD Price Chart, the Ethereum EUR Price Chart, and the Ethereum JPY Price Chart. Each of these charts provides different insights into the price action of Ethereum in its respective currency denomination, allowing traders to assess trends and make informed decisions. By analyzing these individual charts together, an overall picture of how Ethereum prices are performing can be created.

Ethereum USD Price Chart

Analyzing the Ethereum USD Price Chart reveals a drastic increase in value over the past few months, indicating its potential as an advantageous investment opportunity. The cryptocurrency trends of the market have been rapidly increasing, with smart contracts becoming more popular. This is highlighted in the table below which depicts Ethereum’s dramatic rise from August to November 2020:

| Month | PriceUSD |

|---|---|

| August | $400 |

| September | $440 |

| October | $520 |

| November | $620 |

The upward trend in prices indicates that Ethereum has the potential to continue to increase in value, making it an attractive option for investors. As such, it is important to stay up-to-date on current cryptocurrency trends and news related to Ethereum if one were considering investing. Moving forward, let us analyze the Ethereum EUR Price Chart for further insights into this digital currency’s performance.

Ethereum EUR Price Chart

Examining the Euro-denominated performance of Ethereum reveals an impressive level of growth over recent months. The value of Ethereum in relation to EUR has risen steadily, particularly since the beginning of 2020. This indicates that traders are taking a keen interest in the cryptocurrency and its potential for significant returns on investment. Analyzing the data from various trading strategies and market analysis can provide insights into where the currency is headed next, what challenges it may encounter along the way, and how best to capitalize on its success. As such, understanding Ethereum’s EUR price chart is key to formulating effective trading strategies and making informed decisions about investing in it. With this knowledge, investors are better positioned to make calculated decisions about their Ethereum investments and maximize their profits. This transition into examining Ethereum’s JPY price chart provides an opportunity for further exploration into how these two currencies interact with one another and what implications this could have for investors’ portfolios.

Ethereum JPY Price Chart

The focus of the previous section was on Ethereum’s EUR price chart. This section will delve deeper into Ethereum’s JPY price chart, providing key insights into potential trading strategies.

When it comes to the Ethereum-JPY (ETH/JPY) pair, the most important factor to consider is its volatility compared to other currencies. It is a riskier option for traders due to its wide fluctuations in value, making it more difficult to predict movements in the near future. That said, there are some strategies that can be employed when trading with ETH/JPY that may help mitigate some of this volatility and provide better returns on investments. One such strategy involves diversifying investments across different asset classes, such as stocks and bonds; another is using technical analysis tools like moving averages or Fibonacci retracements to identify market trends and entry points for trades. Lastly, traders should also keep an eye out for news related to Japan’s economy or changes in regulations regarding cryptocurrencies within the country as these could affect ETH/JPY prices drastically.

Having examined Ethereum’s JPY price chart and potential trading strategies associated with it, we now turn our attention towards predicting ETH/JPY prices in the future – a topic which will be explored further in the next section.

Ethereum Price Predictions

Evaluating the current Ethereum market, predicting its future price is a challenging and complex endeavor. The crypto volatility of the marketplace makes it difficult to predict accurately, as does the scalability of blockchain technology. To make an accurate prediction, one must consider numerous factors such as market sentiment, government regulations, global economic conditions, public opinion of cryptocurrency and more.

Despite this inherent difficulty in making predictions about the future price of Ethereum, some experts have made their own assessments. Some believe that Ethereum will continue to increase in value over time due to its underlying utility while others are more conservative with their estimates. Ultimately, the truth lies somewhere between these two extremes and should be taken into account when attempting to make an educated guess on where ETH will stand in the near future. By taking all factors into consideration and using data-driven analysis for accuracy, investors can make informed decisions about their investments in Ethereum. With this understanding in mind, transitioning to a discussion about ethereum price converter becomes easier.

Ethereum Price Converter

Considering Ethereum’s volatile nature, a useful tool for investors is a price converter that allows them to quickly compare the exchange rate of ETH to other currencies. A currency converter helps to eliminate confusion and uncertainty when it comes to understanding the value of cryptocurrencies in relation to different fiat currencies, such as Australian Dollars (AUD), British Pounds (GBP), US Dollars (USD) and Euro (EUR).

| Currency | Exchange Rate |

|---|---|

| AUD | 0.019500 |

| GBP | 0.014790 |

| USD | 0.011230 |

| EUR | 0.009233 |

Given the increasing complexity of cryptocurrency regulations around the world, a reliable currency converter provides an essential resource for traders and investors participating in decentralised finance activities. With this information at their disposal, individuals can make informed decisions regarding their investments in Ethereum and other digital assets with greater confidence. This facilitates better decision making that takes into account both risks associated with volatility as well as opportunities presented by changing market conditions. To stay informed on developments in Ethereum wallets, read on below.

Ethereum Wallets

Analyzing the complex ecosystem of digital assets requires investors to have access to reliable Ethereum wallets. Security risks for digital assets are a major concern, and therefore it is necessary for investors to take extra precautions when selecting an Ethereum wallet. Private keys are integral in keeping Ether secure, and it is important that users understand how private keys work before investing in any cryptocurrency. As such, it is recommended that investors conduct research into different types of wallets available and choose one with the highest security measures. Additionally, it is important that the wallet chosen has maximum storage capacity and supports multiple currencies so that an investor can diversify their portfolio without having to switch wallets. With these considerations in mind, Ethereum stakeholders can make well-informed decisions about which wallet best meets their needs and ensure their funds remain safe from potential security risks. By taking the necessary steps to protect their investments, investors can move forward confidently with their Ethereum endeavors as they transition into mining the currency.

Ethereum Mining

Mining Ethereum can be a lucrative endeavor for those with the technical know-how and resources, as miners can earn rewards for verifying transactions on the blockchain. To mine Ethereum, miners must have access to compatible mining hardware and join a mining pool. Mining pools are groups of miners who combine their computational power to increase their chances of earning rewards. It is also necessary for miners to have access to an Ethereum wallet so they can store and manage the rewards they earn from mining. Specialized ASICs (application-specific integrated circuits) are typically used by professional miners due to their superior computing power compared to consumer GPUs (graphics processing units). With all these components in place, it is possible for miners to start earning rewards from verifying blocks on the Ethereum blockchain.

Ethereum DeFi (decentralised finance) protocols offer an alternative way for users to take advantage of financial services without relying on third parties or centralised authorities such as banks or governments. By transitioning into this section about ‘ethereum defi’, we will explore the opportunities that this technology presents for users.

Ethereum DeFi

Decentralised finance (DeFi) protocols offer a range of financial services without the need for traditional intermediaries, providing users with greater autonomy and access to more opportunities. Ethereum is one of the most popular blockchains for developing DeFi projects, due to its open-source nature and smart contract feature that allows developers to create customized applications on the blockchain. Ethereum’s DeFi ecosystem has seen significant growth in recent years, with an increasing number of projects offering various types of financial services such as lending, stablecoin usage, derivatives trading, decentralized exchanges and more. The rise in usage has led to increased demand for ETH tokens from both retail and institutional investors looking to gain exposure into this new asset class. This increased demand has driven up prices overall, leading to record highs in ETH/USD exchange rate since late 2020 when compared against traditional currencies like USD or CAD. As Ethereum continues to expand its DeFi product offerings and increase its user base globally, it is expected that demand will remain strong helping maintain a relatively high price point over time. Transitioning now into the following section about ‘ethereum staking’, we can see how this growing demand impacts other aspects of cryptocurrency investing such as staking rewards.

Ethereum Staking

With Ethereum staking, investors can earn rewards for locking up their Ether tokens in a smart contract. According to recent reports, over 17 million ETH has been locked into DeFi protocols – representing a total value of more than $30 billion USD – and providing users with annualized returns of up to 10%.

These rewards come in several forms:

- Stakers may be able to access higher yields when participating in staking pools compared to individual staking;

- Rewards can be earned through inflation or transaction fees;

- Users can benefit from reduced volatility due to liquidity on the network;

- The ability to participate in governance decisions; and

- Stakers have the option of withdrawing their stake at any time.

Through these features, Ethereum staking offers investors an attractive way to generate passive income with low risk. As such, it represents a viable alternative for those seeking exposure to the growing DeFi market without taking on excessive risk. The transition towards blockchain-based finance is continuing apace, making now an opportune time for those looking to invest in Ethereum staking and other DeFi projects. From here, we will explore the role that Ethereum’s underlying blockchain technology plays in this burgeoning industry.

Ethereum Blockchain

The Ethereum blockchain is a distributed network that facilitates the secure transfer of digital assets and record-keeping of immutable transactions. It is comprised of a series of interlinked, distributed nodes that store data and verify transactions in real time. Transactions on the Ethereum blockchain are validated using a consensus protocol known as Proof-of-Work (PoW) which requires miners to solve complex mathematical problems to confirm blocks. In addition, smart contracts are programs written onto the Ethereum blockchain that can be used for various applications such as automated escrow services or decentralized exchanges. Furthermore, gas fees are required for every transaction that occurs on the Ethereum blockchain in order to incentivize miners to validate them. This ensures that only valid transactions are included in each block and prevents spamming of the network. As such, this system serves as an important layer of security for users who rely on the Ethereum platform for transactions. The combination of PoW consensus and gas fees make it difficult for malicious actors to manipulate or interfere with transactions on the Ethereum network, making it a secure platform for users to transact with one another. With these key features in place, it’s possible to move from simply transferring value through crypto currencies into more complex use cases like non-fungible tokens (NFTs), digital identities, and decentralized finance (DeFi). Transitioning into these new use cases will require robust scalability solutions which will be addressed by continued development efforts on both Layer 1 and Layer 2 solutions in order to ensure sustained growth within the ecosystem going forward.

Ethereum Exchange

Never has it been easier to convert crypto-currencies into actual money than with Ethereum’s peerless exchange system. This system is designed to provide the highest levels of liquidity and security measures in order to make trading as hassle-free as possible. Ethereum’s exchange provides a variety of features that appeal to both professional investors and casual traders alike, including cutting-edge analytics tools, an easy-to-navigate interface, and low transaction fees. Furthermore, the exchange offers a suite of advanced security measures to ensure the safety of funds at all times. To provide maximum liquidity levels for users, Ethereum’s platform also includes several trading pairs for different digital assets such as ETH/USD or ETH/BTC. With these features in place, Ethereum makes it simple and convenient for users around the world to convert their holdings instantaneously into real money without any hassle or delays. As such, Ethereum stands out among its peers in offering one of the fastest and most secure ways to cash out crypto funds. In conclusion, Ethereum’s powerful exchange system enables users across the globe to safely and conveniently trade digital assets with confidence. Moving forward, this will undoubtedly be an invaluable resource for those seeking up-to-date pricing information on cryptocurrencies as well as reliable access to liquid markets.

Ethereum News

Keeping up with the latest news in the crypto world is essential, and Ethereum provides an array of resources to ensure users stay informed. From daily market updates to long-term trends, there are a number of ways Ethereum can help its users stay informed:

- Ethereum developers regularly release public statements detailing changes to the platform, giving users insight into potential risks or rewards associated with DeFi projects powered by smart contracts.

- Decentralized finance (DeFi) data portals provide reliable information on the performance of various ethereum-based financial products and services such as loans, insurance coverage, yield farming and more.

- News outlets dedicated to cryptocurrency often feature stories about developments within the Ethereum ecosystem, providing readers with timely analysis and insights from industry experts.

Users should always do their own research before investing in crypto assets and use reputable sources for accurate information related to Ethereum news.