Ethereum is a blockchain-based decentralized platform that enables the building and deployment of smart contracts and distributed applications. An adage to sum up the potential of Ethereum: ‘Ethereum has been dubbed “the world computer” as it is capable of running code for any decentralized application’. Staking is the process of leveraging one’s existing Ether (ETH) holdings to validate transactions on the Ethereum network and earn rewards in return. In this article, we will explore the current price of staked Ethereum, investment strategies associated with staking, rewards available, risks involved, pros and cons, alternatives to staking and provide resources for further exploration.

Key Takeaways

- Staking Ethereum involves using existing ETH holdings to validate transactions and earn rewards on the Ethereum network.

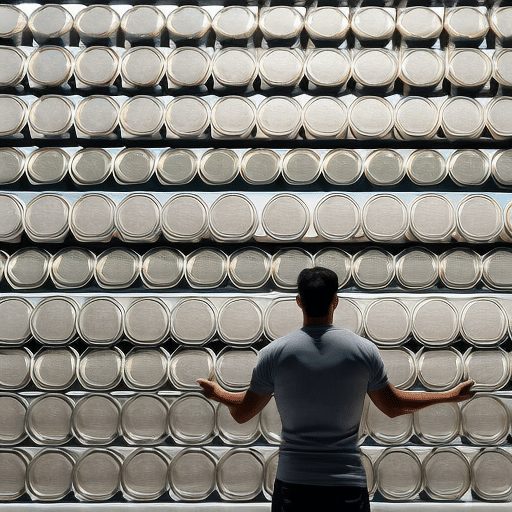

- Staking pools allow users to pool their resources and increase their chances of earning staking rewards.

- Ethereum staking offers advantages such as lower energy consumption, enhanced security, and greater scalability compared to traditional mining.

- Estimating the accurate value of staked Ethereum can be complex due to various variables, but knowledge of the current price of staked Ethereum is essential for successful investment strategies.

Overview of Ethereum

Ethereum is the second largest cryptocurrency by market capitalization, with a current value of over $50 billion USD. Ethereum is an open-source public blockchain-based distributed computing platform and operating system featuring smart contract functionality, which facilitates online contractual agreements. Its native token, Ether (ETH), powers the network and is used to pay for transaction fees and services on the Ethereum network. Staking pools are groups of individuals who pool their resources together to increase their chances of staking rewards. By delegating their ETH tokens to staking pools, users can receive rewards in the form of additional ETH tokens in proportion to the amount they have delegated. This has made it easier for average investors to reap rewards from staking without having to invest large amounts of money upfront. As such, many investors are now turning towards Ethereum staking as one way of earning passive income from their investments. This trend has resulted in an increased demand for ETH tokens, leading to its current high market value and price appreciation over time.

Ethereum Staking

Ethereum staking is a process by which users can lock up their Ethereum (ETH) to receive rewards as part of the proof-of-stake consensus mechanism. It is an alternative to the more commonly known proof-of-work process, whereby miners are rewarded for verifying transactions and adding them to the blockchain. Ethereum staking has several advantages over traditional mining, such as lower energy consumption, enhanced security, and greater scalability. Additionally, ETH holders who stake their tokens can earn rewards in the form of newly minted ETH or transaction fees.

What is Ethereum Staking?

Staking Ethereum is a process whereby ETH holders can lock up their cryptocurrency for a period of time in order to help secure the network and receive rewards for doing so. This has become an increasingly popular investment strategy as staking rewards have grown more attractive over time.

When staking Ethereum, investors must consider different factors such as:

- Risk – the amount of risk associated with Ethereum staking depends on the length of time one is willing to commit their ETH tokens and the current state of the network.

- Rewards – the rewards earned from staking depend on several variables such as how much ETH is locked up, how long it remains locked, and what kind of consensus algorithm is being used by the network.

- Investment Strategies – there are many different strategies available when investing in Ethereum staking, including buy-and-hold strategies, strategies that involve actively trading your ETH tokens, and diversification strategies that spread investments across multiple networks.

Ultimately, understanding these factors can help investors make better decisions when deciding whether or not to stake their Ethereum tokens and maximize their returns on investment.

Benefits of Ethereum Staking

The potential advantages of Ethereum staking have been attractive to investors, particularly in terms of the rewards offered and the security it provides. Staking pools allow those who may not be able to afford a large stake of their own to earn rewards from Ethereum staking by pooling resources with others. Yield farming is another form of investing where users can lock up their ETH in return for tokens that will offer additional profits on top of the staked ETH rewards. These forms of investment provide higher returns than traditional investments while also being more secure due to the decentralized nature of blockchain technology.

Ethereum staking is becoming increasingly popular as an alternative means for generating passive income, and its potential benefits present a viable opportunity for investors looking for ways to diversify their portfolios. With this increasing demand comes fluctuating prices, making it difficult to predict the current price of staked Ethereum without taking into account any external factors or market trends that might affect it.

Current Price of Staked Ethereum

Staking Ethereum has become a popular way of earning passive income, offering the potential for investors to capitalize on the cryptocurrency’s market performance. With crypto volatility and scalability issues always looming in the background, understanding the current price of staked Ethereum is critical for investors. For those who are interested in investing in Ethereum, there are several considerations when it comes to an estimate of its current value:

- The amount staked

- The amount of time staked

- The block reward associated with staking

- Network fees associated with transactions

- Transaction speed and reliability

Considering all these factors, estimating an accurate value for Ethereum can be complex. Understanding how different variables could impact this value is essential in order to make informed decisions about investing in Ethereum. By taking into account all relevant factors involved in pricing staked Ethereum, investors will be better equipped to make decisions that maximize their returns. As such, having knowledge about the current price of staked Ethereum is key for successful investment strategies.

Ethereum Investment Strategies

Investing in Ethereum is a popular way to capitalize on the cryptocurrency’s potential market performance, and having knowledge of effective investment strategies is essential for successful returns. One of the most popular strategies for investing in Ethereum is by staking through pools. Staking through pools allows users to pool together their funds and share rewards from transactions on a proportionate basis. This can be beneficial as it reduces risk associated with holding Ethereum by spreading out investments among multiple participants, while providing greater reward opportunities than simply holding tokens. Additionally, it eliminates many of the gas fees associated with regular transactions which can add up quickly over time.

Staking pools are becoming increasingly popular due to their ability to reduce risk and increase rewards for investors. However, when deciding whether or not to join a staking pool, it is important to consider all factors such as the size of the pool, fees charged by the pool operators, liquidity requirements and other terms & conditions that may apply. By carefully analyzing these factors prior to joining a staking pool can help ensure that an investor gets maximum benefit from their Ethereum investment strategy. With this knowledge in hand, investors can transition into exploring further options regarding Ethereum staking rewards with confidence.

Ethereum Staking Rewards

Continuing from the previous subtopic of Ethereum Investment Strategies, this section will focus on Ethereum staking rewards and how to maximize them. Staking Ethereum in a pool or yield farming are two popular strategies for earning rewards on ETH holdings.

Staking pools provide users with an easy way to stake while also providing added security from malicious actors since the responsibility of securing the network is shared between all members of the pool. Yield farming allows users to put their ETH holdings to work by lending or borrowing assets, allowing them to generate returns in various forms such as interest payments, rewards, and capital gains. As with any investment strategy, it is important that investors consider security when participating in these types of activities so they can protect their funds from malicious actors and other risks associated with cryptocurrency investments.

Security Considerations

When engaging in Ethereum staking or yield farming strategies, it is essential to remain vigilant and take necessary security precautions to protect one’s investments from malicious actors. As the blockchain technology is based on a decentralized network, it becomes increasingly important to be aware of all potential risks that come with using it. It is important for users of such blockchain-based services to understand the underlying technology and its associated security measures, including how to properly secure wallets and smart contracts. The most common security issues include weak passwords, phishing attacks, stolen private keys, and vulnerabilities in smart contract code. To ensure a secure environment when dealing with Ethereum staking or yield farming strategies, users should always use strong passwords for their wallets and make sure they adequately review any third-party code before deploying their own smart contracts. Additionally, users should practice good online security habits such as enabling two-factor authentication for each wallet account they create. By doing so, users can ensure that their funds are safe from potential threats while also enjoying the benefits of participating in the Ethereum staking or yield farming ecosystem. With these considerations in mind, investors can have peace of mind knowing their funds are safe while taking advantage of the opportunities available through Ethereum staking or yield farming strategies. Moving forward into the world of taxes and regulations is another key consideration when investing in cryptoassets like Ethereum.

Taxes and Regulations

As the crypto-asset space matures, taxes and regulations must be considered as a critical component of investing in Ethereum staking or yield farming strategies, similar to swimming through treacherous waters with caution. Firstly, investors should be aware of the potential tax implications of their investments. This could include short-term gains if staked funds are withdrawn within a year or long-term capital gains if held over a longer period. Secondly, it is important for investors to ensure that they are compliant with all legal requirements when engaging in Ethereum trading activities. This could include understanding local laws around cryptocurrency investment and abiding by any applicable anti-money laundering (AML) rules as well as Know Your Customer (KYC) requirements. Thirdly, depending on the country of residence, there may also be additional reporting obligations associated with income derived from staked funds. Lastly, investors should also consider relevant financial advice before entering into any Ethereum related activities to ensure that they understand the risks associated with their particular situation. With this knowledge in mind, the next step is to explore Ethereum staking wallets available for users to securely store ETH tokens and other digital assets.

Ethereum Staking Wallets

Investment in Ethereum staking requires the use of a secure wallet to store digital assets. Staking wallets are specially designed to help users stake their ETH, and offer a variety of features that make it easier and more convenient to do so. These wallets typically offer support for staking services, lower gas fees, and other security measures such as two-factor authentication. They also often have integrated market data which provides information about the current price of staked Ethereum and other cryptocurrencies.

| Features | Benefits |

|---|---|

| Support for Staking Services | Easier process for staking ETH |

| Lower Gas Fees | Reduced transaction cost when sending cryptocurrency |

| Market Data Integration | Access real-time market info on current prices of cryptocurrencies |

Integrating these features into one comprehensive wallet further increases the convenience of investing in Ethereum staking. By providing clear insights into the current price of staked Ethereum, investors can make more informed decisions when deciding how much to invest in this type of asset class. Moreover, with lower gas fees associated with using a staking wallet, investors can save money while still reaping rewards from their investment. Transitioning now into discussing ‘ethereum staking services’, we will explore how these service providers facilitate investments in this asset class.

Ethereum Staking Services

Staking services offer invaluable assistance to those seeking to maximize returns on their Ethereum investments. By joining a staking pool or using specialized DeFi apps, investors can take advantage of the potential rewards that come with staking without having to worry about the technicalities of setting up and managing their own node. By pooling resources, stakers benefit from economies of scale as well as shared risk. Additionally, they have access to tools such as automated rebalancing which can help them optimize their earnings over time. With these services, investors receive not only the rewards associated with staking but also improved security and convenience when compared with self-staking.

However, it is important for users to understand the risks associated with relying on third-party services for their staking needs. Users must ensure that they are fully aware of all fees associated with any service they use and be confident in its security protocols before entrusting it with their funds. They should also thoroughly research any proposed changes or updates which could alter the terms under which they are staking. Ultimately, users must remain informed and vigilant regarding all aspects of their stake in order to ensure maximum profitability in this increasingly popular venture.

Risks of Ethereum Staking

Though staking may be a lucrative venture, it is important to understand the associated risks before entering into an Ethereum staking agreement. Over 20% of Ether tokens locked up in staking contracts are at risk of being lost or stolen due to security vulnerabilities and fraudulent activity. While there can be considerable rewards from investing in Ethereum staking strategies, investors must also consider the potential for losses due to these risks. In addition to technical issues or malicious attacks that could compromise a user’s digital assets, users should also be aware of regulatory changes that could affect their investments. As with any investment decision, investors should thoroughly research all aspects of their chosen strategy before committing funds. To ensure success, investors should weigh both the potential rewards and risks associated with staking rewards and strategies before making any decisions. With this knowledge in hand, transitioning into a discussion about the pros and cons of Ethereum Staking is essential in order to make an informed decision about whether or not it is right for them.

Pros and Cons of Ethereum Staking

Considering the potential benefits and risks that are associated with Ethereum staking, it is important for investors to carefully evaluate the pros and cons before making an investment decision. Staking rewards can be a major advantage of investing in Ethereum, as they provide passive income streams for those who stake their ETH. Investment strategies are also beneficial, as investors can diversify their portfolios by leveraging Ether stakes across different platforms.

On the other hand, there are some risks associated with staking Ethereum. These include a lack of liquidity due to the lack of exchanges that support staked ETH and a need for long-term commitment since many platforms require users to commit their Ether balance for a minimum period of time in order to receive rewards. Furthermore, stakers may be subject to inflationary pressure from rising gas fees or other external factors which can reduce returns on investments. With all these considerations in mind, it is essential to weigh up both sides of the equation before entering into any sort of Ethereum staking arrangement. By taking into account these pros and cons, investors can make informed decisions about how best to leverage their Ether holdings in order to maximize returns over the long term. With this information in mind, we now turn our attention towards exploring alternatives to Ethereum staking.

Alternatives to Ethereum Staking

A wise investment strategy involves exploring alternative options to Ethereum staking, as ‘a bird in the hand is worth two in the bush’. Staking pools are an option for those who want to benefit from Ethereum staking without having to purchase and manage a high amount of tokens. Through pooling their resources together with other users, individuals can gain access to higher rewards than they could have earned on their own. Decentralized staking is another alternative that allows investors to take advantage of various financial products related to Ethereum while giving them more control over how their funds are managed. With this type of staking, users can set up automated contracts on the blockchain that will automatically handle payments and other investments according to pre-set parameters. By taking into account these alternatives, investors can make informed decisions about where best to put their funds for maximum return. As such, it is important for individuals to be knowledgeable about all available options when looking at investing in Ethereum. With this knowledge comes greater opportunity for success and higher returns on investments made. Transitioning now into discussing resources available regarding this topic.

Resources

Investors should research the available resources related to Ethereum staking in order to make informed decisions. Resources such as blockchain rewards, stake decentralization, and other related tools can provide a deeper understanding of how Ethereum staking works and how investors can maximize their returns.

For example, one resource that is often overlooked when researching Ethereum staking is stake decentralization. Stake decentralization helps reduce the risk of an attack on any single node in the network by distributing tokens across multiple nodes instead. This means that if something happens to one node, all other nodes are still protected and will remain operational. Additionally, it increases overall security of the network and allows for more robust transactions using smart contracts. Furthermore, blockchain rewards are another important resource to consider when researching Ethereum staking as they allow users to earn rewards for participating in certain activities within a particular network or platform. These rewards can be used to purchase goods, services, or even new digital assets such as tokens or coins associated with that platform or network.