Ethereum is rapidly becoming a ‘must-have’ asset in the digital economy. With its revolutionary technology, it has emerged as one of the most important cryptocurrencies in the world. Boasting an impressive price history and numerous applications, Ethereum continues to captivate the attention of investors worldwide. In this article, we take a closer look at current Ethereum prices, historical price trends and factors influencing its value. Additionally, we explore how to track Ethereum prices as well as discuss Ethereum’s impact on blockchain technology, decentralized finance (DeFi), non-fungible tokens (NFTs) and smart contracts. By examining these topics in depth, readers will gain a better understanding of what makes Ethereum so valuable and why it is such an attractive investment prospect.

Overview of Ethereum

Ethereum is a decentralized, open-source blockchain platform for smart contracts and Decentralized Applications (DApps). It supports a wide range of programming languages, allowing developers to build applications on the Ethereum network. Security is paramount in the development of Ethereum as it uses a proof-of-work consensus algorithm that provides strong protection against malicious activity. However, scalability issues remain an area of concern due to its current inability to handle large amounts of transactions efficiently. Although various solutions have been proposed to address this issue, none have yet been implemented on the mainnet. As such, Ethereum continues to strive for improved scalability through technology advancements and protocol upgrades that are designed to provide faster transaction speeds.

The current price of Ethereum depends largely on market sentiment and demand from investors as well as speculation about the future value of ETH tokens. The price has also been impacted by news related to technological advancements and new blockchain projects built on top of the Ethereum network. Additionally, events such as forks and hard forks can affect the price significantly as they create uncertainty in the market which often leads to volatility. Ultimately, understanding all these factors will be key in predicting future prices accurately.

Current Ethereum Price

At this time, the value of cryptocurrency is significantly impacted by fluctuations in the market. Ethereum is no exception given its rise as one of the leading players in the space, with a large portion of trading taking place on exchanges. The current security and scalability of Ethereum are factors that play heavily into its price, though these attributes have been subject to debate amongst investors and developers alike. As a result, it is essential for those interested in investing in Ethereum to understand the current state of security and scalability before making any decisions about investments.

Ethereum’s current price can be found by looking at real-time data from various exchanges such as Coinbase or Bitfinex. This data will provide an accurate representation of what Ethereum is currently trading for on open markets. By understanding both current security and scalability issues associated with Ethereum, along with examining historical price trends, investors can make educated decisions about their investment strategy in regards to Ethereum.

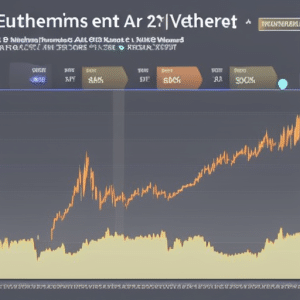

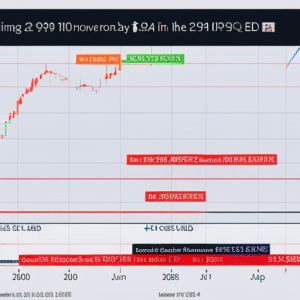

Historical Price Trends

Examining historical price trends for Ethereum can provide insight into the future value of this cryptocurrency. For example, in 2017, Ethereum’s value rose from roughly $10 to over $400 in a span of six months. This rapid increase highlights the potential that security trends and market analysis can have on the price of cryptocurrencies such as Ethereum. Analyzing similar security trends and market analysis could give investors an idea of what kind of impact they may have on Ethereum’s current price. By examining past data points, investors may be able to predict future movements in the cryptocurrency market and make decisions about their own investments accordingly.

In addition to analyzing historical data points, it is also important to consider other factors that influence Ethereum’s price, such as supply and demand dynamics or regulatory changes within certain countries. Understanding these external influences can help investors make more informed decisions when considering their own investments in Ethereum. With this knowledge in hand, investors are better positioned to identify potential risks or opportunities for further growth within the cryptocurrency space. As such, understanding both current and historical pricing trends for Ethereum can be beneficial for making sound investment decisions going forward.

Factors Influencing Ethereum Price

The value of cryptocurrency such as Ethereum is affected not only by historical trends, but also by external factors that can have a significant impact on its price. These external factors may include the overall market sentiment and competing altcoins comparison. In addition, government regulations and laws can also influence the price of Ethereum. For instance, when governments enforce regulations or issue warnings against investing in cryptocurrency assets, this could lead to a decrease in the demand for Ethereum. On the other hand, when governments create favorable conditions towards cryptocurrency investments then this could lead to an increase in demand for Ethereum. Thus, understanding how these different external factors affect the price of Ethereum will provide investors with key insights into their potential investments. In conclusion, it is important for investors to consider both internal and external factors when evaluating their potential investment in Ethereum as they can both significantly impact its value over time.

How to Track Ethereum Price

Tracking the value of cryptocurrency such as Ethereum can help investors gain insights into potential investments and better understand the external factors that influence its price. Being able to monitor changes in Ethereum’s market capitalization, daily trading volume, and price volatility are key elements to consider when tracking this currency. Additionally, being aware of current news and events affecting Ethereum can help inform short-term price predictions.

For those who want to actively invest in Ethereum, it is important to understand not only how to track its value but also how to buy it. By examining possible exchanges with low fees or discounts on trades, investors can set up a strategy for investing in Ethereum that meets their individual financial goals while mitigating risk associated with high price volatility.

How to Invest in Ethereum

Investing in cryptocurrency, such as Ethereum, can provide investors with the opportunity to diversify their portfolio and potentially reap higher rewards. However, there are security risks associated with investing in Ethereum and other cryptocurrencies due to market speculation. As a result, it is important for investors to research the market carefully before making any financial decisions. Furthermore, understanding potential price movements of Ethereum is essential for successful investing. With this knowledge in hand, investors may be better equipped to make informed decisions about when to buy or sell Ethereum tokens and achieve success with their investments. Having established a solid foundation for investing in Ethereum, attention can now be turned towards predicting future price movements of the cryptocurrency.

Ethereum Price Predictions

Investing in Ethereum is a risky but potentially lucrative endeavor for investors. However, with the volatile nature of cryptocurrency markets, it is important to understand the potential future movements of Ethereum prices before investing. Therefore, it is useful to consider various Ethereum price predictions from analysts and experts.

Cryptocurrency regulations are one major factor that will affect Ethereum prices in the future. Regulations have a large influence on how much people are willing to invest in cryptocurrencies and can unexpectedly affect market capitalization suddenly. Additionally, scalability issues may hinder Ethereum’s growth as an investment asset if they cannot be addressed successfully. As such, understanding these factors can provide insight into possible future price movements and help investors make informed decisions when considering investing in Ethereum. With this knowledge, investors can plan accordingly for their investments in order to maximize potential returns while minimizing their risk exposure. To better understand how mining affects the value of Ethereum, it is important to explore the effects of mining on its current price fluctuations and future developments.

Ethereum Mining

Mining is a key factor in determining the value of Ethereum, as it impacts both current price fluctuations and future development of the cryptocurrency. The rewards from mining are one of the main sources of income for miners, with their profits determined by the mining hardware used to solve complex mathematical problems. As these problems become increasingly difficult, more powerful and sophisticated mining hardware is needed to ensure profitability and to remain competitive in the market. This leads to an ever-increasing cost associated with operating a successful mining operation for Ethereum. The resulting increase in demand for more powerful hardware drives up prices, leading to higher levels of volatility in Ethereum’s price movements. In addition, changes in mining difficulty can also impact prices significantly due to their effect on profitability and competition among miners. Thus, it is important for investors to be aware of these factors when assessing risks associated with investing in Ethereum.

Risks of Investing in Ethereum

The potential volatility of the cryptocurrency market presents a significant risk when considering investments in Ethereum. Investment strategies must assess both current and future risks before making decisions on investing in Ethereum. Volatility is a major factor to consider, as large fluctuations in prices can result in significant losses for investors. The cryptocurrency market is volatile due to its lack of regulation and underlying technology that drives it, which adds an additional layer of uncertainty when compared to traditional stocks or commodities. Additionally, due to the global nature of the market, it can be exposed to multiple external forces such as changes in government regulations or macroeconomic events that could affect prices significantly.

Therefore, investors should carefully evaluate potential risks associated with their investment strategies and develop plans for mitigating those risks before investing in Ethereum. This includes developing a clear understanding of the underlying technology driving Ethereum’s value, researching recent price trends and historical data surrounding similar investments, and having an overall knowledge of the current cryptocurrency landscape. By taking these steps into account prior to investing, one can ensure that they are well-prepared for any potential volatility risks that may arise over time. With an informed approach towards investment strategies involving Ethereum, investors can take advantage of its potential benefits while minimizing potential losses from market volatility.

Benefits of Investing in Ethereum

Despite the potential risks associated with investing in cryptocurrencies, Ethereum offers an array of advantages that make it an attractive investment option for many. One such advantage is its accessibility which enables investors to quickly and easily buy or trade Ether tokens. This makes Ethereum one of the most liquid assets on the market, allowing investors to take advantage of shifts in investor sentiment and market volatility. Additionally, Ethereum’s blockchain technology provides a secure platform for investments, offering an extra layer of protection against fraud or theft. These features can provide a strong foundation for long-term investments that seek to capitalize on rising ETH prices over time. With these benefits in mind, it is clear why Ethereum has become so popular amongst traders and investors alike; as such, understanding trading strategies can help maximize gains from this growing asset class.

Ethereum Trading Strategies

Investing in Ethereum can be highly rewarding, but to maximize returns, it is important to understand the available trading strategies. Prediction algorithms are used by traders to forecast market trends and anticipate future price movements. By leveraging predictive analytics tools, investors can accurately identify entry and exit points for profitable trades. Scalping strategies involve taking small profits over a short period of time, which requires an understanding of market volatility. Traders must also have the ability to quickly recognize trends and react accordingly. While prediction algorithms and scalping strategies can help traders increase profits, they also come with the risk of losses if not used properly. Consequently, knowledge about these approaches is essential for successful Ethereum trading. Having an understanding of these techniques allows investors to make informed decisions that could lead to significant gains in their investments. With this in mind, it is important to consider how Ethereum and blockchain technology are related when making investment decisions.

Ethereum and Blockchain Technology

Recent research has shown that Ethereum and blockchain technology are closely linked, with more than 90% of the world’s active blockchain projects being powered by Ethereum. This connection is due to a number of factors, including: 1) Ethereum’s ability to enable decentralized applications (dApps) on its platform; 2) The security features offered by the underlying blockchain protocol; 3) The scalability of Ethereum-based networks; and 4) The cost-effectiveness associated with running an application on the Ethereum network.

Ethereum’s potential in enabling secure transactions across multiple systems is one of its key advantages for crypto security. It allows users to keep their digital assets safe from malicious actors while still allowing them to transact freely with peers located anywhere in the world. In addition, recent advancements have made it possible for blockchain projects to scale and handle thousands of transactions per second – something that was not previously feasible on other platforms. As a result, more people are turning towards Ethereum as a reliable platform for conducting secure transactions at scale. With these benefits in mind, it’s no wonder why so many companies today are using Ethereum as their go-to choice when launching new projects or building out existing infrastructure. These advances in blockchain scalability will pave the way for wider adoption of decentralized finance (DeFi) applications built on top of the Ethereum network.

Ethereum and Decentralized Finance (DeFi)

Decentralized finance (DeFi) applications fueled by Ethereum provide users with the ability to securely transact and manage digital assets without relying on centralized entities. These protocols are designed to facilitate decentralized trading, lending, borrowing, staking and yield farming activities for cryptocurrencies. DeFi allows users to receive passive income from their investments in a much more secure manner than traditional banking systems allow. By utilizing smart contracts on Ethereum’s blockchain technology, DeFi protocols have enabled users to maximize their returns through yield farming strategies such as liquidity mining. This has resulted in significant growth in the number of users leveraging DeFi services and driving up volume across various exchanges. As Ethereum continues to support new protocols and technologies related to DeFi, it is likely that this trend will continue into the future. Transitioning into the subsequent section about non-fungible tokens (NFTs), these unique cryptographic tokens allow for true ownership of virtual or physical assets on blockchain networks including Ethereum.

Ethereum and Non-Fungible Tokens (NFTs)

Non-fungible tokens (NFTs), which are cryptographic tokens that allow for the true ownership of virtual or physical assets on blockchain networks such as Ethereum, have seen an exponential growth in usage over the past year with a reported 8,000% increase in volume. This growth can be attributed to NFTs’ ability to assign unique properties and scarcity to digital items, essentially allowing them to become tradable assets. The popularity of NFTs has led to an increased focus on governance models and marketplaces that facilitate their trading. Many platforms have emerged offering different types of NFT marketplaces and governance protocols designed to provide users with secure trading options and ensure compliance with applicable laws and regulations. In addition, several projects are aiming to create standard frameworks for the development of new NFT applications and services. As these initiatives gain traction, it is likely that the use of NFTs will continue to rise in the future. With this trend in mind, it is important for Ethereum users to understand how smart contracts can be used as part of building trustless systems for managing non-fungible tokens.

Ethereum and Smart Contracts

The rise of Ethereum has brought with it the potential for smart contracts to revolutionize the way we transact and interact online. Smart contracts are self-executing digital agreements stored on a blockchain that enable users to transfer funds, exchange assets, and access data in a secure manner. The key benefits of using smart contracts include: 1) improved security due to their distributed nature; 2) increased scalability by allowing users to execute large numbers of transactions in parallel; and 3) enhanced accuracy by enabling trustless execution.

However, there are still some major challenges facing the implementation of smart contracts, such as security issues related to vulnerabilities in underlying code or hardware, scalability limitations of blockchains due to their reliance on consensus algorithms, and privacy concerns regarding private data stored on public networks. These problems must be addressed before widespread adoption can occur. To this end, developers have proposed various solutions such as formal verification techniques for verifying smart contract code correctness against its specifications and sharding protocols for increasing blockchain throughput capacity.

Frequently Asked Questions

What are the differences between Ethereum and Bitcoin?

Ethereum and Bitcoin differ in various aspects such as their underlying blockchain technology, purpose, and use cases. Ethereum supports smart contracts and decentralized finance applications while Bitcoin is primarily used for its native cryptocurrency. Ethereum also has a different mining process compared to Bitcoin, which uses a proof-of-work consensus algorithm.

What are the security risks associated with Ethereum?

Exaggeratedly, security risks associated with Ethereum are immense, due to its decentralized nature and reliance on smart contracts. Decentralization requires trust-less networks, which can be vulnerable to malicious actors. Smart contracts are also susceptible to bugs and hacking attempts. All of this highlights the need for comprehensive security measures when utilizing Ethereum.

What is Ethereum gas, and how does it affect transactions?

Ethereum gas is the fee associated with running a transaction or smart contract on the Ethereum blockchain. It is used to incentivize miners to include transactions in blocks, thus powering the decentralized applications (Dapps) and smart contracts. Gas is necessary for making sure that users pay for their usage of Ethereum’s resources.

What is the future of Ethereum?

The future of Ethereum is an exciting one, with the potential to revolutionize how we interact with technology through smart contracts and decentralized finance. Analysts predict that these two areas will continue to grow in popularity and adoption, leading to significant growth for Ethereum in the long-term. The advantages of Ethereum’s blockchain technology make it a prime candidate for continued success.

How can I make money with Ethereum?

Investing in Ethereum can be done through various strategies, such as trading or holding. These provide different opportunities for risk and reward due to varying market conditions. Understanding the potential risks and rewards associated with each approach is important for maximizing returns on investment.