Investing in Ethereum has become increasingly popular over the past few years, as its value has skyrocketed and digital currencies have become an attractive option for a growing number of people. Recently, it has been estimated that around 5 million people own some amount of Ethereum worldwide. As the second largest cryptocurrency by market cap, many investors are interested in buying small amounts of Ethereum such as 0.01 ETH to start their crypto investment journey, but finding the best price can be a confusing process. This article will provide an overview on how to buy 0.01 ETH at the best price while minimizing risks associated with investing in cryptocurrency markets. Anecdotally, one investor began their journey by purchasing just 0.04 ETH for $20 USD at the end of 2017 only to see that same amount grow to over $400 USD a year later – a testament to the potential upside of investing in Ethereum markets today.

Key Takeaways

- Selecting the right exchange for Ethereum trading involves considering factors such as fees, security measures, customer service, crypto security, liquidity risk, ease of use, and reputation.

- Creating an account on an exchange requires providing personal information and undergoing identity verification, including a government-issued ID, proof of residency, personal details, and contact information.

- Understanding Ethereum is essential for making informed investment decisions. Ethereum is a blockchain-based platform for decentralized applications and smart contracts, enabling users to interact without relying on third parties.

- When purchasing Ethereum, it is important to ensure safety and security by funding the account before buying, choosing the right payment method, researching additional costs, and transferring Ethereum to a secure wallet.

Understand Ethereum

Ethereum is a blockchain-based platform that enables the development of decentralized applications and smart contracts. This technology has created numerous investment strategies, including the rapidly growing field of decentralized finance. Ethereum’s smart contracts have enabled users to interact with each other without relying on a third party such as a bank or government institution. As such, it has become an attractive option for those looking to diversify their investments and take advantage of new opportunities in the digital age. By understanding the basics of Ethereum, investors can make informed decisions about how best to purchase 0.01 ethereum at the best price available.

The next step is to choose an exchange that offers Ethereum trading services. There are several reliable cryptocurrency exchanges worldwide that enable users to buy and sell Ethereum with ease. It’s important to research each exchange thoroughly and compare their fees, security measures, customer service, and more before making a decision on which one is best suited for your needs.

Choose an Exchange

Exchanges are platforms which facilitate the exchange of assets such as cryptocurrencies. When selecting an Exchange, factors such as trading fees, liquidity of the market, security measures taken by the Exchange and customer service should be considered. As different Exchanges offer unique services, it is important to choose one that best suits your needs in order to have a successful trading experience.

What is an Exchange?

An exchange is a platform where digital currencies can be bought and sold. It provides a means for traders to buy and sell digital assets in an open market, giving them access to liquidity, trading tools, analytics, charts, and other features that facilitate the process. Exchange platforms provide users with a secure environment within which they can conduct transactions without the fear of loss or fraud. Additionally, exchanges have implemented various regulatory measures to ensure compliance with applicable laws and standards:

- Cryptocurrency regulations are enforced to protect investors from predatory practices

- Security considerations are taken into account when designing protocols for user accounts

- Risk management systems are employed to safeguard funds from malicious activities

- Automated processes are used to reduce human error when executing trades

Exchange platforms offer numerous benefits to traders looking for an efficient way of buying and selling digital assets. As such, it is important for users to take into account all factors when selecting an exchange that best meets their needs.

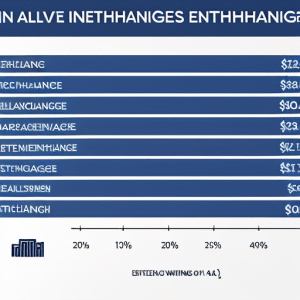

Factors to consider when selecting an Exchange

When selecting an exchange, it is essential to carefully weigh the options in order to make an informed decision. To help with this process, it can be useful to consider several factors that could influence the quality of the exchange. These include crypto security, liquidity risk, fees and commissions, customer support services, ease of use and reputation.

| Factor | Pros | Cons |

|---|---|---|

| Crypto Security | Transactions are secure and data is encrypted | Potential risks associated with cyber-attacks and other threats |

| Liquidity Risk | Ability to quickly convert currencies without effecting market prices | Can cause large price movements due to limited supply or demand for certain coins/tokens |

| Fees & Commissions | Low transaction costs relative to traditional platforms like stock exchanges and banks which charge higher fees for trading securities | Hidden fees can occur when converting between different cryptocurrency pairs or withdrawing funds from exchanges into wallets outside of their platform. |

| Customer Support Services | Responsive customer service team available for inquiries related to technical issues or account management concerns. Can provide helpful advice on best practices when using exchange platforms. | Language barriers may limit access in certain countries where English is not spoken as a primary language. |

| Ease of Use & Interface Design ClarityUser interface (UI) should be intuitively designed so that users can easily navigate through menus and settings on the platform without confusion or frustration.May require some additional learning time for novice users who aren’t familiar with cryptocurrency trading concepts such as order books, candlestick charts, etc.. |

Reputation & CredibilityEstablished exchanges have typically earned trust over time by delivering reliable products/services and complying with applicable regulations.Newer exchanges may be more prone to scams or other fraudulent activities since they lack established track records compared to older players in the industry.

Having weighed these various factors in choosing an exchange, it is important to keep in mind that ultimately no single option will be perfect but rather a combination of multiple features that complete one another’s strengths and weaknesses thus providing an overall satisfactory experience when buying 0.01 Ethereum at the best price possible – transitioning seamlessly into creating an account on the selected platform.

Create an Account

Creating an account on an exchange typically requires providing personal information, such as name and contact details. It may also require verifying one’s identity by submitting documents such as a passport or driver’s license. Additionally, some exchanges might also request proof of residence in the form of a utility bill or other document. All this information is necessary to ensure compliance with anti-money laundering regulations.

Required information to open an account

Gathering the necessary documents for opening an account is paramount for the successful purchase of 0.01 ethereum at the best price. To open an account, users should ensure that their identity and account security are priority by gathering several types of information to verify their identity. This may include:

- A government-issued photo ID such as a driver’s license or passport

- Proof of residency such as a utility bill or bank statement

- Personal details such as name, address, date of birth, and email address

- Contact information such as phone number or Skype username

The compilation of these documents will allow users to create a secure account on any cryptocurrency exchange platform in order to successfully purchase 0.01 ethereum at the best price available. Having this information readily accessible ensures that when verifying one’s identity, it can be done quickly and accurately, allowing them to move forward with their crypto purchases in an efficient manner.

Verifying your identity

Verifying one’s identity is an important step in the process of purchasing cryptocurrency, requiring users to symbolically demonstrate their trustworthiness in order to make secure transactions. This involves providing personal information such as a name, address, telephone number and a valid form of identification (e.g., driver’s license). This information is used to check against a database that will verify whether or not the user is who they say they are and prevent any cases of identity theft. Additionally, most exchanges have strict privacy policies in place that protect the user’s data from being accessed by third parties without permission. By verifying one’s identity, users can ensure that their purchase of cryptocurrency will be safe and secure while also protecting themselves from potential fraud or other malicious activities. To further ensure safety when making purchases online, it is important for users to fund their account before attempting to buy Ethereum at the best price.

Fund Your Account

Funding your account is an important step when buying Ethereum. There are different payment methods to use, such as debit and credit cards, bank transfers or e-wallets. Depending on the method chosen, fees and charges may vary so it is important to be aware of any potential costs before completing a transaction. It is also necessary to ensure that the payment method chosen allows for international transactions if purchasing from an overseas exchange.

Different payment methods

When purchasing 0.01 Ethereum, there are a variety of payment methods available to facilitate the transaction. These include:

- Paypal options

- Bank transfers

- Credit/Debit cards

- Cryptocurrency wallets

Given the variety of ways to pay for Ethereum, it is important to note that different payment methods may come with various fees and charges associated with them. It is beneficial to research these additional costs before making any purchases in order to ensure that the best price has been found.

Fees and charges

It is important to understand the fees and charges associated with different payment methods before making a purchase of Ethereum, in order to ensure the most cost-effective transaction. Security measures are often required when purchasing Ethereum, as it is an extremely valuable asset. This could include verifying identity information or providing additional forms of authentication. Transaction costs can also vary depending on the payment method chosen and may involve paying service fees, processing fees, or other costs associated with using a specific platform or vendor. Understanding these extra charges will help consumers make an informed decision about which payment option best fits their needs while minimizing costs. Furthermore, individuals should keep in mind that some platforms might not support certain currencies or payment methods, so they should research this prior to making a purchase. Overall, familiarizing oneself with the various fees and charges associated with each potential purchase method is essential for ensuring that one achieves the most cost-effective outcome when buying Ethereum. With this knowledge in hand, individuals can move forward in their search for finding the best price available for acquiring 0.01 ETH.

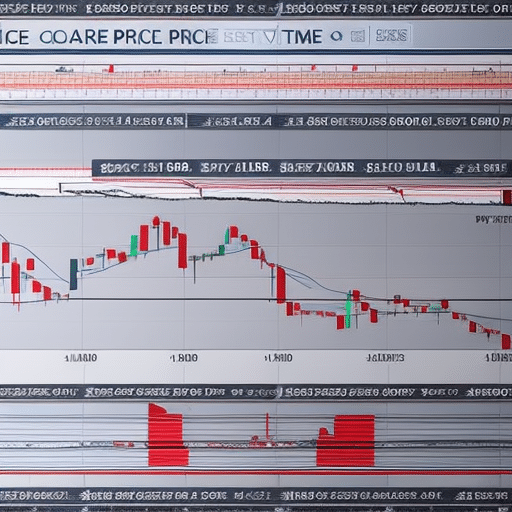

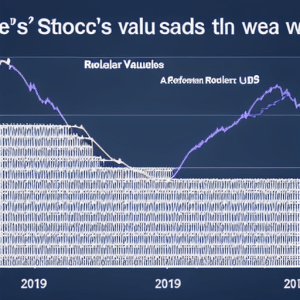

Find the Best Price

Analyzing the market trends can reveal the best price to purchase 0.01 ethereum. For example, data from the past year reveals that fluctuating prices in June 2020 saw the cost of one ethereum rise above $300 for several days before settling at a slightly lower rate. In order to make an informed decision when buying 0.01 ethereum, traders must be aware of various trading strategies and buying limits. Here are some key points to consider:

- Evaluate current market conditions and understand how they might affect pricing

- Use technical analysis tools such as charts and indicators to identify entry and exit points

- Consider placing limit orders so you don’t pay too much for your desired amount of crypto

- Develop a risk management strategy that fits your trading goals and style. By understanding these concepts, traders can find the best price when purchasing 0.01 ethereum on any exchange or platform they choose. From there, they can move forward with their purchase, confident in getting the most value out of their investment.

Place an Order

Once a trader has determined the best price to purchase 0.01 of a given cryptocurrency, they can then proceed with placing an order to complete the transaction. When placing an order, traders must ensure that security measures are in place to protect their transactions and funds. This includes verifying pricing models such as market orders or limit orders so that traders receive the best value for their money when purchasing Ethereum.

The table below outlines the various pricing models available for buying Ethereum and their respective advantages:

| Pricing Model | Advantages | Disadvantages |

|---|---|---|

| Market Order | Quick | Low control |

| Limit Order | High control | Long wait times |

| Stop Loss Order | Controls losses | Slow execution |

Using these different pricing models, traders can find the most suitable option that meets their specific needs before proceeding with placing an order for 0.01 of Ethereum. With this information, traders are able to transfer Ethereum securely and efficiently to a wallet of their choice after completing the transaction.

Transfer Ethereum to a Wallet

After placing an order, traders can transfer Ethereum safely and quickly to a chosen wallet. The important security measures that must be followed for wallet storage should not be overlooked. Traders should always use multiple wallets to store their cryptocurrency and regularly back up their data. Additionally, some wallets offer additional encryption features that can add extra layers of security when storing Ethereum. These multiple layers of security are essential for protecting the digital currency against any malicious attacks or hacks. It is also recommended that traders keep track of their transactions in order to better monitor the price fluctuations and movement of their assets. By doing so, traders can ensure that they are making informed decisions about how to manage their investments. Transitioning into the next step, traders should regularly monitor the price of Ethereum in order to maximize profits and mitigate losses.

Monitor Ethereum Price

Now that Ethereum has been transferred to a wallet, the next step is to monitor its price in order to buy it at the best possible rate. Analyzing trends and understanding volatility are key steps in monitoring Ethereum’s price. To do this effectively, there are several tactics that can be employed:

- Monitoring market news for updates on how current events may impact Ethereum’s price

- Making use of technical analysis tools such as charting and indicators to identify potential buying opportunities

- Utilizing cryptocurrency exchanges and tracking services like CoinMarketCap to compare prices across different markets

- Keeping an eye on social media platforms for insights into sentiment towards Ethereum

- Keeping up with relevant research papers from experts in the field of blockchain technology

By utilizing all of these methods, one can get a better picture of how Ethereum’s price may move over time and make informed decisions when buying or selling. With this knowledge in hand, it is now possible to proceed with purchasing Ethereum.

Buy Ethereum with Other Cryptocurrencies

With the potential for price fluctuations, it is wise to consider alternative methods of acquiring Ethereum that may provide greater flexibility. Two options include Ethereum mining and trading cryptocurrency.

| Ethereum Mining | Cryptocurrency Trading |

|---|---|

| Proof of Work process using specialized hardware to solve math problems | Exchange fiat currency or other cryptocurrencies for Ethereum with an online platform |

| Reward in form of Ether tokens | Price determined by market demand and supply |

| Can be expensive due to cost of hardware, electricity bills, etc. | Provides more control over purchase decisions due to real-time information on prices |

Ethereum mining and cryptocurrency trading both offer advantages that must be weighed against each other when considering purchasing Ethereum at the best possible price. Transitioning into the next section about using trading platforms to automate buying and selling will allow readers to further explore these different options.

Use Trading Platforms to Automate Buying and Selling

Investing in Ethereum can be done through automated trading platforms that execute buying and selling orders on behalf of the investor. Automated trading allows investors to generate profits and manage risk more effectively than manual trading, by using algorithms to analyze market data and execute trades accordingly. This method is also convenient for those who are busy or lack the expertise required for manual trading. The following are a few advantages of using automated trading platforms:

- Increased efficiency: Automated trading systems can quickly process large amounts of data to identify trends and take advantage of profitable opportunities without human intervention.

- Better risk management: Automated systems can be programmed to follow specific strategies or rules, such as stop-loss orders that limit potential losses from adverse price movements.

- Low latency: Automated systems have faster execution speed than humans, reducing the amount of time between when an order is placed and executed in the market.

- Cost savings: With automated trades, there is no need for brokers or other intermediaries resulting in lower transaction costs compared to traditional methods.

Automated trading has become a widely used tool among cryptocurrency traders, especially for those looking to optimize their performance while minimizing risk associated with manual trades. To ensure a successful investing experience with cryptocurrencies such as Ethereum, it may be prudent to consider a peer-to-peer exchange as the next step towards secure investments with minimal fees and effortless transactions

Consider a Peer-to-Peer Exchange

Considering the benefits of automated trading, it may be beneficial to explore further options such as a peer-to-peer exchange; but what makes this an attractive choice? Peer-to-peer (P2P) exchanges are platforms that allow users to buy or sell cryptocurrencies directly with each other, without relying on a third party. This can be seen as advantageous for those who want more control over their transactions since they no longer have to rely on centralized exchanges which present higher risk concerning security and privacy. Furthermore, P2P exchanges make use of blockchain technology which ensures transactions remain secure and immutable, allowing for faster transaction times and lower fees than traditional exchanges.

The following table provides an overview of the main advantages of using a peer-to-peer exchange:

| Advantages | Disadvantages |

|---|---|

| More control over transactions | Security threats due to anonymity |

| Lower fees than traditional exchanges | Difficulty in obtaining cryptocurrency without paying high prices |

| Faster transaction times & greater privacy | Limited availability in certain countries |

| Secured by blockchain technology & smart contracts | Difficult setup process due to technical requirements |

Overall, P2P exchanges offer several advantages compared to other methods when it comes to buying and selling Ethereum at the best price. However, there are some drawbacks that should be taken into consideration before making a decision. With that said, it is important to weigh the pros and cons carefully before choosing between different platforms. By doing so one can ensure they make an informed decision when looking for the best way to purchase Ethereum at the lowest cost available. Moving forward, it may also be beneficial for users to consider decentralized exchanges as another option for buying or selling Ethereum at competitive prices while taking advantage of crypto security features offered by blockchain technology.

Use Decentralized Exchanges

Decentralized exchanges are an appealing alternative to consider for those seeking an efficient and secure way of trading cryptocurrencies. Decentralization benefits include the fact that transactions are done directly between users, meaning there is no central authority or third-party intermediary involved. As such, it eliminates many potential security risks associated with other types of exchanges. Furthermore, decentralized exchanges have strong security measures in place such as two-factor authentication (2FA) which further enhances user protection when trading on the platform. Additionally, these platforms make use of advanced encryption technologies that ensure data privacy and anonymity while transacting. Thus, using a decentralized exchange can offer a greater level of safety than traditional methods of exchanging cryptocurrency. This makes them ideal for those seeking to purchase small amounts like 0.01 ethereum at the best price without compromising on security or trustworthiness.

Use an OTC Exchange

OTC exchanges offer a viable option for those looking to purchase cryptocurrency without sacrificing security or trustworthiness. OTC regulations and safety protocols are often more stringent than on traditional exchanges, making them ideal options when seeking to buy 0.01 ethereum at the best price. Furthermore, OTC exchanges employ several security measures such as two-factor authentication and cold storage wallets for maximum protection of customer assets. All of these factors make an OTC exchange a reliable method for purchasing cryptocurrency with confidence that it is being done securely and in full compliance with applicable laws and regulations. As a result, users can rest assured that their transactions are secure, private, and conducted in accordance with all relevant guidelines. In conclusion, using an OTC exchange is beneficial in terms of both cost savings and security when looking to buy 0.01 ethereum at the best price; consequently, it is worth considering when researching various methods of acquiring digital currency. With this information in mind, investors may want to consider other options such as Ethereum futures before deciding which avenue is most suitable for their needs.

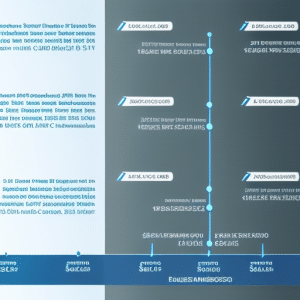

Consider Ethereum Futures

Having discussed the use of an OTC Exchange to buy 0.01 Ethereum at the best price, another option to consider is Ethereum Futures trading. This type of trading allows investors to speculate on the future price movements of Ethereum and can be done through spread betting or through contracts for difference (CFDs).

When engaging in futures trading, it is essential that investors understand what they are getting into and the risks associated with it. When investing in Ethereum through this method, traders should be aware of three key points: 1) Futures contracts have expiration dates that must be monitored; 2) Margin requirements can be high; 3) Leveraged positions may result in losses greater than the initial investment. Therefore, it is important to research and understand the potential risks before entering into any kind of futures contract on Ethereum. With a better understanding of these risks, investors can make more informed decisions about how they choose to invest in Ethereum going forward. To ensure a successful investment experience, it is important to also understand the potential rewards as well as potential pitfalls when investing in Ethereum via Futures Trading before making any trades. From here we can move on to discussing ways one might better understand the risks associated with investing in cryptocurrency generally.

Understand the Risks of Investing in Ethereum

Investors need to be aware of the potential risks associated with investing in Ethereum, which can include expiration dates, margin requirements, and leveraged positions. Risk profiles must be assessed when considering any investment decision and an understanding of market trends is essential for successful investments.

| Risk Factor | Description | Potential Solutions |

|---|---|---|

| Expiration Dates | The date at which a contract or option expires. | Research industry standards and ensure that the correct expiration date is chosen for the particular situation. |

| Margin Requirements | The minimum amount of collateral required by a broker from a trader in order to cover potential losses on trades made. | Set appropriate risk limits and leverage levels that are within investor’s financial comfort zone. |

| Leveraged Positions | A financial position taken by investors where they borrow money from brokers in order to increase their buying power in the markets. | Monitor performance regularly and adjust positions as necessary if conditions become unfavorable. |

Risk management strategies should be employed before investing any capital into Ethereum to ensure that there is sufficient protection against potential losses due to market volatility or other unanticipated events. Appropriate research should also be conducted so that investors have an understanding of how specific market trends may affect their investments over time.