You may have heard of Ethereum, one of the leading cryptocurrencies in the world.

But do you know how its price has fluctuated over time?

In this article, we’ll be taking a look at the historical comparison between Ethereum and Bitcoin, as well as exploring some of the factors that have influenced Ethereum prices throughout history.

We’ll also be giving our predictions on what the future holds for Ethereum.

So, if you’re interested in learning more about Ethereum’s price history, keep reading!

Ethereum Price Overview

Ethereum’s price has had its ups and downs, but it’s still a popular crypto, so let’s take a look at its price history! Ethereum is currently the second-largest cryptocurrency in terms of market capitalization.

It was first released in 2015 and started trading at around $2. It rose to its all-time high of $1,432 in January 2018 and has since dropped to around $400.

The price of Ethereum has been volatile, making it difficult to predict its future direction. Ethereum’s price is affected by a range of factors, including news about the blockchain technology, global economic events, and the performance of other cryptocurrencies.

Analysts have used a variety of techniques to try and predict the future price of Ethereum, but the results have been mixed. Ethereum remains a popular choice among traders and investors, and its price is likely to remain volatile in the future.

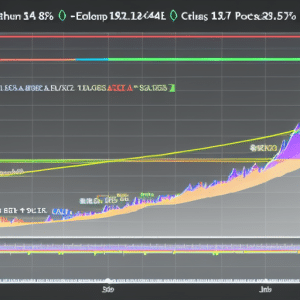

Historical Comparison with Bitcoin

Comparing crypto prices can be tricky, but it’s worth noting that Ethereum has often been on par with Bitcoin over the years.

Ethereum’s price has followed a similar trajectory to Bitcoin’s since its inception, and continues to do so today.

Ethereum and Bitcoin have had their differences, such as the block size debate, but Ethereum seems to be gaining traction as an investment asset similar to Bitcoin.

This is evident in the fact that Ethereum’s price has often been on par with or higher than Bitcoin’s over the past few years.

It’s also worth noting that Ethereum’s market capitalization has grown significantly since its launch, and currently stands at around $21 billion.

As more people become interested in cryptocurrencies, the value of Ethereum is likely to rise even further.

Historical Record of Ethereum Prices

Taking a look at Ethereum’s historical record, we can see that its value has seen some impressive highs and lows over the years. Ethereum’s launch price was around $2.83 in July 2015, and it reached its peak at $1,432.88 in January 2018. This was an incredible increase in value, and it showed that Ethereum could be a valuable asset for investors.

Since then, Ethereum’s price has been volatile, reaching its bottom in December 2018 at $83.87. However, it has since recovered and currently trades at around $360. Ethereum has also been subject to wide price swings, with some days seeing drops of over 20%.

Overall, Ethereum is a relatively new asset, and its price history is still being written.

Factors Impacting Ethereum Prices

You may have noticed that Ethereum prices can be affected by a range of different factors. These include changes in the supply of Ethereum, shifts in investor sentiment, regulatory developments, and macroeconomic trends.

For example, if the supply of Ethereum increases, then prices tend to drop. Additionally, if there’s an increase in investor sentiment, this can lead to an increase in prices.

On the other hand, if there are any changes in regulations that make it difficult for people to purchase Ethereum, this can have a negative effect on the prices. Finally, macroeconomic trends can also have an impact on Ethereum prices.

For instance, if there’s an economic downturn, then investors may be less inclined to invest in Ethereum, leading to a decrease in prices.

Ethereum Price Predictions

Looking ahead, predicting Ethereum prices can be a tricky endeavor. Factors such as geopolitical uncertainty, shifts in market sentiment, and increasing regulatory pressures can all have an impact on the price of Ethereum.

Analyzing past trends and developments can help inform forecasts and predictions for Ethereum’s future price movements.

It’s important to note that no one can predict the future with certainty. As such, it’s best to approach any Ethereum price predictions with a healthy dose of skepticism. It’s also important to keep in mind that Ethereum is a highly volatile asset, and price movements can be unpredictable.

As a result, it’s wise to diversify any investments and manage any potential losses.

Conclusion

You’ve seen the ups and downs of Ethereum’s price history and its comparison with Bitcoin. Factors like the demand for Ethereum, the number of transactions, and the speculation of the market all play a role in determining Ethereum prices.

While it’s difficult to predict what Ethereum prices will be in the future, it’s clear that Ethereum is here to stay and will remain a major player in the cryptocurrency market. With its unique advantages, Ethereum could become even more valuable in the years to come.