Are you interested in learning more about Ethereum’s price history?

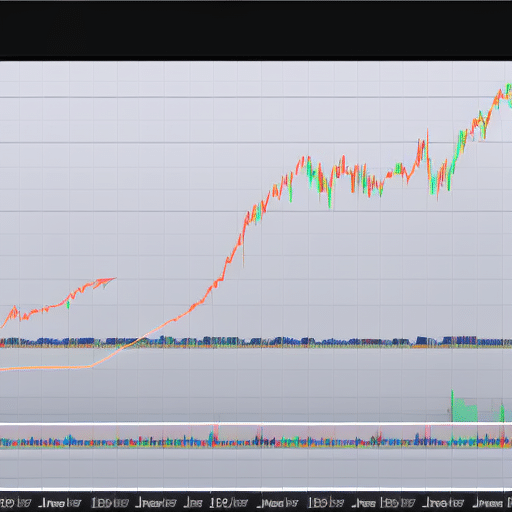

Then you’ve come to the right place! Ethereum has experienced its share of highs and lows since it first emerged in 2015 – and we’re here to take you through its entire price history chart.

You’ll get to find out about the early years of Ethereum, its historic price drops, the bull run of 2017, the 2018 downturn, and recent price trends.

So buckle up and let’s go on an adventure through Ethereum’s price history!

Early Years of Ethereum

Ethereum’s early years were a wild ride, and you couldn’t have predicted the success it would have today!

Ethereum’s development began in 2013 by Vitalik Buterin, a programmer from Toronto. He proposed a decentralized platform which would be powered by Ethereum’s native token, Ether.

Ether’s initial offering was in July 2015, with a price of $2.83 per token.

In 2016, Ethereum’s price started to take off, reaching a high of $14.20 in June and closing out the year at $8.17.

2017 marked a major turning point for Ethereum, as its price skyrocketed to an all-time high of $1,400. The success was driven by Initial Coin Offerings (ICOs), which had become a popular way to fund blockchain projects.

The market cooled off in 2018, with Ethereum’s price dropping to around $100. Since then, Ethereum’s price has been slowly climbing, with a current price of around $2,000.

Historic Price Drops

The cryptocurrency’s value has plummeted several times over its lifetime. Ethereum has seen some of the most extreme price drops of any cryptocurrency.

In June 2017, the price of Ethereum dropped to around $13 USD, nearly 95% lower than the high of $400 USD it had been just two months earlier.

In November 2018, the currency hit its all-time low of $83 USD. The market crash of 2018 saw the value of Ethereum alongside other cryptocurrencies drop significantly.

Many experts attribute this crash to the overvaluation of many altcoins, which caused investors to lose confidence in the market.

The price of Ethereum has since recovered, but these drops still remain in its history.

The Bull Run of 2017

Riding the wave of optimism in the cryptocurrency market, Ethereum experienced a bull run in 2017 that sent its price soaring. The spike began in mid-June, with ETH hitting an all-time high of US$407.10 on June 12.

This was followed by a brief lull in July before an even greater surge took place in August, pushing the price to a peak of US$483.55 on August 14. After this, the price of ETH dropped off slightly, but remained strong, hovering around the US$400 mark for the rest of the year.

This marked a substantial increase compared to the price of ETH at the start of 2017, which was US$8.

The bull run of 2017 showed that Ethereum had attracted the attention of major investors, with the surge being driven by increased demand from institutional investors. As the market grew, more and more businesses began to accept Ethereum as a form of payment, further driving up the demand for ETH.

This in turn had a positive effect on the price, as the demand for ETH continued to increase. This surge in demand was also driven by the increasing popularity of Ethereum-based applications and platforms, such as Decentralized Applications (DApps).

All of this combined to create the bull run of 2017, which saw Ethereum’s price skyrocket to unprecedented levels.

The 2018 Downturn

After the 2017 bull run, you experienced a sharp downturn in 2018 as demand for Ethereum decreased. This marked the end of the bullish trend that had been observed in the months prior, and the price of Ethereum dropped to a low of around $83 in December 2018.

The market was incredibly bearish, with no sign of an impending reversal of the downturn. This was largely due to the prolonged bear market of 2018, which saw a decrease in the number of new Ethereum users and a reduced interest in the technology from the broader public.

The downturn was further exacerbated by the crashing of the cryptocurrency market, which saw the price of Bitcoin plummeting to as low as $3,000 in December 2018. As a result, Ethereum prices were dragged down with the rest of the market, and the value of the coin dropped to a low of $83 in December 2018.

Recent Price Trends

You’re likely wondering what recent trends have been happening with Ethereum’s price – and the answer is that it’s been on an upward trajectory since late 2018.

Ethereum’s price has been steadily increasing since the beginning of 2019, with a major surge in late April and a slight drop in late May. Ethereum is currently trading at around $215, which is still above the price it was trading at the beginning of the year. This is a positive sign for Ethereum investors, as it suggests that the current upward trend may be sustainable.

The Ethereum network has been growing in popularity as well, with more users and developers using the network than ever before. This has helped to drive the demand for Ethereum, which has in turn been driving the price up. This increased demand is also a sign that Ethereum may be a good investment for the long-term, as the demand is likely to remain strong.

Ethereum’s price could potentially continue to rise over the coming months and years, making it a smart investment for those looking to diversify their portfolios.

Conclusion

It’s been a wild ride for Ethereum since its inception. After its initial launch, the price dropped significantly, only to be followed by a major bull run in 2017.

Unfortunately, 2018 brought a downturn, but the price has been relatively stable in recent months. All things considered, Ethereum’s price history has been a roller coaster, but it’s still seen as a major player in the cryptocurrency world.

Ethereum’s future is uncertain, but its past has proven that it can survive in the long-term. Who knows what the future holds for Ethereum, but it’s sure to be an interesting ride.