Ethereum is a decentralized, open-source blockchain platform that enables users to create and deploy applications. It is the most popular platform for building smart contracts and decentralized applications. Ethereum has been gaining popularity over recent years due to its ability to facilitate the transfer of money, property, and assets without involving third parties or intermediaries. As a result, it has become one of the most valuable cryptocurrencies in terms of market capitalization. In this article, we will analyze factors influencing Ethereum price predictions for 2023 and provide tips on investing in Ethereum.

Due to its unique properties such as privacy, security, and low transaction costs, Ethereum’s value has grown exponentially since its launch in 2015. Its market capitalization grew from less than $1 billion at launch to more than $150 billion today. Analyzing various factors that could affect Ethereum’s future price can help investors make informed decisions when investing in Ethereum. Factors such as economic conditions, technological advancements, competition from other cryptocurrencies, adoption rates by merchants and consumers are all important considerations when making investment decisions related to cryptocurrency markets.

Key Takeaways

- Conduct thorough market research and understand potential risks before investing in Ethereum in 2023.

- Diversify your investment portfolio by investing in multiple coins or tokens to reduce risk.

- Analyze industry news and trends to gain insight into Ethereum’s potential worth in 2023.

- Assess potential risks associated with cryptocurrency investing, such as technological, regulatory, and liquidity risks.

Overview of Ethereum

Ethereum, the second largest cryptocurrency by market capitalization, was developed in 2015 as an open-source platform for decentralized applications and smart contracts. Ethereum has become one of the most popular cryptocurrencies due to its ability to execute transactions quickly and securely. The blockchain technology behind Ethereum allows users to create their own secure decentralized applications and smart contracts without having to rely on any third-party services or middleman. In addition, the use of tokens can facilitate payment between parties in a fast and efficient manner. As Ethereum continues to gain more traction in the cryptocurrency markets, its price may be affected by various external factors such as market sentiment, government regulations, and media coverage. To predict Ethereum’s future price accurately requires an analysis of these factors that could potentially affect it.

Factors Affecting Ethereum Price

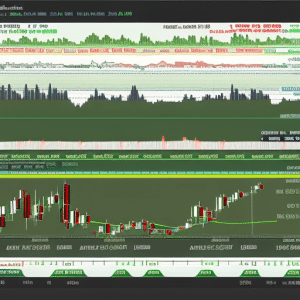

The price of Ethereum is influenced by various factors, such as supply and demand, regulations, technological developments, and network adoption. Supply and demand are the primary forces that drive the market for any asset or commodity and in this case applies to Ethereum. Regulations that govern its use can also affect the price of Ethereum; depending on how it is regulated in certain countries or jurisdictions it can become more or less attractive to investors. Technological developments can have a major impact on the price of Ethereum as well; if new features are added to improve usability or new applications are built on top of the blockchain technology, then this could create additional demand for Ether tokens. Finally, network adoption is also an important factor that affects the value of Ether; as more people become users of decentralized applications (dApps) built on top of Ethereum’s blockchain technology, there could be an increase in demand for Ether tokens.

Supply and Demand

Demand for Ethereum is expected to continue to increase in the next few years, especially considering its current market cap of over $41 billion as of 2021. The supply and demand of Ethereum is largely determined by token economics and miner rewards. Token economics refers to the rules governing the issuance and circulation of tokens within an ecosystem, while miner rewards are compensation paid out to miners participating in mining activities on a blockchain network. In particular, the reward for miners has long been one of the key components that determine the price trend of Ethereum since it was proposed by Vitalik Buterin in 2013. With limited supply and increasing demand, longer-term investor interest could drive up prices for Ethereum going into 2023. This could be further influenced by other factors such as regulations or technological advancements that may impact its usability or value proposition over time.

Regulations

Regulations have the potential to significantly impact Ethereum’s future, potentially leading to a variety of outcomes depending on their nature and scope. Regulatory compliance for cryptocurrency markets is often a challenge as these markets are decentralized and lack the oversight of traditional financial regulations. This may lead to either an increase in demand as it creates confidence in investors, or a decrease in demand due to overly strict measures that limit the growth of Ethereum by discouraging investment. The financial implications of regulations are also something that must be taken into account when predicting Ethereum’s price for 2023; if the cost of compliance is too high, it could lead to a decrease in value throughout the market. Moreover, new regulatory measures could cause rapid fluctuations in price which would further complicate any predictions made about Ethereum’s price in 2023.

Technological Developments

Technological developments can have a profound impact on the future of cryptocurrency markets, with potential implications for investors and market stability. Smart contracts, scalability challenges, and blockchain technology are all key elements of Ethereum’s system that will need to be addressed in order for it to reach its full potential. These technologies are an integral part of how Ethereum works and any changes or advances made in these areas could have substantial impacts on the price of ether.

Ethereum’s success is also dependent upon network adoption and usage. The more people who use or invest in Ethereum-based applications or products, the more value will be placed on ether as a currency. As such, increased adoption should result in higher demand for ether which may ultimately lead to a higher price prediction for 2023. It is important to note that there is still much uncertainty around the actual trajectory of Ether prices due to various factors including technological advancements and regulations.

Network Adoption

Adoption of Ethereum-based applications and products is essential for the success of cryptocurrency markets, particularly in regards to market stability. The ability to facilitate decentralized finance (DeFi) projects and services on the Ethereum blockchain has been a major driver of network adoption, despite scalability challenges that have made it difficult for the platform to process large numbers of transactions. As more people come to rely on DeFi services and other Ethereum-based products, this will lead to increasing demand and greater stability for the cryptocurrency market as a whole. This increased demand can be seen in various metrics such as trading volume, transaction fees, and price appreciation which could all help determine ethereum price predictions for 2023.

Ethereum Price Predictions for 2023

Forecasting the future Ethereum price in 2023 is a highly speculative endeavor, as the cryptocurrency market is known for its high volatility. Market trends and crypto volatility can provide some insight into potential price movements; however, predicting an exact figure is virtually impossible. A few factors that could influence Ethereum prices in 2023 include: 1) The number of developers working on the project 2) The degree of mainstream adoption 3) Government regulations 4) Technological advancements related to Ethereum’s blockchain technology. All these points must be taken into consideration when attempting to project what the Etherum price may look like in 2023. As such, it is important for investors to weigh all these variables carefully before investing in Ethereum. Additionally, understanding current market conditions and having knowledge of cryptocurrencies are essential if one wishes to make informed decisions about their investments. With this information in hand, investors can better prepare themselves for whatever may come and make wise investments decisions accordingly.

Tips for Investing in Ethereum

Investing in Ethereum has the potential to yield a high return on investment, but it is important to understand that there are risks associated with this type of venture. Before investing, researching the market and understanding the potential risks involved is necessary. Additionally, diversifying one’s portfolio by investing in multiple coins or tokens can reduce risk and help protect investors against any potential losses.

Research the Market

Examining the market for Ethereum in 2023 is essential for predicting its price. It is important to understand user sentiment, blockchain scalability, as well as other factors related to Ethereum and the cryptocurrency market in general. Analyzing industry news and trends can give investors an idea of what Ethereum could be worth over the next few years. Evaluating data from previous years can help provide insight into how the market may react under different circumstances. Additionally, studying the performance of other cryptocurrencies can help forecast potential fluctuations in Ethereum prices. By looking at these metrics, investors can gain a better understanding of how their investments will perform before committing their money. Understanding these risks ahead of time is key to making informed decisions about investing in Ethereum for 2023 and beyond.

Understand the Risks

Assessing the potential risks associated with cryptocurrency investing in 2023 is essential for making informed decisions. Crypto security and blockchain technology play an integral role in predicting the future of Ethereum price in 2023, as these trends will affect the volatility and stability of its value. It is important to note that there are numerous forms of risk involved when investing in cryptocurrencies like Ethereum, including technological, regulatory, and liquidity risks. Investing blindly into any asset carries a certain degree of financial risk regardless of how long-term or short-term the investment may be. As such, it is important to not only understand the current market but also have a clear understanding of all potential risks that could arise before making an investment decision regarding Ethereum in 2023. Taking measures to diversify one’s portfolio can help minimize overall risk exposure while still allowing investors to achieve their desired return on investment goals.

Diversify Your Portfolio

Considering diverse investment strategies can help mitigate potential risks associated with cryptocurrency investing in 2023. Tokenization strategies and investment diversification are key to successfully managing any crypto portfolio in the upcoming year.

In terms of tokenization, investors should consider different types of tokens for their portfolio, such as utility tokens that provide access to various services or security tokens that represent a share in an underlying asset or company. By diversifying investments across several blockchain networks, investors can reduce risk while also taking advantage of market movements. Additionally, investors should be mindful about the nature of the project they invest in and its expected performance over time. This is especially important when it comes to Ethereum price predictions for 2023; if a project’s fundamentals do not justify its expected returns, then investors should reconsider their investments accordingly.

Frequently Asked Questions

What is the best way to store Ethereum?

Secure storage of Ethereum is best achieved by utilizing the latest security protocols and scalability solutions. The cryptocurrency market is volatile and requires expertise in order to properly manage risk. The most reliable option for storing Ethereum is through a trusted wallet provider which implements the latest security measures.

How is Ethereum different from other cryptocurrencies?

Ethereum stands out from other cryptocurrencies with its ability to support smart contracts and decentralized applications, making it a powerful tool for developers. Its unique features make it an attractive investment opportunity for those with analytical expertise in the cryptocurrency markets.

Are there any risks associated with investing in Ethereum?

Investing in Ethereum carries risks, such as volatility and the complexity of smart contracts and blockchain technology. Investors require analysis and expertise to understand the cryptocurrency market for informed decision-making.

How does Ethereum mining work?

Cryptocurrency mining utilizes specialized hardware to compute complex mathematical equations, verifying transactions and rewarding miners with Ethereum tokens. Mining requires electricity to operate the hardware, which is offset by transaction fees paid by users for their transactions. Understanding the details of mining and its associated costs can help inform an analytical approach to predicting Ethereum market prices.

What is the potential for Ethereum to be adopted by businesses?

Ethereum has potential to be widely adopted by businesses due to its ability to provide smart contracts and decentralized finance. With its expertise in cryptocurrency markets, it could prove a valuable asset for businesses seeking secure, transparent transactions.