Ethereum is a popular cryptocurrency, second only to Bitcoin in terms of market capitalization. It has been around for several years and is one of the most widely traded digital assets on the market today. In this article, we will examine Ethereum’s current price, its market cap, its drivers, and predictions for future prices. We will also explore factors that influence price volatility as well as compare Ethereum’s performance to Bitcoin and other cryptocurrencies. Additionally, we will analyze how Ethereum’s price compares to USD over time. Through this analysis, readers can gain an understanding of how Ethereum is currently performing and what might be expected in the future.

Key Takeaways

- Recent developments in the cryptocurrency marketplace are impacting Ethereum’s price.

- Increased difficulty in mining Ethereum is affecting miners’ profitability.

- Changes in Ethereum’s price are influencing decentralized applications (dApps) on the platform.

- Investors need to stay updated on Ethereum price movements to make informed decisions.

Ethereum Price Overview

Ethereum prices have seen a significant increase over the past several months, with an overall increasing trend in the market. This is due to increased demand for Ethereum tokens as more entities take advantage of its blockchain technology and crypto mining capabilities. The rise in price has been mirrored by a corresponding increase in Ethereum’s market capitalization, as investors seek out cryptocurrency investments that are likely to yield higher returns. In addition, Ethereum’s decentralized nature offers users greater privacy than traditional financial systems, making it an attractive option for those seeking anonymity. As more entities explore the potential of Ethereum, its price should continue to rise in tandem with increasing market capitalization. Transitioning into this trend is the emergence of new use cases for Ethereum such as smart contracts and non-fungible tokens (NFTs). These applications have further driven up demand for Ethereum tokens and boosted its price even further.

Ethereum Market Cap

The current market capitalization of Ethereum has demonstrated a remarkable surge, creating optimism among investors. According to recent data, mining rewards have increased significantly, allowing the altcoin prices to skyrocket. This surge in mining rewards and altcoin prices has directly contributed to the increase in Ethereum’s market capitalization. Furthermore, this trend is expected to continue as Ethereum developers have introduced new features that are projected to further bolster its value. As such, there is considerable enthusiasm amongst investors for Ethereum’s potential growth and future prospects.

With these developments driving up the price of Ethereum, it remains an attractive investment option despite its volatility. This notion is supported by a number of analysts who believe that if used correctly, investors can reap significant returns from their investments in this digital asset. Thus, while speculative trading could still be risky, those who take a measured approach with their investments could benefit from the increasing popularity of Ethereum in the near future. Transitioning into the next section about ‘ethereum price drivers’, further analysis can help traders understand how various factors influence the value of this digital asset.

Ethereum Price Drivers

Like a giant wave in the ocean, Ethereum prices are driven by various factors that can cause them to rise and fall. These drivers include changes in the Ethereum supply levels, as well as gas fees associated with transactions made on the network. The Ethereum supply is limited by design; however, new coins are released through mining rewards and other incentives. This means that an increase in demand for Ether can put upward pressure on its price. Gas fees also play an important role in driving up or down Ethereum’s price, as they represent transaction costs related to executing smart contracts on the blockchain. High gas fees can signal increased demand for transactions on the blockchain, which leads to higher prices for Ether. Conversely, low gas fees may indicate lower usage of the network and thus a decrease in its value. In conclusion, both Ethereum supply and gas fees have significant influence over its pricing dynamics and should be closely monitored when predicting future values of Ether. With this knowledge firmly established, it is time to turn attention towards making Ethereum price predictions.

Ethereum Price Predictions

Predictions of Ether’s future value depend on a multitude of factors, such as mining effects and supply dynamics. Ethereum is an open-source blockchain-based platform that facilitates the use of smart contracts and decentralized applications (dApps). As with any cryptocurrency, the price of Ethereum is largely driven by market forces, which include speculation, supply and demand dynamics, as well as news events. Mining also plays a major role in determining ETH prices. The more miners involved in processing transactions on the Ethereum network, the higher its potential to increase in value. In addition, changes to the underlying technology can have an immediate impact on prices either positively or negatively depending on investors sentiment towards them. As such, it is difficult to make accurate predictions about Ether’s future value due to its volatility and ever-changing nature. This makes predicting price movements highly speculative and risky; however, those willing to take risks may be rewarded handsomely if they get their forecasts right. With this in mind, understanding volatility is key for anyone wishing to invest or trade Ether successfully.

Ethereum Price Volatility

Volatility is a crucial factor that can significantly influence Ethereum’s future value, making it an important consideration when assessing the cryptocurrency’s projected worth. Price movements of Ethereum tend to be highly dependent on market supply and demand forces. Unpredictable market trends often lead to rapid and unexpected price fluctuations, resulting in a volatile exchange rate. This volatility has consequences for both buyers and sellers, as large shifts in the value of Ethereum can cause significant losses or gains. As such, understanding how the price of Ethereum may fluctuate over time is essential for any investor looking to capitalize on its potential gains while minimizing their risk exposure. The next step is to examine Ethereum’s correlation with other currencies, commodities, and indices to gain insight into its performance against traditional markets.

Ethereum Price Correlations

Analyzing the correlation between Ethereum and other financial instruments can provide insight into the cryptocurrency’s potential future performance. On a basic level, Ethereum prices are largely affected by demand and supply in the same way as other assets. As such, correlations between Ethereum and other financial instruments can be used to gain an understanding of how these factors may affect its price going forward. An analysis of price correlations with gold, bitcoin, and US stocks reveals that Ethereum is positively correlated with all three. This suggests that increases in the value of any of these three assets could have a positive impact on the value of Ethereum in future. Additionally, while its correlation with gold has been relatively stable over time, it has become more highly correlated with bitcoin and US stocks over recent years. This indicates that investors are increasingly viewing Ethereum as being similar to these two asset classes which could result in increased investment opportunities for those looking to diversify their portfolios beyond traditional investments.

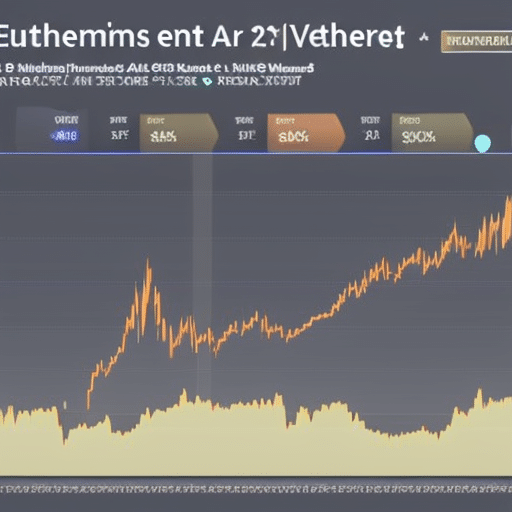

Ethereum Price Technical Analysis

Technical analysis of Ethereum’s pricing behavior can provide valuable insight into the direction of its future movements. Analytical tools such as altcoin comparison and mining rewards may help to better understand the dynamics driving Ethereum’s price movements. By understanding and considering these factors, investors can make more informed decisions regarding their investments in the cryptocurrency. Additionally, technical analysis can be used to identify potential buy or sell signals when trading Ethereum. This type of analysis involves looking at charts and indicators for signs that prices are likely to rise or fall in the near future. Such insights are useful for both long-term investing strategies as well as short-term strategies for active traders. With this knowledge, investors can position themselves to take advantage of market opportunities that may arise from changes in Ethereum’s price behaviour. As such, technical analysis is an important tool when it comes to making successful trades on Ethereum markets.

Ethereum Price News Today

Recent developments in the cryptocurrency marketplace have created a need for investors to stay abreast of current events. Ethereum, being one of the leading cryptocurrencies, is especially pertinent in this regard. Ethereum price news today is primarily focused on the increased difficulty associated with mining and its economic impacts. In particular, recent increases in the Ethereum hash rate are causing miners to struggle against higher costs and reduced profitability as more resources are necessary to compete for rewards. This has caused some miners to opt out from participating altogether. As such, the rising cost of mining is having an effect on Ether prices and by extension affecting those who hold and trade the currency. Furthermore, these changes are also influencing other aspects of the Ethereum platform such as decentralized applications (dApps) that rely upon it for their operation. Thus, it is essential that investors keep up with any relevant news related to Ethereum price movements so they can make informed decisions regarding their investments.

Ethereum Price Outlook

Recent developments have drastically shifted the Ethereum price outlook, making it imperative to explore in greater detail the various implications of these changes. Supply and demand dynamics, investment strategies, regulatory impacts, and macroeconomic outlook are all key factors to consider when analyzing the current state of Ethereum:

- Supply and demand dynamics for Ethereum remain strong despite recent volatility in prices; cryptocurrency miners continue to drive demand for the digital asset.

- Investment strategies in Ethereum have become more sophisticated as institutional investors look for new ways to capitalize on market opportunities.

- Regulatory impacts can also influence the price of Ethereum as governments seek to regulate or ban its use in certain countries.

- Macroeconomic outlooks can also impact the value of Ethereum as global economic trends shape investor sentiment and decision-making.

These factors make it necessary to closely examine the current state of Ethereum before making any investment decisions. Taking into account all these considerations will provide a better understanding of how prices may move in the future, allowing investors to make informed decisions about their investments going forward.

Ethereum Price Forecast

The Ethereum price outlook has been the topic of much discussion in recent months, with the cryptocurrency market being highly volatile. As such, it is important to consider what factors may influence the future trajectory of Ethereum prices. One key factor to consider when forecasting Ethereum’s price is the impact of mining and supply on price movements. Mining is an integral part of cryptocurrency markets, as miners are rewarded for processing transactions and verifying blocks on a network’s blockchain ledger. The more miners there are working to secure a blockchain network, the more computing power increases and hence more transactions can be processed quickly and securely. This increased activity can lead to higher demand for tokens and thus higher token prices. Additionally, changes in supply levels can also have an effect on prices as an increase in token supply could potentially lead to lower prices due to increased competition for buyers in the market.

Ultimately, how these factors affect Ethereum’s price will depend upon various other economic factors such as global economic growth or shifts in investors’ risk appetite. A comprehensive understanding of these inter-related dynamics will be critical when assessing future trends in Ethereum’s price movements. In light of this analysis, it is pertinent to evaluate current trends in order to gain insight into potential future direction of Etheruem prices.

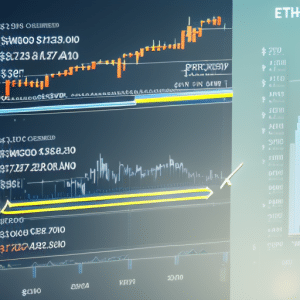

Ethereum Price Trends

Recently observed Ethereum price trends suggest that the cryptocurrency may be headed for a period of volatility in the near future. The supply inflation and demand speculation have been the major factors driving these trends, resulting in a significant increase in market capitalization over the past few weeks. This has led to an overall rise in ETH prices, though there is still uncertainty about how long this trend will continue. As such, it remains to be seen if investors should expect further increases or whether a correction is imminent. With careful analysis of current market conditions, Ethereum traders can make informed decisions on their investments moving forward and prepare for any potential changes in price direction. Transitioning into Ethereum Price Analysis can provide further insight into these fluctuations and help traders stay one step ahead of the game.

Ethereum Price Analysis

Analyzing current market conditions can provide valuable insights into Ethereum prices and potential future trends. Ethereum is a decentralized platform that has become increasingly popular due to its ability to enable smart contracts, which have the potential to reduce transaction costs and risks associated with traditional contracts. But the scalability of the blockchain remains a challenge for Ethereum as it needs to be able to handle more transactions as it grows in popularity. This could potentially cause problems with price stability if not addressed properly. In terms of pricing, Ethereum’s volatility has been lower than Bitcoin’s when compared over a period of time, although this trend is subject to change. This suggests that Bitcoin may be more suitable for short-term investments whereas investing in Ethereum may show greater returns over the long-term. Consequently, investors should take into account these factors when considering their investment strategies before entering the markets. With this in mind, it is important to compare Ethereum prices against those of Bitcoin in order to determine their relative performance and identify any potential opportunities or risks associated with each cryptocurrency.

Ethereum Price vs. Bitcoin Price

The relationship between the Ethereum and Bitcoin prices has been a topic of much debate. While both digital assets have seen their fair share of volatility, there are some key factors that influence the price of each asset differently. Supply and demand play a major role in determining the market price of both digital currencies, as well as speculation amongst investors. Additionally, mining incentives for Ethereum may be vastly different than what is seen with Bitcoin, further affecting their respective prices. Finally, regulatory effects can also play an important role in influencing the value of these two digital assets. It is important to understand how all these factors interact so as to accurately gauge the current state and future outlook for both Ethereum and Bitcoin prices.

Regulatory concerns have been especially influential when it comes to comparing Ethereum and Bitcoin prices. For example, several nations have imposed stringent regulations on cryptocurrency trading practices within their borders which has had an impact on global markets. Given that Etherum is often used by developers for applications such as smart contracts or decentralized finance (DeFi), it is subject to greater scrutiny from regulators than other cryptocurrencies like Bitcoin which could explain why its price movements differ from other digital assets such as BTC. Beyond regulatory influences, understanding how supply/demand dynamics and mining incentives shape the current market conditions will help investors better anticipate potential shifts in cryptocurrency values in relation to one another going forward. As such, examining Ethereum vs USD pricing should provide valuable insight into how these forces are impacting trading activity around this particular asset class today.

Ethereum Price vs. USD Price

Comparing the cryptocurrency market to a rollercoaster, Ethereum’s price movements can often be seen as taking a different route than that of USD. This is due to the fact that Ethereum’s pricing is strongly influenced by supply and demand in the market and not necessarily related to movements in USD. Additionally, mining profitability may also play a role in Ethereum’s price fluctuations compared to USD. For example, if miners are able to make more money from mining other cryptocurrencies than Ethereum, then they may shift their focus away from Ethereum resulting in decreased liquidity which could cause prices to drop relative to USD. On the other hand, if miners find that it is more profitable to mine Ethereum than other cryptocurrencies, then they will likely increase their mining efforts leading to an influx of new coins entering circulation which could help push up the price relative to USD. Ultimately, understanding these two factors can help investors better understand how Ethereum’s prices move relative to USD. These insights can allow investors to incorporate this information when making decisions about investing in cryptocurrency markets going forward. In conclusion, while there are many factors that influence the relationship between Ethereum and USD pricing, understanding supply and demand dynamics along with miner profitability can provide investors with valuable insights into how these two currencies interact with one another. With this knowledge at hand, investors can make informed decisions on when it might be advantageous or disadvantageous for them invest in either currency relative to each other.

Ethereum Price vs. Other Cryptocurrencies

Examining the pricing of Ethereum against other cryptocurrencies can provide investors with valuable insights into how both currencies interact. Leverage trading is one way to measure the fluctuation in price between the two. If Ethereum moves in contrast to another cryptocurrency, then it may be an indication that traders are leveraging their positions and betting on different outcomes. Scalability issues can also impact the pricing of Ethereum relative to other digital assets. The amount of transactions that a given blockchain network can handle sets its overall capacity and this affects the cost associated with using it for various applications. When scalability issues arise, investors tend to flock to alternative blockchains as they offer more economical solutions for transacting. This shift in sentiment could drive down the price of Ethereum versus other digital assets, while at the same time increasing demand for alternatives.

Frequently Asked Questions

What is the difference between Ethereum and other cryptocurrencies?

Ethereum is different than other cryptocurrencies in that it supports decentralized finance (DeFi) protocols and stablecoins, allowing users to access a wide variety of financial services. It also provides a platform for developers to build applications, creating an ecosystem of open source innovation.

What are the advantages of investing in Ethereum?

Investing in Ethereum can offer potential rewards for investors. According to recent data, the cryptocurrency has seen a return on investment of up to 5,000% since its inception. Investment strategies should focus on diversifying portfolios and managing risk. Ethereum is an attractive option due to its high liquidity and low transaction costs.

What are the risks associated with investing in Ethereum?

Investing in Ethereum is subject to short-term fluctuations and liquidity risk. It is important for investors to understand these risks before investing, as they may result in a loss of capital.

What are the most reliable sources for Ethereum price data?

Reliable sources for Ethereum price data include global markets such as Coinbase and Kraken, which provide real-time data on the currency’s performance. Price volatility should also be taken into consideration when analyzing data from these markets.

How have Ethereum prices changed over time?

Ethereum prices have seen varying levels of growth and decline since its launch in 2015, with both supply-demand dynamics and legal implications playing a role. Notably, Ethereum’s price climbed to an all-time high of over $2,000 per ETH in 2021, demonstrating the significant potential for long-term returns on investment.