Ethereum is a decentralized platform that runs smart contracts and applications on blockchain technology. It was launched in 2015, and since then has become one of the most popular cryptocurrencies in the world. Ethereum’s market value has grown exponentially with its increasing popularity, and its Canadian Dollar (CAD) market value has seen similar growth. This article will provide an overview of Ethereum’s CAD market value, including trading history, price predictions, and risks associated with investing in it. Additionally, potential benefits of investing in Ethereum will also be discussed to give readers a comprehensive understanding of the currency’s CAD market value.

Key Takeaways

- Factors influencing Ethereum CAD market value: new technologies, regulations, social media perception

- Mining Ethereum: requires specialized hardware and software, profitability depends on factors like hardware costs, electricity cost, difficulty level, and market value

- Ethereum wallets: provide secure storage and exchange of cryptocurrency, offer flexibility in storage and transactions

- Factors affecting Ethereum’s price performance: rates, GDP growth, macroeconomic trends like inflation and unemployment

Overview of Ethereum

Ethereum is an open-source public blockchain platform with a Turing-complete scripting language, enabling developers to create smart contracts and decentralized applications. In the current environment, Ethereum has been trending in technology circles due to its wide adoption and potential for future development. The platform has seen a surge of interest from corporations and even governments looking to explore the possibilities of blockchain technology. However, there are still many regulatory challenges associated with such use cases that still need to be addressed before widespread adoption can occur. Despite these challenges, Ethereum continues to remain a leader in blockchain technology trends. As more organizations continue to recognize the potential benefits of utilizing this technology, Ethereum’s market value will likely continue increasing in the near future. To gain a better understanding of how far Ethereum has come it is important to look at its history and development over time.

History of Ethereum

Cryptocurrency Ethereum has a history that dates back to 2013, when the concept was initially proposed by Vitalik Buterin. This revolutionary idea of decentralization and smart contracts gave rise to a new form of technology that would soon become an important part of the cryptocurrency world. The first public release of Ethereum was in July 2015, where it began trading on various exchanges and rapidly increased in market value as more investors saw its potential. With the use of innovative technologies such as proof-of-stake consensus algorithms and Turing complete smart contracts, Ethereum quickly became one of the most popular cryptocurrencies globally. Its strong demand led to further development within the platform which enabled it to have a global presence with its own currency (Ether) and decentralized applications (dApps). As Ethereum grew in popularity, so did its market value, allowing developers to create their own projects within this growing ecosystem.

The introduction of Ethereum marked a significant shift in how cryptocurrency markets were viewed, as users now had access to a more secure network for transactions with much faster transaction speeds than traditional banking systems. This revolutionized how people interacted with digital assets and created an opportunity for wider adoption around the world. With its advanced features such as smart contracts and decentralization, Ethereum has since grown into one of the largest digital currencies today, with an ever increasing market cap and value against other currencies like CAD. As we move forward into the future, it is clear that Ethereum will continue to be at the forefront of blockchain technology and remain an essential part of our economy today. Transitioning into exploring what makes up this powerful network is essential for understanding its current success in terms of market value against CADs.

Ethereum Network

The Ethereum network stands out for its unique architecture comprised of innovative technologies such as proof-of-stake consensus algorithms and Turing complete smart contracts, providing users with a secure and fast transaction system that is capable of handling large volumes of digital assets. Ethereum has been noted to be highly scalable due to its ability to process hundreds of transactions per second, making it an ideal solution for applications that require high throughput. Additionally, the platform also enables users to develop custom smart contracts that are self-executing, allowing them to create their own tokens and DApps without needing any third-party intervention. This allows developers to create complex agreements between parties in a trustless manner while ensuring maximum security. As such, the Ethereum network is well suited for powering decentralized applications and tokenized economies where value can be exchanged quickly and securely. With these features in place, the Ethereum network has become one of the most popular blockchain networks in terms of market value. Moving forward, this trend is likely to continue as more people adopt the network’s services due to its scalability and convenience.

Ethereum Market Value

The surge in demand for Ethereum has seen its market capitalization soar, making it one of the most sought-after cryptocurrencies. This increase in popularity has been further amplified by regulatory compliance and improved security measures put in place to protect users from potential risks associated with cryptocurrency trading. These measures have helped to reduce fear of investing in Ethereum, thus driving up its value and creating a more stable environment for investors. This stability has attracted more buyers to invest in Ethereum, leading to an increase of liquidity and volatility as well as a higher market capitalization. Furthermore, the ability for users to trade Ethereum against other digital currencies such as Bitcoin and Ripple has allowed traders to diversify their portfolio and take advantage of different market conditions. As a result, the exchange rate between Ether and CAD (Canadian Dollar) is now highly volatile, providing ample opportunities for traders who wish to capitalize on this dynamic market.

Ethereum CAD Market Value

Recent research has indicated that the exchange rate between Ether and Canadian Dollar is highly volatile, with an interesting statistic showing that it has experienced a 150% increase in its trading range over the past year. This can be attributed to several factors such as:

- Security Concerns – In any cryptocurrency transaction, security measures are of utmost importance to protect against malicious activities. With Ethereum being one of the more popular options for transactions, it is important to ensure users are secure from hackers and other malicious actors.

- Tax Implications – Tax regulations differ depending on the country or region in which you reside; understanding how taxes apply to Ethereum transactions is essential for those wishing to invest in this digital currency.

- Regulatory Environment – The regulatory environment surrounding cryptocurrencies can have a direct impact on their market value; thus, understanding how regional laws may affect Ether’s CAD exchange rate is key for traders.

Overall, these factors have had an influence on Ethereum’s CAD market value and should be taken into account when considering investment opportunities. Understanding these components helps investors make informed decisions about their investments and can potentially lead to greater returns in the long run.

Factors Influencing Ethereum Market Value

The Ethereum CAD market value is constantly fluctuating and it is necessary to understand the factors influencing this variation. There are several external elements that have an impact on the value of Ethereum. These include emerging trends in the blockchain industry, economic forces, political influences, and social media participation.

It is important to gain insight into how these factors interact and affect one another in order to be able to make informed predictions about the future Ethereum market value. Emerging trends such as new technologies or regulations can have a large impact on this value, while social media platforms can also provide valuable information on how users perceive various cryptocurrencies. Therefore, understanding these factors and their influence is essential for predicting changes in Ethereum CAD market value. With this knowledge, we can move forward towards exploring other topics related to Ethereum such as mining.

Ethereum Mining

Mining cryptocurrencies, such as Ethereum, requires specialized hardware and software to solve complex mathematical problems in order to add new blocks to the blockchain. The profitability of Ethereum mining is determined by a combination of factors, including hardware costs, electricity cost, difficulty level and Ethereum’s market value. In general, the higher the market value of Ethereum goes up, the more profitable it becomes to mine. This is because miners have access to more funds when they sell their mined coins at a higher price. Additionally, miners are able to offset some of their hardware costs by selling excess computing power on cloud-based services.

However, there are also drawbacks associated with mining for Ethereum which can affect its market value. For example, if electricity costs become too high or there is an increase in competition among miners then this can reduce profitability and make mining less attractive for investors. Furthermore, since most countries have restricted regulations around cryptocurrency mining operations this could potentially limit growth in certain markets and have an impact on Ethereum’s overall market value. Regardless of these risks however, many people still find that Ethereum mining remains a viable option due to its potential rewards compared with other investment opportunities. As such transactions involving Ether wallets are becoming increasingly popular as a way for individuals and businesses alike to gain exposure into the digital currency space.

Ethereum Wallets

Coinciding with the increase in popularity of Ethereum mining, the utilization of Ether wallets has become increasingly widespread as a means to manage and transact digital currencies. This is due to their ability to provide users with a secure environment for storing and exchanging cryptocurrency, through robust security protocols such as encryption and multi-signature authentication. Cryptocurrency exchanges also enable users to access various markets that support Ethereum trading, allowing them to buy or sell Ether at market value. The use of these wallets offers users greater flexibility in terms of how they can store and transact with cryptocurrencies, while also providing some assurance that their funds are safe from external threats. As the demand for Ethereum continues to grow, so too will the need for secure ether wallets as a way to ensure the safety and reliability of transactions between users. Moving forward, it is likely that more exchanges will offer support for Ethereum transactions, further increasing the liquidity and utility of this digital currency on global markets.

Ethereum Exchange Platforms

Having discussed Ethereum wallets, it is now necessary to review Ethereum exchange platforms. These platforms enable users to buy and sell Ether, the native token of the Ethereum network. There are a number of different ways to access these exchanges:

1) Mining pools: A mining pool is a group of miners who have pooled their resources together to share rewards more evenly based on their contributions. This enables miners to earn Ether without needing to commit large amounts of capital or time into mining hardware;

2) Trading bots: These are automated computer programs that use complex algorithms and data sets to execute trades on behalf of their user. They can be used for both buying and selling Ether; 3) Directly through an exchange platform: This involves setting up an account with an online cryptocurrency exchange like Coinbase or Kraken, where users can buy and sell Ether with fiat currencies such as USD or EUR. By using one of these methods, users can acquire Ether tokens which can then be stored in an Ethereum wallet. With this knowledge in hand, we can now begin examining how Ethereum trading works.

Ethereum Trading

Ethereum trading is a complex and multifaceted activity that can involve long-term investing or short-term trading. Long-term investments may include buying Ethereum with the goal of holding it for a period of months or years, while short-term trades may involve taking advantage of market swings in order to generate quick profits. Both strategies require careful consideration of risk and reward factors, as well as an understanding of the underlying mechanics of the Ethereum markets.

Long-Term Investing

| Investing in Ethereum CAD market value for the long-term entails understanding the underlying economic and technological trends of this cryptocurrency. | Long-Term Investing | Short-Term Trading | |

|---|---|---|---|

| Legal Implications | Cryptocurrencies are still largely unregulated, with many countries yet to set up a legal framework to govern them. As such, investing in cryptocurrencies may entail risks due to lack of investor protection and potential legal implications. | Taxation Issues | Cryptocurrency profits may be subject to taxation rules depending on the country and jurisdiction involved, making it important for investors to be aware of any associated tax obligations before investing in Ethereum. |

Due to these uncertainties around regulation and taxation, understanding the current market dynamics is key when considering whether or not Ethereum could be a viable long-term investment option. With that being said, transitioning into short-term trading requires an entirely different approach as one needs to keep up with the rapidly changing market conditions.

Short-Term Trading

For those looking to capitalize on the rapid fluctuations of the cryptocurrency space, short-term trading may offer a profitable opportunity; however, it comes with its own unique set of risks and considerations. Technical analysis is a key factor in assessing the potential of any investment, especially when engaging in short-term trading. By analyzing past price trends and market conditions, traders can identify opportunities to buy or sell. Risk management is another important concept for traders to consider when engaging in short-term trades. Understanding the basics of risk/reward assessment helps investors make informed decisions about how much capital to invest and when to exit a trade. With these tools at their disposal, traders can take advantage of market movements to generate profits over time. Having said this, it is important for traders to be aware that there are no guarantees in the cryptocurrency markets and losses can occur just as quickly as gains. As such, it is essential for all investors to approach their investments with caution and have realistic expectations for returns. Ultimately, by taking the time to understand technical analysis and risk management techniques, traders can increase their chances of success when trading Ethereum’s CAD market value. With this knowledge in hand, we now turn our attention towards predicting Ethereum’s price trend in the future.

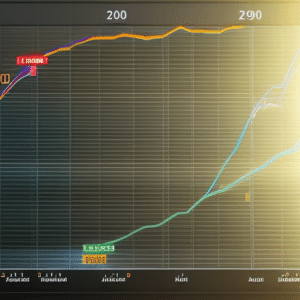

Ethereum Price Prediction

Predicting the future value of Ethereum in the CAD market requires analysis of current market trends and reliable economic indicators. To begin, investors should consider the following key points:

- Cryptocurrency trends: Ethereum generally follows Bitcoin’s lead, so understanding how Bitcoin is performing can help determine where Ethereum prices are headed.

- Blockchain adoption: As more mainstream businesses adopt blockchain technology, more people have access to cryptocurrencies like Etheruem, which can drive up demand and influence prices.

- Economic indicators: Investors should also consider broader macroeconomic trends such as inflation, unemployment rates and GDP growth when assessing the prospects for Ethereum’s price performance.

Overall, these factors can provide insight into what traders may expect from Ethereum moving forward. With this foundation in place, investors must then assess the potential risks associated with investing in Ethereum.

Dangers of Investing in Ethereum

Analyzing the potential risks associated with investing in cryptocurrency, such as Ethereum, is essential for any investor. One of the main dangers of investing in Ethereum are the tax implications. Depending on the jurisdiction and how one classifies their Ethereum investments, taxes may be considerably high due to capital gains tax or other reporting requirements. Additionally, security risks should be considered when investing in Ethereum, as there have been cases of fraudulent activities and hacked exchanges that resulted in losses of hundreds of thousands of dollars. | Tax Implications | Security Risks | | —————– | ————— | | Capital Gains Tax| Fraudulent Activity| | Other Reporting Requirements| Hacked Exchanges|

Investors must also consider other factors such as regulation uncertainty and liquidity risk before investing in Ethereum. Regulations related to cryptocurrencies vary from country to country, making it difficult for investors to accurately assess their liability and compliance with local laws. Liquidity risk can also significantly influence investments since it can be difficult to convert back into cash or trade your holdings at a desired price point if you need access to funds quickly. Thus, it is important for investors to understand the potential dangers associated with investing in cryptocurrency before taking any form of action. With this knowledge, they can then make an informed decision about whether or not they should invest in Ethereum and other cryptocurrencies. Transitioning into the next section about ‘benefits’, understanding these potential risks is only part of what makes up a well-informed investment decision; considering both advantages and disadvantages will help investors make more sound decisions when managing their finances.

Benefits of Investing in Ethereum

Despite the potential risks associated with investing in cryptocurrency, there are also numerous advantages to investing in Ethereum. For starters, Ethereum offers a range of security solutions that help protect investors from malicious attacks and fraudulent activities. The Ethereum blockchain is secured through its Proof of Work (PoW) consensus mechanism, which guards against double spending and other forms of fraud. Additionally, Ethereum provides storage solutions such as the Mist Wallet and MyEtherWallet that help users securely store their funds and information.

In addition to these security features, an investment in Ethereum can be beneficial for investors who are looking for a hedge against inflation or diversification within their portfolio. With crypto-assets being largely unaffected by traditional market fluctuations, investments in cryptocurrencies like Ethereum can provide stability during times of economic volatility. Furthermore, due to the decentralised nature of cryptocurrency transactions, investors can benefit from quicker transaction processing times at lower costs than those usually associated with traditional financial institutions.