Ethereum is a decentralized, open-source blockchain platform and operating system with its own cryptocurrency, ether. It has become the second largest cryptocurrency in terms of market capitalization after Bitcoin. Ethereum enables developers to build and deploy decentralized applications that are not controlled by any central authority. As such, it has been gaining increasing popularity in recent years, particularly in [specific country]. This article will explore the current value of Ethereum in [specific country] as well as potential growth opportunities for Ethereum investments. The article will also discuss ways to invest in Ethereum and what risks may be involved.

Overview of Ethereum

Ethereum is a revolutionary digital currency and platform designed to provide users with a secure, decentralized, and open-source environment for financial transactions. It utilizes blockchain technology to facilitate the transfer of value without the need for third-party intermediaries. Ethereum also supports smart contracts and dapps development, allowing developers to create applications that run on the blockchain instead of relying on centralized servers. This provides users with greater trust in their transactions as well as greater autonomy over their data and other assets. Ethereum has become increasingly popular due to its range of features and its potential as a secure alternative to traditional currencies. As such, it has seen significant growth in its value across many countries around the world including [specific country].

Ethereum Value in [specific country]

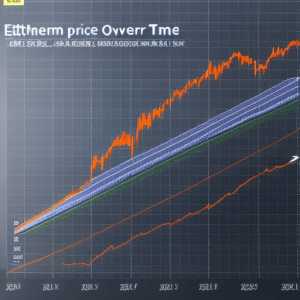

The digital asset, which is comparable to a form of currency, has seen a fluctuation in its worth within the borders of this nation. The value of Ethereum is largely determined by the government policies that rule its use and the general public’s perception of blockchain technology. Factors such as how well-developed the infrastructure for using it is in this country, or if there are any restrictions on activities surrounding it, can significantly affect its value. Additionally, Ethereum’s worth also depends on its widespread acceptance by users and whether they trust it as an alternative form of payment. As such, depending on local regulations and attitudes towards cryptocurrency, Ethereum’s worth may vary from country to country. This means that investors need to be mindful when investing in Ethereum within a certain nation due to possible shifts in market trends and governmental policies pertaining to blockchain technology usage.

Overall, due to factors such as potential government interference and public sentiment regarding digital assets like Ethereum, its value can greatly differ from one nation to another. As such, potential growth opportunities for Ethereum should be carefully considered before investing in this particular cryptocurrency.

Potential Growth Opportunities for Ethereum

The potential growth opportunities for Ethereum in [specific country] are numerous, with increased adoption of the cryptocurrency leading the charge. Moreover, potential regulatory changes could create an even more favorable environment for Ethereum to grow. Finally, there is growing interest from institutional investors that might provide further support to fuel its growth. All these factors could lead to a significant rise in the value of Ethereum over time.

Increased Adoption of Ethereum in [specific country]

Adoption of Ethereum within [specific country] has risen significantly in recent years. This can be attributed to the increasing availability of cryptocurrency exchanges, as well as the growing interest in smart contracts.

The proliferation of cryptocurrency exchanges such as Coinbase and Kraken have made it easier for people in [specific country] to invest in Ethereum without needing access to an overseas exchange or a bank account. Furthermore, the increasing popularity of blockchain-based smart contracts has also encouraged more people to adopt Ethereum, as users are able to set up digital agreements with each other without needing a middleman or lawyer.

These factors have contributed to increased adoption of Ethereum in [specific country], which could lead to potential regulatory changes that may further influence its value.

Potential Regulatory Changes

The possible emergence of new regulatory frameworks could have a considerable impact on the cryptocurrency market. In the case of Ethereum, its value in [specific country] may be influenced by any legal implications that arise from potential crypto regulations. Such regulations could potentially limit the access to certain financial services for Ethereum users, such as trading and exchanging funds. Furthermore, there may be limits imposed on how much can be invested in Ethereum and other cryptocurrencies, or even a total ban of it altogether. As such, legal changes would likely affect the public perception of Ethereum’s value and trustworthiness in [specific country], which could lead to a decrease in its overall demand and price. With this in mind, it is essential that policymakers carefully consider the implications of their decisions when crafting new crypto regulatory frameworks to ensure they do not have an adverse effect on the local cryptocurrency market. Transitioning into the next topic then, increasing interest from institutional investors has become increasingly relevant across all major markets including [specific country].

Growing Interest from Institutional Investors

Institutional investors have recently been demonstrating a growing interest in the cryptocurrency market, particularly in major markets. Investors are increasingly viewing Ethereum as an opportunity to diversify their portfolios, and take advantage of its potential for high returns. This is especially true in emerging markets, where banks have been traditionally slow to adopt the technology underlying cryptocurrencies.

The banking sector has seen notable examples of institutional investors entering the crypto space through large investments in Ethereum and other digital assets. Some of these investors include venture capital firms, hedge funds and private equity groups who are looking to capitalize on the potential growth of this new asset class. Additionally, traditional financial institutions such as pension funds and mutual funds are also beginning to invest in Ethereum due to its low correlation with other assets. Therefore, it is clear that institutional investors see tremendous potential for Ethereum value growth in both major and emerging markets alike. As a result, individuals interested in investing may want to consider ways to gain exposure to this rapidly expanding asset class.

Ways to Invest in Ethereum

Investing in Ethereum has become increasingly popular as the cryptocurrency grows in both value and application. Buying and selling Ethereum is a common way to invest, as is investing in Ethereum-based companies or stocks. For those looking to enter the world of cryptocurrency investments, these three options represent some of the most viable opportunities available on the market today.

Buying and Selling Ethereum

Navigating the market for Ethereum in [specific country] can be an exciting experience. For many people, it is a unique opportunity to invest in the cryptocurrency and benefit from its price volatility. However, many investors need to consider security concerns before investing in Ethereum due to the risk of theft or digital fraud. In order to ensure that they are making a secure investment, potential buyers should do extensive research on any exchanges or wallets they use, as well as proper storage techniques for their private keys.

When buying and selling Ethereum, investors also have to take into account factors such as fees charged by exchanges and other services providing access to crypto markets. Additionally, understanding how market trends affect the price of Ether can help determine when is best time to buy or sell this cryptocurrency. With all these considerations in mind, it is clear that there are risks involved with purchasing Ethereum but also opportunities for those who understand the nuances of the market. From here, we can move on to discuss investing in ethereum-based companies which offer additional benefits over buying and selling cryptocurrency directly.

Investing in Ethereum-based Companies

Exploring Ethereum-based companies can open up a world of potential investment opportunities. By taking advantage of the decentralized nature of blockchain technology, investors are able to access crypto exchanges and potentially benefit from the increased security offered by these platforms. These exchanges provide an opportunity for savvy investors to tap into the developing global cryptocurrency markets as well as the growing Ethereum network. Additionally, they offer exposure to new and exciting projects that utilize Ethereum’s distributed ledger technology in order to build revolutionary applications. Investing in these innovative projects can be a great way for investors to diversify their portfolios while also gaining early access to emerging technologies with huge potential upside.

Investing in ethereum-based stocks is another way that investors can get involved with this rapidly evolving space. Due to their decentralized nature, many companies have opted for Initial Coin Offerings (ICOs) rather than filing with a major stock exchange, allowing them more freedom when it comes to deciding how they want their project structured and managed. By investing in these ICOs, individuals may be able to participate in the growth of these companies while also reaping rewards if they perform well on the markets. However, due to their high risk and speculative nature, it is important for any investor wishing to explore this avenue thoroughly research anything they consider investing in before committing any capital. With this said though, there is undoubtedly enormous potential within Ethereum-based investments which could lead to significant returns over time if managed correctly.

Investing in Ethereum-based Stocks

Investors may have the opportunity to benefit from the growth potential of Ethereum-based stocks by participating in Initial Coin Offerings (ICOs), which provide a decentralized alternative to traditional stock markets. For example, after its ICO in 2017, Bancor Network rose over 500% in value in just three months, illustrating the immense potential that these investments can offer.

The benefits of investing in Ethereum-based stocks include:

- The ability to short sell;

- This means investors can make money if the stock price drops as well as rises.

- Tax implications;

- Depending on individual circumstances, some investors may be exempt from paying capital gains taxes on their profits.

However, investing in Ethereum-based stocks comes with many risks that should be taken into consideration before deciding to invest. These include market volatility, lack of liquidity and regulatory uncertainty which should all be researched thoroughly prior to making any decisions about investing.

What are the Risks Involved?

Analyzing the risks associated with investing in Ethereum in a specific country is an important step for any potential investor. Risk aversion is key, as investors should be aware of both tangible and intangible risks before committing to any financial decision. Security threats pose a major risk for Ethereum investments, as malicious actors can compromise individual accounts or whole networks, resulting in heavy losses. Cybersecurity protocols should be adhered to at all times when dealing with digital assets to ensure sound investments and protect against losses. Countries with higher levels of infrastructure and development tend to have better security measures in place for digital asset trading than countries with lower-level infrastructures. Additionally, it is important to consider factors such as political instability which could lead to volatility within the blockchain market and affect the value of Ethereum-based stocks.