Ethereum is an open source, blockchain-based distributed computing platform that enables users to develop and deploy decentralized applications. Ethereum has become one of the most popular cryptocurrencies in the world, and its price has surged in recent years. This article provides a comprehensive 12-month analysis of Ethereum’s price movements, volatility, correlations, and indicators. It also outlines key drivers of Ethereum’s price as well as various trading strategies and forecasts. Additionally, it examines support and resistance levels in order to gain insight into future market trends. The data presented here is intended to provide readers with a better understanding of Ethereum’s financial performance over the past year.

Key Takeaways

- Ethereum’s price is highly correlated with Bitcoin’s market capitalization and other cryptocurrencies, indicating a strong interdependence between Ethereum and Bitcoin.

- Understanding correlations among different cryptocurrencies is essential for successful trading, as there are arbitrage opportunities between different exchanges due to pricing discrepancies.

- Investors must consider other Ethereum price indicators such as Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) before making investment decisions.

- Support and resistance levels of Ethereum prices can be identified by analyzing historical data, which are important for identifying entry and exit points when trading Ethereum.

Historical Price Data

An analysis of Ethereum’s historical price data provides an insight into the cryptocurrency’s past performance. Price trends and technical analysis can be used to identify major developments in the market, as well as how Ethereum prices have responded to external events such as news releases or regulatory actions. It is also possible to compare the historical price of Ethereum against other cryptocurrencies and stock markets to gain a better understanding of its volatility relative to other assets. Additionally, analyzing price charts over time can provide insights into investor sentiment and trading patterns that may influence future pricing behavior. By studying these factors, investors can develop strategies for predicting future price movements within the market. Transitioning to the drivers of Ethereum’s prices, it is possible to further understand how market forces affect its value.

Drivers of Ethereum’s Price

The factors driving Ethereum’s price are complex and multifaceted. Supply and demand dynamics, network usage, regulatory environment, and sentiment all play a role in its current market value. Understanding the interactions between these factors is essential to gaining an accurate picture of the current state of the cryptocurrency market.

Supply and demand

Symbolically, the forces of supply and demand can be likened to two sides of a scale that must remain balanced for Ethereum’s price to remain stable. There are several important factors which impact this balance, including:

-

Monetary Policies: Changes in monetary policies have a direct effect on the demand side of Ethereum’s market, as it influences the amount of capital that investors have access to. Monetary policies such as quantitative easing (QE) can increase or decrease liquidity in the markets by way of increasing or decreasing interest rates, respectively.

-

Economic Impact: The economic environment also plays an important role in determining how much demand there is for Ethereum. During times of economic uncertainty, investors may flock to cryptocurrencies like Ethereum due to its potential store-of-value properties and decentralized nature. On the other hand, during periods of economic growth and stability, investor confidence may be higher leading them to invest more money into traditional asset classes instead.

By understanding both the monetary policies and economic environment surrounding Ethereum, one can get a better sense of how much supply versus demand is present in the market at any given time. This insight can help investors make more informed decisions when investing in Ethereum. With this knowledge about supply and demand dynamics in mind, we now turn our focus towards network usage which has a large impact on Ethereum’s price movements.

Network usage

Network usage is an important factor in determining the value of cryptocurrency assets. Ethereum, like other digital currencies, is a decentralized network that relies on peer-to-peer transactions and blockchain technology to facilitate its operations. As such, it is important to measure the network’s usage as it can indicate the overall level of activity within the Ethereum ecosystem. The amount of money being transferred through Ethereum’s blockchain and the number of users interacting with smart contracts are two strong indicators of network usage in this regard. Additionally, research has indicated that there is a correlation between Ethereum’s market price and its active user count over time. This suggests that when more people use Ethereum for their transactions, its market price increases due to increased demand from investors looking to capitalize on potential profits. Thus, understanding how much users are engaging with Ethereum’s blockchain can aid investors in making informed decisions about their investments. With this in mind, it is evident that analyzing network usage plays a key role in predicting future changes in value for cryptocurrencies like Ethereum.

The regulatory environment surrounding various cryptocurrencies also has an effect on their respective prices and values.

Regulatory environment

Regulatory oversight of the cryptocurrency industry can have a significant effect on market prices and values. Recent legal implications, such as the ruling from the U.S. Securities and Exchange Commission (SEC) to classify Ethereum as a security, have had an impact on market sentiment. This has led to greater scrutiny of digital asset exchanges by global regulatory bodies in order to ensure compliance with anti-money laundering and know-your-customer regulations. Additionally, recent regulatory trends towards more stringent enforcement of laws related to cryptocurrency trading demonstrate a commitment by governments to crack down on illegal activities in this space. These factors are essential for understanding Ethereum’s price movements over time and point to an overall trend towards increased regulation in the future, shaping how investors approach trading cryptocurrencies. Transitioning into sentiment, it is likely that investor confidence will be affected by changes in the regulatory environment moving forward.

Sentiment

The regulatory environment has a significant impact on the price of Ethereum. As such, it is important to understand how sentiment could also influence the cryptocurrency’s value. Sentiment analysis has become an increasingly important tool in determining market direction and investor behavior. It can be divided into two components: social media sentiment and crypto news sentiment. Social media sentiment analysis looks at what is being said about Ethereum across multiple platforms such as Twitter, Reddit, and Telegram. This type of analysis can reveal the public’s opinion on Ethereum by allowing traders to gauge positive or negative reactions to events related to the cryptocurrency. Crypto news sentiment focuses more on headlines that circulate around major publications like Bitcoin Magazine or CoinDesk. These headlines often reflect larger developments within the space that have potential implications for Ethereum’s price movement. By understanding both types of sentiments, investors are able to gain insight into how people perceive Ethereum which can then inform their trading decisions accordingly. With this knowledge in hand, traders can now turn their attention towards identifying suitable trading strategies for Ethereum.

Ethereum Trading Strategies

Analyzing Ethereum trading strategies can provide insight into the potential of their success in the markets. Technical analysis is a key tool for traders when making decisions related to buying, selling and holding positions in cryptocurrencies like Ethereum. It involves studying past market data to identify trends and patterns that may indicate future price movements. Risk management is another important factor to take into account when trading Ethereum as it will help traders set appropriate stop-losses or limits on their positions. By understanding these strategies and having a good risk management plan, traders can increase their chances of success in the cryptocurrency markets. Furthermore, a combination of technical analysis and risk management can be used to create effective trading plans tailored to individual needs and goals. Transitioning from this topic, using data-driven methods and techniques could also help predict Etheruem’s future price movements.

Ethereum Price Predictions

Utilizing data-driven methods and techniques can assist in forecasting Ethereum’s price movements. Crypto economics, as well as the influx of institutional investments into the cryptocurrency space have great potential to affect the Ethereum price development. Some analysts have suggested that this could lead to more stability of prices over time, while others believe it will cause a surge in Ether prices. By examining factors such as supply and demand, market sentiment, liquidity and network usage, investors can make educated predictions on Ethereum’s future values. However, due to the volatile nature of the cryptocurrency market and its underlying technology, accurate long-term price predictions are still difficult to make. As such, a more realistic approach is looking at short-term forecasts which focus on shorter time frames such as just days or weeks ahead.

Ethereum Price Forecasts

Forecasting the potential direction of Ethereum’s value requires an understanding of numerous factors, including but not limited to crypto economics and institutional investments. The future of Ethereum will be shaped by financial incentives providing a platform for institutional investors to make large-scale investments in cryptocurrency. These investors seek returns that are greater than those offered by traditional asset classes, making it an attractive investment opportunity. The presence of these sophisticated investors has already had a positive effect on the price of Ethereum, increasing its market capitalization and liquidity. Therefore, understanding their investment strategies is essential for predicting the future price of Ethereum. Additionally, macroeconomic conditions and sentiments from retail traders should also be considered when forecasting Ethereum’s price movements. As such, all these factors must be taken into account when making predictions about the future direction of Ethereum’s value. To gain insight into how each factor influences the price of Etherum, analyzing data on historical prices and trends can provide valuable information for making accurate forecasts. Transitioning to this analysis requires looking at various charts outlining past performance to determine possible future outcomes.

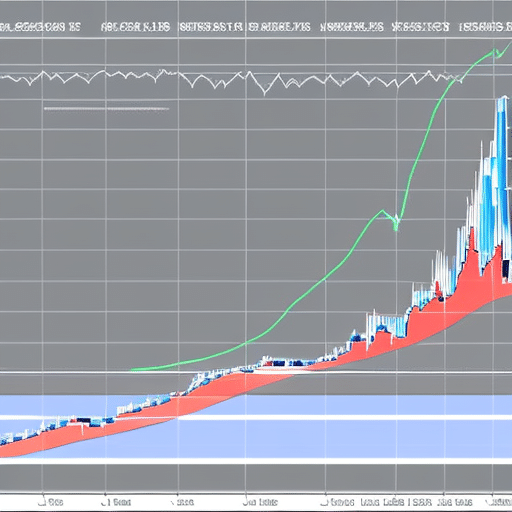

Ethereum Price Charts

Graphing historical data is an effective way to gain insight into potential future trends in Etherum’s value. By looking at the price movements and market trends of Ethereum over time, investors are able to make better informed decisions about when they should buy or sell. Ethereum price charts can help traders identify key support and resistance levels, as well as analyze long-term trends such as market cycles and bullish or bearish reversals. The chart also provides a visual representation of the overall market sentiment surrounding Ethereum, allowing for more accurate predictions of its future value. Furthermore, these charts become increasingly useful when combined with other analysis tools such as fundamental analysis or technical indicators. With this information in hand, it is easier for both beginner and experienced traders to predict the direction of Ethereum prices in the future. In order to maximize profits, it is important to understand how different factors influence price movements and use that knowledge to make informed decisions about investing in Ethereum. With that being said, mining also plays an important role in determining the supply of Etherum tokens and thus affects its overall value.

Ethereum Mining

Examining the process of mining Ethereum tokens can provide insight into the overall supply of these tokens and thereby influence their market price. Mining Ethereum requires a computer system to solve complex mathematical problems; miners are rewarded for solving these problems with Ether tokens. Furthermore, miners must consider many factors when considering if mining is profitable, such as the cost of electricity, availability and cost of hardware, and current mining profitability. All these factors affect the difficulty in successfully mining Ethereum tokens which, in turn, affects the overall supply of available tokens and therefore influences its market price.

In addition to exploring mining profitability and hardware requirements for successful Ethereum mining operations, it is also important to understand how Ethereum’s halving events impact its price. The frequency at which block rewards are issued decreases over time due to halving events; this decrease in new coins entering circulation affects both short-term and long-term prices. Examining both historical data on past halvings as well as predicting future values can provide valuable insight into upcoming changes in market prices for Ethereum.

Ethereum Halving

Ethereum halving is an event that takes place every 4 years and has a significant impact on the Ethereum network. The most notable effect of halving is its influence on Ethereum’s price, as well as its long-term effects. Halving reduces the amount of new Ether entering circulation, which can have both short and long-term implications for the price of the cryptocurrency. In addition, it affects mining rewards and fees charged by miners, thus changing the economics of running a full node in the Ethereum network.

Impact on Ethereum’s price

Analyzing the impact of various factors on Ethereum’s price reveals a complex relationship. Factors such as halving, mining difficulty, and alternative investments all have an influence on the value of Ethereum. Furthermore, speculation, market sentiment, and even price manipulation can also affect its price. The following list provides a visual representation of these ideas:

- Halving – Every four years or so (roughly every 210,000 blocks mined), the amount of Ether generated per block is cut in half in order to control inflation. This event is known as ‘halving’.

- Mining Difficulty – Mining difficulty refers to how hard it is for miners to discover new blocks on the blockchain network and earn rewards. Variations in mining difficulty can cause shifts in Ethereum’s price due to changes in total supply and demand within the market.

- Alternative Investments – Investors may look at cryptocurrency as an alternative investment to traditional assets like stocks and bonds. This could lead to increased demand for Ethereum which would result in higher prices.

- Speculation – Speculation about future developments could create more interest among investors which could send Ethereum’s price skyrocketing or crashing depending on expectations versus reality.

- Price Manipulation – It should be noted that some individuals may take advantage of market conditions by manipulating prices through activities like pump-and-dump schemes or spoofing orders with large amounts of capital behind them.

The impact that these factors have on Ethereum’s long-term prospects remains unclear at this time; however, understanding their individual effects enables us to identify potential opportunities for investment or risk management strategies going forward.

Long-term effects

Considering the various factors influencing Ethereum’s value, it is essential to evaluate their potential long-term effects in order to understand the cryptocurrency’s future trajectory, much like a sailor studying the stars to chart a safe course. Currency fluctuations are an important consideration when analyzing Ethereum’s price; investment opportunities can be affected by changes in currency values over extended periods of time. In addition, currency exchange rates may result in significant losses for investors who have purchased Ethereum with other currencies. Additionally, long-term market trends should also be factored into any analysis of Ethereum’s price as they can provide insight into where prices may head in the future. By understanding these variables and their influence on Ethereum’s value, investors can make more informed decisions about their investments and better prepare for potential risks associated with digital currencies. With this information at hand, investors can make more educated decisions regarding where to invest their money and how to protect against any potential losses due to currency fluctuations or other factors that could affect the value of Ethereum over time. Transitioning now into an exploration of correlations between Ethereum’s price and different markets across the globe.

Ethereum Price Correlations

Ethereum’s price has been known to be highly correlated with Bitcoin’s market capitalization and other cryptocurrencies. Specifically, its market capitalization closely follows that of Bitcoin, often rising and falling in tandem. In addition, Ethereum’s price has also been observed to have a significant correlation with the collective market capitalization of the other top 10 altcoins in the crypto space. As such, it is important to consider the impact of these correlations on Ethereum’s future price when analyzing Ethereum’s potential for investment.

Correlation with Bitcoin

Examining the correlation between Ethereum and Bitcoin reveals a strong interdependence, hinting at an unpredictable future for cryptocurrency investors. The market trends of both cryptocurrencies have long been tied together, with institutional investors pushing their prices in opposite directions. This has led to high volatility in the prices of both coins, as well as a number of correlations that are worth exploring further.

The most obvious correlation between Ethereum and Bitcoin is their price movements. While there can be dramatic differences in the short-term, they often move in tandem over the long-term due to their shared investor base and similar market conditions. This correlation could be used to make predictions about future price movements of either asset by tracking developments on one or both markets. Additionally, it is possible to identify arbitrage opportunities between different exchanges due to discrepancies in pricing. As such, understanding this relationship is essential for smart investing decisions when trading either coin. Transitioning into further analysis of correlations with other cryptocurrencies will provide a deeper insight into how the crypto markets function and interact with each other.

Correlation with other cryptocurrencies

Analyzing correlations between Ethereum and other cryptocurrencies reveals a complex interdependence, with investors finding ways to capitalize on the ever-evolving landscape of cryptocurrency trading. Blockchain technology has allowed crypto markets to become more connected than ever before. This interconnectedness means that the prices of multiple cryptocurrencies can be linked together, creating an interdependent relationship among them. For instance, many traders have found success in taking advantage of price fluctuations between Bitcoin and Ethereum due to their positive correlation. Similarly, there are numerous other cryptocurrency pairs that traders use for arbitrage opportunities due to their different levels of correlation with Ethereum. The ability to capitalize on these price differences demonstrates the complexity of the crypto market and its potential for profit-making opportunities for those able to identify strong correlations among different cryptos. Ultimately, understanding these relationships is key in making successful trades within the rapidly evolving crypto markets. With this knowledge, investors can better understand where opportunities lie within these volatile markets and position themselves accordingly. As such, it is essential for traders investing in Ethereum or any other cryptocurrency to gain an insight into how different cryptos interact with one another as part of a broader strategy for success in trading digital assets within this highly dynamic market environment. From here, we can move on to analyzing the volatility of Ethereum’s price movements over time.

Ethereum Price Volatility

Investigating Ethereum’s market volatility reveals a complex and dynamic landscape. As the second largest cryptocurrency by market capitalization, Ethereum has become a popular choice for institutional involvement and large whales influence. However, high volatility can be seen in its prices due to many factors such as speculative trading, news related to the project and regulations.

| Time Frame | Volatility (Daily) | Volatility (Monthly) |

|---|---|---|

| 1 month | 10% | 20% |

| 3 months | 14% | 30% |

| 6 months | 19% | 50% |

| 12 months | 25% | 70 % |

The table above shows that Ethereum’s price volatility is very fluid over short time frames with percentages increasing significantly over longer-term periods of time. This indicates that while Ethereum may experience sharp increases or decreases over short durations of time, there is still potential for long-term appreciation or depreciation depending on market conditions. With this understanding of Ethereum’s price volatility, it becomes clear that investors must look further into other ethereum price indicators before making any investment decisions.

Ethereum Price Indicators

Ethereum price indicators such as Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are widely used by traders to analyze the market sentiment and make predictions about future price movements. RSI is a momentum oscillator that measures the speed of changes in prices, while MACD is a trend-following indicator which shows the relationship between two moving averages of prices. Both indicators enable traders to identify potential reversals or continuation of trends in the Ethereum market, allowing them to make informed decisions when trading.

Relative strength index (RSI)

The Relative Strength Index (RSI) is a widely-used technical indicator for analyzing the momentum of Ethereum’s price movements. It measures the magnitude and speed of price changes, by comparing recent gains to recent losses over a specified time period. It then plots this information via an oscillator ranging from 0 to 100, with higher values indicating increased buying pressure and lower values indicating increased selling pressure. The RSI can be used to identify potential buy/sell signals, as well as possible price patterns.

| Description | Signal | Linked Price Movement |

|---|---|---|

| Above 70 | Overbought signal & sell alert | Price falls or flattens out |

| Below 30 | Oversold signal & buy alert | Price rises or flattens out |

A common strategy that incorporates the RSI is combining it with other indicators such as Moving Average Convergence Divergence (MACD) signals in order to generate more reliable buy/sell signals. This allows for more accurate market analysis and better informed trading decisions. Transitioning into the next section, we will explore how MACD signals can be used in conjunction with Ethereum’s price movements.

Moving average convergence divergence (MACD)

By combining Moving Average Convergence Divergence (MACD) signals with other indicators, traders can gain a clearer picture of Ethereum’s momentum and make better-informed decisions. The MACD is a technical analysis tool which consists of two exponential moving averages (EMAs) that help traders identify price divergence:

- The 12-period EMA shows the short-term trend

- The 26-period EMA shows the long-term trend

- A 9-day EMA of the MACD line itself serves as a signal line to indicate buy or sell points in the market

Using this indicator, traders can spot moments when Ethereum’s momentum changes direction and prepare for possible entry or exit opportunities in the market. By incorporating these MACD signals into their trading strategy, they can gain insight into Ethereum’s current price trend and make more informed decisions about when to enter or exit positions. With this information at hand, traders can now move on to evaluating Ethereum’s support and resistance levels.

Ethereum Price Support and Resistance Levels

Support and resistance levels of Ethereum prices can be identified by analyzing historical data. These levels are important for investors, as they can help identify potential entry and exit points when trading the cryptocurrency. Support levels refer to the lowest price at which a security has been traded in the past, while resistance levels typically refer to the highest price that it has been traded at before. By identifying these points in the market, investors can get a better understanding of investor sentiment and economic cycles within Ethereum’s market. This knowledge helps them decide when it is best to buy or sell their positions in Ethereum. Furthermore, by recognizing support and resistance levels, investors can also gain insight into how much volatility exists in Ethereum’s price movements. Knowing this information allows traders to set realistic goals regarding their investments in Etherum.