Ethereum, the open-source distributed ledger technology that powers the majority of decentralized applications on the blockchain, has seen immense growth since its launch in 2015. From a price of $0.35 in early 2003 to a peak of over $1400 in late 2017, ETH has been one of the most successful and profitable digital assets for investors. The price trend for ETH during this period was highly volatile due to various factors such as supply and demand dynamics, investor sentiment and market speculation. This article will explore the major events which impacted 03 ETH price trend and provide investment strategies for those interested in investing in ETH.

An illustrative example of how quickly ETH prices can change is highlighted by an incident in August 2013 when the Chinese government banned financial institutions from handling Bitcoin transactions. In response to this news, traders panicked and began selling off their BTC holdings – causing a rapid decrease in prices across all digital assets including Ethereum – from around $90 per coin to just above $50 within 24 hours. Despite this drastic drop, ETH prices quickly recovered within weeks as investors regained confidence and began buying again.

Key Takeaways

- Ethereum’s price is highly volatile due to supply and demand dynamics, investor sentiment, and market speculation.

- The Chinese government’s ban on Bitcoin transactions in 2013 caused a rapid decrease in prices across all digital assets, including Ethereum, but prices quickly recovered.

- Ethereum’s blockchain-based platform for smart contracts provides improved security, transparency, and reduced transaction costs.

- Factors influencing Ethereum’s price trend in 2003 included regulatory changes, media coverage, and the impact of decentralization.

Overview of Ethereum

Ethereum is a blockchain-based platform for smart contracts that has been increasingly gaining attention due to its potential use cases, despite some concerns about its scalability. Ethereum’s mining profitability, which is determined by the Ether (ETH) price, is influenced by the network’s hashrate and gas fees. Blockchain technology – the underlying technology of Ethereum – allows for transactions to be securely stored on a decentralized ledger which eliminates third-party interference. This ensures transactions are immutable and trustless thus eliminating counterparty risk. Additionally, it enables users to access transparent data and provides an immutable audit trail of activities. The cryptographic nature of blockchain also provides improved security over traditional systems while reducing transaction costs significantly. As such, these features have made blockchain technology particularly attractive in various industries such as finance, healthcare and government services where improved security is critical. These advantages have driven more people to invest in Ethereum leading to increased demand of ETH tokens resulting in higher prices over time. Transitioning into the subsequent section about ‘price trend’, it becomes clear that this increasing demand for ETH token has had a large impact on its price trend over the years.

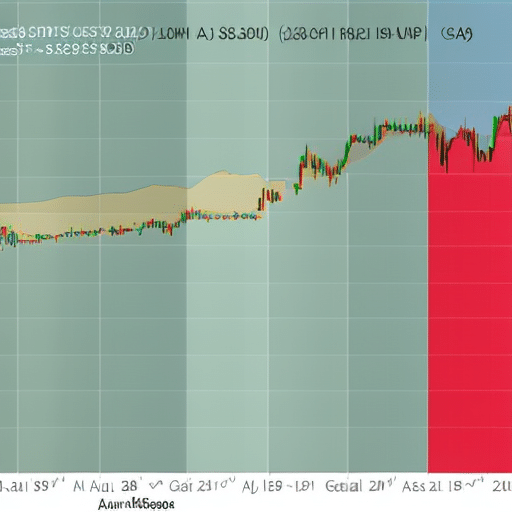

2003 Price Trend

The recent fluctuations in the value of digital currency have created a tumultuous 3-month period for investors. Ethereum, the second-largest cryptocurrency by market capitalization, has been no exception to this trend. In particular, Ethereum’s price trend has been affected by:

- The rise of decentralized finance (DeFi) as a major industry within the blockchain space;

- Advances in scalability and connectivity which have enabled the Ethereum network to handle more transactions per second;

- Increased demand for blockchain applications such as smart contracts and automated supply chain management; and

- Growing interest in decentralization as an alternative to traditional financial systems.

These factors have combined to create a volatile atmosphere surrounding Ethereum’s price movements, with peaks and troughs over the past three months being indicative of its overall volatility. As such, understanding these dynamics is crucial for investors looking to capitalize on future price trends. With this knowledge in hand, it is now possible to make informed decisions about investing in Ethereum or other cryptocurrencies.

Major Events of 2003

In 2003, Ethereum experienced a range of major events that significantly impacted its development and growth. Notably, the project launched its first testnet in August of that year, enabling developers to experiment with features and begin building applications on top of the network. Additionally, Ethereum’s market capitalization surged from $7 million in April 2003 to $54 million by December, representing an increase of 671%. By this time, Ethereum had become one of the most popular cryptocurrencies in terms of trading volume. Technical analysis showed increased price fluctuations as a result of these major events which contributed to potentially higher returns for investors. This created a positive sentiment towards Ethereum amongst crypto traders and investors alike as they perceived it as an attractive investment option. Consequently, these major events had an impact on the overall price trend and set the stage for further growth throughout 2004 and beyond.

Impact of Major Events on the Price Trend

Investigation into the impact of major events on cryptocurrency prices reveals that significant fluctuations may be observed following such occurrences. Regulatory changes, media coverage, and other aspects of market volatility can all have an effect on the price trend for Ethereum (ETH). This was seen in 2003 when a variety of factors influenced the price of ETH:

- Regulatory Changes: The Securities and Exchange Commission’s proposal to regulate digital assets as securities had a large impact on ETH prices in 2003. Additionally, changes to the tax code led to different regulations for cryptocurrencies which also affected their prices.

- Media Coverage: ETH prices were greatly affected by news reports about its potential use cases and technological advancements. This increased public awareness of Ethereum and caused more people to invest, driving up its value.

- Market Volatility: Cryptocurrency is known for its volatile nature, and this was especially true in 2003 since it was still relatively new. Factors such as geopolitical instability could cause drastic swings in ETH prices over short periods of time.

These events impacted the price trend for Ethereum throughout 2003, leading to significant fluctuation from month-to-month as investors reacted to news reports and regulatory changes. In order to understand how these factors influenced the price trend going forward, a closer look at the specific factors influencing ETH pricing is necessary.

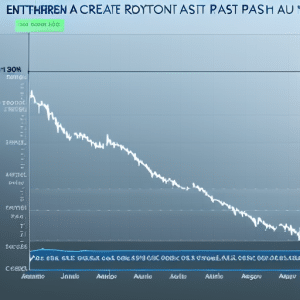

Factors Influencing the Price of ETH in 2003

Analyzing the various factors that impacted the Ethereum market in 2003 reveals a complex interplay between regulatory changes, media coverage, and volatility. The introduction of Initial Coin Offerings (ICOs) was met with widespread enthusiasm and attracted high levels of investment from speculators. At the same time, regulators had to develop rules to control ICOs due to their decentralized nature and lack of oversight by traditional financial institutions. This created an environment where investors were uncertain about how regulations would affect their investments, leading to increased volatility in ETH prices. Media coverage also played a role in influencing investor sentiment regarding ETH prices as positive news stories often drove up prices while negative news stories caused it to fall.

The table below summarizes the impact of different factors on ETH price trends during 2003:

| Factors | Impact on Ethereum Price |

|---|---|

| ICO Regulations | Increased volatility |

| Media Coverage | Positive news caused increase in price; Negative news caused decrease in price |

| Decentralization Impact | Uncertainty among investors as regulations were unclear |

The complexity and uncertainty surrounding these factors has been difficult to navigate for all stakeholders involved. Despite these challenges, the Ethereum market has continued to grow since 2003, indicating that there is still potential for future growth despite the ever-changing landscape of regulations and media coverage. With this understanding, predictions can now be made for the future of ETH based on current data points and historical trends.

Predictions for the Future of ETH

Recent research has indicated that the Ethereum market is expected to continue its upward trajectory in the long-term and could reach a total market capitalization of over $42 billion by 2023. This increase in value will be driven by a number of factors, including:

- Regulatory outlook: As more governments around the world create favorable regulations for cryptocurrencies, an increasing number of investors are becoming interested in investing in ETH.

- Technical analysis: Analysts predict that as Ethereum’s underlying technology matures and new applications are developed on top of it, the price is likely to go up.

- Network effects: With a growing user base and more people using the platform, it is likely that demand for ETH will continue to increase.

These developments suggest that Ethereum’s future looks bright and investors should take advantage of this opportunity while they can. Additionally, understanding investment strategies for ETH could be beneficial for anyone looking to capitalize on these potential gains.

Investment Strategies for ETH

Considering the potential gains of investing in Ethereum, it is important to examine available strategies for ETH investors. When analyzing investment strategies for Ethereum, there are several factors that need to be taken into account such as risk analysis and volatility. It is essential to understand how the market works and how different factors influence the price of ETH before investing. Investors should also take into account their own financial situation and goals when evaluating investment strategies.

There are many tools available to help investors determine which strategy will best suit their individual needs. For example, technical analysis can be used to identify trends in the market and make predictions about future prices. Additionally, fundamental analysis can reveal valuable information about a company or asset that may be beneficial for investors interested in long-term investments. Along with these analyses, there are also various indicators such as moving averages which assist investors in making informed decisions about investments based on past performance data. By utilizing all of these resources, ETH investors can develop an effective investment strategy that suits their personal circumstances and goals while minimizing risk exposure. With careful planning and research, investors can capitalize on opportunities presented by the Ethereum market while avoiding costly mistakes due to insufficient knowledge or ill-preparedness. As such, understanding proper investment techniques is key when attempting to maximize returns from Ethereum investments while minimizing risks associated with them.

Risks of Investing in ETH

Investing in Ethereum is not without its risks, and understanding these potential pitfalls is essential for making informed investment decisions. The price of ETH can be volatile, and there may be sharp changes in value without warning. As such, investors should diversify their portfolio to manage risk. Additionally, the blockchain technology powering ETH has yet to prove itself over time and could potentially have security vulnerabilities that have not been discovered. Furthermore, various government regulations across different countries could affect how ETH is used or traded and could make investing more difficult. It is important for investors to research potential laws and regulations before investing in order to gain a better understanding of any restrictions they may face. In conclusion, it is essential that investors familiarize themselves with the challenges associated with investing in Ethereum in order to effectively manage their portfolios and minimize losses.

Tips for Investing in ETH

When it comes to investing in Ethereum, there are several important tips that can help ensure successful returns:

- Technical Analysis:

- Use technical analysis tools such as support and resistance levels, chart patterns, and indicators to predict the price movements of Ethereum.

- Develop an understanding of technical analysis principles to gain insight into potential entry and exit points for trades.

- Fundamental Analysis:

- Analyze the underlying fundamentals of Ethereum such as its technology, development team, user base, and market capitalization to gain a better understanding of its potential long-term growth prospects.

- Monitor news sources regarding any developments related to Ethereum or its competitors.

By following these tips for investing in ETH, investors can properly assess risk/reward opportunities before making decisions about buying or selling cryptocurrencies. To further protect their investments from volatility or theft risks, investors should also consider strategies such as diversifying portfolios and using secure wallets.

Tips for Protecting Your Investment

Investing in ETH can be a great way to diversify one’s portfolio, but it is important to take the proper precautions to ensure that your investment is secure. To protect one’s investment, it is important to use a secure wallet and regularly monitor price fluctuations. Additionally, following security best practices such as two-factor authentication can help reduce the risk of unauthorized access and further safeguard one’s investment.

Use a Secure Wallet

Securing cryptocurrency investments through the use of a secure wallet is paramount, as it can be likened to safeguarding stored riches with a veritable fortress. Cold storage wallets are an effective way to store cryptocurrency offline, and when used in combination with wallet backups, investors can create an additional layer of security for their crypto assets. Cold storage wallets are typically hardware devices that generate private keys on the spot without ever being connected to the internet. This eliminates any potential risk from malicious actors attempting to access funds via digital means. Additionally, cold storage wallets are also designed such that they require multiple signatures before funds can be moved or accessed – making them much more difficult to compromise than digital alternatives. By creating a combination of cold storage and wallet backups, investors can rest assured that their cryptocurrency investments remain safe from harm. To further ensure security of crypto-assets, investors should monitor price fluctuations regularly and adjust strategies accordingly.

Monitor Price Fluctuations

Observing market conditions is an essential component of safeguarding cryptocurrency investments. Therefore, it is important to be aware of the price fluctuations and monitor trends in the Ethereum (ETH) market. To successfully do this, investors must utilize technical analysis tools such as charting packages, understand how to identify sentiment within the crypto markets, and use a variety of indicators to track price movements. By employing these strategies, investors can gain insight into market behavior and make informed decisions about when to buy or sell ETH.

Investors should also consider following security best practices when monitoring price fluctuations in order to ensure that their funds remain safe. This includes regularly changing passwords for online wallets and exchanges, using two-factor authentication whenever possible, being mindful of phishing scams, and keeping up with software updates from wallet providers. By taking these measures, investors can mitigate potential risks while engaging in cryptocurrency trading activities.

Follow Security Best Practices

Transitioning from the previous subtopic of monitoring price fluctuations, proper security practices should always be employed when trading cryptocurrencies. As with any form of investment it is important to take the necessary steps to ensure that funds are kept safe and secure. Safety measures must be taken when trading Ethereum, as one wrong decision can have a huge impact on the success of an investment. There are several ways in which investors should follow security best practices:

| Security Measure | Benefit |

|---|---|

| Create strong passwords | Protects personal information from malicious actors and hackers |

| Use two-factor authentication (2FA) | Adds an extra layer of protection for accounts by requiring both a password and additional authentication code or device to access account information |

| Avoid phishing scams | Prevents personal data theft caused by online scams disguised as legitimate websites or emails |

Investors should also practice good trading habits such as researching before investing, setting goals, tracking performance, regularly reviewing investments and diversifying portfolios. Developing good trading habits helps investors make better decisions with their investments while minimizing risks associated with cryptocurrency trading. By taking these basic steps investors can ensure that their money is well protected while still reaping potential gains through cryptocurrency trading.