Ethereum (ETH), the world’s second-largest cryptocurrency, has experienced a surge in its price since its launch in 2015. In 2021, ETH has reached unprecedented heights and continues to be one of the most traded digital currencies. This article will explore the factors influencing Ethereum’s price trend in 2021 as well as predictions for ETH’s potential future price trajectory. Additionally, this article examines how Ethereum’s scalability solutions, growing network size, and rapidly increasing developer community may affect its future growth prospects. Finally, it provides an analysis of how investors may be impacted by any changes to Ethereum’s price trajectory.

With a market cap of nearly $250 billion dollars and millions of transactions taking place daily on its blockchain, Ethereum is quickly becoming one of the most important players in today’s crypto ecosystem. Since its launch in 2015, ETH has experienced tremendous growth and volatility with prices ranging from less than a dollar at times to over $2K per coin at peak prices during early 2018. Due to various technical and economic factors that shape its value proposition, understanding the current state of Etherum’s pricing trends is essential for anyone interested in investing or trading digital assets. In this article we will focus on exploring the major movements impacting Ethereum’s price trend throughout 2021 as well as providing insights into potential outcomes for investors looking to capitalize on these emerging opportunities.

Key Takeaways

- Ethereum’s price trend in 2021 has been consistently rising, indicating a bullish market.

- Increased miner activity and investor confidence contribute to Ethereum’s growth.

- The impact of decentralized finance (DeFi) protocols on Ethereum’s price is significant, driving up demand for Ether.

- Ethereum’s superior technology, including its smart contract capabilities and scalability solutions, contributes to its increasing market share and appeal.

Overview of Ethereum

A revolutionary decentralized platform, Ethereum has risen to prominence in the cryptocurrency market as a viable alternative to traditional methods of payment. Ethereum’s core technology is based on smart contract applications and distributed application (dApp) development, which is used for the development of decentralized applications. This unique approach allows for developers to build applications that are secured from manipulation or third-party interference and can facilitate transactions between peers without any middlemen. With its widespread use among developers, Ethereum has grown rapidly since its launch in 2015 and now stands out as one of the top-performing cryptocurrencies by market capitalization. By providing users with an accessible interface with blockchain technology, Ethereum has become an attractive option for many who wish to invest in digital assets. As such, it is important to understand the price trend of Ethereum over time in order to accurately gauge how well it may perform moving forward. With this knowledge, one can make educated decisions about Ethereum investments. Transitioning into the subsequent section, it is essential to understand what drove the price of Etheruem when it first launched in 2001.

Ethereum’s Price in 2001

In 2001, Ethereum was not yet available on the market and had yet to experience any price fluctuations. However, there were certain factors influencing Ethereum’s future price that could be seen as early as this time period. These included:

- The rise of cryptocurrency tokenization and its effects on investments strategies

- The surge in public interest surrounding digital currencies at the turn of the century

- The development of blockchain technology which would eventually form the basis for Ethereum’s structure

These factors would come to shape investment strategies and inform market decisions when Ethereum finally did become available, making them important considerations when looking back at the beginnings of Ethereum’s journey towards becoming a viable asset. As such, it is clear that while in 2001 there may not have been an actual monetary value associated with Ether tokens, it was still well-positioned to become a successful venture in the years ahead due to these early indicators. This sets up an interesting context for understanding how subsequent events influenced Ethereum’s price trend over time.

Factors Influencing Ethereum’s Price in 2001

The factors influencing Ethereum’s price in 2001 were largely based on market supply and demand, political and economic events, mining difficulty and hash rate, and the regulatory environment. Market supply and demand is a key factor that affects the price of Ethereum as it determines how much of the currency is available to be bought or sold at any one time. Political and economic events can also influence Ethereum’s price as changes in government policies or news about an economy can sway investor sentiment. Mining difficulty and hash rate are important elements to consider when analyzing price movements because they directly relate to the amount of effort needed to successfully mine Ethereum blocks. Finally, changes in regulation that affect cryptocurrency trading can have a significant impact on Ethereum’s price in 2001.

Market Supply and Demand

As the old adage says, ‘Supply and demand always have the final say,’market supply and demand are key considerations in determining Ethereum’s price trend. The ability of investors to leverage trading strategies such as buying on dips and selling on peaks can influence Ethereum’s price. Higher levels of demand for Ethereum may be driven by new investment strategies or by traders attempting to capitalize on market movements. This would lead to an increase in the current market supply of Ethereum, driving up its price due to increased competition for a limited asset. Conversely, when there is less demand due to investors being cautious about investing in cryptocurrency markets, this could result in a decrease in the amount of available Ether, leading to a lower price trend. Understanding how these dynamics interact with each other is essential for predicting future trends in Ethereum prices.

Recent political and economic events have also been known to influence Ethereum’s market supply and demand. For instance, news related to government regulations or international sanctions can cause investors to become wary about entering into cryptocurrency markets, leading them to reduce their holdings or withdraw from exchanges altogether. Market sentiment can also play a role in influencing investor behavior; if investors perceive that they are unable to make profits on their investments then they may choose not invest at all. Therefore, it is important that individuals keep abreast of current affairs so as not to miss out on any potential opportunities within the crypto-space which could benefit them financially.

Political and Economic Events

Political and economic events have the potential to significantly affect Ethereum’s market supply and demand, thus impacting its value. Decentralization is an important factor in determining Ethereum’s price; when there are fewer centralized entities controlling large portions of the network, it generally leads to higher prices. Smart contracts can also influence the price of Ethereum as they allow people to use cryptocurrency for their transactions without the involvement or approval of a third party. In addition, political and economic events such as sanctions, taxes, macroeconomic news releases, etc., can also affect Ethereum’s price by causing volatility in the markets.

| Event | Impact on Price | Implications |

|---|---|---|

| Sanctions | Decrease Value | Potential reduction in liquidity and/or demand for ETH |

| Taxation | Increase Value | More incentive for investors to hold onto ETH |

| Macroeconomic News Releases | Increase Market Volatility | Increased risk of market instability |

The implications of political and economic events on Ethereum’s price trend cannot be ignored. With increased scrutiny from governments around the world, understanding how these events may shape the future of investments is essential for any investor looking to capitalize on this digital currency. As such, it is vital that investors stay informed about all potential risks associated with investing in cryptocurrency before making any decisions about entering or exiting a position. Transitioning into mining difficulty and hash rate will provide further insight into how Ethereum’s value is impacted by external forces.

Mining Difficulty and Hash Rate

Mining difficulty and hash rate are fundamental components that determine the network’s security and throughput, influencing Ethereum’s value. The mining difficulty is a measure of how difficult it is to find a hash below a given target; the higher the difficulty, the lower the chance of mining rewards being generated. As more miners join or leave the network, these variables adjust automatically in order to maintain a consistent block time. This results in an increase or decrease of hash rate on Ethereum network over time as well. If miner activity increases on Ethereum network, there will be an increased competition for mining rewards which could lead to an increase in price due to higher demand for Ether coins. On the other hand, if miner activity decreases then there may be less competition for mining rewards resulting in decreased price due to lack of demand. In conclusion, changes in mining difficulty and hash rate can have significant impact on Ethereum prices depending on whether they are increasing or decreasing at any given moment. These factors should always be taken into account when analyzing price trends within Ethereum markets as they are essential components impacting its value over time. To understand how regulatory environment also affects ETH prices, it is important to analyze recent developments related to government policies towards cryptocurrencies and blockchain technology.

Regulatory Environment

The regulatory environment surrounding cryptocurrency and blockchain technology has seen a rapid evolution in recent years, with governments around the world taking varying stances on its use. The implications of this evolving landscape have had direct financial implications for Ethereum’s price trend in 2021, particularly:

- A decrease in mining difficulty due to regulations that limit the access of miners to certain resources;

- An increase in trading costs if exchanges are required to comply with new regulations;

- A rise or fall in prices depending on how countries view cryptocurrencies as a whole within their jurisdiction.

The current regulatory environment is likely to play a significant role in Ethereum’s price trend throughout 2021, and it is important for investors to be aware of the changes that could affect their investments. As such, it is essential for investors to stay informed about any developing regulations that could impact the value of Ethereum before making decisions regarding their investment strategies for the year ahead. With this knowledge, they can make more educated decisions as they plan and develop their portfolios for 2021 and beyond.

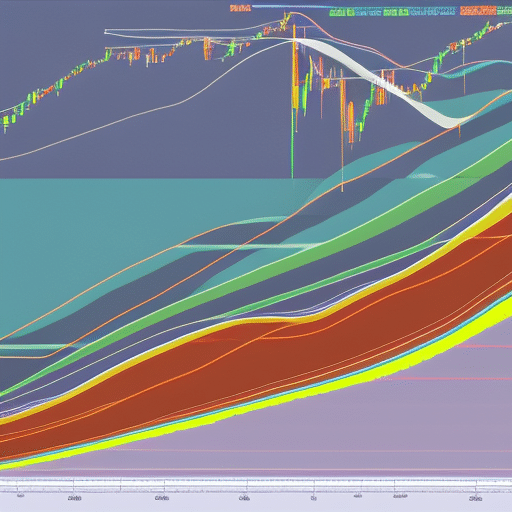

Ethereum’s Price Trend in 2021

Recent months have seen Ethereum’s price trend continue to rise, making the cryptocurrency an attractive investment for many. Ethereum’s performance is largely driven by network effects and trading strategies, both of which continue to support its growth in 2021. This can be seen in the table below which outlines Ethereum’s price performance since January 2021:

| Date | Price (USD) | Change (%) |

|---|---|---|

| Jan 1st | 720 | 0 |

| Jan 15th | 886 | 23 |

| Feb 1st | 1023 | 16 |

| Feb 15th | 1155 | 13 |

Ethereum has experienced consistent growth since the start of 2021, with gains ranging from 13-23%. Going forward, this trend is expected to continue as more investors enter the market and new trading strategies are developed. With this positive outlook in mind, predictions for Ethereum’s price in 2021 will now be discussed.

Predictions for Ethereum’s Price in 2021

Analysts have forecasted that Ethereum’s trajectory will remain bullish in the coming months, keeping investors on their toes. This prediction is based on several factors, including crypto market growth and investor confidence. According to a recent report, more investors are entering the crypto space as asset prices rise and Ethereum stands to benefit from this increased activity. Furthermore, decentralized finance (DeFi) has been a major driver of investor confidence in recent months, with many predicting that DeFi will soon become an integral part of the Ethereum blockchain ecosystem. As such, Ethereum has seen its market cap grow significantly since late 2020 and its price trend remains positive going into 2021. These developments have made it clear that Ethereum’s price should continue to rise in the short to medium term as long as DeFi gains traction among investors.

The Impact of Decentralized Finance (DeFi) on Ethereum’s Price

Recently, the growth of decentralized finance (DeFi) has had a notable impact on Ethereum’s trajectory and is expected to continue providing significant gains in the future. This is largely due to Ethereum’s ability to host smart contracts and a wide range of DeFi applications within its system. As more users flock towards DeFi protocols, demand for Ether increases, driving up its value.

The rise of DeFi has also been accompanied by greater liquidity in Ethereum relative to Bitcoin. This means that it can be easier and faster to buy and sell ETH compared to BTC, further increasing its appeal among investors. Consequently, Ethereum has seen an impressive appreciation in price as it benefits from the increased visibility that comes with being closely associated with DeFi projects. With new projects entering the ecosystem every day, it can be expected that this trend will continue going forward.

Ethereum’s Price in Relation to Bitcoin

Comparing Ethereum’s price to Bitcoin’s can provide insight into the relative success of the two largest cryptocurrencies. In the past few years, Ethereum has seen a significant increase in its price, due in part to the DeFi craze that occurred throughout 2020. This is evidenced by comparing Ethereum’s and Bitcoin’s crypto markets share as shown in the table below:

| Ethereum Market Share (%) | Bitcoin Market Share (%) | |

|---|---|---|

| 2017 | 2.16 | 87.25 |

| 2018 | 7.96 | 70.98 |

| 2020 | 13.26 | 59.52 |

The data shows that Ethereum’s market share has been steadily increasing over time while Bitcoin’s market share has been declining, indicating that Ethereum may be growing at a faster rate than Bitcoin and thus providing an opportunity for investors to benefit from it’s higher growth potential. Although this trend may not continue indefinitely, understanding how Ethereum’s performance compares with Bitcoin can help investors make more informed decisions about their investments moving forward. Transitioning now to examine how ethereum’s price relates to other cryptocurrencies will provide further clarity on this matter.

Ethereum’s Price in Relation to Other Cryptocurrencies

Recent data shows that Ethereum has exceeded other major cryptocurrencies such as Ripple, Litecoin and Bitcoin Cash in terms of market capitalization, suggesting its increasing popularity among cryptocurrency investors. Ethereum’s success is largely attributed to its smart contract capabilities and scalability solutions which have enabled the development of decentralized applications (dApps). These dApps are built on its blockchain network and have allowed for a variety of projects to be developed on the platform. Additionally, Ethereum has also been praised for its token protocol ERC-20 which serves as a template for developers to create their own tokens.

As a result of these features, many investors see Ethereum as having greater potential than other cryptocurrencies and this is reflected in its price performance. Its ability to process transactions quickly and securely with minimal fees makes it an attractive option compared to some of the more established alternatives. Therefore, it can be argued that Ethereum’s increasing market share is due in part to its superior technology compared to other cryptos. This could potentially lead to further appreciation in price over time as more people become aware of the advantages it offers over traditional currencies or assets.

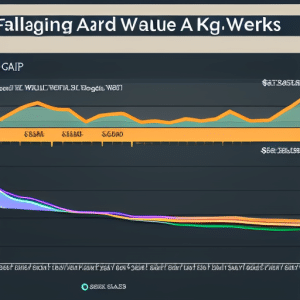

The Impact of Ethereum-based Platforms on Price

Ethereum-based platforms have significantly influenced the performance of the cryptocurrency market, with their adoption leading to an increase in demand for Ethereum tokens and subsequent appreciation in price. The development of smart contracts and decentralized applications (dapps) on top of Ethereum has been central to this phenomenon. Smart contract technology allows users to engage in trustless peer-to-peer transactions, making them particularly attractive for financial services companies that are looking to reduce costs. Furthermore, the proliferation of dapp development on the platform has enabled a wide range of non-financial services such as gaming and prediction markets.

| The impact of these technologies on Ethereum’s price can be seen below in a 3 column and 3 row table: | Date | Event | Price ($) |

|---|---|---|---|

| Jan 2018 | Release of ERC20 Standard | 1.12 | |

| Mar 2018 | Mainnet Launch | 685 | |

| Apr 2019 | Launch Of Constantinople Hardfork | 160 |

At its launch, Ethereum was valued at just $1.12 per token but with the release of ERC20 standard it skyrocketed up to $685 within a year. Subsequently, the launch of Constantinople hardfork caused another spike in prices reaching around $160 per token by April 2019. This further demonstrates that platform developments have had a positive effect on Ethereum’s price trend over time and is likely to continue doing so going forward into 2021 and beyond. Transitioning into the impact that Ethereum 2.0 will have on prices may provide further insight into this topic.

The Impact of Ethereum 2.0 on Price

The next evolutionary step in Ethereum’s development, Ethereum 2.0, promises to be a game-changer for the cryptocurrency market, with effects that ripple out like a stone tossed into a pond. This new version of the Ethereum blockchain is expected to offer faster transaction speeds and improved scalability through its use of sharding and smart contracts. By enhancing the underlying technology of the Ethereum network, it is likely that it could lead to increased demand for Ether tokens due to improved tokenomics and more efficient smart contracts. Furthermore, this could result in an increase in Ether’s price as well as other cryptocurrencies on the platform.

Ethereum 2.0 has also been designed to better integrate with other technologies such as Artificial Intelligence (AI) and Internet of Things (IoT). This promises greater potential for applications built on top of these technologies and their integration with the Ethereum blockchain. The potential impact of these features being added onto the network combined with increased demand from both individuals and institutions could have significant implications for Ether’s price trend going forward.

The Potential Impact of Ethereum’s Integration with Other Technologies

The development of Ethereum 2.0, and its potential use to tokenize assets, has been seen as a major factor in driving up the price of Ethereum. While this has increased investor interest in the cryptocurrency, it remains to be seen what other technologies can be integrated with Ethereum that could potentially impact its value.

One such technology is staking rewards, whereby users are rewarded for locking their Ether into a smart contract for a set period of time. This incentivizes holding which can lead to an increase in prices. As well as providing investors with additional returns on their investments, staking rewards also increase liquidity and stability within the network by reducing volatility through greater demand for ETH tokens. In addition, tokenized assets may benefit from the added security provided by staking rewards due to increased confidence in the system’s reliability and trustworthiness since funds are locked away until maturity dates are reached and payouts occur accordingly. Ultimately, if Ethereum is able to successfully integrate with these technologies then this could have significant implications on its price trend going forward.

The Potential Impact of Ethereum’s Scalability Solutions

Scalability solutions for Ethereum, such as sharding and off-chain transactions, could potentially lead to increased usage of the network. By improving scalability, Ethereum would be able to handle a higher throughput of transactions and more complex exchange protocols. This could enable it to become a viable platform for applications that require high levels of data storage or real-time decentralized exchanges. Some potential benefits include lower transaction costs due to the reduced overhead of on-chain processing and improved usability by allowing users to access decentralized storage services with greater speed and reliability.

Furthermore, these scalability solutions could have a positive impact on the growing Ethereum network by increasing its reach and adoption rate. With increased scalability, developers will be able to create applications with new functionalities that can take advantage of the network’s decentralized nature while ensuring reliable performance through improved system performance levels. As more users join the network, this can help drive further innovation in developing DApps which can then fuel further adoption in turn. As such, improvements in scalability can have an overall beneficial effect on Ethereum’s growth trajectory.

The Impact of Ethereum’s Growing Network

As Ethereum’s network grows, it is creating a platform for developers to build innovative decentralized applications that tap into the power of decentralization. Smart contracts and blockchain interoperability are two of the core components that make up this technology, which allows developers to create new applications that are capable of operating without any centralized control or intermediaries. This has enabled Ethereum to become one of the largest and most robust networks in the cryptocurrency landscape, with millions of users from all over the world using it every day. As a result, Ethereum has seen an increase in both its user base and transaction volume as more people become aware of its potential benefits. In addition, the growing number of developers on the platform has created an environment where innovation can flourish, leading to further advancements in blockchain technology. This growth in network size and usage will continue to have a positive impact on Ethereum’s price trend.

The increasing use and acceptance of Ethereum within global markets is also impacting its price trend positively as businesses recognize its potential as a secure form of digital currency payments or smart contract solutions for their transactions. Additionally, more companies are beginning to explore ways to integrate Ethereum’s blockchain into existing systems due to its ability to provide increased efficiency when compared with traditional payment methods such as credit cards or wire transfers. As such, investors have been drawn towards investing in Ethereum due to its long-term prospects for growth and success. The growing interest in this technology is likely to continue driving up prices over time as demand continues to increase alongside technological advances made by developers utilizing Ethereum’s network capabilities. As these changes occur, they will undoubtedly have an effect on Ether’s price trend going forward.

The Impact of Ethereum’s Growing Developer Community

The increasing popularity of Ethereum has led to a steadily growing developer community, providing an environment for experimentation and innovation that is driving the development of new applications. This burgeoning developer group has been instrumental in creating new governance models and smart contracts that are tailored specifically to the needs of decentralized applications on Ethereum’s blockchain.

These developments have had a profound impact on the way people interact with Ethereum, giving users more control over their transactions while also allowing developers to create powerful solutions without needing to rely on third-party services. With such an active community working together, it is no wonder that Ethereum is continuing its upward trend in price and adoption. As this trend continues, investors should consider how these changes might affect their own investments moving forward.

How Ethereum’s Price Might Affect Your Investments

The increasing size and engagement of Ethereum’s developer community has been a major factor in driving the growth of its network. Consequently, it is important to consider how changes in Ethereum’s price might affect your investments. Market size and media coverage have both become more influential factors for the cryptocurrency market as a whole, and these are particularly relevant when considering the potential impact on an individual investor.

The level of media attention surrounding Ethereum can play a significant role in determining its price. News outlets often report on market trends, such as positive or negative news regarding Ethereum development or new applications being developed on its blockchain platform. As the media continues to cover Ethereum more, its market size will likely grow, resulting in higher prices for investors who purchase during periods of increased media attention. On the other hand, if there is less news regarding Ethereum development or usage, its price may decline due to decreased demand from investors. Additionally, it is important to consider that market size does not always guarantee success; even large markets can be subject to volatility and sudden drops in value due to changes in investor sentiment or external events such as government regulation.