Ethereum is a decentralized, open-source software platform for blockchain technology. It was first proposed in 2013 by Vitalik Buterin and has since become one of the most popular cryptocurrencies on the market. As its popularity continues to grow, more investors are looking to invest in Ethereum and make predictions about how its price will fluctuate in the UK. This article examines various factors that influence Ethereum’s price in the UK, including technical and fundamental analysis as well as predictions made by experts. Furthermore, it explores how reliable these predictions are and what investors should consider when making their investment decisions.

Key Takeaways

- Risk management strategies, such as setting stop-loss levels and limits on capital investment, are crucial for investors in Ethereum to protect their investments.

- Diversification across different assets, asset classes, and industries helps to reduce overall risk and increase potential returns for investors in Ethereum.

- Monitoring market sentiment and staying updated on market trends can aid in predicting Ethereum prices and making informed investment decisions.

- Including other cryptocurrencies like Bitcoin or Litecoin, as well as investing in stocks or commodities, can further diversify an investor’s portfolio and limit the impact of any single investment on overall portfolio value.

Factors Influencing Ethereum Price UK

The Ethereum price in the United Kingdom depends on a range of economic, financial, and technological factors. Brexit has had a significant impact on the Ethereum price in the UK due to its potential implications for the country’s economy. Institutional demand from investors can also influence the Ethereum price as it can lead to increased investor confidence and liquidity. Furthermore, technological advancements such as blockchain technology have made it easier for people to buy and sell cryptocurrencies like Ethereum, which can also have an effect on the cryptocurrency’s value in the UK market. In addition, macroeconomic factors such as inflation levels or interest rates will affect how much investors are willing to invest in digital currencies like Ethereum. All these factors combined determine how volatile or stable the Ethereum price will be at any given time in the UK market.

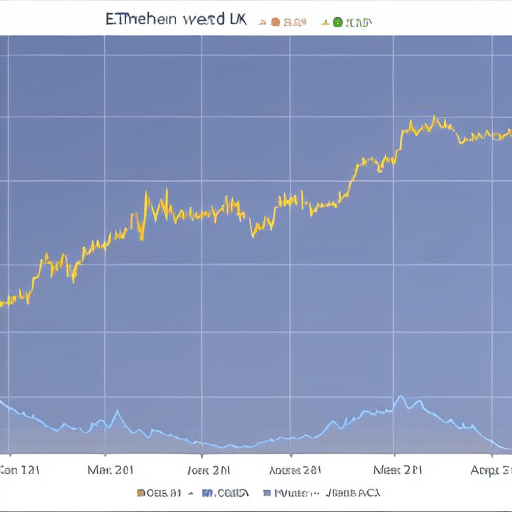

These economic and financial forces are only part of what influences Etherprice fluctuations; technical analysis is another key factor that should be considered when examining prices over time. Technical analysis involves using historical data points and charts to gain insights into where prices may go next based on past patterns of behavior. Analyzing trading volume, support/resistance levels, and other metrics can give traders valuable insights into future trends that could influence Etherprice movements in the UK market.

Technical Analysis of Ethereum Price UK

Analyzing the fluctuations of the digital asset within the United Kingdom reveals potential trends. Ethereum is a popular cryptocurrency due to its decentralized and open-source nature, and thus has been subject to multiple technical analysis strategies by investors in order to make optimal investment decisions. The UK’s market liquidities can also be considered when making these decisions, as it affects how quickly traders can buy or sell an asset without affecting its price. The following are three key points that should be taken into account when analyzing Ethereum price in the UK:

- Investment Strategies – It is essential for investors to consider their own investment strategies when trading Ethereum in the UK. This includes deciding on which type of orders they want to use (such as limit orders, market orders, stop loss orders), and understanding how this will impact their trading strategy.

- Liquidity Concerns – Liquidity is an important factor for any trader looking to invest in Ethereum in the UK, as it affects how quickly trades can be executed without impacting prices significantly. By considering liquidity levels before investing, traders can ensure that they have enough liquidity available if they need to enter or exit a position quickly.

- Technical Analysis – Technical analysis of Ethereum’s price movements can provide insight into potential future price movements, giving investors a better chance of predicting where prices may go next and helping them generate successful returns from their investments. With careful consideration given to these three points, traders can develop effective trading strategies that maximize their profits on Ethereum investments within the UK.

By taking into account all these factors when analyzing Ethereum price in the UK, investors can increase their chances of success with their investments while mitigating against potential risks associated with volatile markets. Moving forward with this analysis requires an examination of fundamental factors influencing Ethereum’s price instead – another step towards optimizing one’s investment strategy during uncertain times.

Fundamental Analysis of Ethereum Price UK

Investors must consider fundamental factors when attempting to maximize returns from Ethereum investments within the UK. Alternative investments have become increasingly popular and Ethereum has shown tremendous promise as a viable asset class in terms of potential returns. Market trends also need to be taken into consideration, with careful analysis of historical data needed to determine the long-term prospects of any crypto investment. This could include factors such as economic growth, inflation, and geopolitical events that could all impact the price of Ethereum in the future. By understanding these fundamentals investors can make more informed decisions about their cryptocurrency investments in order to maximize their returns while minimizing their risk exposure. With a detailed understanding of both technical and fundamental analysis, investors may be better equipped to anticipate market movements and position themselves accordingly for success.

Ethereum Price UK Predictions

Forecasting market movements of cryptocurrencies in the UK can be difficult, but understanding Ethereum’s fundamental factors and historical data may help investors identify potential trends. For example, long-term investing may be advantageous for those looking to invest in Ethereum due to the fact that it eliminates short-term volatility and allows investors to benefit from compounding returns. Additionally, investors must consider tax implications when making investments in Ethereum as well as other cryptocurrencies. Furthermore, many analysts make price predictions based on a variety of technical indicators such as Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Fibonacci retracements. By taking these into account, investors can gain insight into future price movements. Finally, the use of machine learning algorithms can help traders pinpoint exact entry and exit points for their trades with increasing accuracy.

Overall, predicting the future price of Ethereum is no easy feat; however, by using a combination of fundamental analysis and technical forecasting techniques, investors may better predict future trends in the cryptocurrency markets.

How Reliable are the Predictions?

Gaining insight into the accuracy of cryptocurrency price predictions requires careful consideration of a variety of factors. Ethereum’s position as an alternative investment option in portfolio management has generated significant interest in its predicted prices in the UK. Analyzing these predictions requires breaking them down into two components: short-term and long-term forecasts. Short-term forecasts, which are often based on technical analysis, provide investors with a snapshot view of Ethereum’s potential trajectory for a limited period and should be taken cautiously due to their inherent lack of accuracy. Long-term predictions, however, are more reliable when taking into account fundamental metrics such as blockchain adoption rate and the impact on businesses within the Ethereum network. These types of predictions offer investors greater insights into Ethereum’s future price movements and can help them make informed decisions about their investments. Transitioning from this discussion, it is also important to consider what other factors investors should take into account when making decisions about investing in cryptocurrencies like Ethereum.

What Should Investors Consider?

When investing in Ethereum, it is important for investors to consider how they can manage risk and diversify their portfolios. Risk management strategies such as having a stop-loss level or setting limits on the amount of capital to be invested in any one asset should be employed. Additionally, diversification is key to reduce overall risk by spreading the investments across different types of assets. This helps to ensure that if one asset decreases in value, the other assets can help to balance out the loss.

Risk management

Managing the risks associated with predicting Ethereum prices in the UK is essential for successful financial forecasting. Investors should consider implementing hedging strategies such as diversifying their portfolios, utilizing short-term investments, or investing in derivatives to protect against price volatility. Additionally, monitoring market sentiment can help investors make more informed decisions when predicting future Ethereum prices.

When attempting to manage the risks associated with predicting Ethereum prices, diversification is key; by spreading investments across different types of assets or industries, investors can reduce their exposure to risk and ultimately improve their chances of a profitable return. Moreover, other strategies such as dollar-cost averaging and tactical asset allocation can also be used to mitigate losses and maximize returns. By taking these steps into consideration, investors will be better equipped to make sound investment decisions when predicting cryptocurrency prices in the UK.

Diversification

Diversifying investments across different asset classes or industries can help reduce exposure to risk and improve chances of achieving a profitable return. Hedging strategies are used by investors to diversify their portfolios, thereby reducing the overall risk. For example, if an investor is speculating in Ethereum prices in the United Kingdom, they may opt for a portfolio allocation that includes other cryptocurrencies such as Bitcoin or Litecoin to spread out the risk. In addition, they could invest some of their funds into stocks or commodities, further diversifying their portfolio and mitigating potential losses from Ethereum market fluctuations. Such strategy enables investors to protect against losses by taking advantage of market movements in different asset classes. By investing in multiple assets with differing returns over time, an investor can limit the impact of any single investment on their overall portfolio value.

Frequently Asked Questions

What is the current Ethereum price UK?

The current ethereum price in the UK is skyrocketing, highlighting the need for careful investment strategies and consideration of tax implications. Investors must be well-versed in market trends to maximize returns on their investments, with a keen eye to spot any potential changes in price. Numbers and analytics should be used to inform decisions, enabling investors to make sound financial choices.

How does Ethereum price UK compare to other cryptocurrencies?

The Ethereum price in the UK is heavily influenced by economic factors and investment strategies. In comparison to other cryptocurrencies, it has seen significant growth in recent years, making it an attractive option for investors. Quantitative analysis of its performance can provide further insights into potential future trends.

How can I buy Ethereum in the UK?

Alluringly, there are several buying options available for Ethereum in the UK. Security solutions such as hardware wallets or multi-signature accounts should be considered to secure funds. Additionally, ETH can be acquired through exchanges using GBP or other cryptocurrencies. A numerical analysis of fees and liquidity should also be conducted to select the most suitable purchasing option.

How do I store Ethereum securely?

Hardware wallets and cold storage are secure methods to store Ethereum cryptocurrency. They provide the highest degree of security, as private keys remain offline and away from potential hackers. Hardware wallets can protect coins from malware, viruses, and other malicious attacks. Cold storage further reduces the risk of theft or loss by storing funds in an offline environment.

What are the risks associated with investing in Ethereum?

The fickle nature of the market can be likened to a game of chess, where every move must be carefully calculated in order to reap rewards. Investing in Ethereum carries risks that cannot be ignored, including market trends and volatile investment strategies. It is essential for investors to research and prepare before entering the ever-changing landscape of cryptocurrency.