The year 2007 marked a major turning point for the Ethereum network. This was the year when its cryptocurrency, Ether (ETH), began to be traded on exchanges, and it quickly rose to become one of the world’s most traded digital assets. As more people became aware of this new technology, ETH’s price skyrocketed as investors sought to capitalize on its potential. While there were many factors that influenced ETH’s rapid rise in value, such as the ICO boom and increased adoption of blockchain technology, one thing is clear: 2007 was an important milestone in Ethereum’s history and it had a significant impact on ETH’s market performance. The following article explores these events from 2007 and examines their influence on ETH’s price evolution over time.

Key Takeaways

- Year 2007 marked a major turning point for the Ethereum network.

- Ether (ETH) began trading on exchanges in 2007 and quickly became one of the most traded digital assets.

- Factors influencing ETH’s rapid rise in value include the ICO boom and increased adoption of blockchain technology.

- Ethereum saw an impressive rise in value in 2007.

Overview of the Ethereum Network

The Ethereum network is a veritable beehive of activity, with transactions being processed at a rapid pace. It is the world’s second-largest cryptocurrency by market capitalization and the most widely used blockchain platform for decentralized applications. The platform offers excellent security features which ensure that all transactions are secure and can only be performed by authorized parties. Furthermore, its scalability allows it to process thousands of transactions within seconds while ensuring low latency and reduced transaction fees. This makes it an ideal choice for businesses looking to leverage blockchain technology both quickly and securely. Additionally, Ethereum’s smart contract capabilities allow developers to create autonomous systems that can automate processes without relying on third-party approval or trust. These features make the Ethereum network an attractive option for businesses looking to adopt distributed ledger technology. Transitioning into market performance in 2007, Ethereum was launched in July 2015 with an initial coin offering (ICO) where users were able to purchase ETH tokens with Bitcoin or other cryptocurrencies.

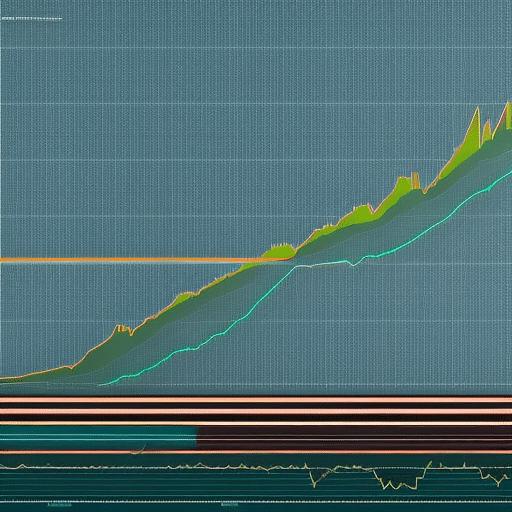

Market Performance in 2007

In 2007, the cryptocurrency saw an impressive rise in value. To further understand this success, it is important to consider its community effects and scalability issues. Firstly, Ethereum’s innovative programming language enabled developers to create decentralized applications (dApps) that were previously impossible with Bitcoin and other blockchains. Secondly, the lower transaction fees attracted more users who wanted to benefit from blockchain technology without paying exorbitant amounts for every transaction. Thirdly, a strong sense of trust was generated between investors and developers due to open-source development which helped build confidence in the platform’s security features. Lastly, Ethereum’s improved scalability made it easier for dApps to be built on a large scale.

These factors contributed significantly towards Ethereum’s market performance in 2007 when compared to other cryptocurrencies. As more people became aware of the benefits of using this new technology, demand for ETH increased exponentially resulting in higher prices per token. This marked a turning point for Ethereum as user adoption rates grew faster than ever before – setting up a successful future trajectory that continues to define the cryptocurrency today. The impressive growth of ETH in 2007 demonstrates how important community effects and scalability issues are when considering market performance over time.

Factors Influencing ETH’s Price

Cryptocurrency prices are greatly influenced by a variety of factors, particularly when it comes to Ethereum. Investment strategies and scalability solutions can play an important role in the price of ETH due to the high volatility of the cryptocurrency markets. Investors who understand how these solutions can affect their trading decisions may be more successful at predicting changes in ETH’s market price. Additionally, ICOs have been seen as drivers of growth and innovation within the Ethereum network, but they also bring with them risks that can cause drastic fluctuations in prices. As such, investors must be aware of both the potential rewards and pitfalls associated with investing in ICOs before making any decisions. The next section will explore the impact of the ICO boom on Ethereum’s market performance.

The Impact of the ICO Boom

Initial coin offerings (ICOs) have been seen to have a significant effect on the Ethereum network, both in terms of growth and innovation as well as volatility. The introduction of ICOs provided an alternative approach to raising funds for startups, allowing them to bypass traditional capital-raising methods. This created opportunities for projects that may not have otherwise existed before and generated interest in the Ethereum network. However, the lack of regulations concerning ICOs has caused increased market volatility, leading many investors to suffer losses due to fraudulent or failed projects. As such, governments around the world are beginning to take more stringent action towards token regulation and ICO regulations in order to protect investors from fraud. The effects of these regulations will likely be felt on the Ethereum market price as they begin to take shape over time. With this in mind, it is important for Ethereum enthusiasts and investors alike to remain aware of any upcoming changes regarding ICOs and token regulation as they could dramatically affect ETH’s market price going forward. As such, it is pertinent that we transition into discussing the launch of Ethereum 2.0 which could potentially bring about further changes in the cryptocurrency landscape.

The Launch of Ethereum 2.0

The highly anticipated launch of Ethereum 2.0 is likely to induce seismic shifts in the cryptocurrency landscape, revolutionizing how digital assets are used for financial transactions. This upgrade promises greater security and scalability improvements compared to its predecessor. The most notable of these changes is the introduction of a new consensus algorithm called Proof-of-Stake (PoS). Unlike traditional mining-based algorithms like Bitcoin’s Proof-of-Work (PoW), PoS does not require miners to expend energy in order to confirm blockchain transactions. Instead, users can stake their ETH coins directly in order to receive rewards from transaction fees and network activity. This shift could potentially lead to an increase in user adoption due to reduced costs associated with running full nodes on the network. Additionally, scalability issues that have been plaguing Ethereum since its inception may be addressed by this upgrade as well, due to an expected increase in transaction throughput capacity on the network.

Overall, the launch of Ethereum 2.0 is a landmark moment for digital asset technology and will likely shape how cryptocurrencies are used for years to come. Its implementation promises improved security measures and scalability solutions which could help foster wider adoption among investors and businesses alike. With these improvements now available for use on the platform, attention can now turn towards furthering smart contract adoption and exploring other potential applications within the blockchain space.

Smart Contract Adoption

Smart contract adoption is increasing rapidly, with an estimated 40 million Ethereum-based smart contracts created in 2020 alone. Much of this growth can be attributed to the rise of decentralized exchanges (DEXs) and staking rewards. DEXs are platforms where users can exchange cryptocurrency without a centralized intermediary, often leading to cheaper fees and improved privacy compared to centralised exchanges. Staking rewards are incentivization mechanisms that reward users for holding their cryptocurrency in a specific address over time, often providing passive income streams for holders.

The combination of these two features has driven increased interest in Ethereum-based smart contracts, resulting in the explosive growth seen throughout 2020. This growth has also been boosted by the growing interest in decentralized finance (DeFi), which provides increased access to financial products such as loans and derivatives on a permissionless basis. As DeFi continues to expand its position within the crypto space, it is likely that smart contract adoption will continue its strong upwards trend into 2021 and beyond.

Growing Interest in Decentralized Finance (DeFi)

Increasingly, decentralized finance (DeFi) is gaining traction as a financial system that offers users access to financial services without the need for centralized intermediaries. DeFi banking provides users with the ability to access loans and receive interest payments without needing to rely on traditional banking institutions. Additionally, it offers investors opportunities to trade in crypto derivatives such as futures contracts and options without having to use an exchange or broker. This has enabled more people around the world to participate in digital asset trading and increase their exposure to Ethereum-based markets. The growing popularity of DeFi has also allowed greater liquidity in these markets, which can help stabilize pricing in volatile periods. As more individuals become aware of the potential benefits offered by DeFi and its associated crypto derivatives, there is likely to be a continued rise in interest as well as increased investment from institutional players. These developments point towards a bright future for Ethereum and other blockchain-based assets, providing further catalysts for growth within the eth market price. This growing interest in DeFi will pave the way for further innovation within this space, including new products like non-fungible tokens (NFTs).

Growing Market for Non-Fungible Tokens (NFTs)

Non-fungible tokens (NFTs) have recently become an increasingly attractive investment vehicle for digital asset traders, offering investors the opportunity to diversify their portfolios and capitalize on unique ownership rights. As a form of digital asset, NFTs provide security through encryption and blockchain technology that is difficult to replicate or forge. This security makes them a desirable option in comparison to more traditional assets such as stocks and bonds. Furthermore, NFTs offer investors scalability when compared to decentralized finance (DeFi) applications which often have limitations in terms of transactions due to underlying blockchain technology constraints.

NFTs are also becoming popular as a medium for creating novel marketplaces around collectibles and digital art. Platforms such as OpenSea, Rarible, CryptoKitties, and Decentraland are allowing users to buy virtual real estate or trade exclusive assets with each other while leveraging the Ethereum network for secure transactions. This has resulted in an increase in demand for unique assets backed by the Ethereum network as more developers create new ways of using NFTs within games or other applications. As such, NFTs represent an exciting new frontier for cryptocurrency investors looking to gain exposure to digital assets with high potential returns.

Increasing Use of Ethereum in Games

The utilization of Ethereum technology in gaming has become a highly attractive proposition for developers and gamers alike, offering unique opportunities to create immersive experiences backed by blockchain technology. The use of Ethereum-based tokens provides an ability to represent digital assets, create gaming economies, and trade virtual items in a secure manner. This has resulted in an increased adoption of these tokens as the gaming industry seeks to capitalize on the potential benefits that can be derived from blockchain technology. Moreover, Ethereum’s smart contract capabilities enable players to securely purchase game assets with digital currencies or fiat money without requiring any centralized authority. As such, gaming platforms are increasingly utilizing Ethereum-based tokens to facilitate transactions within their ecosystems and provide users with access to virtual assets that can potentially generate real value. These developments have created new opportunities for both developers and gamers that are helping drive the growth of the Ethereum market price.

Increasing Adoption of Ethereum-Based Tokens

Adoption of Ethereum-based tokens has grown rapidly in the gaming industry, providing gamers and developers with a secure means to purchase and trade virtual assets. The increased use of decentralized exchanges for trading Ethereum-based tokens is also driving their adoption as more users are able to access them securely without relying on central authorities or banking systems. Token regulations have also been put into place in various jurisdictions to ensure that the transactions related to these tokens are secure and transparent, further boosting their acceptance among gamers. This increasing popularity of Ethereum-based tokens provides a solid foundation for the growth of decentralized applications (dapps) within the gaming space.

Growing Popularity of Decentralized Applications (DApps)

The growing popularity of decentralized applications (DApps) has enabled gamers to interact with a variety of digital assets that are not controlled by any single entity, allowing for increased security and transparency. DApps have been built on the Ethereum protocol, which offers developers the advantages of scalability, low cost transactions, and smart contracts. Furthermore, Ethereum-based protocols allow developers to create trustless networks with no single point of failure. This has resulted in an increase in dapp usage and consequently an impact on the Ethereum market price as more users transact within this network. The increased demand for these types of digital assets has also led to improvements in dapp scalability and security features that make them more attractive to users. As the use of decentralized applications continues to grow, it is likely that their effect on the Ethereum market price will only become more pronounced. Transitioning into increasing use of ethereum-based protocols, it is increasingly evident that they offer a wide range of benefits over traditional methods such as improved privacy measures and fast transaction speeds.

Increasing Use of Ethereum-Based Protocols

The increasing popularity of Decentralized Applications (DApps) has spurred the demand for Ethereum-based protocols. These protocols allow developers to create applications on top of the Ethereum blockchain, providing various advantages and opportunities for businesses. One such advantage is the reduction in deployment costs, as developers can deploy an application with a fraction of the cost incurred when compared with traditional web applications. This has enabled many companies to develop complex applications quickly and affordably. Additionally, these protocols provide scalability solutions that are more efficient than those provided by traditional databases, meaning users can trust their data will remain secure even if it is stored on a public network.

In addition to cost savings and scalability benefits, Ethereum-based protocols also offer increased security measures for businesses. Through using distributed systems and cryptographic techniques, organizations can rest assured that their data remains secure from malicious actors. By leveraging these tools, companies can protect themselves from costly breaches or other cyber attacks that could potentially cripple their operations. As this level of security increases in sophistication over time, more organizations will likely adopt Ethereum-based protocols as an integral part of their infrastructure moving forward. Ultimately, this will result in a wider adoption of Ethereum’s blockchain technology across industries and sectors globally – making it critical for any business looking to remain competitive in today’s marketplace.

Increasing Adoption of Ethereum’s Blockchain Technology

As Ethereum’s blockchain technology continues to gain traction, more businesses are turning to it for its various advantages. Its capacity to facilitate secure and transparent transactions, along with its decentralized platform makes it an attractive option for companies looking to increase their efficiency and reliability. Despite some scalability issues that have been observed in the past, these can be addressed through sharding or other techniques such as Plasma and Casper. Security concerns are also addressed by Ethereum through its use of smart contracts and cryptographic algorithms ensuring the immutability of the blockchain data.

The increasing adoption of Ethereum’s blockchain technology has led to a growing interest in ethereum-based tokens. Such tokens provide a way for businesses to monetize their services by issuing tokens on the network, allowing them to raise capital while also giving users access to unique features or products from those companies. With this increased demand comes increased liquidity which can potentially benefit both investors and developers alike. This rising trend further highlights Ethereum’s potential as a viable platform for business applications across numerous industries.

Growing Interest in Ethereum-Based Tokens

Interest in Ethereum-based tokens has been steadily rising, with an estimated $5.8 billion worth of value transacted on the Ethereum blockchain in 2020. The popularity of tokenized assets is due to the decentralization of storage that it provides and its ability to provide secure access to digital financial products. This has sparked growing interest in new applications such as non-fungible tokens (NFTs) which are a type of unique cryptographic asset that can be used for many different purposes, including gaming, art, and collectibles. Additionally, smart contracts have enabled users to securely create and store tokenized versions of traditional assets like stocks and bonds without relying on third parties. These developments have made it possible for businesses to issue their own custom tokens with built-in features such as voting rights or dividends. Moreover, cryptocurrency exchanges now offer trading pairs specifically for Ethereum-based tokens which can be used by investors looking for higher returns than those available from traditional markets. All these advances have led to increased public awareness around the power and potential of Ethereum-based tokens as an alternative asset class. As a result, investment into this sector is likely to continue expanding given its increasing utility compared to other forms of digital currencies.

Increasing Interest in Ethereum-Powered Platforms

The potential of Ethereum-powered platforms is enabling the development of a wide range of new applications, offering users unprecedented control over their digital assets. Platforms that are built on Ethereum allow developers to create decentralized applications (dApps) which can be used to store and transfer data or value across a network without relying on centralized servers. The use of smart contracts allows these dApps to execute transactions without any third-party interference, giving users more confidence in the system’s security and reliability. Furthermore, Ethereum-based platforms have become increasingly attractive due to the flexibility they offer in terms of regulatory framework. Smart contracts enable developers to create their own governance models and establish rules for how transactions will be conducted, providing an efficient way to handle compliance with various regulations. This makes it easier for businesses and individuals alike to conduct business within a compliant framework, allowing them to take advantage of the opportunities offered by Ethereum-powered applications while still adhering to legal requirements.

Frequently Asked Questions

What is the current market value of ETH?

The current market value of ETH is determined by a range of factors, including mining rewards and liquidity risks. Prices vary regularly according to supply and demand dynamics. Analyzing these conditions can provide insight into the overall value of ETH in the marketplace.

What is the difference between Ethereum and Ethereum-based tokens?

Ethereum is a blockchain-based distributed computing platform, while Ethereum-based tokens are digital assets created and stored on the Ethereum network. Tokens can be used to facilitate transactions on Decentralized Exchanges and to create Smart Contracts, giving users greater control over their money.

How has the Ethereum network grown since 2007?

Since 2007, the Ethereum network has seen remarkable development in terms of both its supply dynamics and infrastructure. Steadily increasing in complexity with every technological advancement, it has revolutionized the way we view blockchain networks. With its ever-evolving protocol and capacity for growth, Ethereum is now one of the most widely used platforms for smart contracts and cryptocurrencies.

What risks are associated with investing in Ethereum?

Investing in Ethereum carries risks, such as volatility and network security. It is important to understand the potential implications of these factors before making an investment decision.

How can Ethereum be used to create new digital assets?

Smart contracts, enabled by the Ethereum blockchain, can be used to create new digital assets. These assets are created and managed through decentralized exchanges which are secured by the immutable nature of the blockchain technology.