Money is the lifeblood of our globalized economy. It has become an essential part of everyday life, allowing us to buy goods and services, pay our bills, and build a better future. One type of money that has recently gained in popularity is cryptocurrency, such as Ethereum. This digital currency offers the potential for cheaper transaction fees and faster transfers than traditional currencies like the US dollar (USD). Furthermore, Ethereum to USD conversion can be useful for those making remittances. This article will explore the advantages and risks associated with using Ethereum for remittance payments as well as how to choose the best exchange rate for such transactions.

Key Takeaways

- Network congestion and fees can cause delays in Ethereum to USD transfers

- Compliance with AML and KYC requirements is necessary for financial institutions

- Choosing a compliant exchange is important for successful remittance transactions

- Digital wallets offer advantages such as lower fees, faster transactions, and increased security

What is Ethereum?

Ethereum is a decentralized, open-source blockchain platform that enables users to create smart contracts and cryptocurrency transactions. The platform utilizes innovative scalability solutions like sharding and Plasma, which allow for faster processing of transactions than traditional blockchains. Ethereum provides developers with the tools they need to build sophisticated applications such as tokens, non-fungible tokens (NFTs) and Decentralized Autonomous Organizations (DAOs). Smart Contracts are at the core of Ethereum’s operations; these self-executing digital contracts can be programmed with specific conditions that must be met in order for the contract to be fulfilled. With its wide range of features and flexibility, Ethereum has become one of the most popular public blockchain networks in the world.

The utilization of cryptocurrency for remittances has been gaining traction due to its low cost and convenience when compared to traditional methods. In particular, Ethereum’s low transaction fees make it an ideal choice for remittances since users don’t have to pay hefty fees associated with traditional money transfer services. Additionally, since all transactions are recorded on a public ledger, they are more secure than those conducted on centralized platforms. As such, Ethereum is becoming increasingly popular among individuals who wish to send funds internationally without having to worry about high conversion rates or slow transaction times.

What is Remittance?

Remittance is the process of transferring money from one person or entity to another. It is generally done through remittance systems, such as wire transfers, e-money transfers and other digital payments which are becoming increasingly popular due to their low cost and convenience. Remittances can be used for a variety of purposes, including personal transactions, business payments and foreign exchange markets. The main advantage of using electronic money transfers for remittances is that they are faster and more efficient than traditional methods. Additionally, the use of ethereum to convert USD to other currencies offers a secure alternative with low transaction fees. This makes it an ideal choice for international money transfers, allowing individuals and businesses to send funds quickly and securely across borders without incurring high costs associated with traditional methods. Through these advantages, ethereum conversion for USD remittances provides a reliable way to transfer funds internationally while saving on fees. With this in mind, the next step is exploring the advantages of ethereum to USD conversion for remittances.

Advantages of Ethereum to USD Conversion for Remittances

Utilizing digital currencies such as ethereum for remittances offers numerous advantages over traditional methods, making it an increasingly popular choice. One of the primary benefits of using ethereum is its ease of use. It is simple and straightforward to send money anywhere in the world with a few clicks or taps on a computer or phone. Additionally, fees related to remittance payments are typically lower than those associated with other forms of currency conversion, making it an attractive option for those who are looking to save money when sending funds abroad. Another advantage of using ethereum for remittances is that transactions occur almost immediately, allowing funds to be sent and received quickly without any delay. As more people become aware of these advantages, ethereum’s popularity as a means for international remittance payments will continue to increase. With this in mind, understanding how to convert ethereum into USD is becoming increasingly important in order to access these benefits.

How to Convert Ethereum to USD?

With an ever-increasing demand for digital currency remittances, the ability to quickly and easily convert ethereum into USD has become essential. As such, trading strategies that seek to take advantage of exchange rate volatility should be adopted in order to maximize gains when converting ethereum into USD. Among the most popular methods is by leveraging a cryptocurrency exchange platform, which provides users with access to real-time market rates and allows them to place buy or sell orders with ease. Additionally, traders can also use automated systems such as bots which can track price movements across different exchanges and execute trades on their behalf, giving them more control over the process. Ultimately, choosing the right trading strategy will depend on each individual’s risk tolerance and knowledge level of cryptocurrency markets.

Potential Risks and Drawbacks

When converting Ethereum to USD for remittances, it is important to consider the potential risks and drawbacks associated with this process. Exchange rate volatility can pose a significant challenge as fluctuations in cryptocurrency prices may result in a great deal of uncertainty when attempting to accurately calculate exchange rates. Additionally, unexpected transaction delays may occur due to network congestion or other technical issues that could potentially delay transfers across different networks. Finally, regulatory restrictions must also be taken into account as certain countries may have limitations on the types of digital currencies that can be exchanged within their borders.

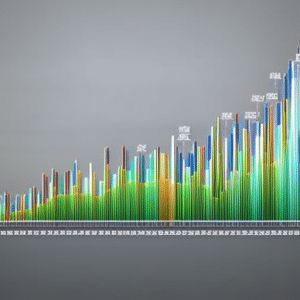

Exchange Rate Volatility

Addressing the issue of exchange rate volatility in Ethereum to USD conversions for remittances is an important factor for consideration. Exchange rates can experience sudden and drastic price swings, resulting in liquidity issues that can cause unexpected delays when converting from one currency into another. Such volatility can also result in discrepancies between the expected amount and received amount due to the changing exchange rate during the duration of a transaction. This means that users must be aware of potential risks associated with this type of conversion, such as:

- Sudden price shifts leading to liquidity concerns

- Unexpected delays due to changing exchange rates

- Discrepancies between expected and received amounts

- Potential losses due to volatile market conditions

Considering these factors, users should be mindful of any unexpected transaction delays or losses that could occur as a result of fluctuations in Ethereum-USD conversion rates for remittances purposes. To prepare accordingly, users should research current market trends and anticipate any possible changes before sending their funds overseas. Moving forward, it is essential that users become knowledgeable about Ethereum-USD conversions and their potential risks so they can prepare accordingly prior to making any transactions abroad.

Unexpected Transaction Delays

Unexpected transaction delays can arise due to the inherent volatility of currency exchange rates, creating potential complications for those sending funds overseas. Network congestion and high transaction fees resulting from cryptocurrency purchases are also a factor that can lead to unexpected delays in remittances. This is especially true when converting Ethereum to USD, which may require several transactions on different networks before arriving at its destination. If the network is congested or fees increase during the process, this could cause an unexpected delay in completion of the transfer. Additionally, regulatory restrictions may further complicate matters by limiting access to certain exchanges or services used in the conversion process.

Regulatory Restrictions

Regulatory restrictions may complicate the process of transferring funds internationally by limiting access to certain exchanges or services. Financial institutions must comply with various regulations such as anti money laundering (AML) and know-your-customer (KYC) requirements. These regulations can impede the use of certain exchanges for Ethereum to USD conversion, as some platforms may not be compliant with all applicable laws:

- Compliance Enforcement: Regulators may restrict or prohibit access to certain services based on their compliance criteria. Additionally, authorities can require financial institutions to take extra steps towards AML/KYC enforcement.

- Anti Money Laundering: Financial institutions must adhere to AML rules in order to reduce the risk of fraudulent activities associated with cryptocurrency transactions. AML measures include verifying customer identity, monitoring suspicious activity, and implementing measures against money laundering.

These regulatory restrictions make it important for individuals looking to convert Ethereum into USD to choose an exchange that is compliant with applicable laws in order to ensure successful remittance transactions without unexpected delays.

How to Choose the Best Exchange for Ethereum to USD Conversion?

When researching exchange services for Ethereum to USD conversions, it is important to read reviews and ratings to gain an understanding of the customer experience with the service. Additionally, fees and exchange rates should be taken into consideration in order to find a service that provides competitive rates. Finally, security measures should not be overlooked – check what safety protocols are in place before committing to any exchange service.

Research Exchange Services

Examining exchange services for converting Ethereum to US Dollars in regards to remittances can provide a detailed overview of the current market. Digital wallets, such as those associated with blockchain technology, are becoming increasingly popular and offer various advantages including lower transaction fees, faster transactions and increased security measures. Many digital wallet exchanges also allow users to directly convert their Ethereum into USD, allowing for seamless and efficient remittances from one country to another.

In addition to examining the various features offered by digital wallet providers, it is important to research reviews and ratings from past customers in order to gain insight into the quality of service being provided. Reviews can provide valuable information about customer experience with different services, including the speed of transactions, customer service response times and overall satisfaction levels. By researching reviews and ratings prior to selecting an exchange service for remittance purposes, users may be able to identify trustworthy services that offer reliable conversions between cryptocurrencies such as Ethereum and fiat currencies such as USD. Ultimately, this research will help ensure that customers receive seamless conversions at competitive rates when making international payments or other transfers across borders.

Read Reviews and Ratings

Reading reviews and ratings from past customers can provide valuable insight into the quality of service provided by digital wallet exchanges. These customer reviews, often found on third-party websites such as Trustpilot or Google Reviews, can include comments regarding transaction speeds, customer support responsiveness, and security measures taken to protect users’ data. Additionally, customers are able to comment on the fees associated with a given exchange service and how they compare to its competitors. This information is important for evaluating whether an exchange’s fees are reasonable for the services it provides. Furthermore, these reviews often mention any issues that customers have had with their transactions; this includes any difficulties faced when exchanging cryptocurrencies such as Ethereum for fiat currencies like USD. By considering these reviews and ratings before selecting an exchange service for remittances, users can ensure that they receive a high-quality product with minimal transaction fees. Moreover, this research also allows individuals to compare different services in order to find the best exchange rate available.

Consider Fees and Exchange Rates

Comparing fees and exchange rates is essential when selecting an optimal digital wallet exchange service, as they can fluctuate like the tide. When comparing different services for Ethereum to US Dollar (USD) conversion, it is important to look at both the cost analysis and transaction speed of each provider. This will help ensure that users are getting the best possible rate available for their transactions. In addition, it is important to consider any hidden costs associated with cryptocurrency exchanges such as withdrawal fees or minimum deposit amounts. Understanding these charges ahead of time can help prevent unexpected surprises later on in the process.

Furthermore, it is essential to pay attention to real-time exchange rates so that you can be sure you are getting the most out of your remittances. Doing this may require a bit more research than simply selecting the first digital wallet option available; however, it could potentially save money in the long run due to better rates and lower fees. To conclude, taking into account cost analysis and transaction speed when looking for a digital wallet exchange service can make all the difference when converting Ethereum to USD for remittances. For this reason, careful consideration should be given before making a final decision about which service best meets one’s needs — proceeding directly onto checking security measures without prior thought could result in undesired outcomes.

Check Security Measures

Having considered the fees and exchange rates associated with Ethereum to USD conversion for remittances, it is also important to investigate the security measures in place. Fraud prevention and risk management are two key aspects when looking into a secure platform. To ensure safety when using an Ethereum to USD conversion service, one should:

- Check customer reviews of the platform or service provider online.

- Ensure that the website is encrypted, meaning that data is protected via Secure Socket Layer (SSL) technology.

- Confirm that there are fraud prevention tools in place such as identity verification processes and advanced analytics solutions to detect suspicious activity quickly and accurately.

In conclusion, evaluating a reliable Ethereum to USD conversion service for remittances requires researching the fees and exchange rates as well as investigating security measures such as customer reviews, encryption protocols, and fraud prevention tools. With these considerations in mind, remittance senders can make informed decisions on which platform best suits their needs while ensuring their funds remain safe and secure throughout the process.

Frequently Asked Questions

What is the current rate of exchange for Ethereum to USD?

The current rate of exchange for Ethereum to USD is subject to currency volatility, and transaction speed can vary. Exchange rates are determined by a variety of factors, such as market conditions and liquidity.

Are there any restrictions on the amount of Ethereum I can convert to USD?

Figuratively speaking, converting Ethereum to USD can be likened to a balancing act. Depending on the payout methods chosen, there may be restrictions on the amount that can be converted. Furthermore, taxation rules must also be taken into account when setting limits for conversions.

Are there any additional fees when converting Ethereum to USD?

Exchange regulations and fiat currencies may include additional fees when converting Ethereum to USD. These fees can vary depending on the exchange and should be researched before conversion to ensure the optimal rate of exchange.

Are there any special considerations when converting Ethereum to USD for remittances?

When converting Ethereum to USD, transaction speed and exchange rate fluctuations can have an impact on the remittance. Accurate timing and thorough research is key to ensure maximum value for funds transferred.

Is there a limit on how often I can convert Ethereum to USD?

Exchange platforms may impose restrictions on how often a user can convert Ethereum to USD, depending on currency fluctuations. Some platforms may limit conversion frequency or require additional verification steps before allowing transactions to proceed.