Ethereum is a blockchain-based decentralized platform that enables the development and deployment of smart contracts. It is one of the most popular cryptocurrencies, second only to Bitcoin in terms of market capitalization and transaction volume. Ethereum has seen an impressive price increase in recent months due to various factors, such as broadening adoption, increased demand for digital assets, and speculation activities. This article will discuss the price performance of Ethereum, identify some of the key drivers behind its rise in value, and provide considerations for potential investors.

Key Takeaways

- Ethereum’s price has steadily risen since its launch in 2015 due to adoption, demand, and speculation.

- Factors driving the price increase include demand for alternative currencies and DeFi usage.

- Institutional interest has also driven up prices for Ethereum.

- Understanding market conditions and developing a risk management strategy are crucial when investing in Ethereum.

Overview of Ethereum

Ethereum is a decentralized, open-source blockchain platform that facilitates the development of smart contracts and distributed applications. It has become one of the most popular cryptocurrencies due to its wide range of features, such as staking rewards and token exchange. Ethereum also provides an environment for developers to create their own tokens with ease. Its underlying technology makes it well-suited for decentralized finance (DeFi) applications, which has been a major driver of its price increase over the years. Ethereum’s native currency Ether (ETH) is used to pay transaction fees on its blockchain network and power various DeFi protocols. The rise in usage of DeFi protocols has driven up demand for ETH, resulting in a steady increase in its price performance over time.

Ethereum Price Performance

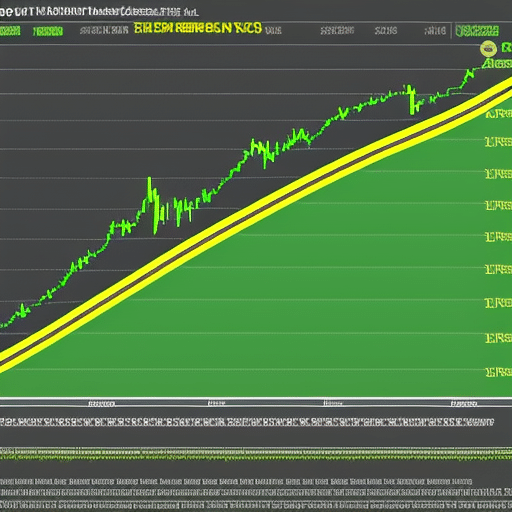

Analysis of the performance of the cryptocurrency has indicated a steady rise in value. Ethereum, one of the most popular cryptocurrencies, has seen its price increase significantly since its launch in 2015. This trend is likely to continue as Ethereum’s popularity grows and more people invest in it. The cost analysis for mining profitability indicates that miners are able to make a significant return on their investments when they mine Ethereum. Additionally, investors can expect to see an increase in Ethereum’s value with each new block that gets added to the blockchain network.

The factors driving this price increase include increased demand for alternative currencies, increased usage of smart contracts and decentralized applications (dApps), and improved scalability with the introduction of technologies such as sharding and Plasma. Furthermore, large-scale institutional interest has also been identified as a key factor driving up prices for Ethereum. As these trends continue to drive up demand for ETH tokens, market participants can expect to see further increases in price over time.

Factors Driving the Price Increase

The surging demand for alternative currencies, combined with the utilization of smart contracts and decentralized applications, is like a wave that has propelled the value of Ethereum to unprecedented heights. The decentralised autonomy of blockchain technology and Ethereum’s scalability implications have been emphasized as major contributors to its increasing value in recent years. These features allow users to transfer money directly between individuals without having to go through an intermediary or third-party institution. Furthermore, Ethereum has managed to establish itself as one of the most secure platforms due to its high levels of data encryption which ensures safety and privacy for its users. As a result, investors are beginning to see Ethereum as a viable investment option for their portfolios, leading to an increase in interest and thus further driving up the price. This trend is expected to continue in the near future as more people become aware of Ethereum’s potential benefits. Transitioning into subsequent sections about investing considerations, it is important for potential investors to be aware of various factors that may influence this asset’s performance over time such as regulation, technological developments and market sentiment.

Investing Considerations

Investing in this digital asset carries numerous considerations that potential investors must explore before committing to a purchase. For example, understanding the affiliate marketing setup associated with Ethereum and other cryptocurrencies is important for those seeking to enter the market. It can be difficult to ascertain the legitimacy of certain outlets that promote such investments, so it is wise to research these sources thoroughly before investing. Additionally, it is important for potential investors to develop a plan for investment strategies and risk management. This includes developing an understanding of how much money one can afford to invest in Ethereum and how often they will need or want to make purchases or sales. Investing in cryptocurrency requires sound risk management practices, as well as staying abreast of current market conditions in order to ensure success. With these considerations taken into account, investors can then move towards setting up an appropriate Ethereum wallet from which they can store their cryptocurrency securely.

Ethereum Wallets

Ethereum wallets are used to store Ether, the native crypto-asset of the Ethereum blockchain. They provide a secure way to access and manage Ether. There are two main types of Ethereum wallets: hardware wallets and hot/cold storage. Hardware wallets are physical devices that store private keys offline, providing an extra layer of security against malicious actors. Hot/cold storage refers to keeping crypto assets online (hot) or offline (cold), depending on user preference for convenience or security.

Hardware wallets

A recent survey has revealed that nearly 80% of Ethereum investors are safeguarding their investments by storing them in hardware wallets. Specifically, these wallets grant users extremely secure access to their crypto-assets with the benefit of hardware durability and wallet security. Hardware wallets are designed with a physical device in mind, such as a USB drive or an external hard drive, and provide further security than other forms of storage due to their ability to be both ‘hot’ and ‘cold’.

The distinction between hot and cold storage is important for understanding Ethereum wallet security levels. Hot storage refers to active online accounts which allow immediate access to Ether tokens at any time, while cold storage stores coins offline on physical mediums such as paper or metal backups. Cold storage provides additional protection from cyber-attacks since the private keys are not exposed online. Generally speaking, hot storage is more convenient but comes with greater risk whereas cold storage is considered more secure because it eliminates any possibility of hackers accessing funds.

Hot and cold storage

Hot and cold storage methods offer varying levels of security for Ethereum investors, with the former providing convenience and the latter providing greater protection. Cold storage involves storing cryptocurrency such as Ethereum in an offline wallet, typically on a USB drive or paper wallet. This ensures that no one is able to access private keys, which are needed to access funds stored on exchanges or wallets. Hot storage involves keeping cryptocurrencies online, on exchanges or other digital wallets. Although less secure than cold storage, it allows users to quickly buy and sell Ether tokens without having to transfer them from an offline wallet.

Ethereum exchanges and mining profitability are two factors that should be taken into consideration when deciding between hot and cold storage solutions. While exchanges provide a convenient way to buy or sell Ether tokens, they also create an additional layer of risk since user funds can be stolen if hacked or compromised by malicious actors. Mining may also be more profitable depending on the current market conditions, however this requires significant technical knowledge and resources in order to successfully set up a mining rig. As such, users must weigh these considerations carefully before deciding which type of storage solution best fits their needs. Moving forward with either hot or cold storage choice will depend heavily on individual preferences as well as desired levels of security.

Ethereum Mining

Mining Ethereum is the process of using computing power to solve complex cryptographic problems in order to secure and verify transactions on the Ethereum network. In order to mine, miners must invest in specialized hardware that is specifically designed for cryptocurrency mining. Additionally, miners often join mining pools to increase their chances of successfully validating a block and earning rewards.

Mining hardware

With the increased demand for Ethereum, the need for efficient mining hardware has become essential in order to keep up with the market, as the adage goes ‘time is money’. Advances in technology have allowed for GPU mining rigs to be used more commonly than ever before, providing miners with an affordable and profitable way of producing cryptocurrency. Some have even gone so far as to develop ASIC chips that are specially designed for cryptocurrency mining and can produce vastly higher returns. These chips are highly sought after due to their efficiency but also come at a much higher price tag that puts them out of reach of most miners. Despite this, it does serve to show just how advanced the industry has become and indicates that there is still plenty of room for growth. With these advancements in mind, it is clear why many miners turn towards joining mining pools in order to increase their chances of success.

Mining pools

Mining hardware is a necessary component for mining cryptocurrency such as Ethereum. While this hardware enables miners to carry out the computations required to generate blocks, it does not guarantee success in terms of block rewards. Mining pools provide an effective way of pooling resources and increasing the chances of successfully finding blocks. Mining pools allow miners to combine their hashing power, thereby reducing the overall network mining difficulty and improving their chances of receiving a reward when a block is found.

Cloud mining services are also available which allow users to gain access to mining resources without investing in expensive hardware. Cloud mining services can offer users more cost-effective ways to mine Ethereum since they do not require significant upfront investment or additional operating costs like electricity bills that come with traditional hardware-based solutions. However, depending on the nature of the cloud service agreement, there may be additional fees associated with cloud mining services compared to solo mining or joining a pool. With all these options available for miners seeking rewards from Ethereum’s blockchain, understanding Ethereum contracts is another important step in the process.

Understanding Ethereum Contracts

Ethereum contracts are a powerful tool for creating smart contracts and decentralized applications. These smart contracts are self-executing pieces of code stored on the Ethereum blockchain, allowing for digital agreements to be made without the need for third parties. Decentralized applications, or DApps, are also created using Ethereum’s platform as they utilize its blockchain technology to provide users with a more secure alternative than traditional web applications. Both of these applications rely heavily on Ethereum’s contract system to function properly and securely.

Smart contracts

Smart contracts, a key component of Ethereum technology, enable the execution of digital agreements between parties without the need for third-party intermediaries. Smart contract programming is based on a decentralized and immutable ledger which records every transaction in real-time, allowing for fast and secure transactions. This makes it an ideal platform for decentralized finance (DeFi) applications such as lending and borrowing, insurance, derivatives trading and more. Smart contracts are deployed to the Ethereum blockchain using its native programming language Solidity, which is used to create complex financial instruments with few lines of code. As Ethereum’s price increases due to increased adoption of DeFi applications built on its blockchain, smart contracts will become increasingly important in driving growth in this sector. The increasing use of smart contracts could potentially lead to a surge in demand for developers skilled in Solidity programming language as well as other related technologies.

The next subtopic will focus on ‘decentralized applications’ (dApps), which are built atop the Ethereum network by leveraging smart contract technology. dApps bring transparency and trust through their open source structure while also providing users with greater control over their funds compared to centralized systems. Furthermore, they allow users to connect directly with each other without relying on any third-party intermediary or middleman that may charge high fees or restrict access from certain jurisdictions or countries. By utilizing existing protocols such as ERC20 tokens or stablecoins like DAI, dApps can provide services such as decentralized exchanges (DEXs), prediction markets and peer-to-peer marketplaces that are uncensorable and not subject to government interference. Thus, dApps represent a major driving force behind the burgeoning crypto economy envisioned by many enthusiasts today.

Decentralized applications

Decentralized applications (dApps), built atop the Ethereum network, are granting users unprecedented control over their funds while providing a transparent and trust-less environment for financial transactions. This is achieved by leveraging the blockchain technology, which allows for peer-to-peer interactions with no middlemen or third party authorities controlling them. Moreover, dApps also offer an increased level of privacy compared to traditional services such as banks and centralized exchanges. For example, decentralized exchanges enable users to trade cryptocurrencies without having to expose sensitive information like bank account details or personal identity documents. In addition, most dApps have strict privacy policies that ensure user data is kept safe from public view and only used in accordance with their wishes. All these features make it much easier for users to transact securely on the Ethereum network. As a result, more people are turning towards dApps as a viable alternative to conventional banking services, leading to an increase in the Ethereum price. These factors combined provide further evidence that decentralized applications will be integral in driving further adoption of Ethereum and its associated technologies in the near future.

Ethereum Security

Ethereum security is an important factor to consider when using the platform. Protecting your wallet and following best practices for safe transactions are key elements of maintaining a secure Ethereum environment. It is recommended that users take proper steps to ensure their wallets are encrypted and protected, as well as use caution when engaging in any type of online transaction involving Ethereum.

Protecting your wallet

Protecting one’s wallet is a critical step for investors to consider when making decisions about Ethereum investments. To ensure their wallet is secure, investors must consider various security measures that help prevent unauthorized access and malicious activities from taking place. Such measures include using strong passwords, enabling two-factor authentication, and utilizing encryption technologies like AES-256. Additionally, investing in hardware wallets can reduce the risk of hacking as they are not connected to the internet. Mining rewards should also be taken into consideration when protecting an Ethereum wallet since these rewards can be stolen if proper security protocols are not implemented.

Finally, best practices such as avoiding phishing attacks or downloading malware must also be followed in order to keep an Ethereum wallet safe from malicious actors. Keeping all software updated to latest versions and conducting regular backups are also essential steps towards maintaining a secure environment for cryptocurrency investments and transactions. By following these guidelines, investors can ensure their Ethereum wallets remain safe and secure while increasing the chances of successful investments with Ethereum.

Best practices for safe transactions

Conducting secure transactions with Ethereum requires following best practices that help protect users from malicious actors. These best practices include ensuring that the wallet and private keys used to make the transaction are securely stored, using multiple authentication factors when transferring funds, being aware of the fees associated with making a transaction, and selecting reliable exchanges for conducting business. Transaction fees will vary based on network congestion and activity; however, users should always be aware of any additional charges they may incur during an Ethereum transaction. Network fees are also important to consider as they can add up quickly if not managed properly. It is also wise to consult a financial advisor or tax professional before engaging in any cryptocurrency-related activities due to potential tax implications down the road. To ensure safe transactions with Ethereum, it is essential to follow these best practices. As such, understanding the tax implications of Ethereum transactions is an important step in protecting one’s investments.

Tax Implications of Ethereum Transactions

Considering the increasing value of Ethereum, it is important to understand the associated tax implications of any transactions conducted using this cryptocurrency. Tax deductions and capital gains can be generated through these transactions and as such, should be taken into account when calculating taxes. For example, Ethereum miners who are self-employed may be eligible for various tax deductions related to their business expenses such as equipment costs or electricity bills. Additionally, profits from trading Ethereum may be subject to capital gains taxes depending on the jurisdiction in which they reside. As a result, it is essential that those engaging in Ethereum transactions fully understand the applicable tax laws in order to ensure full compliance with all relevant regulations. With this knowledge, individuals can better plan ahead for any potential financial ramifications that could arise from their cryptocurrency activities. Moving forward into the regulatory environment surrounding Ethereum will provide further insight into how best to proceed with future investments and transactions involving this digital asset.

Regulatory Environment

The taxation of Ethereum transactions has been a major area of focus for many countries, as this digital asset can provide significant financial benefits. As such, it is critical to understand the regulatory environment surrounding Ethereum in order to ensure that any investment or transaction is compliant with applicable laws and regulations. This regulatory environment includes both the direct impact on Ethereum transactions and indirect impacts on tax incentives.

The direct impact of regulation on Ethereum transactions is primarily focused on preventing fraud and money laundering by ensuring proper disclosure requirements are met. Additionally, some jurisdictions have implemented capital gains taxes on cryptocurrency trades. In general, the regulations governing cryptocurrencies are still in their early stages and vary widely from country to country but will become increasingly important as more investors enter the market. Moreover, understanding how financial incentives from governments can help promote or restrict certain activities related to cryptocurrencies is key to assessing potential returns associated with investing in Ethereum.

Comparison to Other Cryptocurrencies

Comparing Ethereum against other major cryptocurrencies provides insight into the market dynamics and potential investment opportunities. When comparing Ethereum to Bitcoin, both have a similar mining reward structure, yet Ethereum’s network is capable of executing smart contracts which gives it added functionality. Additionally, Ethereum has had significantly more successful token sales than Bitcoin since its inception, providing investors with numerous options for cryptocurrency investments. Lastly, Ethereum has a much higher transaction throughput compared to Bitcoin due to its use of sharding technology. These factors combined create an environment where investors may be drawn to the greater investment possibilities associated with Ether over that of Bitcoin or other cryptocurrencies. As such, understanding how different cryptocurrencies compare can inform decisions about potential investment opportunities in the crypto market and provide insight into Ethereum’s price increase trajectory..

Ethereum’s price volatility is another key factor that impacts investor confidence in the cryptocurrency markets.

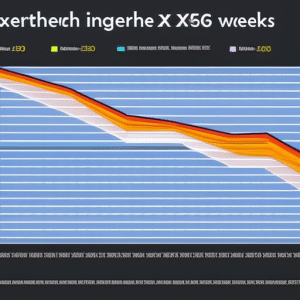

Ethereum Price Volatility

It is important to understand how the cryptocurrency market is affected by fluctuations in prices, such as those of Ethereum, which has been known to experience high levels of volatility. Price swings can be caused by sudden changes in market sentiment, and investors must take this into consideration when deciding whether or not to invest in Ethereum. Despite this risk factor, the potential for significant returns can outweigh the inherent risks for savvy investors who are prepared and willing to take on such investments. Therefore, understanding price volatility and taking measures to mitigate its effects will be essential for successful trading strategies.

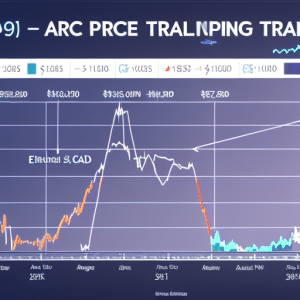

Ethereum Trading Strategies

Ethereum is a digital asset that has experienced price volatility in the past, making it a risky investment. As such, investors should be aware of the importance of trading psychology and risk management when attempting to gain profits from Ethereum trading. Trading strategies can help traders manage their risks and maximize their returns by utilizing different techniques such as market analysis, technical indicators, trend following strategies, etc. Furthermore, understanding one’s risk aversion level is essential to developing an effective strategy tailored to each investor’s individual needs. By understanding how to control emotions and trade with discipline, traders can improve their chances of success in this volatile cryptocurrency market. Moving forward, these same principles apply when considering Ethereum as a long-term investment option.

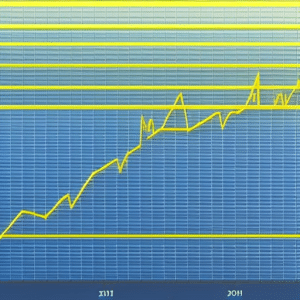

Ethereum as a Long-Term Investment

Investing in Ethereum as a long-term asset requires careful consideration of market conditions, risk management strategies, and the ability to maintain emotional control. In order to make an informed decision about investing in Ethereum for the long haul, investors should consider the following:

1) The current investor sentiment towards Ethereum – is there a heightened demand for Ether?

2) Network scalability – how able is the blockchain network to handle increased usage over time?

3) Security of the network – how secure is the blockchain technology from malicious actors?

Ethereum’s capacity for growth and stability depends upon these factors. An investor must weigh all available information before making a decision about investment. Factors such as mining activity, trading volume, and technical upgrades can also provide insight into a potential long-term investment in Ethereum. Researching these areas will help an investor determine if this cryptocurrency has potential as an asset that could appreciate over time.

Frequently Asked Questions

What is the expected price of Ethereum in the future?

The expected future price of Ethereum is difficult to predict, as it highly depends on individual buying and trading strategies. Analytical data can help identify trends and inform decision-making; however, market conditions are always changing and will ultimately drive the price of Ethereum.

How can I safely buy Ethereum?

Investors must consider buying strategies and liquidity risks when purchasing Ethereum. Analyzing market data and trends determines optimal entry points for a safe purchase. Researching potential exchanges is crucial to ensure access to the necessary liquidity.

What is the best Ethereum wallet to use?

The best Ethereum wallet to use is one that provides staking rewards, supports decentralized exchanges and offers a secure environment. It should also be user-friendly and provide easy access to funds. Analyses of available wallets suggest that Coinbase, MyEtherWallet and Trust Wallet are among the top choices.

What is the risk of investing in Ethereum?

Investing in Ethereum comes with high market volatility and potential risks. Despite having the right investment strategies, there is no guarantee of a return on investment due to the unpredictable nature of cryptocurrency markets. Hyperbole aside, caution should be taken when investing in Ethereum.

Is Ethereum mining profitable?

Mining Ethereum can be profitable depending on the mining hardware used, as well as the gas costs associated with it. Profits are dependent on the cost of electricity and other operational expenses. Mining difficulty and block rewards also factor into overall profitability.