Ethereum is a decentralized public blockchain network that enables users to create and manage smart contracts. As such, it has become one of the most popular cryptocurrencies in the world, with a current market capitalization of over $20 billion USD. This article seeks to provide an analysis of Ethereum’s price history, identify factors influencing its price, and make predictions about future trends in order for investors to make informed decisions when considering investing in the cryptocurrency.

The analysis begins by examining key historical prices over time. This includes looking at previous highs and lows as well as identifying major trends or shifts within the data. Further analysis then looks into both internal and external factors that can affect Ethereum’s price, such as news events, regulations governing cryptocurrencies, technological advancements related to the protocol itself, etc. Finally, we take a look at Ethereum’s correlations with other markets such as commodities and bonds in order to gain further insight into how its price may be affected by changes outside of its own ecosystem.

Key Takeaways

- Ethereum’s price has experienced significant growth since its launch, reaching over $1,400 per token by early 2021.

- Factors influencing Ethereum’s price include supply and demand dynamics, mining activities, network activity, technology developments, regulations, and policies.

- The limited supply of Ethereum, with a maximum cap set at 18 million ETH, contributes to its price fluctuations.

- Recent technological developments, such as sidechains and sharding solutions, have improved Ethereum’s scalability and decentralized finance capabilities, impacting its value.

Historical Price Analysis

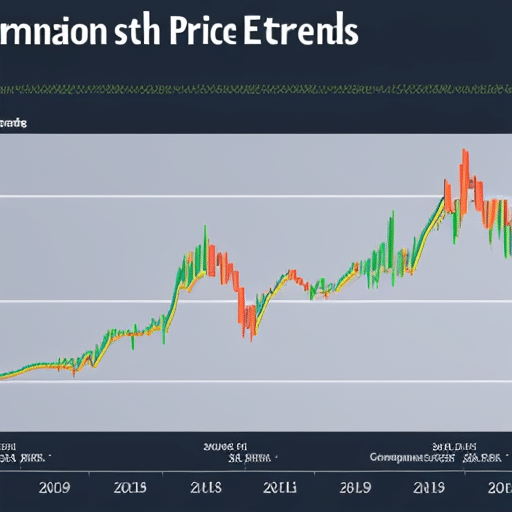

Ethereum’s historical price analysis reveals a significant increase in value since its launch in 2015, with an example being the rise from $0.309 in August 2017 to over $1,400 per token by early 2021. This incredible surge of Ethereum prices has attracted investors around the world to invest in this cryptocurrency as part of their investment strategies for market diversification. Many factors have been identified that contributed to this remarkable growth and these will be discussed in the subsequent section.

Factors Influencing Ethereum’s Price

Ethereum’s price is influenced by a variety of factors, including supply and demand, mining activities, network activity, technology developments, regulations and policies. Supply and demand dynamics are key drivers of Ethereum’s price as the limited supply creates an environment for the price to fluctuate with changes in demand. Mining activities also play a role in affecting Ethereum’s price through the issuance of newly minted coins which can increase or decrease depending on market conditions. Network activity has been known to influence Ethereum’s price as increased usage leads to higher prices due to increased demand. Technology developments such as updates to the blockchain also have implications for Ethereum’s value as new features can increase its utility and desirability. Finally, regulations and policies have wide-reaching consequences for Ethereum’s price as government interventions can restrict or expand its use.

Ethereum Supply and Demand

The supply and demand of Ethereum is an integral factor in determining the cryptocurrency’s price. The supply of Ethereum is limited, with a maximum cap set at 18 million ETH, while the demand for it is dictated by its use cases. Factors influencing demand include its utility, energy consumption efficiency, scalability, and blockchain security. As a result of Ethereum’s increasing popularity and usage since its launch in 2015, the demand has also seen significant growth. On the other hand, the production rate of new Ethers entering circulation through mining activities may affect supply and price levels. As miners are incentivized to participate in verifying transactions on the network by receiving rewards in Ethers for their work, they can drive up prices as they compete to mine coins faster than others by investing more resources into processing power. Thus, both supply and demand play an important role in setting Ethereum’s price levels. To conclude this section on Supply and Demand of Ethereum, it is worth noting that ETH mining activities have significantly increased over time which could potentially lead to further volatility in pricing if not managed carefully. As such, transitioning into discussion about Ethereum mining is vital to understanding how current market conditions might affect future prices of Ethers.

Ethereum Mining

Mining Ethers is a process by which new units of the cryptocurrency are created and released to circulation, incentivizing miners to participate in the network’s verification of transactions. This is an essential component of Ethereum’s blockchain technology, as it helps secure and validate data on the network while providing financial incentives for miners to do so.

Efficiency improvements in mining hardware have resulted in a surge of competition among miners as they seek improved hash rate optimization. With more efficient rigs, miners are able to generate more returns with less energy expenditure. Additionally, Ethereum has seen an increase in its overall hash rate over time due at least partially to improved mining hardware capabilities. This increase in efficiency can be beneficial for both miners and users alike as it reduces costs associated with participating in the network while also increasing transaction speeds for users. From these developments, it is possible to see how Ethereum mining has become increasingly competitive and efficient over time, setting up Ethereum’s network activity for further success going forward.

Ethereum’s Network Activity

Network activity on the Ethereum blockchain has become increasingly active over time, with an increase in transactions and miners joining the network. This is largely due to Ethereum’s scalability, which allows for more transactions to be processed at a faster rate than other blockchains. As more people use the Ethereum blockchain, transaction fees have also increased as miners compete for rewards. Additionally, as new technology developments are introduced, such as sidechains and sharding solutions, this could further increase network activity. These technological advancements could also help reduce transaction fees by increasing scalability of Ethereum’s network and allowing for more efficient processing of transactions. With these developments in place, it is likely that Ethereum will continue to see increased levels of activity on its network in the future.

Technology Developments

Recent technological developments, such as sidechains and sharding solutions, have the potential to significantly improve the scalability of blockchain networks and offer more efficient processing of transactions. These advancements in decentralization technologies are highly beneficial for Ethereum’s network security and decentralized finance (DeFi) capabilities:

-

Blockchain Security

-

Sidechains provide additional layers of security by allowing developers to move assets between them without affecting the main chain’s stability.

-

Sharding also improves security by increasing the number of nodes required to attack a single node or consensus mechanism on a given network.

-

Decentralized Finance

-

Sidechains enable DeFi applications to interact with each other efficiently while providing privacy features that are not available on public blockchains.

-

Sharding is expected to greatly reduce transaction costs for users interacting with DeFi protocols which should further increase their adoption rates.

Overall, these technology developments offer significant improvements to Ethereum’s network security and decentralized finance capabilities, paving way for smooth transition into the next section about regulations and policies that impact ETH prices.

Regulations and Policies

Regulatory and policy considerations are an important factor in the long-term success of any blockchain network. The Ethereum network is no exception, as it has been subject to a number of regulatory and policy changes in recent years. These changes have had both positive and negative impacts on its price, making it necessary for investors to stay apprised of the current state of regulations and policies governing the Ethereum network.

The table below summarizes some of the most significant regulatory changes that have impacted Ethereum’s price since 2018:

| Year | Policy/Regulation | Impact on Price |

|---|---|---|

| 2018 | SEC designation as non-security | Positive |

| 2020 | IRS Guidance on Cryptocurrency Taxes | Neutral |

| 2020 | SEC Statement on Digital Assets Investor Protection Act (DAIPA) | Positive |

These examples demonstrate how quickly regulations can change, often with little warning or anticipation. As such, investors must remain vigilant about potential changes in order to ensure they are investing responsibly and managing their portfolios accordingly. This section has discussed the importance of monitoring these regulatory developments in order to make informed decisions about when to buy or sell Ether tokens. The next section will discuss potential ethereum price predictions for 2021.

Ethereum Price Predictions

Analyzing Ethereum price predictions is an important factor for determining the success of the cryptocurrency. By studying long term trends, economic implications, and other factors that may influence Ethereum’s value, analysts can better understand current and future market conditions.

In particular, much attention has been given to Ethereum’s price volatility; a key factor in predicting its overall performance. This article will explore potential causes of this volatility and how it should be taken into consideration when making investment decisions.

Ethereum’s Price Volatility

The Ethereum price has remained relatively volatile over the past few months. This volatility is due to a variety of factors, including but not limited to decentralized finance (DeFi) and smart contracts.

To better understand Ethereum’s price volatility, it is necessary to analyze its relationship with various market variables. To this end, a comparison of the changes in Ethereum’s price and those of other cryptocurrencies and traditional markets will be discussed below.

| Variable | Relationship with Price |

|---|---|

| DeFi | Positive |

| Smart Contracts | Positive |

Ethereum’s Price Correlations

Comparing Ethereum’s price with that of other cryptocurrencies and traditional markets can provide insights into the correlations between these variables. Decentralized finance (DeFi) protocols built on Ethereum have become increasingly popular in recent years, resulting in a rise in the price of ETH as more people are enticed to use and invest in blockchain governance. Analyzing the correlation between Ethereum’s price and other assets can also help investors identify potential opportunities for diversification or hedging against volatility. This type of analysis can be done by looking at market capitalization, volume traded, daily returns, liquidity risk premiums, and other factors related to asset prices. Ultimately, understanding how Ethereum relates to other financial instruments is important for making informed investment decisions about portfolio construction and risk management strategies. By analyzing these correlations, investors may be able to better predict future market movements or capitalize on existing trends. With this knowledge, they can make educated decisions about when it might be appropriate to enter or exit certain positions. Transitioning now into an evaluation of ‘Ethereum’s Price Comparison’, we will take a deeper look at how the cryptocurrency performs relative to its peers.

Ethereum’s Price Comparison

Having established the correlations between Ethereum’s price and various other market forces, a further analysis of Ethereum’s current performance can provide additional insight into its potential value. Comparing Ethereum’s price trends to those of other cryptocurrencies and traditional markets is an important aspect of understanding its value.

To begin with, comparing the market trends of Ethereum to those of Bitcoin provides valuable information on their respective trajectories. For instance, when looking at the growth in USD terms for both cryptocurrencies over the course of 2019, it becomes apparent that Ethereum experienced greater volatility than Bitcoin did: while BTC was relatively stable compared to ETH, experiencing only moderate swings in either direction during this time period, ETH saw rapid spikes as well as noticeable drops in its value. Additionally, observing the daily trading volume for each currency reveals that ETH tends to draw more attention from investors than BTC does on a regular basis.

Overall, these comparisons indicate that Ethereum holds potential for significant swings in prices both positively and negatively due to higher levels of investor activity and volatility compared to Bitcoin. This knowledge can be used to inform investment decisions going forward; however, further exploration into the opportunities available with investing in Ether is necessary before drawing any conclusions.

Ethereum’s Investment Opportunities

Investigating the investment opportunities offered by Ether can provide insight into its potential value. Ethereum offers numerous ways to invest, ranging from short-term trading strategies to longer-term investments in blockchain-based projects and applications. As with any type of investment, it is important to consider the inherent risks associated with cryptocurrencies such as Ethereum when developing an investment strategy. Risk management techniques such as diversification can help mitigate those risks while still offering potential returns on investments. Additionally, understanding the current state of the crypto market and Ethereum’s price movements over time can help investors make informed decisions regarding their investments. With this knowledge at hand, investors can ensure they are making sound decisions that will yield financial rewards in the future.

Ethereum’s Price and the Crypto Market

Analyzing the performance of cryptocurrencies such as Ethereum relative to other traditional investments can provide insight into potential investment opportunities. Ethereum’s price and the crypto market are highly correlated, with both rising and falling in tandem. Factors that drive Ethereum’s price include mining efficiency, blockchain scalability, and investor sentiment. The key to success in investing in Ethereum is understanding how these factors interact: miners who optimize their hardware for maximum efficiency have a greater chance of profiting from mining rewards; developers who focus on scaling up the blockchain increase its usability; and investors who maintain a long-term view will benefit from increased liquidity in the market. Additionally, heightened interest from institutional investors provides stability to the cryptocurrency markets and contributes to overall growth. By understanding these dynamics, investors can make informed decisions when considering Ethereum as an investment vehicle. Transitioning into the subsequent section about ‘Ethereum’s Price and Stock Market’, it is evident that there can be significant crossover between these two markets which could lead to interesting trading strategies for those looking for short-term returns or long-term investments.

Ethereum’s Price and the Stock Market

Comparing Ethereum’s price movements to those of the stock market can help investors identify potential trading opportunities. Examining the economic implications of both markets provides insight into whether Ethereum is a good investment or if investing in stocks would be more profitable. Monetary policy is an important factor when considering how prices may react in either market, and understanding its effects on asset pricing can be useful for predicting future trends. By understanding how these two markets interact, investors can better assess their options and make informed decisions about their investments. This analysis also helps to identify areas where Ethereum’s advantages over traditional stocks may provide greater returns. Transitioning from this discussion about Ethereum’s price and the stock market, we will now consider how Ethereum fares against the Forex Market.

Ethereum’s Price and the Forex Market

Examining the interplay between Ethereum and the foreign exchange market is essential for investors to forecast potential trading opportunities. Ethereum’s increasing popularity in the cryptocurrency space has become more evident following its integration with several forex brokers. This move has enabled traders to access Ethereum as a currency pair, further expanding its reach in the global markets. The emergence of stablecoins have also had an impact on the price of Ethereum, allowing it to remain relatively stable even during periods of high volatility in other crypto assets. Additionally, macroeconomic trends and geopolitical events also influence Ethereum’s price when compared against fiat currencies such as US Dollar and Euro.

| Currency Pair | Description | Risk Level |

|---|---|---|

| ETH/USD | The ratio of one Ether (ETH) to one United States Dollar (USD) | High |

| ETH/EUR | The ratio of one Ether (ETH) to one Euro (EUR) | Medium-High |

| ETH/GBP | The ratio of one Ether (ETH) to one Great British Pound (GBP) | Medium-Low |

The current subtopic discussed how Ethereum’s price is affected by the Forex Market, along with understanding how stablecoin impact, macroeconomic trends, and geopolitical events play a role in influencing prices. Moving forward, it would be beneficial for investors to assess how Ethereum interacts with commodities markets like gold or oil because these commodities are often used as safe-haven investments when there is uncertainty within financial markets.

Ethereum’s Price and the Commodities Market

The study of Ethereum’s price and the Forex market revealed a strong correlation between the two, but there is another factor that can influence Ethereum’s value: commodities. Investors often trade in commodities markets as a form of hedging strategies to balance out any risks in their portfolios. Similarly, investor sentiment towards commodities can influence Ethereum’s price. For example, if an investor perceives a commodity to be valuable, they may also view Ethereum as being valuable and invest in it or vice versa. Understanding how investor sentiment regarding commodities affects Ethereum’s price is essential for investors looking to maximize returns on their investments.

To further analyze how commodities influence Etheruem’s price, it is helpful to consider the demand-supply dynamics of these markets and the effects on pricing trends. It is likely that when there is an increase in demand for certain commodities, this will have a positive effect on Ethereum prices due to increased investing activity from speculators who are attempting to capitalize on short-term opportunities within both markets. Conversely, when supply increases faster than demand for certain commodities then this may result in downward pressure on Etheruem prices as investors become wary about entering into long positions during bearish market conditions. With these considerations in mind, understanding how different commodity markets affect Ethereum prices provides insights into potential investment strategies that could be used by traders and investors alike. Transitioning from this subtopic into the subsequent section about ‘Ethereum’s Price and Real Estate Market’ reveals the implications of such analysis across other asset classes as well.

Ethereum’s Price and the Real Estate Market

Investigating the influence of real estate on cryptocurrency prices can provide a unique insight into the dynamics of asset markets. Price movements in the real estate market are affected by sentiment, and when these sentiments shift they may cause a ripple effect throughout other asset classes such as cryptocurrencies. For example, bank investments in real estate that have been spurred by recent government initiatives could result in an increase in Ethereum’s price due to increased liquidity and investor confidence. On the other hand, if there is negative news about the real estate market or banks that could lead to reduced demand for Ethereum and a decrease in its price. As such, it is important to keep an eye on how the sentiment around real estate affects Ethereum’s price so that investors can make informed decisions about their financial strategies. This analysis provides valuable insight into how different asset classes interact and how these interactions can influence prices across multiple markets. Moving forward, it will be interesting to explore how Ethereum’s price is influenced by developments within the bond market.

Ethereum’s Price and the Bond Market

The correlation between Ethereum’s price and the Real Estate market has been examined in great detail. Similarly, the bond market also exerts a strong influence on Ethereum prices. Hedge funds and investment banks often use bonds as a tool to gain exposure to Ethereum’s digital currency markets. Bond issuers can offer investors fixed-term investments with returns that are often linked to the performance of Etherium’s tokens or other crypto assets such as Bitcoin. As such, Ethereum’s price movements are closely monitored by these large institutional investors who may choose to invest in cryptocurrencies if they believe it will provide them with better returns than traditional asset classes.

The bond market can have both positive and negative impacts on Ethereum prices, depending on whether the cryptocurrency is viewed as a safe haven asset or a risky gamble. For example, if investors view Etherium tokens as an attractive alternative to traditional investments due to their potential for higher returns then this could drive up demand and increase prices. On the other hand, if investors perceive Etherium tokens as too risky then they may choose not to invest in them which could lead to decreased demand and lower prices. It is therefore important for investors to understand how different macroeconomic factors affect the bond market so they can make informed decisions about their investments in cryptocurrencies like Ethereum. With this knowledge, they can assess whether investing in Etherium is likely to be profitable over time or not. Having done so, they can decide whether it is worth taking risks when investing in Ethereum or not; this understanding of how macroeconomic forces interact with the bond market serves as an essential factor when considering any investment strategy involving digital currencies such as Ethereum’s tokens. From here, we now turn our attention towards exploring how macroeconomics influences Ethereum’s price movements.

Ethereum’s Price and the Macroeconomy

Examining the macroeconomy’s influence on cryptocurrency prices can provide insight into potential investment opportunities, with one noteworthy statistic suggesting that nearly 70% of Ethereum’s price data can be explained by the performance of traditional financial markets. This suggests that investors should pay close attention to macroeconomic trends and their political implications. For example, a recession or economic crisis could lead to an increase in demand for cryptocurrencies as investors search for safer asset classes. Conversely, a period of strong economic growth could reduce demand due to increased risk appetite among investors seeking higher returns from more volatile investments. It is important to note that while macroeconomic events may have short-term impacts on Ethereum prices, they are unlikely to have long-lasting effects since Ethereum’s underlying technology remains largely independent of traditional financial markets.