Ethereum is a decentralized open-source blockchain platform that enables the development of distributed applications and smart contracts. It was initially launched in 2015, by Vitalik Buterin, and has since become one of the most popular platforms for blockchain-based applications. Ethereum’s price has seen remarkable volatility over the past few years, making it an attractive investment opportunity for traders and investors alike. This article aims to analyze the Ethereum price from a historical perspective and consider factors affecting its future prospects. Additionally, this paper will discuss various market influencers, price projections for 2021, network security measures, mining capabilities, wallets associated with Ethereum as well as its smart contract functionality.

Key Takeaways

- Ethereum is a decentralized open-source blockchain platform that enables the development of distributed applications and smart contracts.

- Ethereum’s price has seen remarkable volatility over the past few years, making it an attractive investment opportunity for traders and investors.

- Factors such as supply and demand, mining costs, market influencers, and overall market sentiment can influence Ethereum’s price.

- Price projections for 2021 can be determined using technical and fundamental analysis, which evaluate areas of support and resistance and underlying financial and economic factors.

Overview of Ethereum

Ethereum is an open-source distributed computing platform akin to a digital quilt, with each node of its network hosting a unique section. It has become the largest and most popular blockchain for developers to build decentralized applications (dApps) and token economics on top of it. Ethereum also offers smart contract security, which makes it difficult for malicious actors to access data or alter contracts without authorization. This feature has made Ethereum attractive as an investment, allowing users to trust that their transactions and data are secure on the network. The platform’s ability to offer dApp development, token economics, and smart contract security have all contributed to its rise in popularity and value over time. As such, Ethereum’s price analysis is highly dependent on external factors such as market trends and regulations that shape the cryptocurrency industry. Looking at Ethereum’s historical price performance can provide important insights into how these factors have impacted its price over time.

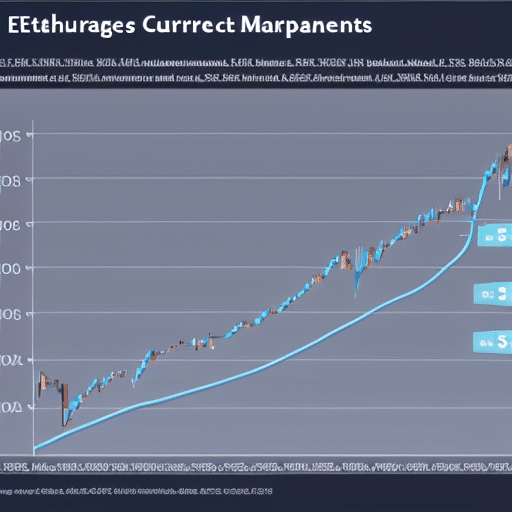

Historical Price Analysis

A comprehensive examination of historical trends reveals important insights into the cryptocurrency’s trajectory. Ethereum has seen a dramatic rise in its price since it was first released in 2015, with a steady increase from around $60 to over $1000 in 2018. This can be attributed to several factors such as supply scarcity and increasing demand from investors looking for alternative investments.

An analysis of Ethereum’s historical price trends also suggests that the cryptocurrency is subject to significant volatility. For instance, after reaching its all-time high of around $1400 at the start of January 2018, Ethereum experienced a steep decline, losing almost 70% of its value before rallying back up again by mid-2018 and hovering around $400 till present day. It is thus evident that despite experiencing periods of growth and decline, Ethereum has been able to maintain stability overall due to various influencing factors. Moving forward, these same factors will continue to play an important role in determining the future direction of Ethereum prices.

Factors Influencing Ethereum Price

Understanding the various factors that impact Ethereum’s price is essential for making informed investment decisions. The primary drivers of price are related to supply and demand, mining costs, market influencers, and overall market sentiment. Supply and demand can have a significant effect on the cryptocurrency market as a whole, particularly when it comes to Ethereum. As demand increases, more miners join the network which in turn leads to an increase in the amount of Ether available for purchase. On the other hand, when there is a decrease in demand or an increase in supply due to mining activities, this can cause prices to drop.

Mining costs are also important since they affect how much it costs to mine Ether from its blockchain. High mining costs can make it difficult for miners to remain profitable which could lead them to sell their holdings at a lower rate than what would be expected based on current conditions. Additionally, market influencers such as news outlets and social media platforms can have an impact on Ethereum’s price by influencing public opinion about its value and potential use cases. Finally, overall market sentiment will determine whether investors view Ethereum as a good investment opportunity or not since negative sentiment could lead people away from investing in Ether altogether. By understanding all these different factors that influence Ethereum’s price investors will be better equipped to make informed decisions about their investments going forward.

Market Influencers

News outlets and social media platforms can have a significant impact on Ethereum’s value by influencing public opinion about its potential. This influence is especially pertinent to the cryptocurrency market, which is still in its early stages of development and subject to frequent volatility. Utility tokens, such as those associated with Ethereum, are highly susceptible to market fluctuations due to their reliance on token economics for stability. As such, even minor shifts in public sentiment can lead to drastic changes in the price of these utility tokens. Social media networks provide an unprecedented platform for disseminating news and opinions that can shape popular perception of cryptocurrencies like Ethereum, thus having a direct effect on their price. It is important for cryptocurrency investors to be aware of these influencers in order to effectively manage risk when investing in the volatile markets associated with utility tokens. With this knowledge, investors may be able to gain insight into potential price projections for 2021.

Price Projections for ’21

Price projections for 2021 can best be determined by using both technical and fundamental analysis. Technical analysis utilizes historical data to identify trends, while fundamental analysis looks at the underlying economic factors that affect currency prices. Both techniques provide insight into the current market conditions and can help analysts make more accurate price predictions for Ethereum in 2021.

Technical Analysis

Technical analysis is an important tool for traders as it helps to identify potential areas of support and resistance. By using technical indicators, such as moving averages, oscillators and trendlines, investors can more accurately predict future price movements. Technical analysis also allows traders to develop their own trading strategies by backtesting different scenarios and analyzing the data from those tests. This type of analysis can provide a valuable insight into market trends and opportunities for profit or loss. In addition, by watching volume patterns one can gain insight into how the market might react to certain news or events that may affect prices in the future. Having this knowledge can help traders make sound decisions when entering or exiting positions. With this in mind, transitioning now to fundamental analysis provides another layer of understanding when interpreting Ethereum’s recent price movements.

Fundamental Analysis

Fundamental analysis is a method of evaluating an asset based on its underlying financial and economic factors. In the case of Ethereum, fundamental analysis looks at:

- Trading strategies that traders use to exploit price movements in Ethereum

- The scalability issues facing the cryptocurrency blockchain technology

- The potential for adoption of smart contracts built on Ethereum

- The number and quality of decentralized applications (dApps) currently using the platform

- The overall market sentiment regarding Ethereum and other cryptocurrencies.

By evaluating these aspects, investors can gain insight into whether or not Ethereum is undervalued or overvalued and make informed trading decisions. This information can also be used to assess the overall volatility of Ethereum’s price over time. As such, understanding fundamental analysis is key to predicting how Ethereum’s prices will change in response to external economic forces. With this knowledge, traders can better position themselves for success when trading Ethereum.

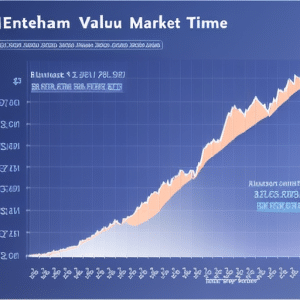

Ethereum Price Volatility

An important factor that contributes to Ethereum’s market dynamics is its price volatility, which can have a significant impact on the asset’s value. Price correlations between Ethereum and other assets can be used to assess the degree of volatility in the market. For example, if there is a strong positive correlation between Ethereum and Bitcoin, it may indicate that Ethereum will experience higher levels of volatility when compared to other assets. Trading trends also play an important role in determining the degree of price fluctuations. A sudden increase or decrease in trading volume may lead to sharp changes in prices, which could further affect sentiment and cause further fluctuations. As such, understanding Ethereum’s price movements requires an analysis of both fundamental factors and technical indicators such as trading trends. In conclusion, it is clear that Ethereum’s price volatility has an impact on its overall market dynamics, making it essential for investors to understand and monitor these factors closely. The next section will discuss the impact of tokenization on Ethereum’s price movements.

The Impact of Tokenization

Tokenization of assets has had a significant influence on Ethereum’s market dynamics, influencing the degree of its price volatility. By tokenizing real-world assets, it allows for fractional ownership that can be bought and sold like any other digital asset. This has created new investment opportunities for traders and investors alike, allowing them to access previously inaccessible markets with high liquidity and low transaction costs.

The tokenization process also provides more efficient ways to trade assets by removing middlemen and creating immutable records stored on a blockchain ledger. This decentralization model has enabled trading platforms to provide greater transparency and trustless transactions while reducing settlement times from days to minutes. Furthermore, this technology enables users to leverage decentralized financial instruments such as derivatives and automated market makers that can help manage risk in volatile markets, thus providing potential investment opportunities for Ethereum holders.

Potential Investment Opportunities

The tokenization of assets has opened up a range of potential investment opportunities, allowing traders and investors to access markets that previously may have been out of reach. One such opportunity is investing in Ethereum, which is the leading cryptocurrency platform for decentralized finance (DeFi). With DeFi, users can access financial services without the need for intermediaries such as banks or brokers. This presents many advantages, including lower fees, faster transaction times and improved access to new markets.

The economic impact of Ethereum’s growth is significant; it has enabled companies to use digital assets in innovative ways and create new products that are designed for global audiences. By providing an open-source platform with advanced features, Ethereum has created a lot of value for its users. However, it is important to note that there are still risks associated with investing in Ethereum due to its volatility and uncertain regulatory environment.

Risks of Investing in Ethereum

Investing in Ethereum can be a risky proposition due to the decentralization issues and scalability problems that it faces. As a decentralized platform, Ethereum is subject to unpredictable price fluctuations due to its lack of central control. This means that investors must be prepared to assume more risk when investing in Ethereum than in other traditional investments. Furthermore, scalability problems have plagued Ethereum since its launch, causing transaction speeds and throughputs to remain low. This has caused many investors to shy away from investing in Ethereum as it can take days for transactions to process on the network. Both of these risks are important considerations for any investor looking into investing in Ethereum.

As with all investment decisions, potential investors must carefully weigh the pros and cons before committing their capital. Comparing Ethereum with Bitcoin is an important step towards understanding the long-term value proposition of each cryptocurrency and should be considered by any investor looking into either asset class.

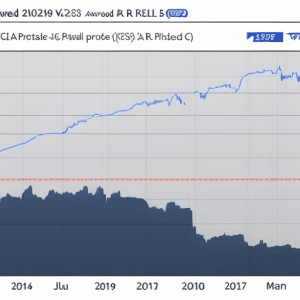

Ethereum vs. Bitcoin

Comparing two of the most popular cryptocurrencies, Ethereum and Bitcoin, is an important step for investors wishing to understand the long-term value proposition of each asset. A key distinction between these digital tokens lies in their token regulation and mining costs. Ethereum’s token supply is regulated by a smart contract which increases or decreases depending on the demand in the market. This makes Ethereum’s mining costs much lower than Bitcoin as miners can mine fewer coins but still receive rewards for their efforts. On the other hand, Bitcoin’s token supply is fixed and its mining costs are significantly higher due to more resources required to secure the network at any given time. Thus, understanding these differences between Ethereum and Bitcoin is essential for investors looking to make informed decisions regarding cryptocurrency investments. Furthermore, it is important to consider the implications of this comparison when evaluating Ethereum as an investment opportunity versus Bitcoin or other digital assets. As such, evaluating Ethereum’s blockchain technology and decentralized applications should be done next in order to gain further insight into its potential long-term value proposition.

Ethereum Blockchain and Decentralized Applications

Evaluating the potential of Ethereum’s blockchain technology and decentralized applications is an important step in understanding its long-term value proposition. Ethereum is a digital currency powered by its own blockchain, which can be used as a platform for creating distributed applications (dapps). The Ethereum blockchain consists of nodes that communicate with each other to validate transactions and ensure the integrity of the data stored on it. This distributed ledger technology provides users with secure access to their funds without requiring any centralized authority or third-party intermediary. Furthermore, dapps built on top of this network allow developers to create and deploy smart contracts that are executed automatically when certain conditions are met.

In addition, Ethereum’s blockchain offers improved scalability compared to Bitcoin while still providing strong security measures such as multi-signature wallets and cryptographic signatures. This allows it to process more transactions per second while maintaining its trustless nature. Moreover, the use of smart contracts enables developers to create complex financial instruments such as derivatives and insurance products that can be traded over the Ethereum network without any third-party interference. These features make Ethereum an attractive choice for those who want to invest in digital currencies or build innovative dapps on top of its reliable infrastructure.

Ethereum Network Security

The Ethereum blockchain and decentralized applications are a major focus of the platform, but no less important is its network security. With the rise of DeFi protocols and other more complex smart contracts, it is increasingly necessary to ensure that the network scales properly and securely. To that end, Ethereum developers have employed a number of measures to protect their users from malicious actors. These include code audits, rigorous security testing, and continuous monitoring of activities on the network.

In addition to this proactive approach, there are also a number of defensive mechanisms in place for when an attack does occur. Ethereum has built-in resistance against DDOS attacks and other malicious attempts to exploit vulnerabilities in the system by using multiple layers of encryption. This ensures that any breach is quickly identified and prevented from spreading across the entire system. As such, these measures provide a high level of assurance that Ethereum transactions will remain safe even as new technologies emerge on its platform. With these robust security measures in place, miners can be confident that they will be able to safely mine Ethereum without fear of loss or theft due to outside interference. By transitioning into secure mining processes for Ethereum tokens, miners can help bring greater peace of mind within the community while helping drive further adoption across various industries.

Ethereum Mining

Mining Ethereum is an essential part of the development and maintenance of the blockchain, allowing miners to receive rewards for verifying transactions and securing the network. Mining requires significant resources, especially in terms of energy consumption, as it involves solving complex cryptographic puzzles with powerful computing hardware. Miners are rewarded for their efforts with tokens which can then be exchanged on various digital currency exchanges for fiat money or other crypto-currencies such as Bitcoin. In addition to mining rewards, miners also get transaction fees from users who send Ether (ETH) over the network for a small fee. The amount of electricity used to power mining operations continues to rise as more miners join the network in an effort to earn these rewards. With this increase in energy consumption comes increased pressure on governments around the world to regulate crypto-currency mining activities and ensure that they are conducted sustainably. As such, it is important that miners carefully consider all associated costs before embarking on an Ethereum mining venture. This transition leads into discussing Ethereum wallets and how they store ETH securely and allow users to easily access them online or through mobile applications.

Ethereum Wallets

An Ethereum wallet is a crucial piece of technology that allows users to securely store and access their Ether (ETH) tokens, while also providing an easy way to send them over the network. Security is of utmost importance when it comes to using an Ethereum wallet, as they are often targeted by malicious actors. To ensure maximum wallet security, most wallets feature built-in encryption and backup features such as data recovery phrases which can allow users to recover their wallets if lost or stolen. Additionally, most wallets provide the ability for users to securely back up their wallets in multiple locations, helping protect against potential theft or damage from natural disasters. In conclusion, proper wallet security and backups are essential for any user looking to safely store and use their Ether tokens. Transitioning into the next section on Ethereum smart contracts, it is important to understand how these digital agreements function on the Ethereum platform in order to maximize their potential benefits.

Ethereum Smart Contracts

Smart contracts are revolutionizing the way we conduct business, enabling the secure and trustless execution of transactions between two or more parties. Ethereum is a blockchain platform that utilizes smart contract technology to facilitate the transfer of money, assets, and information without need for an intermediary. Smart contracts are self-executing contracts with rules set by its creator, which can be used in different applications such as decentralized finance (DeFi). The development of smart contracts on Ethereum has become increasingly popular due to its public nature and high level of security.

The use of Ethereum smart contracts is beneficial because it eliminates the need for processing fees from middlemen and offers greater transparency to users. Additionally, it also reduces operational costs by eliminating paperwork required for manual processes. Furthermore, smart contracts have enabled developers to create new decentralized products such as DeFi applications which allow users to invest their funds securely without depending on third-party services. As a result, Ethereum’s value has increased significantly over time due to increasing demand from investors looking to benefit from its versatile application capabilities in various industries.

| Advantages | Disadvantages | Applications |

|---|---|---|

| No Processing Fees | Complexity & Costly Development Processes | Decentralized Finance (DeFi) |

| Greater Transparency & Security | Potential Legal Issues | Automated Payments & Auctions |

| Reduced Operational Costs | Limited Accessibility To Non-Tech Users | Digital Identities |