Ethereum is a decentralized platform for applications that run exactly as programmed without any chance of fraud, censorship or third-party interference. It was first released in 2015 and quickly gained traction due to its ability to facilitate smart contracts and decentralized applications. As such, the value of Ethereum has been subject to significant fluctuations over the years. This article will provide an overview of the current worth of Ethereum, its historical performance, and factors influencing its value. Additionally, it will compare Ethereum’s performance to other cryptocurrencies and offer tips for safely storing it. Finally, this article will provide a comparison between Ethereum and Bitcoin as well as discuss cryptocurrency mining in relation to Ethereum.

Overview of Ethereum

Ethereum is a decentralized, open-source platform that enables the development of distributed applications and smart contracts. It is built on blockchain technology which allows for secure and transparent operations. Ethereum has gone through various upgrades since its launch in 2015 to improve scalability, sustainability, and security. In addition to running decentralized applications, Ethereum also provides a platform for users to create their own digital tokens or cryptocurrencies.

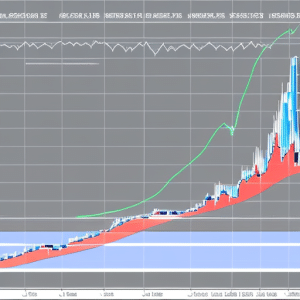

The current value of Ethereum varies depending on the market conditions but it is currently trading at around $1,943 USD as of April 2021. This is significantly higher than when it was launched 6 years ago but still far from its all-time high of over $1,400 in January 2018. Despite this volatility, Ethereum remains one of the most popular cryptocurrencies in the world with a strong community behind it. As such, many investors remain optimistic about its future value potential. Moving forward into the next section we will explore what factors influence Ethereum’s worth today.

Current Value of Ethereum

At its current rate, the digital currency known as Ethereum is exhibiting an impressive value. With increased security implications and technology advancements, Ethereum has grown in popularity since its initial launch in 2015. These factors have all contributed to the rise of its value:

- The introduction of decentralized finance applications using Ethereum as a foundation.

- The increase in usage among developers to create and deploy distributed applications (dApps).

- The use of this digital currency for transactions with low fees and quick confirmation times that are more secure than traditional payment methods.

- Its ability to facilitate smart contracts, which allows users to enter into agreements without needing third-party verification or trust between parties involved.

Considering these features, it’s clear why many investors have chosen Ethereum over other digital currencies when looking for potential investments with great returns on investment potentials. As a result, the current value of Ethereum continues to rise steadily, providing a favorable outlook for the future prospects of this digital asset class. By understanding how this new form of money works and its associated benefits, investors can make informed decisions about their financial goals while also taking into account the ever-changing market dynamics surrounding cryptocurrencies today.

History of Ethereum

Ethereum was initially proposed in 2013 by Vitalik Buterin, a Canadian programmer and blockchain enthusiast. In 2014, Ethereum launched an Initial Coin Offering (ICO) to fund the project’s development of its own blockchain-based platform. Since then, Ethereum has seen a steady increase in popularity, drawing investments from individuals and institutions alike due to its ability to facilitate decentralized applications on a global scale.

Early Development

Launched in 2015, Ethereum has revolutionized the blockchain industry with its innovative features and capabilities. It is a decentralized platform that enables developers to build and deploy decentralized applications (dApps). Due to its pioneering nature, Ethereum faced various technical challenges which were difficult to overcome at the time of its launch. These included scalability issues as well as navigating through the complex regulatory environment. Despite these obstacles, Ethereum was able to rise above them and prove itself as a powerful platform for developers around the world. Its ability to enable secure transactions without any centralized authority has made it popular amongst users worldwide. As such, Ethereum continues to be an important tool for developers seeking to create dApps on top of the blockchain technology. By providing powerful features and capabilities, Ethereum has set itself up for success in the future and established itself as a leader in this space. With this strong foundation in place, Ethereum is poised to have an even brighter future ahead of it with potential Initial Coin Offerings (ICOs) on the horizon.

Initial Coin Offering

The potential for Initial Coin Offerings (ICOs) on the Ethereum platform has been widely discussed as a means to further revolutionize the blockchain industry. With its ability to provide an accessible, transparent and secure way of raising funds, ICOs have become increasingly popular among investors. Their popularity has also led to a surge in regulatory initiatives aimed at better understanding and managing the risks associated with these investments.

| Regulation | Benefit |

|---|---|

| KYC/AML Compliance | Prevents financial fraud |

| Investor Protection | Ensures investor safety |

| Enforcement | Helps regulators identify violations |

| Token Economics | Determines economic incentives |

These regulations are necessary in order ensure that token issuers maintain high standards of integrity while protecting investors from any potential mismanagement or abuse. As this space continues to evolve, so too must the regulations surrounding ICOs in order to ensure their longevity. Through proper regulation and token economics there is great potential for ICOs on Ethereum to continue revolutionizing the blockchain industry.

Rise to Popularity

The Initial Coin Offering (ICO) has been the primary factor in the rapid rise of Ethereum’s popularity. ICOs are a type of crowdfunding where investors can purchase tokens, and have resulted in more accessible and alternative investments for individuals looking to diversify their portfolio. This has enabled an influx of new investors, attracted by the current trends of cryptocurrency. These trends include low transaction fees, decentralization and anonymity, which make it an attractive option for potential investors. With these factors driving its appeal, Ethereum rose to become one of the most popular cryptocurrencies on the market.

In addition to ICOs, there are many other factors influencing Ethereum’s value today; such as global regulation, economic cycles and speculation among investors. It is clear that Ethereum’s success is due to its ability to appeal to these various types of investors through its unique features and potential for growth. Looking forward, it will be interesting to see how each factor will contribute towards determining Ethereum’s worth in the future.

Factors Influencing Ethereum’s Value

Analyzing the current market conditions, it can be seen that a variety of factors are influencing Ethereum’s value. The most significant of these is the relationship between supply and demand in the cryptocurrency market. As with any economic commodity or resource, when demand exceeds supply, prices tend to rise. When there is more supply than demand, prices typically fall. This dynamic has been seen in Ethereum’s price movements over time as its popularity has grown and the number of investors buying Ether has increased.

Another important factor affecting Ethereum’s value is economic factors such as inflation and deflation. These can influence not only the value of Ether but also other cryptocurrencies in relation to each other. In periods of high inflation, for example, Ether may become relatively more valuable compared to other coins due to its greater scarcity and limited use cases at present. Similarly, during times of economic difficulty or deflationary pressure, Ether could suffer a decrease in value compared to other coins with larger user bases or more applications available on their networks. By understanding how these various factors shape Ethereum’s value today, investors can make better decisions about when and where to invest in Ether for maximum returns. With this knowledge in hand, we can now move on to examine Ethereum’s performance compared to other cryptocurrencies

Ethereum’s Performance Compared to Other Cryptocurrencies

Comparing Ethereum’s performance to other cryptocurrencies, it is clear that its value is determined by a variety of external factors. These include the number of active users, mining pools, and the security of private keys. It has shown a strong resilience against fluctuations in the market and maintained an edge over many of its competitors due to its transactional speed and scalability. Ethereum’s ability to remain competitive despite numerous changes in the industry demonstrates its staying power. The project has also seen significant improvements in terms of transaction fees, allowing users to send money quickly with minimal cost. As such, Ethereum appears well-positioned for continued success as more investors recognize its potential and utility. This indicates that Ethereum may have a bright future ahead in terms of both price appreciation and adoption rate. Transitioning into this discussion about the future of Ethereum, it is important to consider the various developments that will shape its trajectory.

Future of Ethereum

Exploring the possibilities for Ethereum’s future reveals a landscape of growth and potential. The potential for Ethereum lies in its ability to facilitate a secure platform for decentralized applications, also known as smart contracts. This technology offers users an unprecedented level of trust and security when it comes to digital transactions; since these transactions are immutable, they cannot be changed or censored by any third party. Additionally, Ethereum mining has seen significant growth in recent years due to its ability to generate new tokens as rewards for miners. This leads to increased liquidity in the market which can help increase the value of Ether over time. With this combination of innovative technologies and increasing demand, Ethereum appears poised for further growth in both usage and value going forward. As such, investors should consider adding Ethereum to their portfolios in order to capitalize on its potential long-term gains. To do so successfully requires an understanding of how best to invest in Ethereum which will be discussed in the following section.

Ways to Invest in Ethereum

Recent studies indicate that the number of Ethereum wallets has jumped from 6 million in December 2018 to over 40 million today, representing a growth rate of nearly 600%. This demonstrates the growing popularity of Ethereum as an investment option for those interested in crypto markets. There are several ways to invest in Ethereum:

- Buying Ethereum directly:

- Investors can purchase Ether (ETH) tokens on exchanges

- ETH transactions are secured by blockchain technology

- Many popular exchanges support ETH trading pairs and offer wallets for storage

- Investing through derivatives:

- Derivatives allow investors to speculate on future price movements without actually owning any cryptocurrency

- Futures, options, and CFDs provide leverage, enabling traders to open larger positions with less capital

- Staking Ether:

- Staking is similar to earning interest on regular deposits held at banks and other financial institutions

- By staking their holdings, investors earn rewards paid out in ETH tokens for validating new blocks on the network

The advantages associated with investing in these various methods have made Ethereum an attractive asset class among crypto traders. Understanding how each method works is necessary for making informed decisions about where and how to invest. With this knowledge, investors can make educated decisions regarding their investments while mitigating risks associated with volatile markets.

Advantages of Investing in Ethereum

Investing in Ethereum has become increasingly popular among traders due to its many advantages. Buying strategies, such as buying at the right time or holding long-term, can be beneficial when investing in Ethereum. Additionally, trading advantages like lower transaction costs and faster transactions are attractive benefits of investing in Ethereum. Moreover, due to Ethereum’s decentralized nature and its ability for developers to create applications on the platform, investors have access to a wide variety of investment opportunities. As a result of these advantages, more people are turning towards Ethereum for their investments. However, despite these benefits there are also risks associated with investing in this cryptocurrency which must be considered before committing funds into this asset class.

Risks of Investing in Ethereum

Given the volatility of cryptocurrency markets, investing in Ethereum carries certain risks that must be taken into account before committing funds. Regulatory risks are one potential concern, as governments and regulatory bodies worldwide have yet to establish clear rules and regulations surrounding cryptocurrencies such as Ethereum. Additionally, security risks associated with the storage and use of Ethereum should be considered. There is a risk of theft or loss through hackers or users’ mistakes, which can result in significant financial losses for investors. It is important to understand these security risks when investing in Ethereum so that measures can be taken to protect against them. As such, it is essential to consider the various potential risks before deciding whether or not to invest in Ethereum. Transitioning now into what should be considered before investing in Ethereum will provide further insight into how investors can make informed decisions regarding their funds.

What to Consider Before Investing in Ethereum

Before committing to an investment in Ethereum, it is important for potential investors to carefully consider various factors that could affect the success of their decision. To make a wise decision, investors should understand and weigh their financial strategies against the long-term outlook of Ethereum. For instance, they must consider whether Ethereum’s popularity will increase or decrease over time and what the future value of Ether may be.

Additionally, investors should assess whether or not investing in Ethereum meets their current financial needs and goals. They should also think about how much risk they are willing to take on when it comes to investing in a new technology such as cryptocurrency. | Factors | Short-term Impact | Long-term Impact | | — | — | —| | Popularity | Increased demand due to media exposure may drive up prices quickly but can drop just as fast| Dependent on technology innovation and adoption; price could remain stable or continue increasing for years to come|

| Competition from other Cryptocurrencies| Potential influence on prices if one coin gains more market share than another| Same as above; competition between different coins could drive prices higher over time|

| Regulatory Changes| Governmental regulations can have a direct impact on the currency’s legal status and usage restrictions within certain countries/regions| Regulations can limit growth opportunities but also provide stability if enforced consistently across markets

As potential investors contemplate these factors, they must also determine how best to store Ethereum before making any purchases.

How to Store Ethereum

Investigating the various methods of storage for Ethereum can enable investors to make an informed decision. Securing funds is a primary concern when investing in any asset, and Ethereum is no different. It is highly recommended that investors diversify their investments across multiple wallets as a means of protection against potential losses due to theft or mishandling. There are several types of online wallets available, such as mobile wallets, desktop wallets, and web-based wallets. Depending on the user’s preferences and needs, one may choose to use any combination of these wallet types. Furthermore, hardware wallets provide another layer of security by allowing users to store their private keys offline away from malicious actors. Ultimately, selecting the right wallet will depend heavily on an individual’s risk appetite and personal preference. As such, it is critical for investors to research all available options before making any decisions about how best to store their Ethereum investments in order to ensure their funds are secure and adequately protected from potential loss or theft. With this knowledge in hand, investors can then move forward with evaluating the best Ethereum wallets for them personally.

Best Ethereum Wallets

Having discussed the various methods of storing Ethereum, it is important to consider the best wallets for securely storing ETH. There are many different types of Ethereum wallets that vary in terms of features and security risks:

- Hot Wallets: These are online wallets that provide quick access to funds, but they come with a greater security risk due to their constant connection with the internet. Popular hot wallet options include Coinbase and Exodus.

- Cold Wallets: Cold storage solutions offer an offline method for keeping funds secure from hackers and other malicious actors. Examples include Trezor and Ledger Nano S.

- Paper Wallets: This type of wallet is created by writing down a user’s private key on a piece of paper or other physical medium, which can then be stored somewhere safe and secure. All three types have their own advantages and disadvantages when it comes to cost comparison, security risks, accessibility, and more; careful consideration should be taken when choosing an appropriate wallet for one’s needs. In addition to these factors, there are also some tips that users should keep in mind when storing Ethereum safely such as setting strong passwords, backing up private keys regularly, etc., which will be discussed further in the next section.

Tips for Safely Storing Ethereum

When considering the security of Ethereum, there are a few tips to keep in mind for safely storing it. One way to secure Ethereum is through cold storage, which refers to keeping an offline wallet and private key. Cold storage can help prevent theft or loss due to hacking since it doesn’t require internet access. Furthermore, having multiple copies of the private key stored in different locations helps protect against physical damage or destruction of data.

Another important tip when storing Ethereum is to not share your private key with anyone else. It’s also helpful to use 2-factor authentication when possible as an additional layer of protection. Additionally, setting up automatic backups on a regular basis ensures that if anything happens, users still have access to their funds and data. Keeping these tips in mind will help users maintain control over their Ethereum wallets and stay safe when using digital currency.

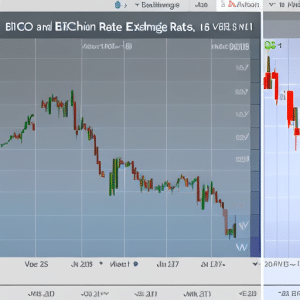

Ethereum vs. Bitcoin

Comparing the two digital currencies, Ethereum and Bitcoin, can provide insight into their respective differences. One of the key benefits of Ethereum is its decentralized architecture. As a blockchain-based platform, it offers users many advantages over traditional centralised systems. Through decentralization, transactions are secured from manipulation or fraud thanks to a public ledger that records all transactions on the network. Furthermore, decentralization provides benefits such as increased scalability and improved speed in comparison to more centralized systems. On the other hand, Bitcoin has had long-standing issues with scalability due to its limited block size limit which can cause transaction fees to increase when usage increases. This could lead to certain individuals being unable to access the network due to cost prohibitive fees. Ultimately, both platforms offer different sets of features and capabilities for users looking for cryptocurrency solutions but understanding their difference is essential for making informed decisions about which one best suits your needs. With this knowledge in mind, it’s time turn our attention towards cryptocurrency mining and Ethereum.

Cryptocurrency Mining and Ethereum

Cryptocurrency mining has become increasingly popular as a means of earning income through the use of blockchain technology, and Ethereum is no exception. Mining Ethereum involves verifying transactions on the Ethereum blockchain with computers or specialized hardware in order to earn Ether, the native cryptocurrency associated with Ethereum. This process requires a large amount of electricity and computing power and can be done through crypto exchanges or by using dedicated mining hardware. Crypto exchanges enable miners to buy and sell Ether, while mining hardware allows users to mine for Ether without having to register with an exchange. Both options are viable methods for miners looking to earn income from Ethereum, although they require different levels of expertise and resources. As the demand for cryptocurrency continues to grow, so too does the need for more sophisticated mining techniques that leverage both crypto exchanges and dedicated mining hardware.

![Ue bars representing ETH value in [local currency] over time, gradually increasing in length](https://ethereumfunding.io/wp-content/uploads/2023/08/03-eth-value-in-your-local-currency_528-300x300.png)