Ethereum has become a major player in the cryptocurrency market, with its value reaching unprecedented heights. But how much is one Ether worth in US dollars? This article will provide an overview of Ethereum and explore the factors that influence its price, as well as its potential for future growth. Additionally, this article will discuss how to invest in Ethereum, its use cases such as stablecoins and NFTs, blockchain governance considerations to keep in mind when investing, and the privacy implications of using Ethereum. It’s important to note that investing in cryptocurrencies comes with inherent risks; while there may be significant gains to be made from investing in Ethereum, it’s essential to take caution when making any investment decisions.

Key Takeaways

- Ethereum’s value has reached an all-time high of over US$2,000, indicating its increasing worth in dollars.

- Ethereum’s increasing utility and use cases, such as decentralized finance (DeFi) and non-fungible tokens (NFTs), contribute to its growing value.

- Ethereum’s technological advances like Plasma and Sharding enhance its transaction capacity and scalability, making it an attractive investment.

- Ethereum’s blockchain technology has immense potential in creating new financial models and shaping the future of decentralized finance and cryptocurrencies.

Overview of Ethereum

Ethereum is a decentralized platform that utilizes blockchain technology to facilitate digital contracts and transactions. It was founded in 2014 by Vitalik Buterin, and has become the world’s second-largest cryptocurrency platform after Bitcoin. Ethereum is open source, meaning anyone with programming knowledge can develop applications on its network. The main purpose of Ethereum is to act as a ledger for smart contracts, allowing users to securely store data and execute transactions without intermediaries. Despite its popularity, Ethereum is highly volatile due to crypto market fluctuations caused by speculation around DeFi products. This volatility makes it difficult for investors to accurately predict the current value of Ether (ETH) in USD terms. As such, any investment decision should take into account potential changes in the ETH/USD exchange rate before committing funds. With this in mind, let’s move on to analyze the current value of ethereum in USD.

Current Value of Ethereum in USD

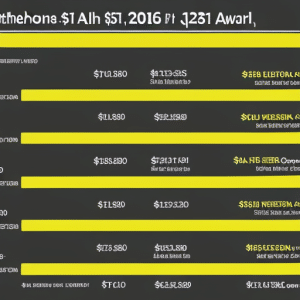

The value of Ethereum expressed in United States dollars is currently fluctuating. This trend is due to the volatility of the cryptocurrency market, and it has made predicting Ethereum’s future price difficult. The table below shows the recent changes in Ethereum’s price as expressed in USD.

| Date | Price (USD) |

|---|---|

| 04/30/2020 | $174.49 |

| 05/31/2020 | $199.98 |

| 06/30/2020 | $223.73 |

| 07/31/2020 | $234.99 |

| 08/31/2020 | $412.03 |

Over the past few months, Ethereum’s price has experienced significant fluctuations that require traders to employ more sophisticated trading strategies to remain profitable and minimize losses incurred through price volatility over time. A variety of factors influence these prices including speculation, economic conditions, government regulations, and market sentiment which will be discussed further in a subsequent section about “Factors Influencing Ethereum’s Price".

Factors Influencing Ethereum’s Price

The price of Ethereum is determined by the relationship between the current supply and demand for it, market trends, sentiment about cryptocurrency in general, network transactions and adoption of blockchain technology, as well as the regulatory environment. The balance between these factors determines how much people are willing to pay for a single Ether token. Market trends and sentiment can vary significantly based on news coverage of Ethereum or other cryptocurrencies, while network transactions and adoption provide an indication of how useful the platform is becoming. Regulatory policies also have a major influence on whether investors are willing to risk their money in Ethereum or not.

Supply and Demand

Examining the market forces of supply and demand, it can be seen that Ethereum’s worth in dollars is significantly affected. Supply dynamics are determined by the amount of Ether coins available on the market, which can be influenced by mining activities as well as buying and selling trends among investors. Demand dynamics, meanwhile, are determined by the number of people who want to purchase Ether coins for investment or use them to participate in transactions. As these two factors increase or decrease over time, so does Ethereum’s value against other currencies such as the US Dollar. When supply outweighs demand, prices tend to drop; when demand outweighs supply, prices tend to rise. Thus, understanding both supply and demand dynamics is essential in predicting Ethereum’s worth in dollars accurately. With this knowledge at hand, one can then move onto examining market trends and sentiment that could further influence Ethereum’s price movements.

Market Trends and Sentiment

Analyzing market trends and sentiment can provide valuable insight into the fluctuating value of cryptocurrencies, paving the way for investors to make wise decisions. When analyzing Ethereum’s worth in dollars, investors should consider a few key factors:

- Trading strategies – How are traders positioning themselves with respect to Ethereum? Are they buying or selling?

- Price volatility – What is causing fluctuations in Ethereum’s price over time? Is it responding to news events or other external forces?

- Market Sentiment – How is the market feeling about Ethereum as an investment opportunity? Are buyers bullish or bearish on its future prospects?

- Network Transactions and Adoption – What is driving network usage and mainstream adoption of Ethereum? What kind of usage numbers are we seeing in terms of daily transactions, user accounts, etc.?

- Regulation and Supply/Demand balance – How friendly are governments towards cryptocurrency and how does this affect supply/demand dynamics for Ether tokens? With these considerations in mind, investors can gain a better understanding of the current trends affecting Ethereum’s worth in dollars. This knowledge can then be used to inform their trading strategies and help them make smart investments.

Network Transactions and Adoption

What role do network transactions and adoption play in determining the value of cryptocurrency? Network scalability is a key factor in determining the value of cryptocurrency, as it relates to its ability to process transactions quickly and securely. An increase in the number of users on a blockchain’s network will require an increase in its capacity for processing transactions. This means that the more people who use a given cryptocurrency, the more valuable it becomes. Additionally, decentralization impact can also help determine the value of a digital asset. The more decentralized a network is, the less susceptible it becomes to manipulation from external forces and thus increases confidence in its stability and longevity. As such, this leads to higher trust among users and an appreciation for its worth amongst investors. In conclusion, network scalability and decentralization impact are two major factors when considering how much a digital asset is worth. Such considerations ultimately shape investor sentiment which can further influence market trends around Ethereum’s price. Consequently, these elements must be taken into account when assessing Ethereum’s overall worth in dollars. Having considered this, attention now turns to how regulatory environments affect Ethereum’s valuation.

Regulatory Environment

Regulatory environments can have a significant influence on the valuation of cryptocurrency, as they can impact investor sentiment and market trends. Uncertainty in the regulatory environment can lead to increased volatility in the market, while specific laws or regulations may create new opportunities for growth. Regulatory uncertainty surrounding Ethereum has been a major factor in its fluctuating worth in dollars. The legal implications of Ethereum use are still being sorted out across different jurisdictions, leading to fear among potential investors that could cause them to avoid investing or reduce their holdings. This uncertainty has held back some investors from fully embracing Ethereum due to concerns about its legal status and how it might be affected by changing regulations. At the same time, there is potential for future growth if more countries develop and adopt friendly regulations towards cryptocurrency usage. As more clarity emerges regarding these legal issues, Ethereum’s worth in dollars could advance significantly depending on how governments respond.

The Potential for Future Growth

Ethereum has the potential for future growth due to its increasing utility and use cases, as well as new technologies and developments. The cryptocurrency is increasingly being adopted by a wide range of businesses, governments, financial institutions, and developers to create new applications powered by blockchain technology. Furthermore, technological advances such as Plasma and Sharding are set to dramatically increase Ethereum’s transaction capacity and scalability. As more users adopt the digital currency and new technologies develop, Ethereum stands to benefit from further growth in value.

Increasing Utility and Use Cases

The increasing utility and use cases of Ethereum have been demonstrated by its recent rise in value, with the cryptocurrency’s worth reaching an all-time high of over US$2,000. The driving forces behind this surge are:

- Ethereum’s ability to overcome scalability issues through new technologies and developments;

- Stakeholder incentives that provide financial rewards for investing; and

- Increased demand for the currency due to its rising popularity in various online markets and exchanges.

As such, these factors are allowing Ethereum to experience increased utility and use cases as it continues to expand into new areas. This has resulted in a marked increase in the overall value of Ethereum, making it one of the most sought after cryptocurrencies on the market today. As new technologies continue to be developed and implemented in the coming years, it is likely that Ethereum will only become more popular amongst investors looking to make a profit from its increasing worth in dollars.

New Technologies and Developments

Recent technological developments have enabled Ethereum to address scalability issues, creating new opportunities for the cryptocurrency. Alternative investments such as decentralized finance (DeFi) projects are now becoming popular due to the advantages they offer over traditional investment options. These projects provide access to a wide range of financial services and products that can be used to securely store and trade digital assets. Moreover, DeFi protocols are built on Ethereum’s blockchain technology, making them more secure than their traditional counterparts. This has resulted in an increased interest in Ethereum as an asset class among investors looking for alternative investments with better returns and security measures. As a result, Ethereum is continuing to gain value, providing investors with significant potential for growth in the future. Transitioning into the subsequent section about ‘how to invest in ethereum’, it is important for prospective investors to understand the various factors that influence its price before committing any capital.

How to Invest in Ethereum

Investing in Ethereum is an increasingly popular option for those looking to diversify their portfolios. To successfully invest, one must understand the basics of exchanges and wallets, as well as how to protect their security and store assets safely. Exchanges are online brokerages that allow users to buy and sell cryptocurrencies such as Ethereum using fiat currencies or other digital assets. Wallets, on the other hand, provide a secure place to store cryptocurrency funds. Security is paramount when investing in Ethereum; it is essential for investors to ensure that their wallets are adequately protected from malicious actors. Lastly, storage solutions should be chosen with care in order to keep assets safe for future use.

Exchanges and Wallets

Examining exchanges and wallets, one can discover numerous options for storing Ethereum worth in dollars. Crypto farming is becoming an increasingly popular way of obtaining Ether tokens, as it allows users to leverage their computing power in order to earn rewards. A blockchain-based system offers greater scalability when compared to centralized networks, allowing users to send and receive transactions quickly and securely.

The most common types of exchanges and wallets used are hot wallets (online) or cold wallets (offline). Hot wallets offer convenience but are more vulnerable to hackers than cold wallets; however, they offer the highest liquidity when it comes to exchanging cryptocurrencies with fiat currencies. Cold wallets provide excellent security but are not as liquid as hot wallets, making them ideal for long-term holders who do not plan on trading frequently. A comparison of these two options is provided below:

| Hot Wallet | Cold Wallet |

|---|---|

| Accessibility | Security |

| Liquidity | Limited Access |

| Vulnerability | Durability |

| Low Cost | High Cost |

Security and storage considerations must also be addressed when investing in Ethereum worth in dollars.

Security and Storage

When it comes to cryptocurrency, both security and storage are paramount considerations. While exchanges and wallets offer users the ability to buy, sell, and store digital assets like Ethereum, they also have inherent risks associated with them. In order to ensure user safety, those trading in Ethereum should understand the importance of risk management and privacy protection when dealing with digital assets:

- Risk management strategies should be employed that include measures for protecting accounts against unauthorized access and theft.

- Privacy protection techniques must be used such as strong passwords, two-factor authentication methods, encryption technology, etc.

- Careful consideration must be taken when selecting a wallet or exchange as there are many options available which differ in terms of security protocols implemented.

- Users should not store large amounts of Ethereum on an exchange or wallet but instead transfer them to cold storage solutions for added protection from malicious actors.

- All transactions within a wallet or exchange should be conducted using secure networks like Tor in order to maximize anonymity and minimize potential threats.

Taking these steps will help protect users’ investments in Ethereum and minimize any risks associated with the currency’s storage or use. With this in mind, it is important for Ethereum investors to understand the various risks that can arise from investing in digital currencies before making their decision about whether or not to invest.

Risks to Consider

Considering Ethereum’s worth in dollars comes with certain risks that should be taken into account. The primary risk to consider when investing in Ethereum is platform security. It is important to understand the potential vulnerabilities of the blockchain network, as well as any associated mining costs. If not properly managed, these security issues can have a significant impact on the value of Ether and other cryptocurrencies. Additionally, it is essential for investors to understand the technical aspects of mining Ether and how those costs may affect an investment return. As such, understanding the various risks associated with Ethereum’s worth in dollars is critical for any investor looking to take advantage of its potential growth opportunities. Transitioning from this discussion about security and storage risks to a discussion about mining presents another unique set of challenges and considerations for investors.

Ethereum Mining

Mining cryptocurrencies can be a complex and costly endeavor, particularly when it comes to Ethereum. Mining rewards are typically paid out in the currency of the blockchain being mined – in this case, Ether (ETH). As miners join the network and more blocks become available for mining, mining difficulty increases as well. This makes it more expensive to mine ETH due to increased energy costs and hardware requirements. Furthermore, miners must take into consideration the cost of electricity and equipment maintenance when calculating profitability associated with mining Ethereum. To remain competitive, miners must continuously upgrade their hardware setup. All these factors contribute to Ethereum’s worth in dollars as they directly affect its supply and demand on the open market. With an ever-changing landscape that is dependent on price fluctuations across various cryptocurrency exchanges, Ethereum’s worth remains a constantly changing figure that is subject to numerous external influences.

Ethereum vs. Bitcoin

Comparing Ethereum and Bitcoin, two of the most prominent cryptocurrencies, reveals stark differences in their respective characteristics. One major difference is trading; Ethereum is more suited to crypto trading than its counterpart. This is due to Ethereum’s ability to support decentralized applications (dApps) that facilitate rapid transactions compared to the slower processing speed of Bitcoin. Moreover, Ethereum’s scalability issues are better managed than Bitcoin, with quicker transaction times and lower fees for users. These advantages make it easier for traders to use it as a platform for investment rather than simply an asset class like Bitcoin. Despite these distinctions due to different technologies and development teams behind them, both have seen increased adoption over time and remain significant players in the crypto space. Furthermore, both benefit from having large user bases that further propels their growth even when competing against each other directly. As such, transitioning into the topic of ‘Ethereum and Smart Contracts’ becomes clear given how closely intertwined they are with one another in terms of development progressions as well as usage potentials within financial markets today.

Ethereum and Smart Contracts

Smart contracts are computer protocols that facilitate, verify, and enforce the performance of a contract and can be used to facilitate transactions on the Ethereum blockchain. These contracts enable two or more parties to enter into an agreement without requiring third-party mediation. Smart contracts allow for automation of agreed-upon terms and conditions, making them highly useful for dApp development.

The advantages of using smart contracts include increased security, cost savings, and speed compared to traditional legal agreements. Additionally, they provide a degree of transparency as all members have access to the same information at any given time. Ethereum’s decentralized platform also allows anyone with internet access to use these smart contracts from anywhere in the world without having to trust a middleman or worry about censorship or manipulation. With these features in place, Ethereum provides an attractive platform for developers wishing to create decentralized applications (dApps). This leads nicely into discussing ‘ethereum and decentralized applications’.

Ethereum and Decentralized Applications

Decentralized applications (dApps) are built on the Ethereum blockchain and provide an alternative to traditional web-based applications. A prime example of a dApp is CryptoKitties, a game that allows players to buy, sell, and breed virtual cats using Ether as currency. DApps have become increasingly popular in recent years due to their ability to enable decentralized finance (DeFi) by allowing users to access financial services without relying on a centralized authority. DeFi utilizes distributed ledgers such as Ethereum’s blockchain to facilitate transactions, enabling users from all over the world to borrow and lend money securely. By utilizing smart contracts and other innovative technologies enabled by Ethereum, DeFi has created new opportunities for people around the globe who may otherwise not have access to financial services. As these technologies continue to evolve, so too will the potential they offer for innovation in the world of finance. Through this growing technology, individuals can explore new ways of managing their finances without relying on traditional banking systems. With this in mind, it is clear that Ethereum will continue playing an important role in shaping the future of decentralized finance.

Ethereum and DeFi

Ethereum has become an integral part of the Decentralized Finance (DeFi) movement. This new financial system is built on blockchain technology, allowing users to access services and products that are not available in traditional banking systems. The DeFi protocols enable users to participate in yield farming, lending, and stablecoin yields. Ethereum’s decentralized nature allows for trustless asset exchange without relying on third-party intermediaries or centralized authorities.

One of the key benefits of DeFi protocols is the ability to generate returns from passive income streams such as yield farming and staking rewards. Yield farming involves providing liquidity by locking up funds in a platform’s pool, which can then be used to provide liquidity for decentralized exchanges (DEXs). Stablecoin yields involve investing in stablecoins with attractive interest rates. These two forms of passive income have become increasingly popular among Ethereum users due to their potential for high returns with minimal risk. With these tools at hand, it is no surprise that Ethereum has been able to increase its value over time as more people use it as a medium for generating returns through DeFi protocols. As such, its worth in US dollars continues to climb steadily while continuing to fuel the growth of the DeFi ecosystem. Thus concluding this subtopic before transitioning into discussing ‘Ethereum and Stablecoins’.

Ethereum and Stablecoins

Stablecoins are an increasingly popular form of digital asset that offer users a level of price stability by pegging their value to a fiat currency or other reference asset. Ethereum is at the forefront when it comes to the development and deployment of stablecoins, as it provides its decentralized infrastructure for cryptocurrency projects to build on. The advantages of using Ethereum for developing stablecoins include simplified blockchain governance, increased decentralization, and improved scalability. Moreover, the use of smart contracts allows for trustless transactions between parties, removing the need for intermediaries in financial transactions. This makes Ethereum an ideal platform for DeFi projects, which rely heavily on stablecoins’ ability to maintain price stability while allowing users to move funds quickly and securely. Ethereum’s open source nature also ensures that developers have access to all necessary tools needed to create innovative applications that could potentially revolutionize traditional finance. As such, Ethereum has tremendous potential when it comes to providing solutions within the decentralized finance space and will likely remain a major player in this field going forward. With its growing number of successful stablecoin launches, Ethereum is well-poised to play an important role in helping shape the future of decentralized finance and cryptocurrencies as a whole. Consequently, its worth in dollars can be expected to increase over time as more projects leverage its capabilities for building secure and reliable financial services. Transitioning into the subsequent section about ‘ethereum and nfts’, we can now consider how non-fungible tokens (NFTs) built on top of Ethereum’s blockchain might further expand its reach beyond just payments networks and into larger areas such as digital art markets or gaming platforms.

Ethereum and NFTs

Non-fungible tokens (NFTs) built on Ethereum’s blockchain could revolutionize the digital art markets and gaming platforms, providing users with verifiable ownership of digital assets. NFTs offer an immutable record of ownership, allowing users to easily trade digital items without relying on centralized entities. Moreover, NFTs are also paving the way for Decentralized Finance (DeFi) applications that enable peer-to-peer transactions and smart contracts to automate agreements between parties.

The potential of Ethereum’s blockchain technology in terms of creating new financial models is immense; from facilitating secure payments to trading digital assets such as artwork or game items through NFTs, the possibilities are limitless. The future of the gaming industry will be shaped by these new technologies, making it easier for developers to create innovative experiences and monetize their creations in a more efficient manner. As more people become aware of these opportunities, Ethereum’s worth in dollars will continue to increase significantly over time. Moving forward into the realm of blockchain governance, Ethereum stands poised to revolutionize economic systems around the world.

Ethereum and Blockchain Governance

As a decentralized platform, Ethereum is paving the way for new models of blockchain governance that have the potential to transform economic systems like a rising tide. This shift has been catalyzed by the need for scalability, interoperability and decentralization. To ensure scalability, Ethereum has implemented solutions such as sharding and Plasma which enable it to process more transactions while maintaining its underlying security guarantees. Additionally, the development of various distributed applications (dapps) on top of Ethereum has enabled interoperability between different blockchains, allowing users to access dapps across multiple networks without having to trust any centralized service provider. Finally, improvements in consensus algorithms have enabled greater decentralization among participants in the network, leading to increased fairness and transparency within blockchain governance. All these developments suggest that Ethereum is well-positioned to become a leader in blockchain governance and provide immense value for users around the world. As such advances continue to be made towards blockchain privacy and anonymity features, Ethereum’s worth will only continue to grow in terms of both dollars and influence within the industry.

Ethereum and Privacy

Recent technological advancements have enabled Ethereum to become a platform for enhanced privacy, allowing users to securely transact without revealing their identity. Ethereum is unique in its approach to data security and privacy, as it takes into account the various privacy policies of each user. By using cryptographic techniques such as zero-knowledge proofs and ring signatures, Ethereum allows for secure and private transactions that are untraceable.

In addition, Ethereum is able to provide users with a high level of data security through its distributed ledger system. This ensures that all records stored on the blockchain are secure and immutable. Furthermore, Ethereum’s smart contracts can be used to enforce specific conditions regarding the usage of personal data, providing users with an additional layer of protection against malicious actors or unauthorized access. Finally, by leveraging decentralized systems such as sharding and consensus mechanisms like proof-of-stake, Ethereum is able to maintain scalability while still preserving user privacy.